Guam Buy-Sell Agreement between Shareholders of Closely Held Corporation: A Comprehensive Overview When engaging in business transactions within Guam's closely held corporations, it is crucial to establish a Buy-Sell Agreement between shareholders. This legally binding contract outlines the terms and conditions governing the buying and selling of shares in such corporations. By having a well-drafted Buy-Sell Agreement, shareholders can protect their rights, ensure a smooth transition of ownership, and minimize potential conflicts. Key Elements of a Guam Buy-Sell Agreement: 1. Shareholder Provisions: The agreement specifies the shareholders involved and their respective ownership percentages. It outlines how shares can be transferred and under what circumstances, such as death, disability, retirement, divorce, or voluntary sale. 2. Valuation Methods: To determine the fair market value of shares during a buyout, various valuation methods can be utilized, including the book value, earnings multiple, or independent appraisal. The agreement should clearly state the preferred approach and how disputes regarding valuation will be resolved. 3. Right of First Refusal: The Buy-Sell Agreement may grant existing shareholders the right of first refusal, meaning that any shareholder intending to sell their shares must offer them to the other shareholders first at the determined fair market value. This provision preserves the existing ownership structure and discourages external ownership. 4. Financing Terms: In cases where the purchasing shareholder requires financing, the agreement can specify the terms and conditions of such financing arrangements. This may include interest rates, repayment schedules, and collateral requirements. 5. Mandatory vs. Optional Redemption: A Buy-Sell Agreement can outline whether the redemption of shares by the corporation is mandatory or optional. In mandatory redemption, the corporation is obligated to buy back shares from a departing shareholder under specified circumstances. In optional redemption, the corporation has the choice to repurchase shares. Types of Guam Buy-Sell Agreements: 1. Cross-Purchase Agreement: Under this type of agreement, each shareholder agrees to buy the shares of a departing shareholder in proportion to their existing ownership percentages. This is common when there are only a few shareholders. 2. Stock Redemption Agreement: In this agreement, the corporation itself buys back the shares of a departing shareholder, maintaining ownership within the corporation. This is often preferred when the corporation has sufficient funds or wants to avoid dilution of ownership. 3. Combined Buy-Sell Agreement: This agreement combines aspects of both the cross-purchase and stock redemption agreements. It allows the corporation and other shareholders to have the option to purchase departing shareholders' shares, providing flexibility in the event of a buyout. In conclusion, a Guam Buy-Sell Agreement between shareholders of a closely held corporation is an essential tool in ensuring the orderly transfer of shares and protecting shareholders' interests. By addressing key elements, such as shareholder provisions, valuation methods, right of first refusal, financing terms, and redemption options, the agreement provides clarity and minimizes conflicts. Consider the type of agreement that best suits your corporation's needs, whether it be a cross-purchase, stock redemption, or combined buy-sell agreement. Seek professional legal advice to draft a comprehensive and tailored agreement that safeguards all parties involved.

