As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

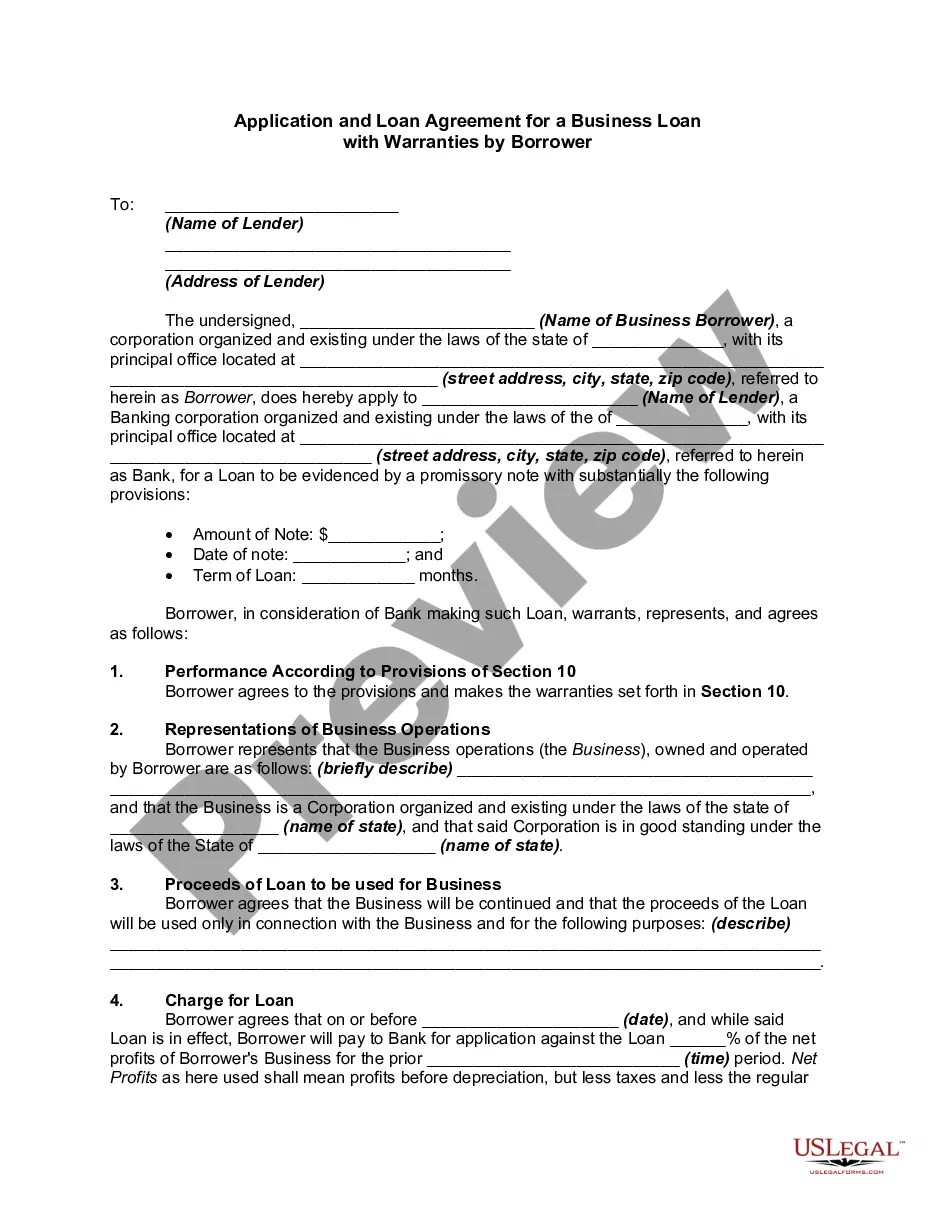

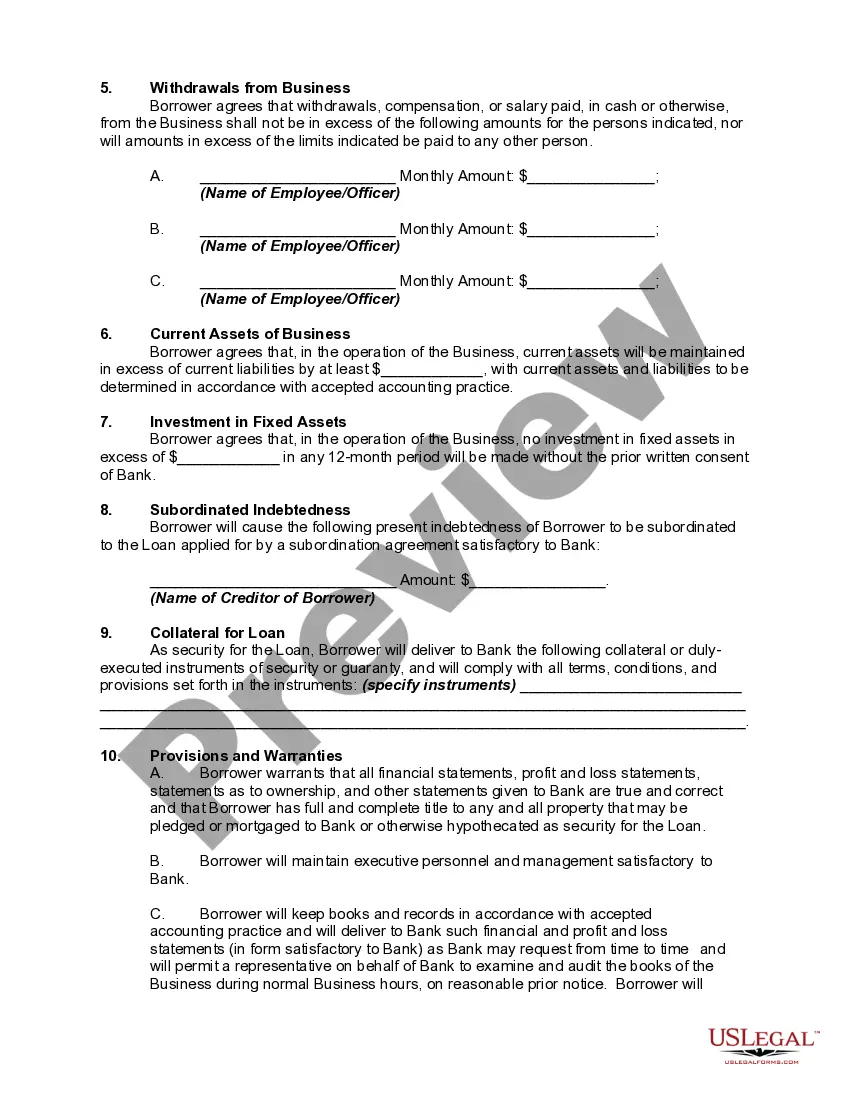

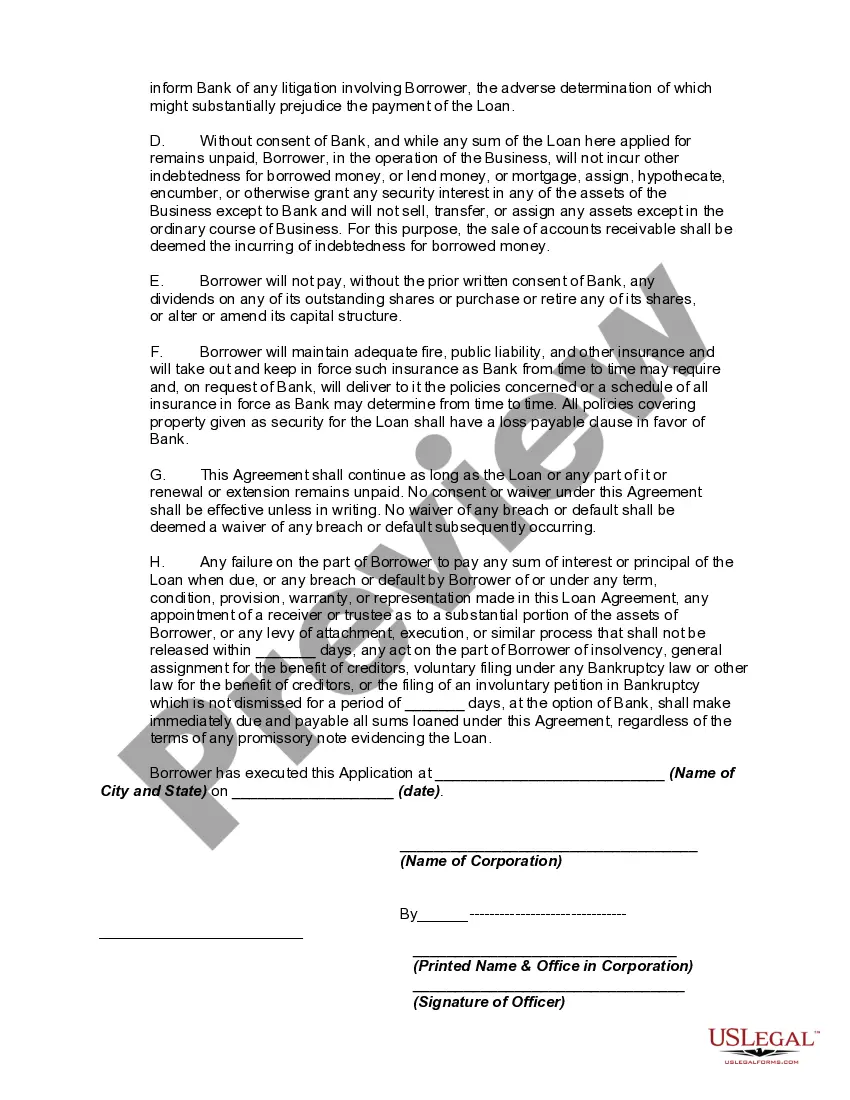

Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legally binding document required by financial institutions or lenders in Guam when extending a loan facility to a business entity. This comprehensive agreement outlines the terms and conditions of the loan, as well as both the financial obligations and the warranties provided by the borrower. The Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower is a key document in the loan approval process, providing crucial information about the borrower, the purpose of the loan, and the specific terms that govern the loan agreement. It facilitates transparency, mitigates risks, and protects the interests of both parties involved. The agreement typically includes the following information: 1. Identification of the Parties: The document identifies the borrower and the lender, stating their legal names, addresses, and contact details. These details help establish the relationship between the parties involved and ensure proper documentation. 2. Loan Terms: The agreement specifies the loan amount, interest rate, repayment schedule, and the purpose of the loan. It serves as a guide to both the borrower and the lender, outlining their financial responsibilities throughout the loan tenure. 3. Representations and Warranties: The borrower provides warranties and representations regarding their business, financial standing, and ability to repay the loan as per the agreed terms. This section ensures that the borrower is legally and financially capable of fulfilling their obligations. 4. Conditions Precedent: This section outlines the conditions that must be met before the loan disbursement, such as submission of financial documents, collateral agreement, insurance requirements, etc. It ensures that all necessary procedures are completed before the loan becomes effective. 