[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Designation] [Department/Organization Name] [Address] [City, State, ZIP Code] Subject: Request for Free Port Tax Exemption Sample Letter Dear [Recipient's Name], I hope this letter finds you in good health and high spirits. I am writing to discuss an urgent matter regarding the Free Port Tax Exemption in Guam, which has caught our attention. As a representative of [Your Organization/Company], I would like to request a sample letter addressing this issue. As you are aware, Guam, a United States territory located in the western Pacific Ocean, plays a crucial role in regional and international trade. To sustain and promote economic growth, it is imperative to create an environment that encourages investment, job creation, and business expansion. We have recently discovered that Guam offers a Free Port Tax Exemption option to eligible businesses. This exemption allows businesses to import goods and raw materials without incurring any tax obligations under specific conditions. However, due to the complexity of the application process and the lack of accessible guidelines, it has become challenging for companies to apply for this tax benefit successfully. In order to understand the intricacies of the Free Port Tax Exemption and guide our organization through the application process, we kindly request a sample letter that addresses the relevant authorities in Guam responsible for granting this exemption. This sample letter should cover the following key areas: 1. Introduction: Start the letter by briefly introducing our organization and our interest in the Free Port Tax Exemption in Guam. 2. Statement of Intent: Clearly state our intention to apply for the Free Port Tax Exemption and explain how this opportunity aligns with our business objectives. 3. Request for Assistance: Politely request the recipient's guidance, expertise, and support to navigate through the application process effectively. 4. Supporting Documentation: Seek advice on the required supporting documents, forms, or any other materials that need to be submitted alongside the application. 5. Compliance with Regulations: Express our commitment to comply with all relevant laws, regulations, and reporting requirements associated with the Free Port Tax Exemption. 6. Contact Information: Provide our contact details, including mailing address, email address, and phone number, so that the authorities can reach out to us with any queries or further instructions. We understand that every business application may have its specific requirements or peculiarities. Therefore, if there are any variations or subtypes of the Guam Sample Letter concerning Free Port Tax Exemption, we would greatly appreciate receiving guidance on those as well. Thank you for your attention to this matter. We believe that the Free Port Tax Exemption will significantly benefit our organization, and we look forward to receiving your timely response and the requested sample letter. Should you require any additional information or clarification, please do not hesitate to reach out to us. We anticipate a positive outcome, and we appreciate your assistance in this endeavor. Yours sincerely, [Your Name]

