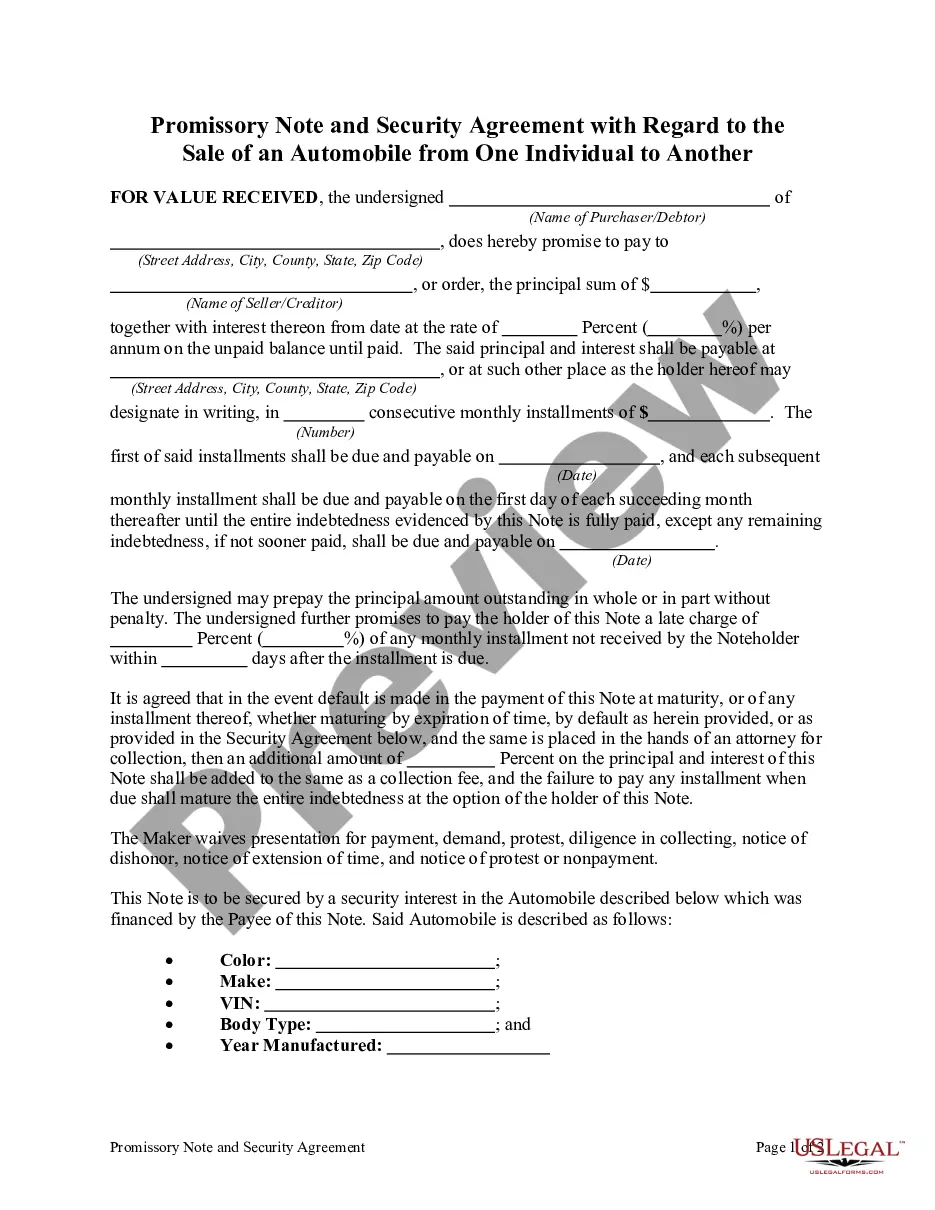

In this form, the Buyer is assuming the indebtedness on a loan used to purchase a vehicle. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness

Description

How to fill out Conditional Sales Agreement Of Automobile Between Individuals And Assumption Of Outstanding Indebtedness?

