The Guam Participation Agreement in Connection with Secured Loan Agreement refers to an agreement that outlines the terms and conditions governing the participation of Guam in a secured loan agreement. This agreement serves as a legal document that defines the roles, responsibilities, and rights of Guam and the lender in relation to the secured loan. The Guam Participation Agreement typically includes several key provisions. First, it establishes the purpose of the secured loan and the specific project, program, or initiative it is intended to finance. This could range from infrastructure development, economic stimulation, or public projects. Second, the agreement outlines the terms of the participation, including the amount of the loan that Guam will be responsible for. The loan amount may vary depending on the specific agreement and the particular needs of Guam. Third, the agreement details the repayment terms, such as the interest rate, repayment schedule, and any additional fees or charges associated with the loan. These terms are negotiated between Guam and the lender and are aimed at ensuring timely and efficient repayment. Furthermore, the Guam Participation Agreement establishes the rights and obligations of both parties. It specifies the conditions under which the loan may be called due, the consequences of non-payment or default, and any collateral or security provided to secure the loan. Different types of Guam Participation Agreements in Connection with Secured Loan Agreements can be classified based on the purpose of the loan, the type of collateral, or the sector being financed. For example, there could be agreements specific to infrastructure development like roads, bridges, or airports. Alternatively, there might be agreements focused on financing public services such as education, healthcare, or public housing. To summarize, the Guam Participation Agreement in Connection with Secured Loan Agreement is a contractual arrangement between Guam and a lender that governs Guam's participation in a secured loan. It establishes the terms of the loan, repayment conditions, rights, and obligations of both parties. The specific types of agreements can vary based on the purpose, collateral, or sector being financed.

Guam Participation Agreement in Connection with Secured Loan Agreement

Description

How to fill out Guam Participation Agreement In Connection With Secured Loan Agreement?

If you wish to complete, download, or produce legal document themes, use US Legal Forms, the greatest variety of legal kinds, which can be found on the Internet. Make use of the site`s simple and easy convenient research to obtain the files you want. Numerous themes for company and individual uses are sorted by groups and says, or keywords and phrases. Use US Legal Forms to obtain the Guam Participation Agreement in Connection with Secured Loan Agreement with a couple of mouse clicks.

When you are presently a US Legal Forms client, log in to the bank account and click the Acquire switch to find the Guam Participation Agreement in Connection with Secured Loan Agreement. You may also accessibility kinds you earlier delivered electronically within the My Forms tab of your own bank account.

Should you use US Legal Forms the first time, follow the instructions below:

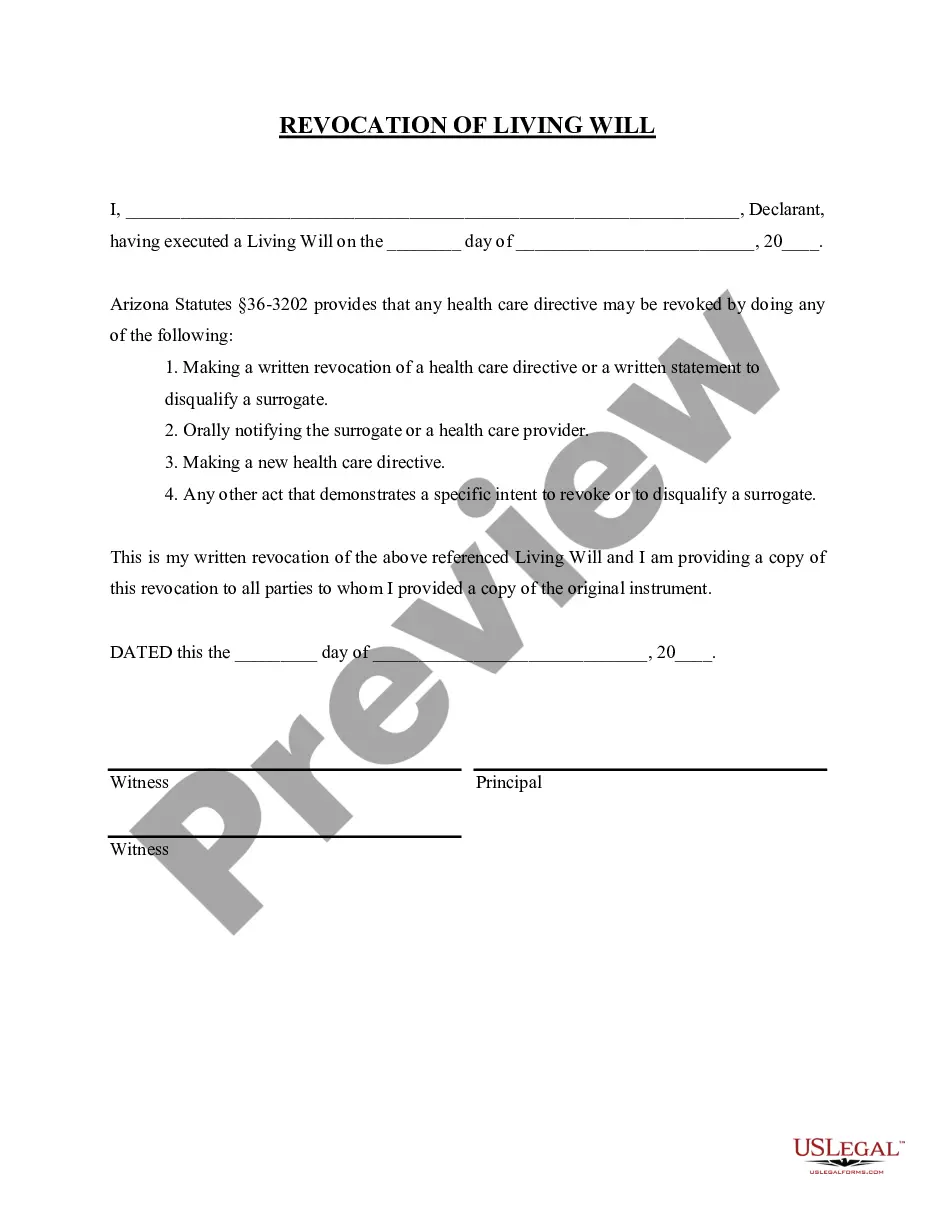

- Step 1. Ensure you have chosen the shape to the proper town/land.

- Step 2. Make use of the Preview choice to check out the form`s content material. Never neglect to learn the information.

- Step 3. When you are unhappy together with the form, use the Lookup area towards the top of the monitor to discover other types from the legal form design.

- Step 4. Upon having found the shape you want, select the Get now switch. Opt for the pricing program you favor and include your qualifications to sign up for an bank account.

- Step 5. Process the deal. You may use your Мisa or Ьastercard or PayPal bank account to accomplish the deal.

- Step 6. Choose the format from the legal form and download it in your device.

- Step 7. Total, change and produce or signal the Guam Participation Agreement in Connection with Secured Loan Agreement.

Every single legal document design you buy is the one you have eternally. You may have acces to every form you delivered electronically inside your acccount. Click on the My Forms segment and decide on a form to produce or download once again.

Remain competitive and download, and produce the Guam Participation Agreement in Connection with Secured Loan Agreement with US Legal Forms. There are many professional and condition-certain kinds you can utilize for your company or individual requirements.