Guam Sample Letter concerning Free Port Tax Exemption

Description

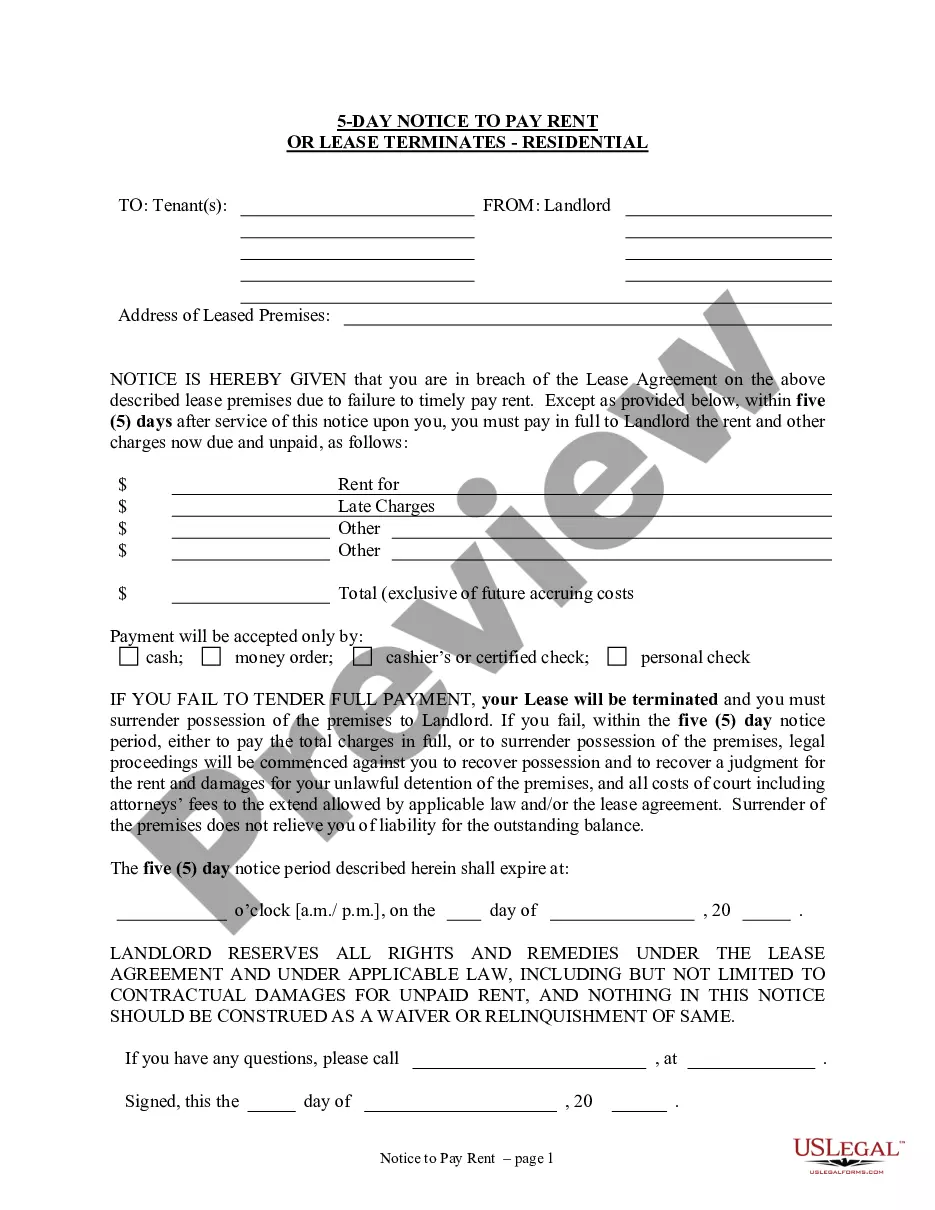

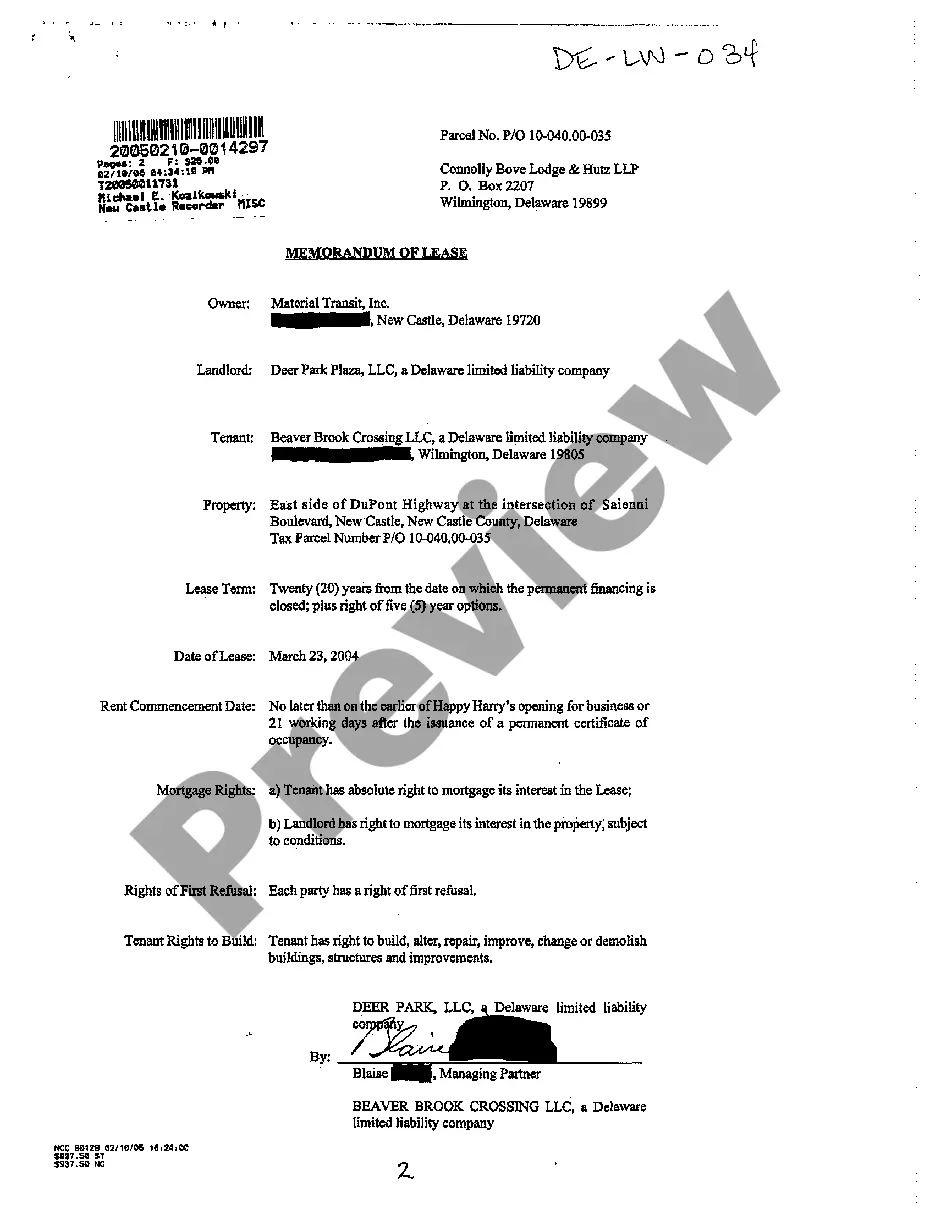

How to fill out Guam Sample Letter Concerning Free Port Tax Exemption?

You may spend hrs online searching for the lawful file format that fits the federal and state demands you will need. US Legal Forms gives a huge number of lawful forms which can be evaluated by pros. You can easily obtain or print out the Guam Sample Letter concerning Free Port Tax Exemption from your service.

If you already possess a US Legal Forms account, you are able to log in and then click the Down load option. Afterward, you are able to comprehensive, change, print out, or indication the Guam Sample Letter concerning Free Port Tax Exemption. Every single lawful file format you acquire is your own property permanently. To obtain an additional copy of the obtained develop, go to the My Forms tab and then click the related option.

If you work with the US Legal Forms site initially, follow the simple guidelines below:

- Initially, ensure that you have selected the proper file format to the area/metropolis of your liking. Look at the develop information to ensure you have selected the right develop. If offered, utilize the Review option to appear throughout the file format at the same time.

- If you want to discover an additional edition of your develop, utilize the Look for area to discover the format that fits your needs and demands.

- Once you have identified the format you would like, simply click Buy now to proceed.

- Select the costs plan you would like, key in your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your Visa or Mastercard or PayPal account to purchase the lawful develop.

- Select the structure of your file and obtain it for your system.

- Make adjustments for your file if possible. You may comprehensive, change and indication and print out Guam Sample Letter concerning Free Port Tax Exemption.

Down load and print out a huge number of file themes making use of the US Legal Forms Internet site, which provides the greatest variety of lawful forms. Use skilled and state-specific themes to handle your company or specific requirements.