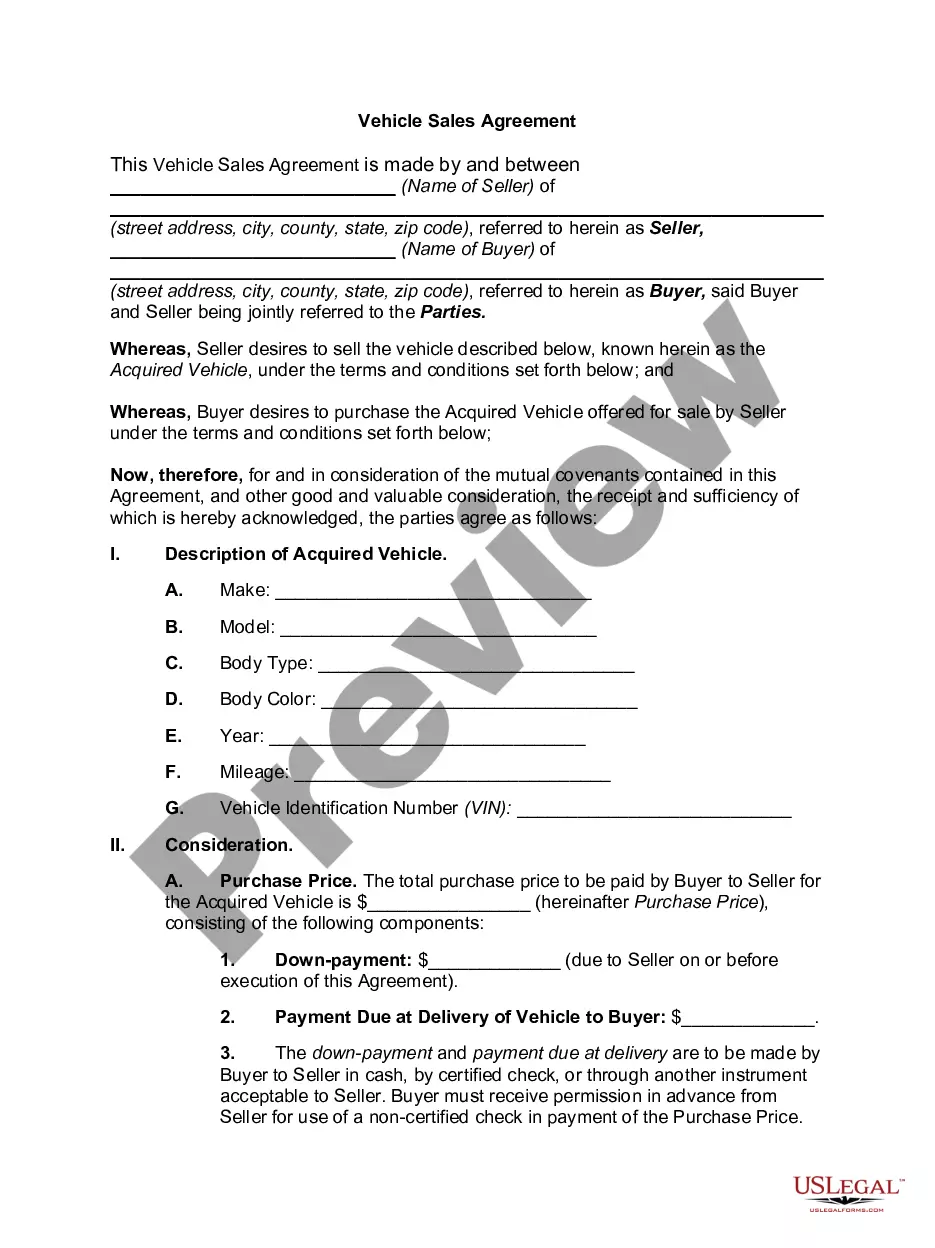

Locating the appropriate legal document format can present challenges. Clearly, there are numerous templates available online, but how can you find the legal form you require? Utilize the US Legal Forms platform. The service offers thousands of templates, such as the Guam Conditional Sales Agreement for Automobile between Individuals and Assumption of Outstanding Indebtedness, which can be utilized for both business and personal purposes. Each document is vetted by professionals and meets state and federal requirements.

If you are already signed up, Log In to your account and press the Obtain button to acquire the Guam Conditional Sales Agreement for Automobile between Individuals and Assumption of Outstanding Indebtedness. Use your account to browse through the legal documents you may have previously purchased. Go to the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward steps you can follow: First, ensure you have selected the correct form for your city/state. You can examine the form using the Review button and read the form description to verify that it is suitable for you. If the form does not meet your needs, use the Search box to find the right form. Once you are confident that the form is appropriate, click the Buy now button to acquire the document. Choose the payment plan you want and input the necessary information. Create your account and pay for the purchase using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired Guam Conditional Sales Agreement for Automobile between Individuals and Assumption of Outstanding Indebtedness.

- US Legal Forms is the largest repository of legal documents where you can find a variety of template files.

- Take advantage of the service to download professionally crafted documents that comply with state requirements.

