Guam Promissory Note in Connection with a Sale and Purchase of a Mobile Home

Description

How to fill out Promissory Note In Connection With A Sale And Purchase Of A Mobile Home?

Are you currently in a situation where you require documents for occasional corporate or personal use nearly every workday.

There are numerous legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Guam Promissory Note related to the Sale and Purchase of a Mobile Home, designed to meet state and federal requirements.

Select a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Guam Promissory Note related to the Sale and Purchase of a Mobile Home at any time, if needed. Just click on the required form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid errors. The service provides properly crafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Promissory Note related to the Sale and Purchase of a Mobile Home template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you require and ensure it is for the correct city/region.

- Use the Review button to examine the form.

- Check the summary to ensure you have selected the correct form.

- If the form does not meet your expectations, utilize the Search field to find the form that aligns with your needs and requirements.

- Once you acquire the correct form, click Get now.

- Choose the pricing plan you prefer, provide the necessary details to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

Form popularity

FAQ

You can create a Promissory Note as a lender or borrower by following these steps:Select the location. Our Promissory Note template will customize your document specifically for the laws of your location.Provide party details.Establish the terms of the loan.Include final details.Sign the document.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Unlike a promissory note, a loan agreement imposes obligations on both parties, which is why both the borrower and lender must sign the agreement. A loan agreement should state what purpose the loan is used for, and whether the borrower must provide compensation if the lender suffers loss.

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

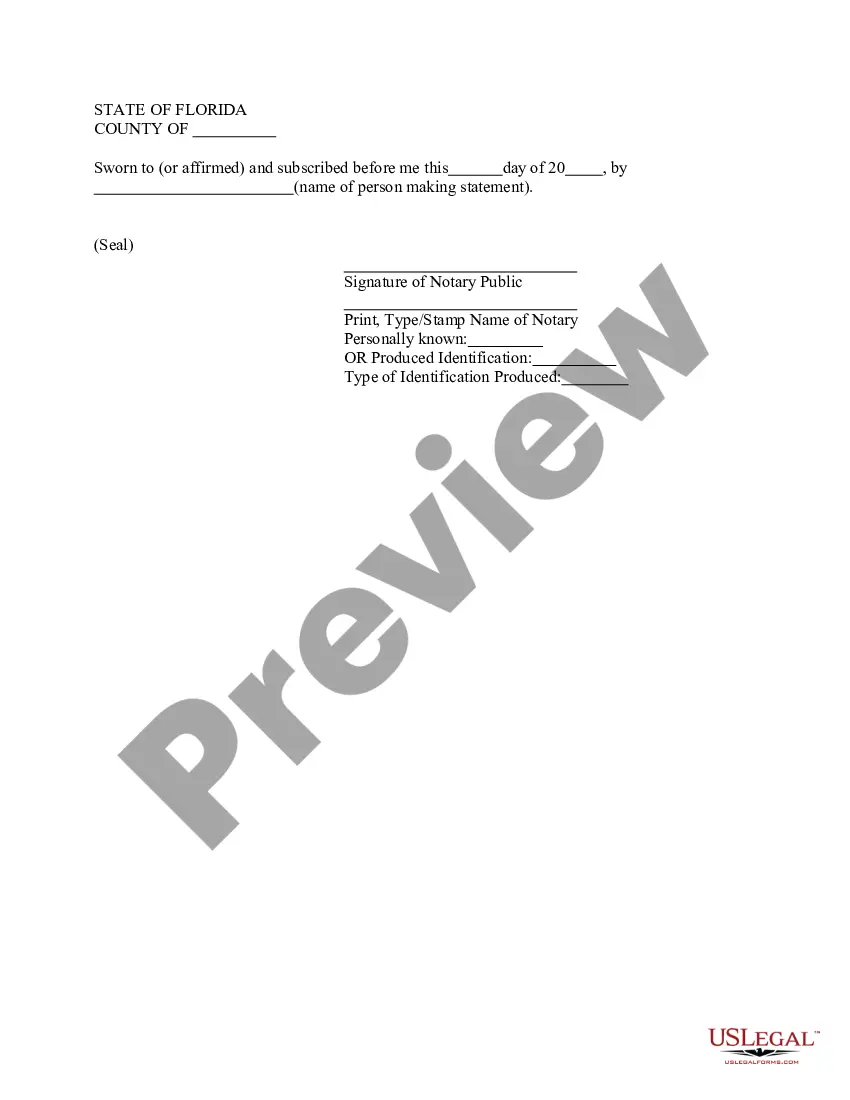

How To Write a Promissory NoteStep 1 Full names of parties (borrower and lender)Step 2 Repayment amount (principal and interest)Step 3 Payment plan.Step 4 Consequences of non-payment (default and collection)Step 5 Notarization (if necessary)Step 6 Other common details.

Executing a note involves signing, dating and having your signature witnessed.Create the promissory note.Create date and signature lines for yourself and a witness.Sign the form in front of a witness.Give the note to the lending party.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.