Guam Buy-Sell Agreement between Shareholders of Closely Held Corporation

Description

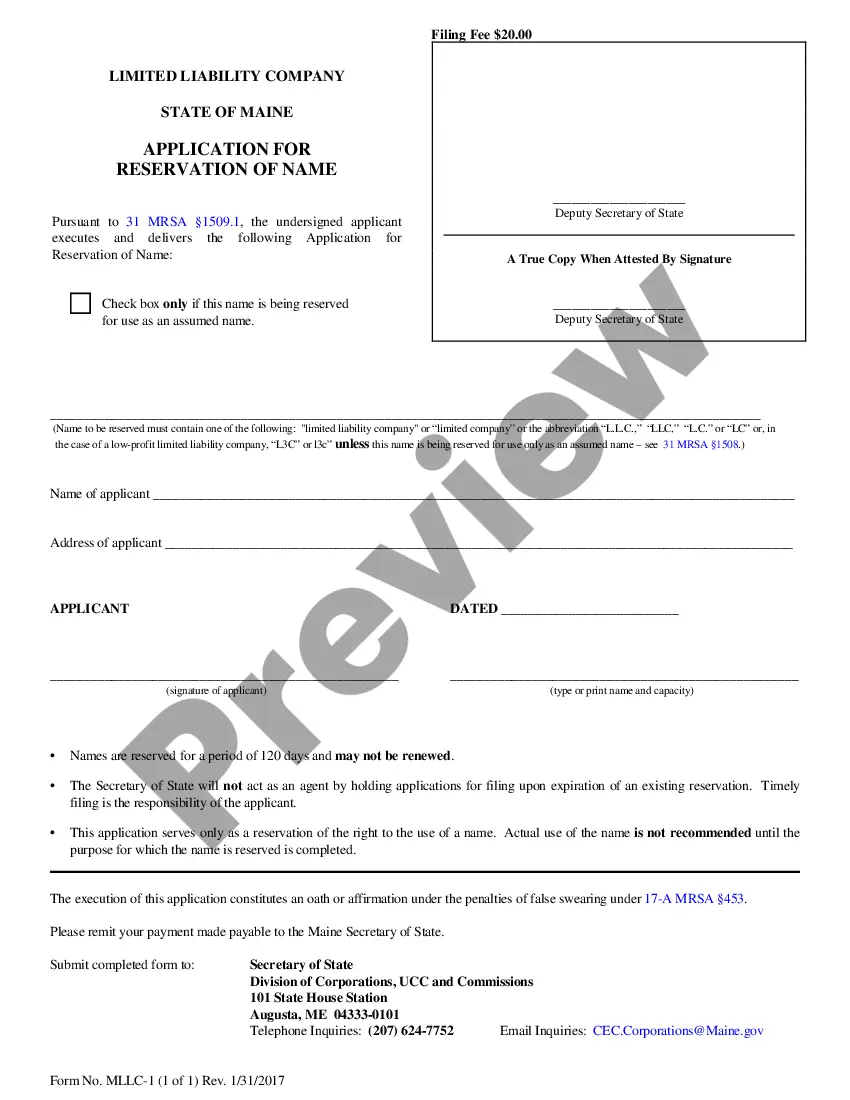

How to fill out Guam Buy-Sell Agreement Between Shareholders Of Closely Held Corporation?

If you want to full, down load, or print out lawful record themes, use US Legal Forms, the largest collection of lawful forms, which can be found on the Internet. Make use of the site`s easy and hassle-free research to obtain the files you need. Numerous themes for organization and individual reasons are categorized by categories and claims, or key phrases. Use US Legal Forms to obtain the Guam Buy-Sell Agreement between Shareholders of Closely Held Corporation in a number of clicks.

When you are already a US Legal Forms consumer, log in to the accounts and click on the Download button to find the Guam Buy-Sell Agreement between Shareholders of Closely Held Corporation. You may also entry forms you earlier acquired within the My Forms tab of your own accounts.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the shape for that correct city/country.

- Step 2. Utilize the Preview option to check out the form`s articles. Never forget to learn the explanation.

- Step 3. When you are not happy with the form, utilize the Research industry near the top of the display to find other variations of your lawful form format.

- Step 4. Once you have identified the shape you need, click the Acquire now button. Pick the pricing program you favor and include your references to register for an accounts.

- Step 5. Approach the transaction. You should use your Мisa or Ьastercard or PayPal accounts to perform the transaction.

- Step 6. Choose the format of your lawful form and down load it on the product.

- Step 7. Full, edit and print out or indication the Guam Buy-Sell Agreement between Shareholders of Closely Held Corporation.

Every lawful record format you acquire is your own forever. You have acces to every single form you acquired in your acccount. Select the My Forms portion and pick a form to print out or down load once more.

Contend and down load, and print out the Guam Buy-Sell Agreement between Shareholders of Closely Held Corporation with US Legal Forms. There are millions of specialist and status-particular forms you can utilize to your organization or individual demands.