Are you inside a place that you require paperwork for sometimes enterprise or individual reasons nearly every day time? There are a lot of authorized papers templates available on the net, but getting ones you can rely is not straightforward. US Legal Forms gives a huge number of develop templates, such as the Guam Alimony Trust in Lieu of Alimony and all Claims, that happen to be created in order to meet state and federal demands.

Should you be previously knowledgeable about US Legal Forms site and possess a free account, simply log in. Following that, you can acquire the Guam Alimony Trust in Lieu of Alimony and all Claims format.

If you do not come with an account and want to begin using US Legal Forms, adopt these measures:

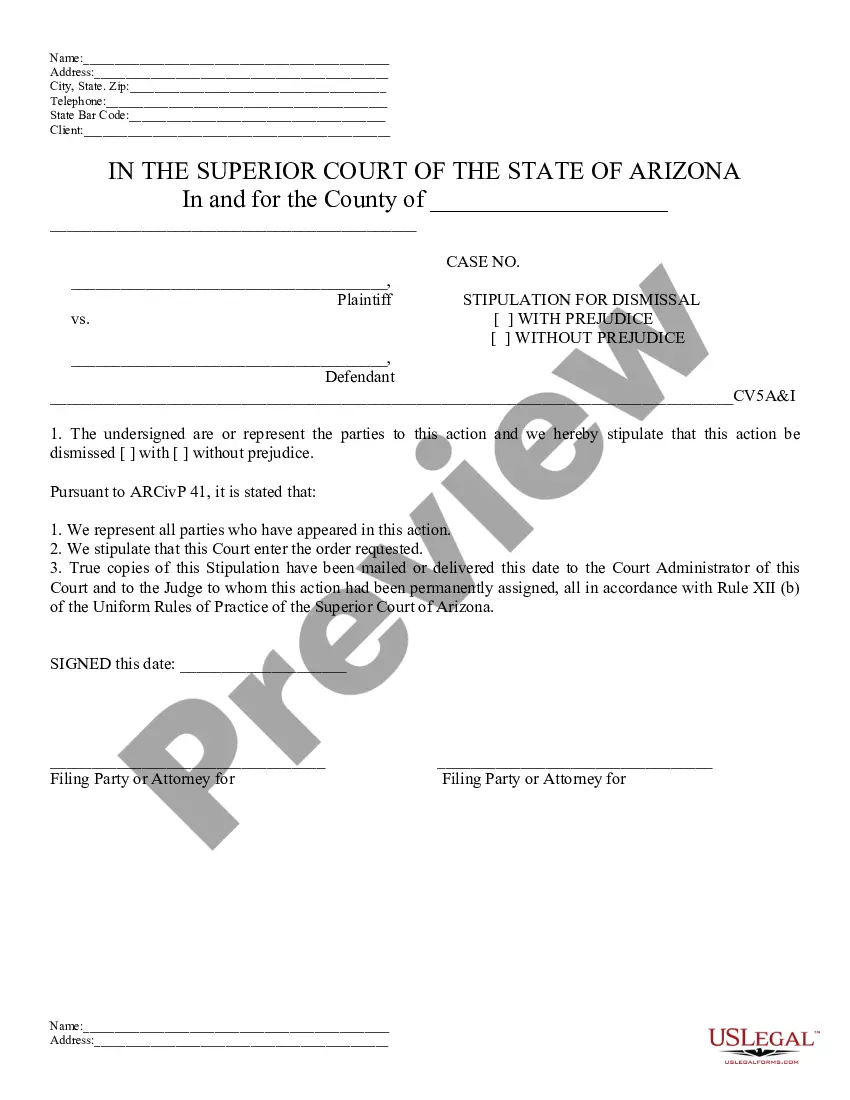

- Discover the develop you require and ensure it is for the right area/region.

- Make use of the Preview switch to examine the form.

- Read the outline to ensure that you have chosen the proper develop.

- If the develop is not what you are searching for, utilize the Research industry to discover the develop that meets your needs and demands.

- When you get the right develop, click on Purchase now.

- Choose the costs program you need, complete the desired info to make your account, and buy your order making use of your PayPal or credit card.

- Select a practical document structure and acquire your backup.

Locate every one of the papers templates you have purchased in the My Forms food selection. You can obtain a additional backup of Guam Alimony Trust in Lieu of Alimony and all Claims at any time, if needed. Just click on the required develop to acquire or print out the papers format.

Use US Legal Forms, probably the most extensive selection of authorized varieties, in order to save time and avoid mistakes. The service gives professionally manufactured authorized papers templates that can be used for an array of reasons. Produce a free account on US Legal Forms and begin creating your life easier.