5. Default and Remedies: The agreement highlights the consequences of default by the borrower, such as accelerating the loan repayment, charging late penalties, or seeking legal action. It provides a framework for resolving disputes and exercising remedies in case of default. Some variations of Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower may include specific clauses or terms tailored for particular loan types, such as: 1. Working Capital Loans: These loans are designed to finance day-to-day operations or cover short-term cash flow needs for the business. 2. Equipment Financing Loans: This type of loan is specifically used to purchase or lease equipment necessary for business operations, such as machinery, vehicles, or technology. 3. Real Estate Loans: For borrowers seeking funds for purchasing, refinancing, or renovating commercial properties, a real estate loan agreement outlines specific terms related to the property being financed. Overall, the Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower provides a comprehensive framework for borrowers and lenders to engage in a legally sound and transparent business loan arrangement. It ensures that both parties uphold their commitments and safeguard their respective interests throughout the loan term.Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legally binding document required by financial institutions or lenders in Guam when extending a loan facility to a business entity. This comprehensive agreement outlines the terms and conditions of the loan, as well as both the financial obligations and the warranties provided by the borrower. The Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower is a key document in the loan approval process, providing crucial information about the borrower, the purpose of the loan, and the specific terms that govern the loan agreement. It facilitates transparency, mitigates risks, and protects the interests of both parties involved. The agreement typically includes the following information: 1. Identification of the Parties: The document identifies the borrower and the lender, stating their legal names, addresses, and contact details. These details help establish the relationship between the parties involved and ensure proper documentation. 