Guam Simple Promissory Note for Family Loan is a legally binding document that outlines the terms and conditions of a loan agreement between family members in Guam. This note serves as evidence of the borrower's commitment to repay the loan amount borrowed from the lender within a specified time frame. A Guam Simple Promissory Note for Family Loan typically includes important details such as the names and contact information of both the borrower and lender, the loan amount, the interest rate (if applicable), repayment terms, and any penalties or default provisions. This document ensures transparency and mitigates any potential disagreements between family members regarding the loan agreement. Different types of Guam Simple Promissory Notes for Family Loans may vary based on specific loan purposes or conditions: 1. Fixed-Interest Promissory Note: This type of note establishes a fixed interest rate, which remains constant throughout the loan term. It simplifies the repayment process and provides clarity on the total interest to be paid over time. 2. Variable-Interest Promissory Note: In the case of a variable-interest promissory note, the interest rate may fluctuate over the loan term based on a predetermined index, such as the prime rate. This type of note allows the interest to be adjusted periodically, reflecting changes in the market conditions. 3. Installment Promissory Note: An installment note breaks down the loan amount into equal periodic payments over a specific period. It ensures the borrower repays the loan in smaller increments, making it more manageable and predictable. 4. Balloon Promissory Note: This note structure involves making smaller (or interest-only) payments over a specified period, with a larger payment, known as a balloon payment, due at the end of the term. This type of note is beneficial for borrowers who expect a significant inflow of funds or plan to refinance the loan at the end of the term. By implementing a Guam Simple Promissory Note for Family Loan, both borrowers and lenders can establish clear expectations, ensuring a smooth borrowing process without any misunderstandings or disputes. It is always advisable to consult with legal professionals to ensure compliance with Guam's specific rules and regulations when drafting a promissory note for family loans.

Guam Simple Promissory Note for Family Loan

Description

How to fill out Guam Simple Promissory Note For Family Loan?

Are you presently in a situation in which you will need paperwork for either organization or specific functions almost every time? There are plenty of authorized record layouts accessible on the Internet, but locating types you can rely on isn`t simple. US Legal Forms delivers thousands of form layouts, like the Guam Simple Promissory Note for Family Loan, which can be created to fulfill state and federal demands.

Should you be currently knowledgeable about US Legal Forms internet site and possess an account, just log in. Following that, it is possible to obtain the Guam Simple Promissory Note for Family Loan format.

If you do not offer an account and want to begin using US Legal Forms, follow these steps:

- Discover the form you want and ensure it is for that correct city/state.

