Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Declaration of Gift Over Several Year Period

Description

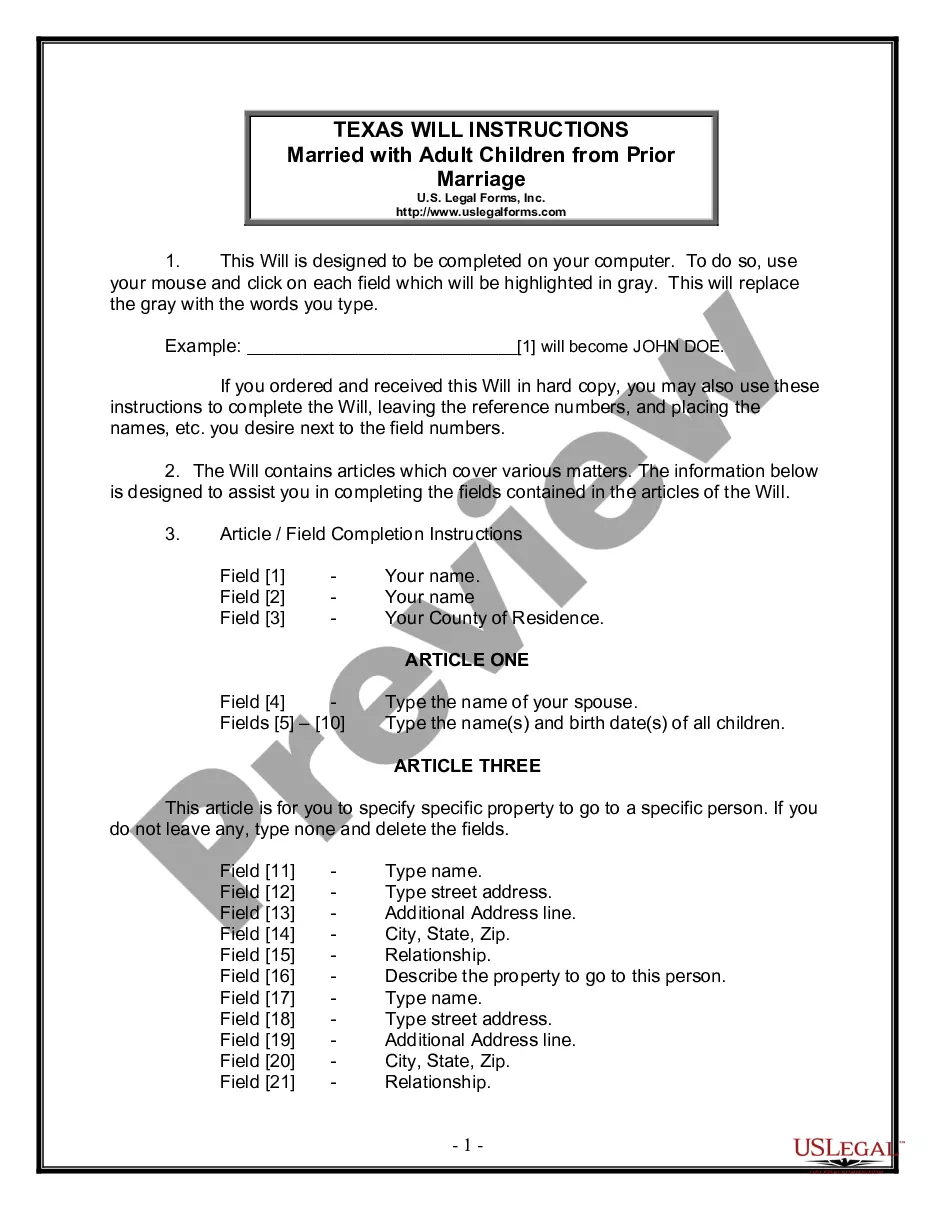

How to fill out Declaration Of Gift Over Several Year Period?

Selecting the appropriate legal document template can be challenging. It goes without saying that there are numerous layouts available online, but how can you discover the legal form you need? Utilize the US Legal Forms website.