Form popularity

FAQ

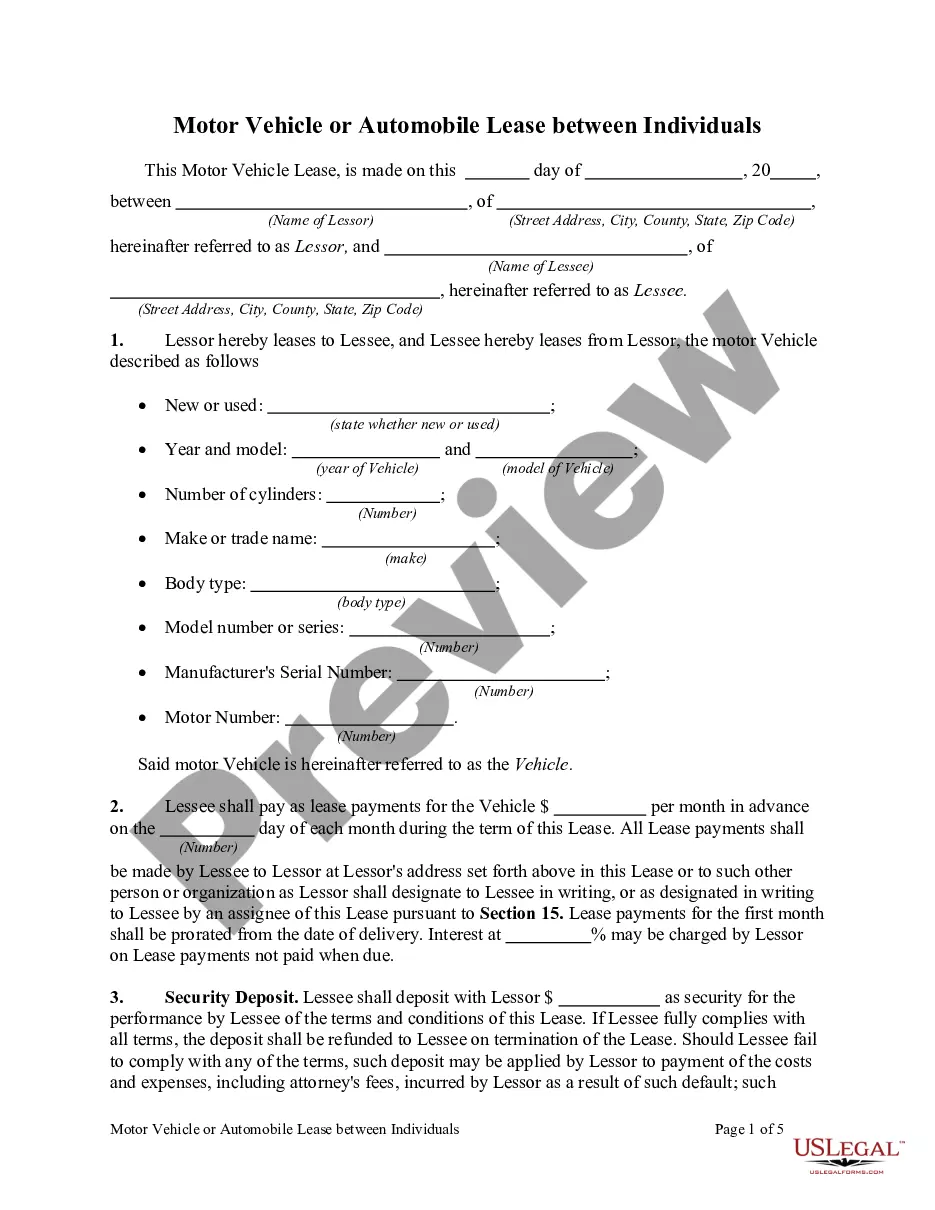

The primary difference between a true lease and a Conditional Sale lies in ownership; a true lease does not transfer ownership, while a Conditional Sale does, but under specified conditions. With a Guam Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, ownership is contingent upon the buyer fulfilling the financial terms outlined in the agreement. Understanding this distinction can help you make informed decisions when considering your automobile financing options.

