Title: Exploring Guam Contract for Part-Time Assistance from Independent Contractors Introduction: In this article, we will provide a detailed description of the Guam Contract for Part-Time Assistance from Independent Contractor. We will explain what it encompasses, its importance, and shed light on any variations or types that may exist within this contract framework. Keywords: Guam Contract, Part-Time Assistance, Independent Contractor. I. Understanding the Guam Contract for Part-Time Assistance: The Guam Contract for Part-Time Assistance from Independent Contractor is a legally binding agreement between two parties: the employer (company, organization, or individual) seeking part-time assistance, and the independent contractor willing to provide their services. It outlines the terms and conditions of collaboration, the scope of work, responsibilities, and compensation. Keywords: legally binding agreement, collaboration, scope of work, responsibilities, compensation. II. Importance of the Guam Contract for Part-Time Assistance: 1. Clear Expectations: This contract establishes clear expectations and ensures both parties are on the same page regarding the nature of the work, roles, and responsibilities. 2. Legal Protection: Having a written contract safeguards the rights and interests of both parties and helps prevent any potential misunderstandings or disputes. 3. Defined Working Arrangements: The contract determines the duration of the agreement, working hours, agreed-upon rates or fees, and desired deliverables. Keywords: clear expectations, legal protection, working arrangements, rates, deliverables. III. Different Types of Guam Contract for Part-Time Assistance: Though the basic structure of the Guam Contract for Part-Time Assistance from Independent Contractor remains the same, there might be specific variations based on the industry, nature of work, or other factors. Common types may include: 1. Freelance Service Agreement: Primarily used in creative industries, this contract type outlines the specific services to be provided, project timelines, and payment terms. 2. Consulting Agreement: Suitable for professional services, this contract focuses on advisory or consulting work and may include confidentiality clauses, intellectual property rights, and non-compete agreements. 3. Tutoring or Teaching Agreement: Tailored for educational services, this contract details the educational content to be covered, the duration of teaching sessions, and compensation. Keywords: Freelance Service Agreement, Consulting Agreement, Tutoring Agreement, industry-specific variations. Conclusion: The Guam Contract for Part-Time Assistance from Independent Contractor plays a crucial role in establishing a mutually agreed-upon agreement, protecting both the employer and the independent contractor involved. By providing clarity on the working arrangements, responsibilities, and compensation, this contract ensures a smooth and professional working relationship. While variations may exist based on industry or specific requirements, the fundamental principles of such contracts remain consistent.