The service offers a vast array of templates, including the Guam Declaration of Gift Over Several Year Period, which you can utilize for both business and personal purposes. All documents are reviewed by experts and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Acquire button to locate the Guam Declaration of Gift Over Several Year Period. Use your account to search through the legal documents you have purchased previously. Access the My documents section of your account and obtain another copy of the document you desire.

Complete, modify, print, and sign the acquired Guam Declaration of Gift Over Several Year Period. US Legal Forms is the largest repository of legal templates where you can discover various document formats. Take advantage of the service to obtain professionally crafted documents that comply with state requirements.

- If you are a new user of US Legal Forms, here are straightforward instructions that you can follow.

- First, confirm that you have chosen the correct form for your region/county. You can review the form using the Preview button and examine the form outline to ensure it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Get now button to retrieve the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

While predicting the future gift tax exclusion amount can be challenging, estimates suggest it may increase due to inflation. For the Guam Declaration of Gift Over Several Year Period, individuals should expect the exclusion to rise from the current limit. Always check current tax guidelines or consult with a tax professional as 2026 approaches to ensure you are preparing effectively.

The basic exclusion for the year of the gift represents the maximum amount you can give without incurring a gift tax during your lifetime. For the Guam Declaration of Gift Over Several Year Period, this exclusion is set at $11.7 million as of 2021, but it may adjust in the coming years. Understanding this exclusion helps you plan effectively, utilizing resources like uslegalforms to draft necessary documents without hassle.

The annual gift exclusion amount can change from year to year. For the Guam Declaration of Gift Over Several Year Period, the exclusion was $15,000 in 2021 and it has remained the same for subsequent years. It's essential to stay updated on the current exclusion limits as they may rise due to inflation adjustments in the future, allowing you to maximize your gifting strategies.

In the United States, you can gift up to a certain amount each year without needing to file a gift tax return. For the Guam Declaration of Gift Over Several Year Period, this means that individuals can gift up to $15,000 per recipient annually without tax implications. If you exceed this amount, you must file a gift tax return, although you may not owe any taxes due to the lifetime gift tax exclusion. It's important to keep records to ensure compliance with tax laws.

Yes, you should declare everything at customs, including gifts and personal items. For those dealing with a Guam Declaration of Gift Over Several Year Period, it is crucial to declare these gifts properly to avoid penalties later. This declaration helps customs assess taxes correctly and ensures you have no trouble with your items. Transparency in your declarations is beneficial for your peace of mind and legal compliance.

You can obtain a customs declaration form from various sources, including the official customs website or at airports and borders. When handling the Guam Declaration of Gift Over Several Year Period, make sure to use the correct form to adequately declare your gifts. Additionally, uslegalforms provides templates that can guide you through completing your customs form correctly. Ensuring all sections are filled out properly will ease your process at customs.

Failing to declare items at customs can lead to criminal charges in certain situations, especially if it appears intentional. If you are dealing with a Guam Declaration of Gift Over Several Year Period, it's essential to present all relevant information to avoid legal troubles. Customs officials view undeclared items seriously, and the potential for penalties is high. Always prioritize compliance to protect yourself.

If you choose not to declare anything at customs, you risk significant penalties, including fines and possible seizure of your belongings. For items covered by a Guam Declaration of Gift Over Several Year Period, this could lead to higher scrutiny and issues with future customs transactions. It is always better to declare your items, as this fosters a straightforward process. By being open, you contribute positively to customs regulations.

Not declaring items at customs can result in serious consequences, including large fines and potential legal action. When it comes to the Guam Declaration of Gift Over Several Year Period, failing to declare gifts could complicate your tax reporting and lead to audits. Always take the time to declare all items truthfully to ensure a smooth experience. Your honesty helps maintain trust and transparency with customs officials.

If you forget to declare an item at customs, you may face penalties, including fines or confiscation of the undeclared item. It is essential to be consistent in your declarations, especially when dealing with a Guam Declaration of Gift Over Several Year Period. Customs officials have tools to identify discrepancies, which could lead to further investigations. Always declare all items to avoid complications.