A Transmutation Agreement is a marital contract that provides that the ownership of a particular piece of property will, from the date of the agreement forward, be changed. Spouses can transmute, partition, or exchange community property to separate property by agreement. According to some authority, separate property can be transmuted into community property by an agreement between the spouses, but there is also authority to the contrary.

Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property

Description

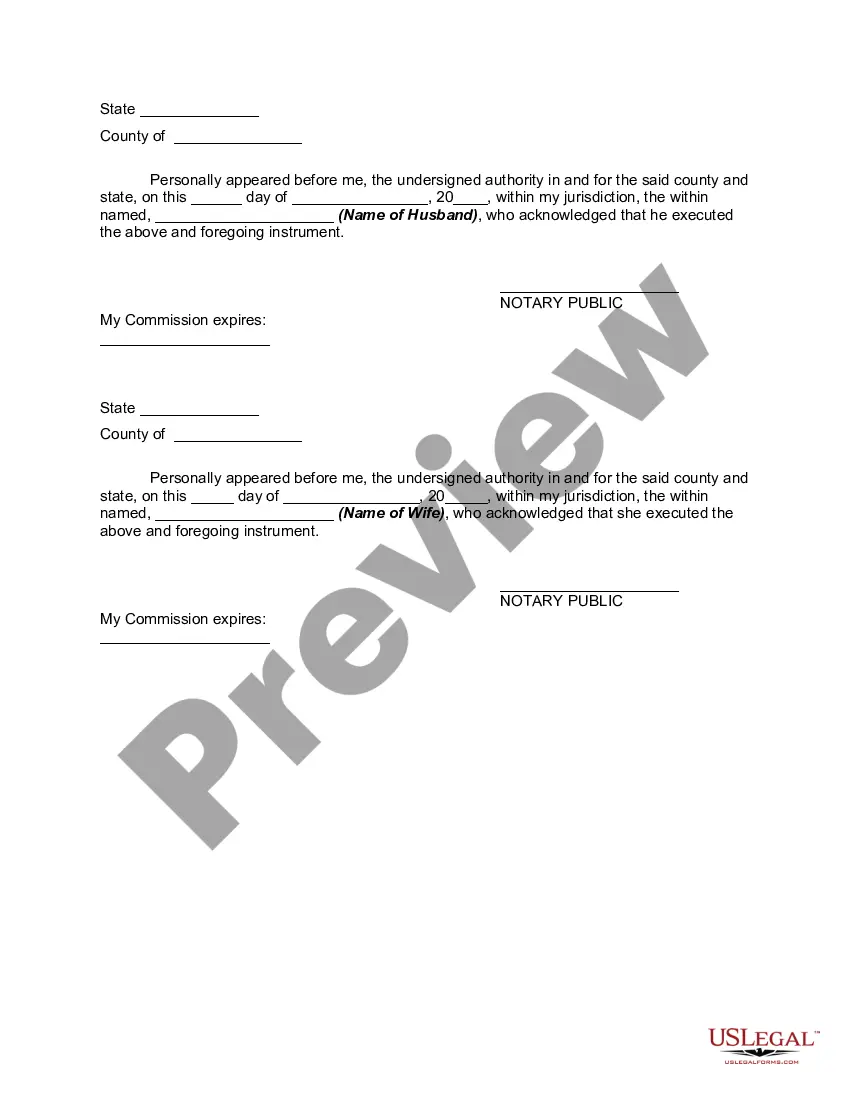

How to fill out Transmutation Or Postnuptial Agreement To Convert Community Property Into Separate Property?

If you want to complete, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you require.

A wide range of templates for business and personal applications is organized by categories and states, or keywords.

Step 4. Once you find the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to sign up for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to find the Guam Transmutation or Postnuptial Agreement to Change Community Property into Separate Property in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Download button to find the Guam Transmutation or Postnuptial Agreement to Change Community Property into Separate Property.

- You can also access forms you previously saved from the My documents section of your account.

- If you're using US Legal Forms for the first time, follow these steps.

- Step 1. Make sure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review option to check the form's content. Be sure to read the overview.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of your legal form template.

Form popularity

FAQ

Filing separately while married can affect your tax brackets and the deductions you're eligible for. Generally, this route leads to a higher tax burden compared to filing jointly. Additionally, establishing a Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can alleviate some financial confusion by defining asset ownership, which is particularly helpful during tax filing.

In a community property state, when filing separately, you will report half of the community income and half of the community expenses on your tax returns. It’s essential to document all income and expenses accurately to avoid disputes. To simplify your financial arrangements, you might explore a Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property, which helps delineate ownership and can make filing easier and clearer.

Filing taxes while living apart as a married couple involves specific steps to ensure compliance with tax laws. You can choose to file jointly or separately; however, filing separately may limit certain tax benefits. To optimize your asset division even further, a Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can assist in establishing clear entitlement to your individual assets and obligations.

When married couples file separately, the issue of who claims property taxes can be complex. Typically, each spouse claims tax deductions proportional to their ownership share of the property. If you're navigating this situation, consider using a Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property to clarify your legal rights and responsibilities, making tax season less complicated.

When filing taxes as married but separately in California, it's important to use the appropriate community property form. This form helps in clearly dividing income and expenses between spouses. If you want to adjust how your property is classified during this process, consider a Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property. This agreement simplifies your financial responsibilities and clarifies ownership.

The transmutation rule refers to the legal process by which spouses can change their property rights through a mutual agreement. This rule allows couples to convert community property into separate property or the other way around, contingent upon both parties' consent and proper legal documentation. In Guam, employing a Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can facilitate this process effectively. Being informed about these rules ensures that couples take the correct steps in managing their properties.

Yes, Guam is categorized as a community property territory, meaning that most property acquired during marriage is considered jointly owned by both spouses. This principle significantly affects how property is divided in cases of divorce or separation. A Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property can help couples manage their assets effectively and clarify ownership rights, ensuring that each party understands their stakes. It is advisable to consult with legal professionals when navigating community property laws.

The key difference lies in their primary functions; a transmutation agreement specifically addresses the change of property ownership between spouses, while a postnuptial agreement encompasses a broader range of marital issues, including property division, debt allocation, and spousal support. Essentially, a Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property includes elements of both but narrows the focus on property rights. Understanding this distinction can help you choose the right legal tool for your situation.

A postnuptial agreement cannot include provisions that violate public policy or laws. For example, it cannot address child custody or child support arrangements, as those matters must be determined based on the child's best interests. It also cannot contain illegal activities or performance obligations that would not hold up in court. Thus, ensuring that your Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property is compliant with local regulations is essential.

A transmutation agreement serves to formally change the ownership status of property between spouses. Typically, it is used to convert community property into separate property or vice versa. By establishing clear terms, the Guam Transmutation or Postnuptial Agreement to Convert Community Property into Separate Property helps avoid potential disputes in the future. It provides legal protection and peace of mind for both parties.