Guam Private Annuity Agreement with Payments to Last for Life of Annuitant is a financial arrangement that offers individuals a secure and reliable source of income for their entire lifetime. This agreement is specifically designed for individuals who wish to transfer their assets into a private annuity while ensuring a consistent stream of payments until the end of their life. The Guam Private Annuity Agreement serves as a legal contract between the annuitant (the individual transferring the assets) and the annuity provider. It allows the annuitant to exchange their assets for a regular income, with the promise of payments to last for their entire lifetime. These payments can be customized based on the annuitant's preferences, considering factors such as the value of the assets transferred, the annuitant's age, and the prevailing interest rates. One advantage of the Guam Private Annuity Agreement is the potential for tax benefits. By transferring their assets into a private annuity, individuals can effectively defer their capital gains taxes until they start receiving payments. This provides financial flexibility and can optimize their tax planning. Different types of Guam Private Annuity Agreements with Payments to Last for Life of Annuitant may include variations in payment structures and options. For instance, a fixed annuity guarantees a constant payment amount throughout the annuitant's life, providing stability and security. Conversely, a variable annuity offers the potential for growth by allowing the annuitant to invest in underlying investment funds, with payment amounts tied to the performance of those investments. It is important to note that entering into a Guam Private Annuity Agreement should be done with thorough consideration and consultation with financial advisors. While providing a steady income stream, the agreement requires the annuitant to transfer ownership of their assets. Therefore, it is essential to carefully assess the implications, terms, and conditions of the agreement to make an informed decision that aligns with their long-term financial goals. In summary, the Guam Private Annuity Agreement with Payments to Last for Life of Annuitant presents individuals with an attractive option for securing a consistent income stream for their lifetime. By exploring the different types of annuity agreements available and consulting with financial professionals, individuals can make informed decisions that suit their financial situations and long-term objectives.

Guam Private Annuity Agreement with Payments to Last for Life of Annuitant

Description

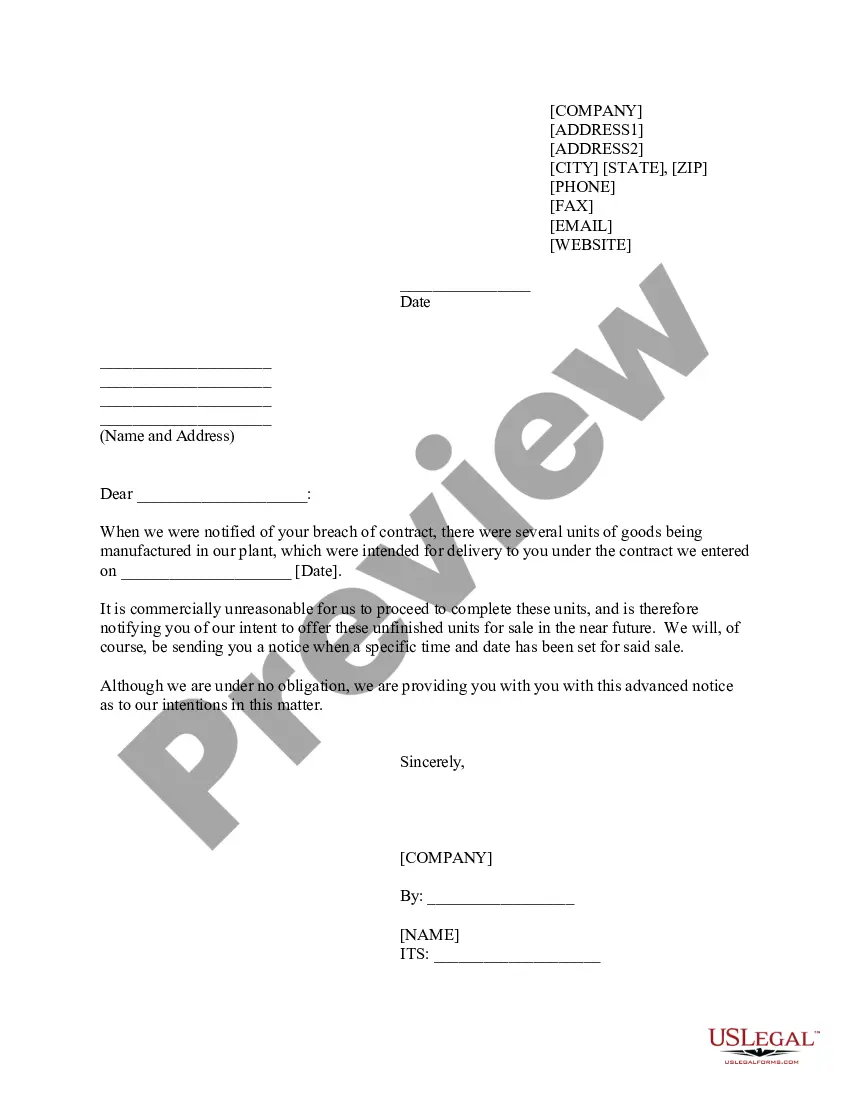

How to fill out Guam Private Annuity Agreement With Payments To Last For Life Of Annuitant?