2. Loan Terms: The agreement specifies the loan amount, interest rate, repayment schedule, and the purpose of the loan. It serves as a guide to both the borrower and the lender, outlining their financial responsibilities throughout the loan tenure. 3. Representations and Warranties: The borrower provides warranties and representations regarding their business, financial standing, and ability to repay the loan as per the agreed terms. This section ensures that the borrower is legally and financially capable of fulfilling their obligations. 4. Conditions Precedent: This section outlines the conditions that must be met before the loan disbursement, such as submission of financial documents, collateral agreement, insurance requirements, etc. It ensures that all necessary procedures are completed before the loan becomes effective. 5. Default and Remedies: The agreement highlights the consequences of default by the borrower, such as accelerating the loan repayment, charging late penalties, or seeking legal action. It provides a framework for resolving disputes and exercising remedies in case of default. Some variations of Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower may include specific clauses or terms tailored for particular loan types, such as: 1. Working Capital Loans: These loans are designed to finance day-to-day operations or cover short-term cash flow needs for the business. 2. Equipment Financing Loans: This type of loan is specifically used to purchase or lease equipment necessary for business operations, such as machinery, vehicles, or technology. 3. Real Estate Loans: For borrowers seeking funds for purchasing, refinancing, or renovating commercial properties, a real estate loan agreement outlines specific terms related to the property being financed. Overall, the Guam Application and Loan Agreement for a Business Loan with Warranties by Borrower provides a comprehensive framework for borrowers and lenders to engage in a legally sound and transparent business loan arrangement. It ensures that both parties uphold their commitments and safeguard their respective interests throughout the loan term.