Guam Demand for Payment of an Open Account by Creditor

Description

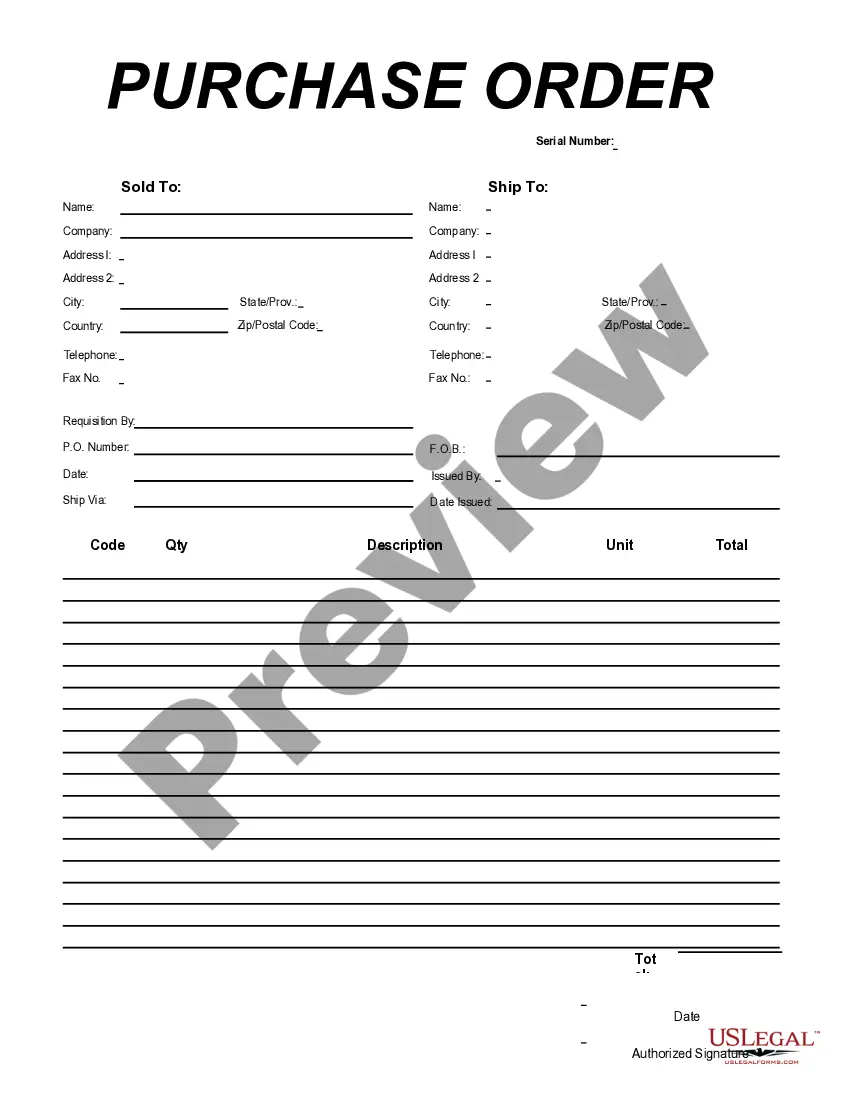

How to fill out Demand For Payment Of An Open Account By Creditor?

