Guam Agreement to Compromise Debt

Description

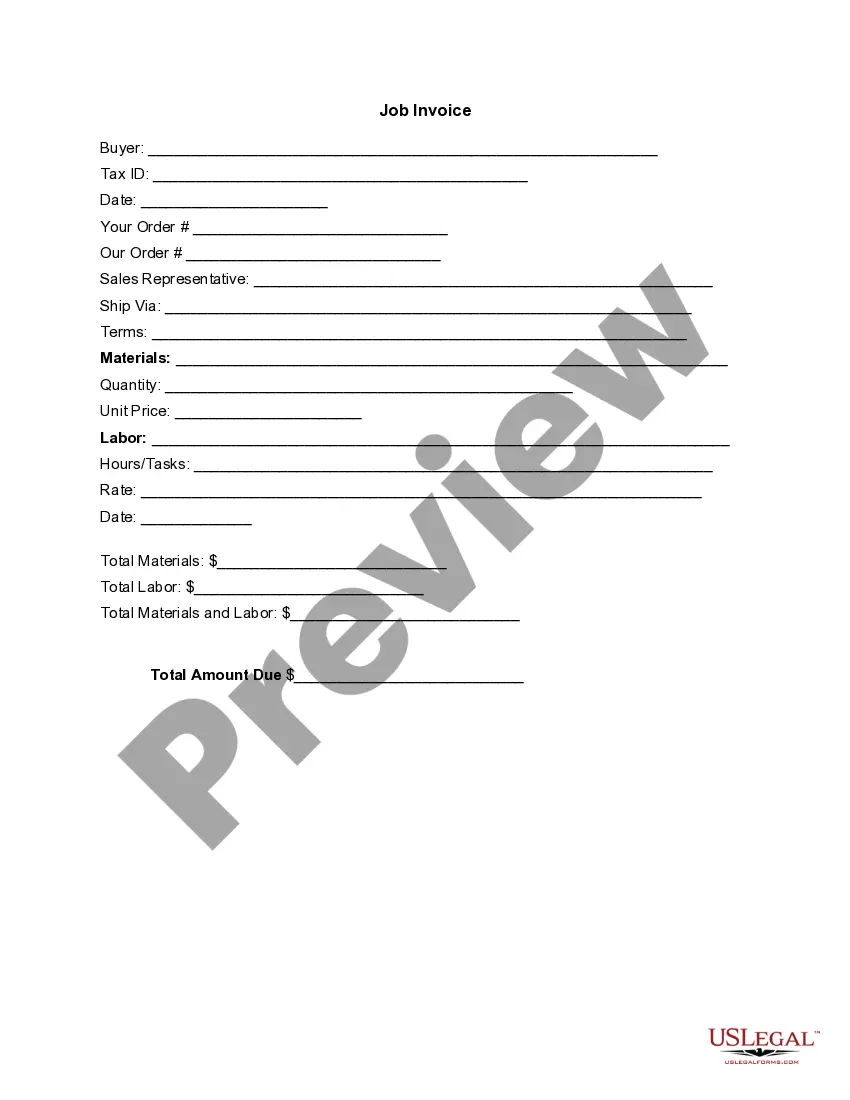

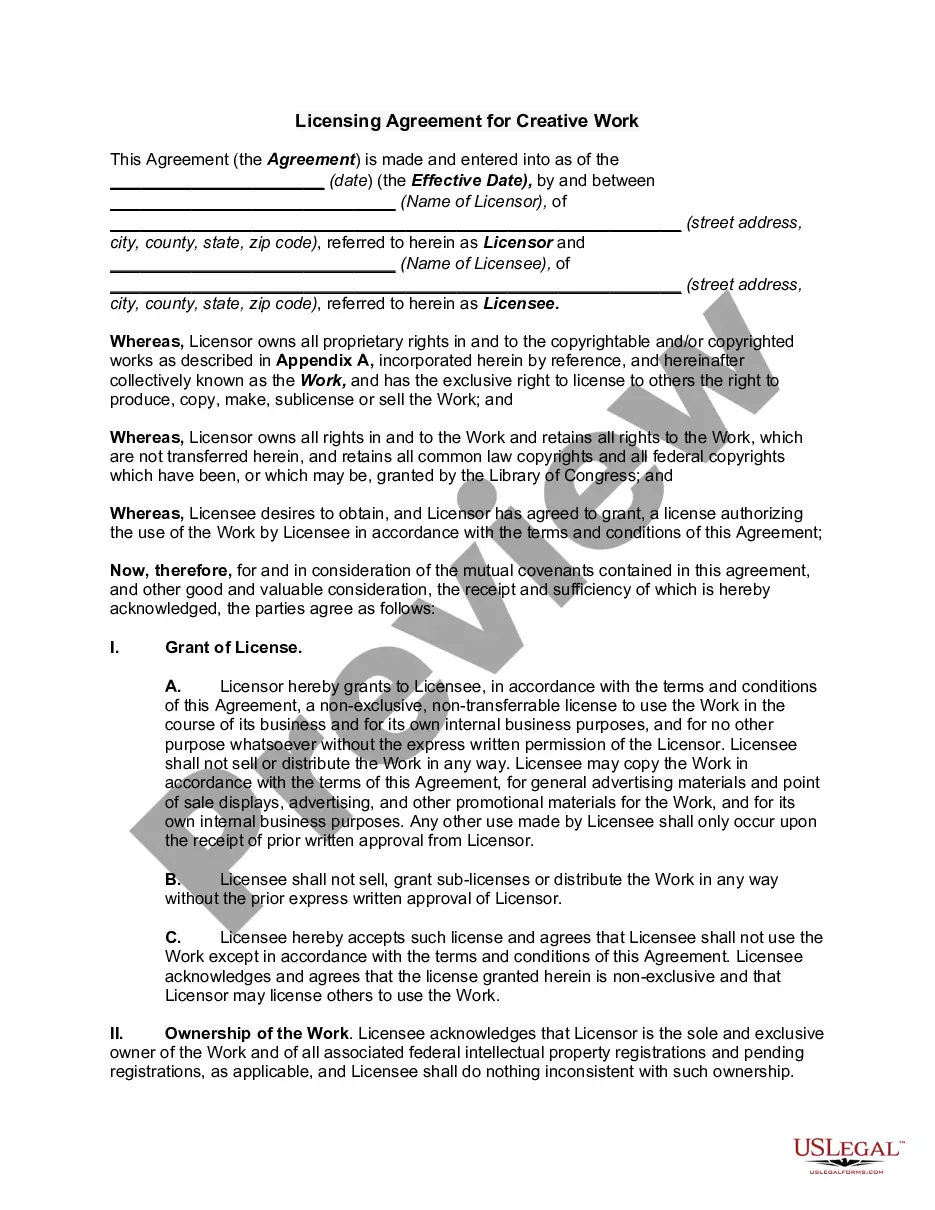

How to fill out Agreement To Compromise Debt?

You might spend several hours online attempting to locate the legal document format that meets the federal and state specifications you need.

US Legal Forms offers a vast array of legal forms that have been examined by experts.

You can download or print the Guam Agreement to Compromise Debt from your service.

To find another version of the form, use the Search field to locate the format that suits you and your needs.

- If you possess a US Legal Forms account, you can sign in and click on the Obtain button.

- After that, you can complete, alter, print, or sign the Guam Agreement to Compromise Debt.

- Each legal document format you acquire is yours forever.

- To retrieve another copy of any purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the right document format for your region/area that you choose.

- Check the form description to confirm you have selected the accurate form.

Form popularity

FAQ

The California Compromise of arrears program offers a specific framework for residents to resolve unpaid debts. By participating, you may be able to settle your debts for less than what you owe. This program aligns with the concept of the Guam Agreement to Compromise Debt, emphasizing the importance of negotiation and effective financial management.

The compromise of arrears program is designed to aid individuals in settling overdue debts through negotiation. This program focuses on reaching a more manageable payment plan, making it easier for you to handle your financial responsibilities. Engaging in a Guam Agreement to Compromise Debt can lead to more favorable terms and improved financial health.

Yes, there is government debt relief available that aims to assist citizens facing financial difficulties. This program can help you explore various options to manage your debts, including research into the Guam Agreement to Compromise Debt. It’s a resourceful avenue for finding solutions and working towards debt freedom.

