Guam Notice of Shareholders Meeting

Description

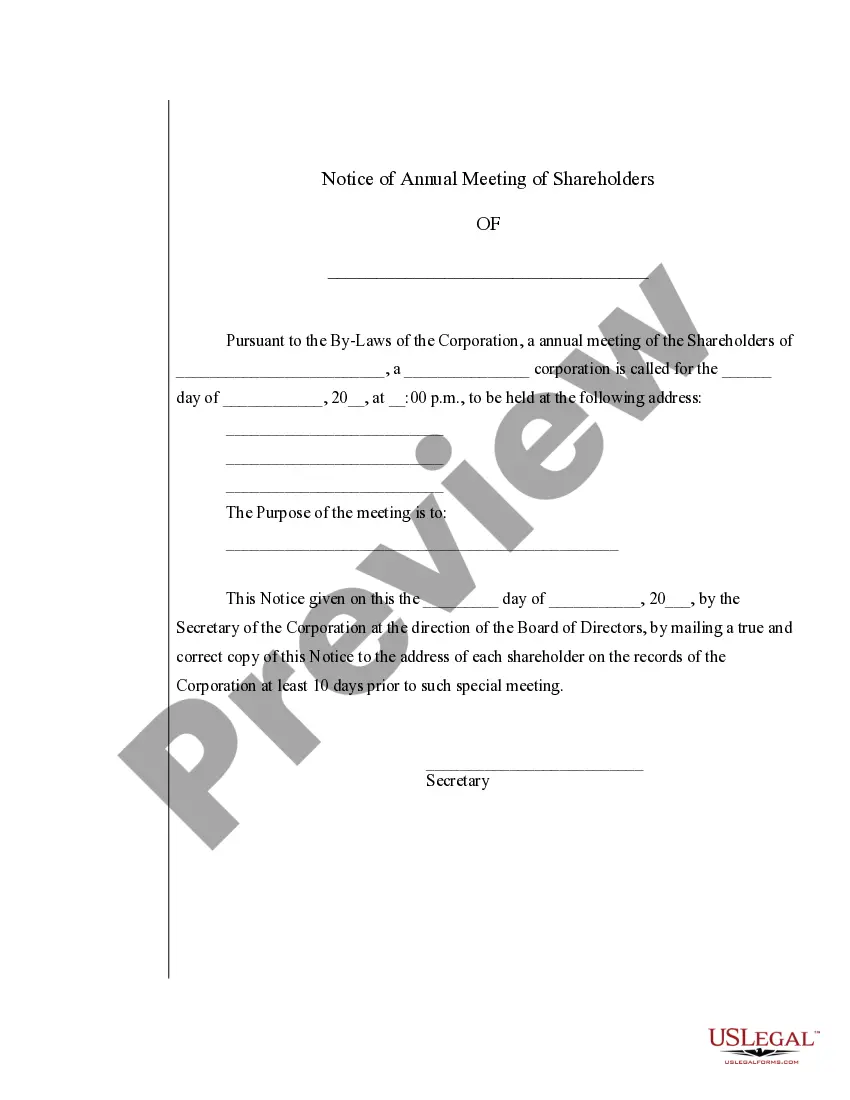

How to fill out Notice Of Shareholders Meeting?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal uses, categorized by types, states, or keywords. You can find the latest forms, like the Guam Notice of Shareholders Meeting, in mere seconds.

If you already have a monthly subscription, Log In and download the Guam Notice of Shareholders Meeting from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms under the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the saved Guam Notice of Shareholders Meeting. Each template you save in your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Guam Notice of Shareholders Meeting with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast range of professional and state-specific templates that satisfy your business or personal requirements and preferences.

- Ensure you have selected the correct form for the area/region. Click the Preview button to review the contents of the form.

- Check the form description to confirm that you have selected the right one.

- If the form does not suit your needs, utilize the Search field at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your choice by pressing the Get now button.

- Then, choose the pricing plan you desire and provide your information to register for an account.

Form popularity

FAQ

For a shareholders meeting in Guam, the law mandates giving at least 21 days' notice before the event. This Guam Notice of Shareholders Meeting should be sent to all shareholders to ensure they have sufficient time to review the upcoming agenda. It's important to deliver this notice through official channels such as mail or electronic communication to maintain compliance. By adhering to this notice period, companies help promote participation and uphold good governance.

Shareholder meetings in Guam must comply with specific legal requirements established by the local corporate laws. Generally, these include notifying shareholders through a Guam Notice of Shareholders Meeting, outlining the agenda, and specifying how to vote. Additionally, a quorum must be present for decisions to be made, ensuring that a significant portion of shareholders are involved in the deliberations. Meeting these requirements is crucial for valid proceedings and shareholder satisfaction.

Yes, under Guam law, the company must provide at least 21 days' notice for the Annual General Meeting (AGM) through the Guam Notice of Shareholders Meeting. This allows shareholders adequate time to prepare and participate effectively. The notice should include essential details such as the date, time, and location of the meeting. By ensuring timely notice, companies foster transparency and encourage active shareholder engagement.

A shareholders meeting should include several key elements to ensure effective communication and decision-making. First, the meeting should outline the agenda, which typically covers important topics such as financial reports, election of board members, and any proposed changes to company policies. Additionally, it's essential to provide proper notice to shareholders, known as the Guam Notice of Shareholders Meeting, to inform them about the date, time, and location of the gathering. By including these components, you create a transparent and organized meeting that fosters shareholder engagement.

The general meeting of shareholders is a gathering that usually occurs annually, where shareholders review the company's performance and future outlook. In the Guam Notice of Shareholders Meeting, topics include financial results, board elections, and major company initiatives. This essential gathering keeps shareholders aligned with the company’s goals and achievements.

The shareholders meeting is designed to facilitate communication between company management and shareholders. During the Guam Notice of Shareholders Meeting, key issues such as financial performance, operational matters, and strategic plans will be discussed. This meeting provides an opportunity for shareholders to express their views and influence company decisions.

The purpose of the notice of meeting is to formally inform shareholders about essential matters that will be addressed during the Guam Notice of Shareholders Meeting. It ensures transparency, allows for adequate preparation, and promotes active participation. By receiving this notice, shareholders can make informed decisions.

The notice of meeting of shareholders is a crucial document that announces the scheduled gathering to discuss corporate affairs outlined in the Guam Notice of Shareholders Meeting. It highlights the agenda, voting procedures, and any resolutions that will be proposed. This notice serves to keep shareholders informed and engaged in the company's direction.

Shareholders meetings, as outlined in the Guam Notice of Shareholders Meeting, must adhere to specific regulations. Critical agenda items must be identified, and shareholders should receive all relevant materials in advance. It's essential for these meetings to follow a structured process to ensure smooth and productive discussions.

A minimum of 10 days notice is generally mandated for a Guam Notice of Shareholders Meeting. This timeframe enables shareholders to gather pertinent information and consider any changes on the agenda. Additionally, it fosters better attendance and participation from shareholders.