Guam Contract for Part-Time Assistance from Independent Contractor

Description

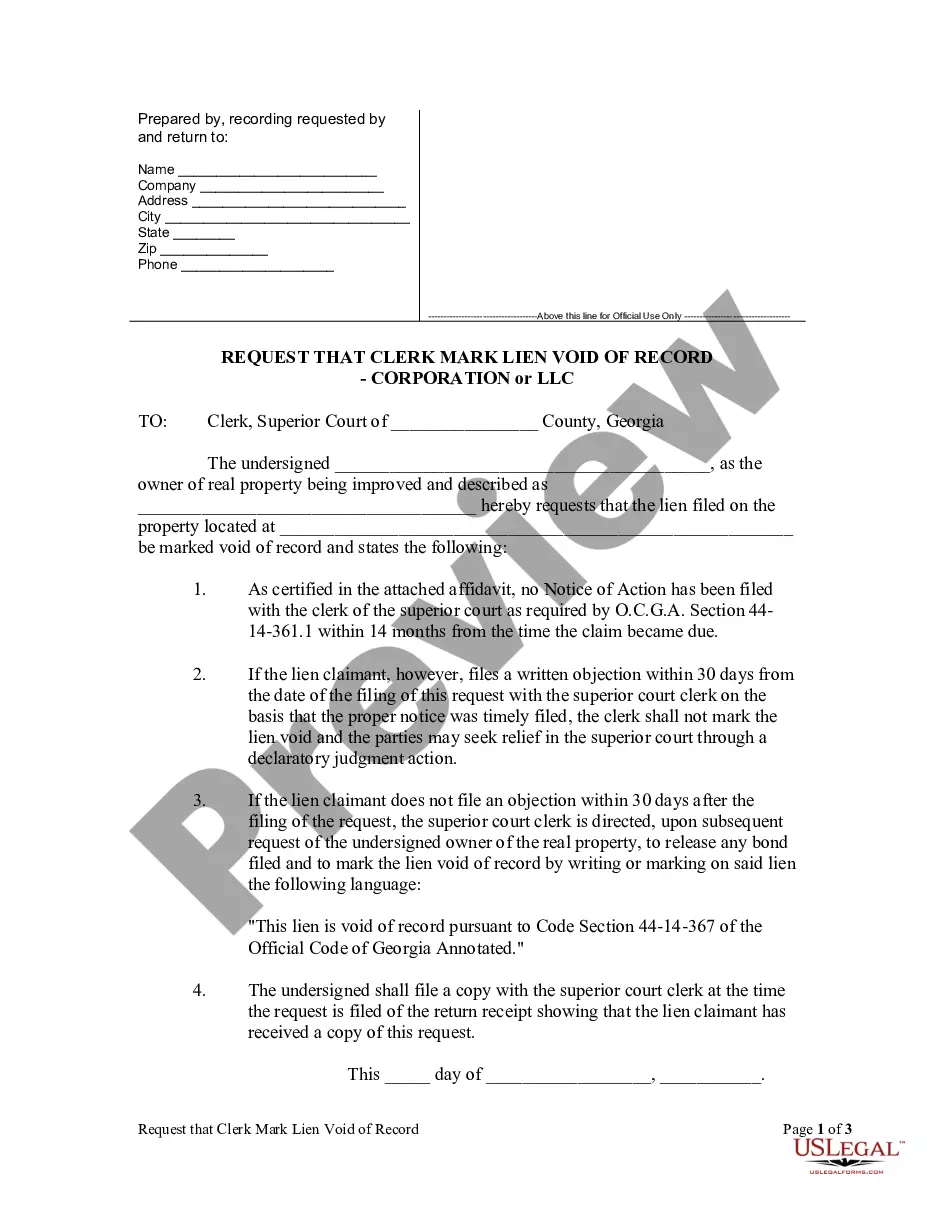

How to fill out Guam Contract For Part-Time Assistance From Independent Contractor?

US Legal Forms - one of several most significant libraries of lawful types in the States - provides an array of lawful papers layouts it is possible to download or printing. Using the web site, you may get a large number of types for organization and individual purposes, sorted by classes, says, or search phrases.You can find the most up-to-date models of types much like the Guam Contract for Part-Time Assistance from Independent Contractor in seconds.

If you already have a membership, log in and download Guam Contract for Part-Time Assistance from Independent Contractor from the US Legal Forms local library. The Down load button will appear on every single kind you see. You gain access to all previously saved types within the My Forms tab of your respective profile.

If you want to use US Legal Forms for the first time, listed here are basic recommendations to help you began:

- Make sure you have picked the right kind for the area/state. Click the Review button to examine the form`s content. See the kind information to actually have selected the correct kind.

- In case the kind doesn`t fit your requirements, utilize the Look for industry towards the top of the display screen to discover the one who does.

- In case you are pleased with the shape, validate your choice by clicking the Acquire now button. Then, select the pricing plan you like and supply your qualifications to register to have an profile.

- Procedure the deal. Use your charge card or PayPal profile to perform the deal.

- Select the structure and download the shape on the device.

- Make changes. Fill up, revise and printing and indicator the saved Guam Contract for Part-Time Assistance from Independent Contractor.

Each and every format you put into your money lacks an expiry particular date and is yours forever. So, if you want to download or printing yet another backup, just go to the My Forms section and then click on the kind you want.

Gain access to the Guam Contract for Part-Time Assistance from Independent Contractor with US Legal Forms, probably the most considerable local library of lawful papers layouts. Use a large number of specialist and condition-specific layouts that satisfy your business or individual needs and requirements.

Form popularity

FAQ

The McNamara-O'Hara Service Contract Act requires contractors and subcontractors performing services on prime contracts in excess of $2,500 to pay service employees in various classes no less than the wage rates and fringe benefits found prevailing in the locality, or the rates (including prospective increases)

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

One of the best parts of being an independent contractor is that you can choose your own work hours. Most employees get schedules telling them when and how long they have to work. For hourly workers, schedules often change from week to week. This can make it hard to plan childcare, errands, and hang-outs with friends.

Service Contracts are agreements between a customer or client and a person or company who will be providing services. For example, a Service Contract might be used to define a work-agreement between a contractor and a homeowner. Or, a contract could be used between a business and a freelance web designer.

The McNamara-O'Hara Service Contract Act (SCA) covers contracts entered into by federal and District of Columbia agencies that have as their principal purpose furnishing services in the U.S. through the use of service employees. The definition of service employee includes any employee engaged in performing services

There are exemptions to the SCA, as laid out in 29 CFR § 541.300. These exemptions include executive, administrative, professional, outside sales, and computer employees.

A contractor also called a contract worker, independent contractor or freelancer is a self-employed worker who operates independently on a contract basis.

How do I know if I'm an independent contractor or an employee in California?You are paid by the hour.You work full-time for the company.You are closely supervised by the company.You received training from the company.You receive employee benefits.Your company provides the tools and equipment needed to work.More items...

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

time contract is similar to a fulltime contract, the main difference being the agreed working hours. time worker will work less than 35 hours per week. The agreed amount of hours required to work each week needs to be visible in the contract. However, you may have the option to work overtime.

More info

Ownership true dataGnavElementName.