The arrears payment incentive program offers support for individuals struggling with unpaid debts. This program provides strategies to help you manage your financial obligations, including options for negotiation and payment plans. It is often an effective step towards achieving a Guam Agreement to Compromise Debt, allowing you to settle debts more efficiently.

To support a debt relief order, you will need to gather evidence of your financial situation. This includes income statements, expense statements, and any relevant documentation of your debts. Additionally, presenting a Guam Agreement to Compromise Debt can provide a structured approach to your debts, helping strengthen your case.

Asking for debt forgiveness involves crafting a respectful and honest message to your creditor. Clearly explain your financial challenges and express your desire to resolve the debt. You can also mention a Guam Agreement to Compromise Debt as a viable option to ease your burden and facilitate the conversation.

When asking for a debt to be forgiven, clarity and sincerity are essential. Start by contacting your creditor and clearly explaining your financial difficulties. Propose a Guam Agreement to Compromise Debt, emphasizing your commitment to resolving the debt and any factors that may support your request.

To get your debt waived, you can reach out to your creditor and formally request consideration. When discussing your circumstances, you can mention a Guam Agreement to Compromise Debt as a potential solution. Showing genuine hardship and willingness to negotiate can significantly increase your chances of success.

Getting out of a debt settlement agreement is possible, but it requires careful consideration. You must review the terms of your agreement and communicate openly with your creditor about your situation. In some cases, negotiating a Guam Agreement to Compromise Debt can provide an effective way to restructure your obligations.

Writing a letter of forgiveness for debt involves a few clear steps. Start by identifying the debt you wish to forgive and address it to the creditor. Express your circumstances sincerely and request consideration for a Guam Agreement to Compromise Debt, highlighting any extenuating factors that support your case.