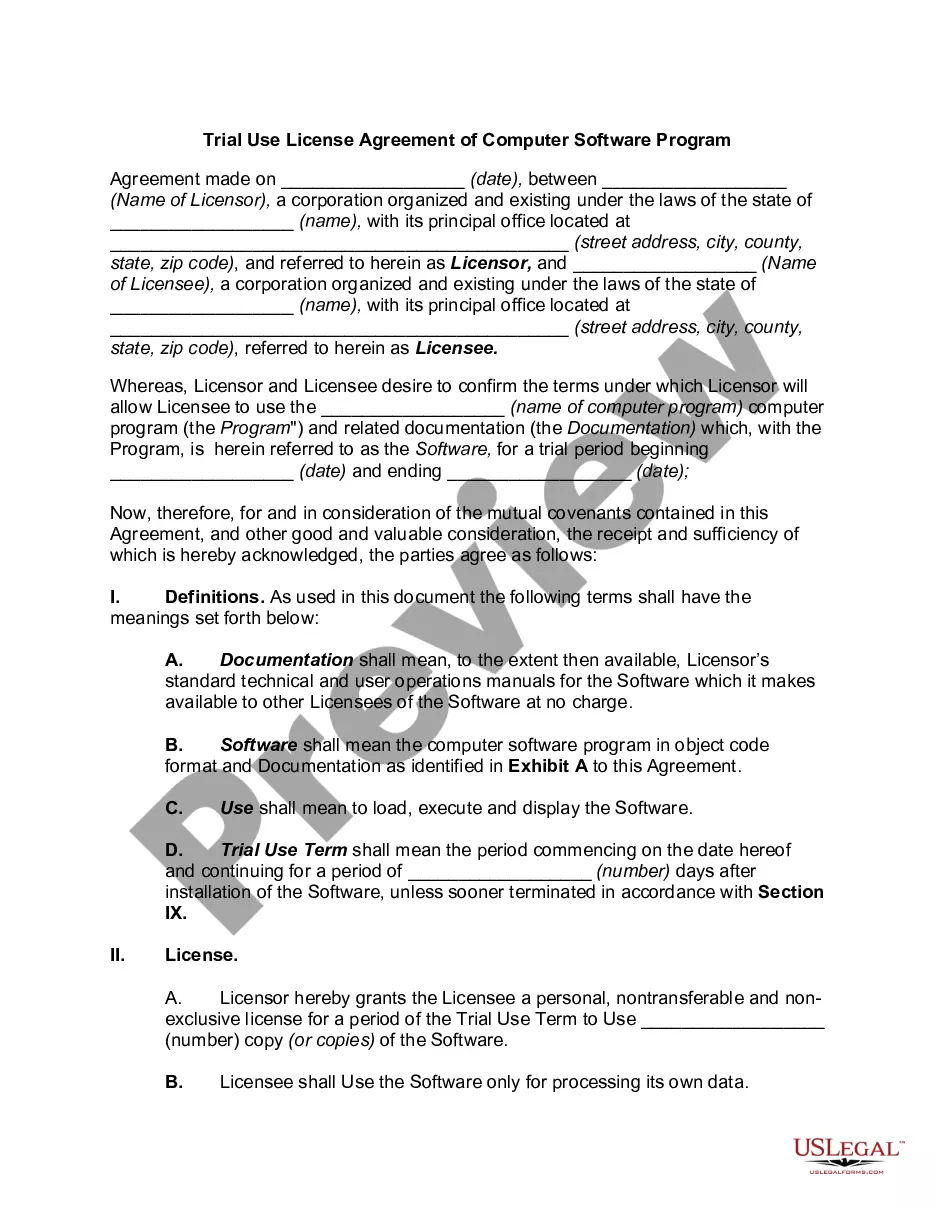

If you wish to full, acquire, or produce legal document templates, use US Legal Forms, the largest selection of legal varieties, that can be found on the web. Utilize the site`s basic and practical research to discover the files you need. A variety of templates for enterprise and personal functions are sorted by groups and says, or search phrases. Use US Legal Forms to discover the Guam Demand for Payment of an Open Account by Creditor in just a couple of mouse clicks.

If you are already a US Legal Forms buyer, log in to the profile and click the Download key to get the Guam Demand for Payment of an Open Account by Creditor. You can even accessibility varieties you formerly saved in the My Forms tab of the profile.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form to the proper metropolis/nation.

- Step 2. Make use of the Review method to check out the form`s information. Never neglect to learn the outline.

- Step 3. If you are unhappy using the form, use the Search discipline on top of the screen to get other variations from the legal form web template.

- Step 4. Once you have located the form you need, go through the Buy now key. Pick the rates program you favor and put your accreditations to sign up for the profile.

- Step 5. Method the purchase. You can utilize your Мisa or Ьastercard or PayPal profile to accomplish the purchase.

- Step 6. Pick the file format from the legal form and acquire it on the device.

- Step 7. Total, edit and produce or sign the Guam Demand for Payment of an Open Account by Creditor.

Every legal document web template you acquire is yours forever. You may have acces to every single form you saved within your acccount. Select the My Forms section and decide on a form to produce or acquire once again.

Remain competitive and acquire, and produce the Guam Demand for Payment of an Open Account by Creditor with US Legal Forms. There are many specialist and condition-specific varieties you can use to your enterprise or personal requirements.

Form popularity

FAQ

The debt collector has a certain amount of time to file the suit, called the "statute of limitations." In Texas, the statute of limitations for debt is 4 years. After that time passes, they can no longer file a lawsuit to collect the debt.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

In Guam, creditors have up to 60 days from the first creditor notice publication to make claims against the estate. Within that limit, note that most debts in Guam have a 5-year statute of limitations, and so make sure the debt has not already become barred (i.e., expired).

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

Looking back at your records, find the last time you paid toward your specific debt. This is the date you'll use to calculate whether your debt has reached the statute of limitations. Understand the statute of limitations in your state. Each state has its own laws to determine when a debt becomes time-barred.