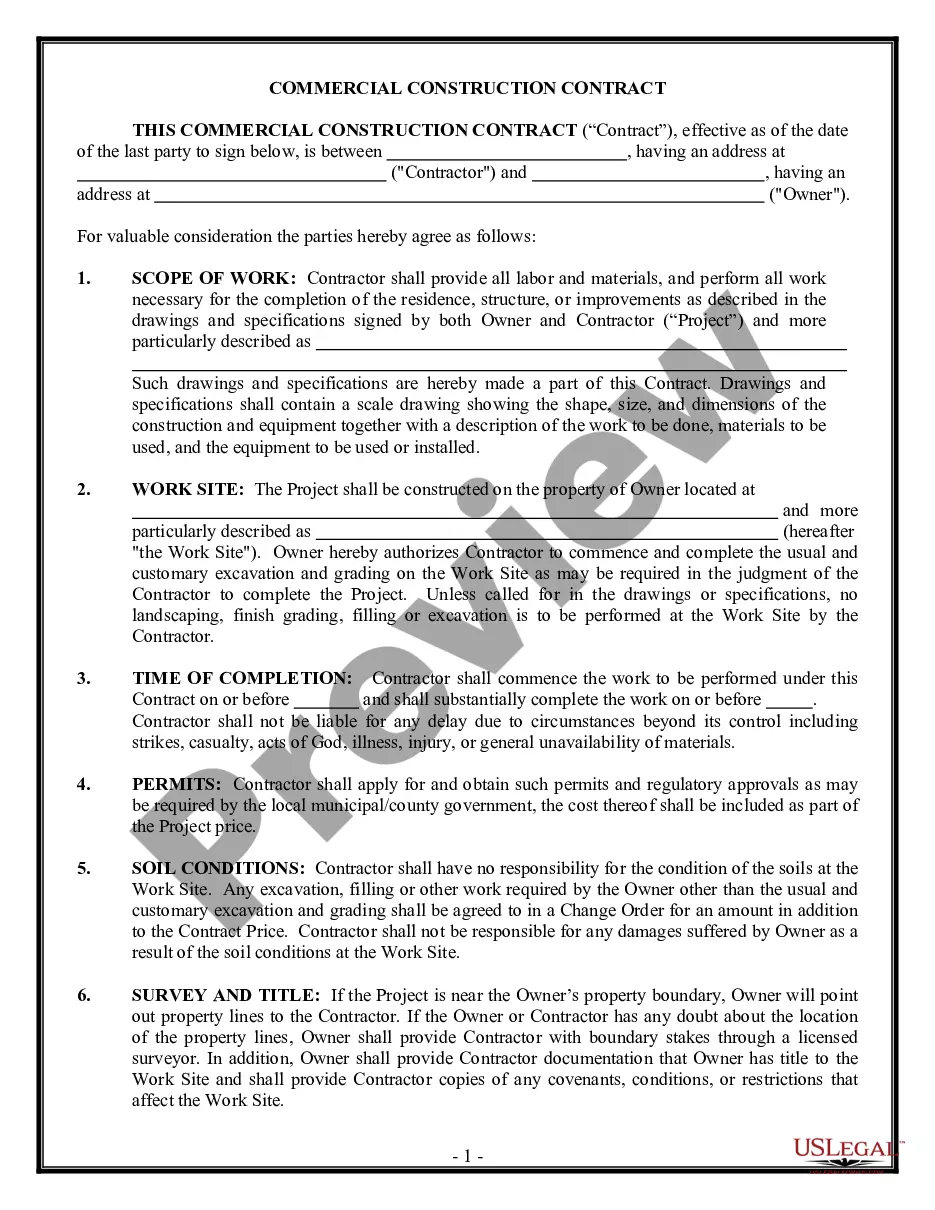

- Utilize the Review option to review the form.

- Browse the information to ensure that you have chosen the appropriate form.

- When the form isn`t what you`re searching for, make use of the Research area to get the form that meets your requirements and demands.

- If you discover the correct form, just click Get now.

- Opt for the rates prepare you need, fill out the necessary info to create your bank account, and pay for the order making use of your PayPal or credit card.

- Select a convenient document format and obtain your duplicate.

Find all the record layouts you may have purchased in the My Forms menu. You can aquire a additional duplicate of Guam Simple Promissory Note for Family Loan whenever, if needed. Just select the essential form to obtain or printing the record format.

Use US Legal Forms, one of the most substantial variety of authorized kinds, to save lots of time and avoid faults. The support delivers professionally created authorized record layouts that can be used for a selection of functions. Produce an account on US Legal Forms and initiate producing your lifestyle easier.

Form popularity

FAQ

The name and address of the person loaning the money. The name and address of the person borrowing the money. Terms of repayment: schedule of repayment, amount of each payment and manner of payments (in-person, cash, check, etc.) Interest to be charged related to the loan, if any.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A personal loan agreement should include the following information:Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

Any two parties who wish to enter into a loan agreement can draft a promissory note, which states the intention of the lender to loan the borrower a specific amount of money, as well as the terms and conditions for repayment of that loan, to which both parties have agreed.

Easier approval: There's typically no formal application process, credit check or verification of income when you're borrowing from family. Traditional lenders often require documents such as W-2s, pay stubs and tax forms as part of the loan application process.

More info

Deed Mortgage Loan Deed Trust Deed More Mortgage Loan Deed Trust Deed Person Deed Mortgage Loan Deed Trust Deed More Business Bill Sale Employment Contracts Operating Agreement Loan Agreement Promissory Note.