US Legal Forms - one of the biggest libraries of authorized types in America - delivers a wide range of authorized record web templates you can acquire or printing. Making use of the website, you can find thousands of types for business and personal functions, sorted by classes, states, or keywords.You can find the most up-to-date models of types much like the Guam Private Annuity Agreement with Payments to Last for Life of Annuitant in seconds.

If you already have a subscription, log in and acquire Guam Private Annuity Agreement with Payments to Last for Life of Annuitant from the US Legal Forms library. The Obtain key can look on every develop you see. You get access to all in the past downloaded types from the My Forms tab of your accounts.

If you want to use US Legal Forms for the first time, listed below are straightforward directions to get you started:

- Ensure you have selected the best develop for your personal metropolis/state. Select the Preview key to check the form`s articles. Read the develop outline to actually have selected the correct develop.

- In the event the develop does not suit your requirements, utilize the Lookup field at the top of the monitor to find the one who does.

- If you are pleased with the form, affirm your decision by visiting the Buy now key. Then, select the prices program you want and provide your credentials to sign up for the accounts.

- Process the purchase. Utilize your charge card or PayPal accounts to finish the purchase.

- Pick the formatting and acquire the form on your device.

- Make changes. Load, edit and printing and indication the downloaded Guam Private Annuity Agreement with Payments to Last for Life of Annuitant.

Each and every format you included in your account lacks an expiration time and is also the one you have forever. So, if you want to acquire or printing yet another duplicate, just proceed to the My Forms segment and click on around the develop you require.

Gain access to the Guam Private Annuity Agreement with Payments to Last for Life of Annuitant with US Legal Forms, by far the most comprehensive library of authorized record web templates. Use thousands of professional and status-particular web templates that fulfill your company or personal requires and requirements.

Form popularity

FAQ

Also known as a straight-life or life-only annuity, a single-life annuity allows you to receive payments your entire life. Unlike some other options that allow for beneficiaries or spouses, this annuity is limited to the lifetime of the annuitant with no survivor benefit.

Joint life annuity settlement option pays benefits to two or more annuitants, but stops upon the death of the first.

With a single-life or immediate annuity, the payments will simply cease at that point. However, you can purchase contracts that will provide payments to one or more beneficiaries after the annuitant's passing.

A lifetime annuity is a financial product you can buy with a lump sum of money. In return, you will receive income for the rest of your life. A lifetime annuity guarantees payment of a predetermined amount for the rest of your life. This is different from a term annuity which only pays you for a fixed amount of time.

Income annuities provide guaranteed lifetime income, either now or in the future, while other types of annuities help defer taxes or provide protection from stock market losses.

Annuity payout options include:Life Annuity with Period Certain (Fixed Period/Guaranteed Term) Joint and Survivor Annuity. Lump-Sum Payment. Systematic Annuity Withdrawal. Early Withdrawal.

The straight life income annuity option pays the annuitant a guaranteed income for his or her lifetime.

A lifetime payout annuity is a type of retirement investment that pays a portion of the underlying portfolio of assets for the life of the investor. The guaranteed payments associated with lifetime payout annuities eliminate the risk for investors of outliving their retirement funds.

Fixed-Period Annuity A fixed-period, or period-certain, annuity guarantees payments to the annuitant for a set length of time. Some common options are 10, 15, or 20 years. (In a fixed-amount annuity, by contrast, the annuitant elects an amount to be paid each month for life or until the benefits are exhausted.)

The life with period certain option is designed to pay the annuitant an income for life, but guarantees a minimum period of payments whether the individual is alive or not. Before he died, Gary received a total of $9,200 in monthly income payments from his $15,000 straight life annuity.

More info

Your portfolio can be in the same money market funds, managed and invested with one of a broad variety of advisors or managed with a separate advisor or broker. You can have your account invested in exchange-traded funds or directly as an individual investment in the name of a beneficiary. And you can invest as if you were not investing for retirement. The small Portfolio, as the name implies, can be small. The small portfolio allows you to diversify your retirement investments at a very low cost and offers an attractive portfolio choice that allows you to choose your investments and manage your portfolio with a very little effort and expense. There are many funds available to choose from in the large portfolio plans that come with more sophistication and complexity. The small portfolio has a lower expense ratio without any of the complexity. The small portfolio is a small portfolio by design.