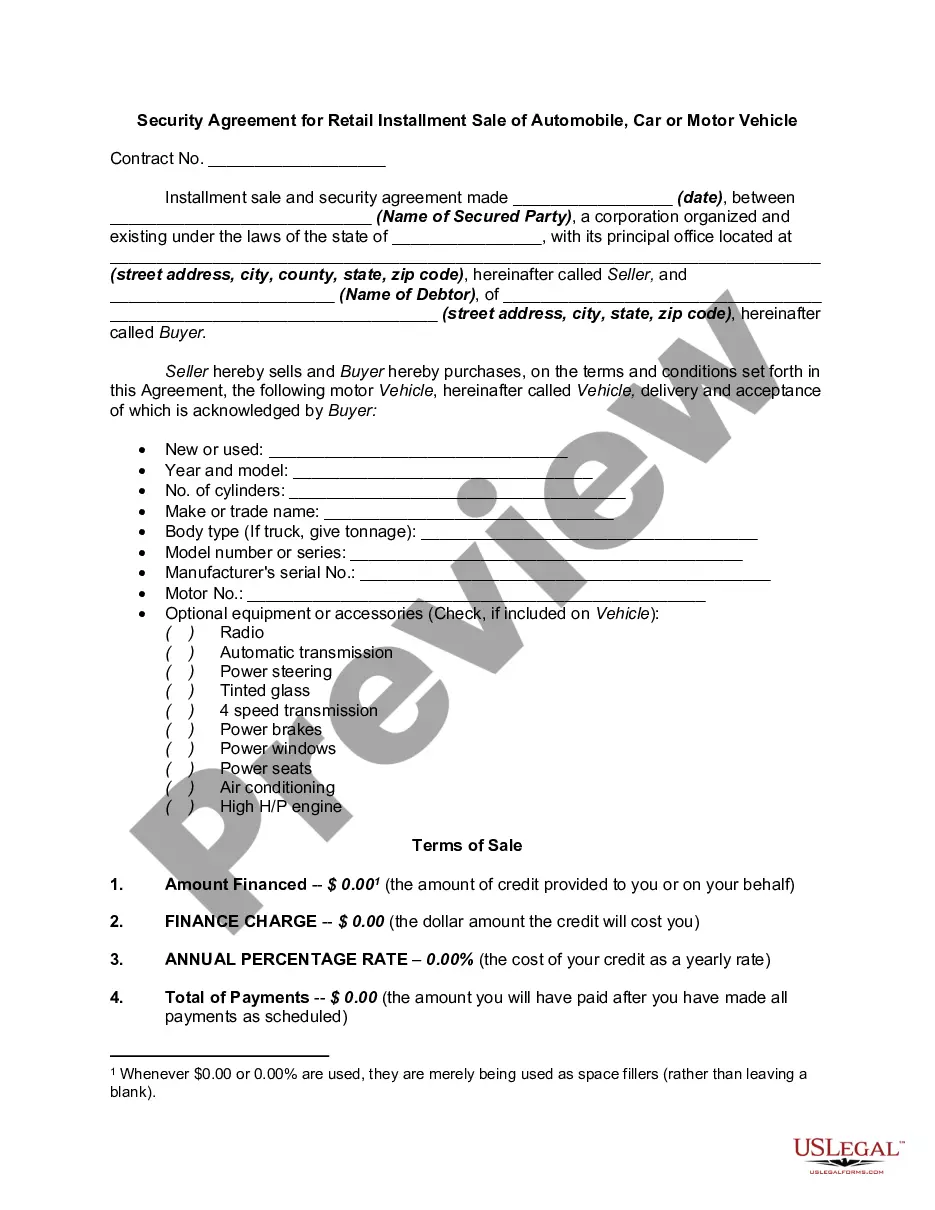

A conditional sales agreement is a contract that allows a seller to keep ownership of a vehicle until the buyer has fulfilled their financial obligations. In a Guam Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, this agreement governs the details of the transaction and establishes the terms necessary for the transfer of ownership. It serves as a protective measure for both parties involved, ensuring clarity in financial and legal responsibilities.

At the end of a Conditional Sale agreement, the buyer typically gains full ownership of the automobile once all terms are met and payments made. This process is crucial in a Guam Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, as it clarifies when any remaining debts or obligations are discharged. Consequently, it ensures a smooth transition of ownership and financial responsibilities.

A conditional sale deed is a legal document that facilitates the transfer of property ownership based on specific conditions being satisfied. Within the framework of a Guam Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, this deed is used to ensure that both parties understand their obligations related to the debt tied to the vehicle. It highlights both the seller's and buyer's rights throughout the sale process.

A conditional agreement is a contract that becomes enforceable when certain conditions are met. In the context of a Guam Conditional Sales Agreement of Automobile between Individuals and Assumption of Outstanding Indebtedness, this type of agreement outlines the conditions under which one party can sell a vehicle to another. Your responsibilities in the agreement depend on these specific conditions being fulfilled.