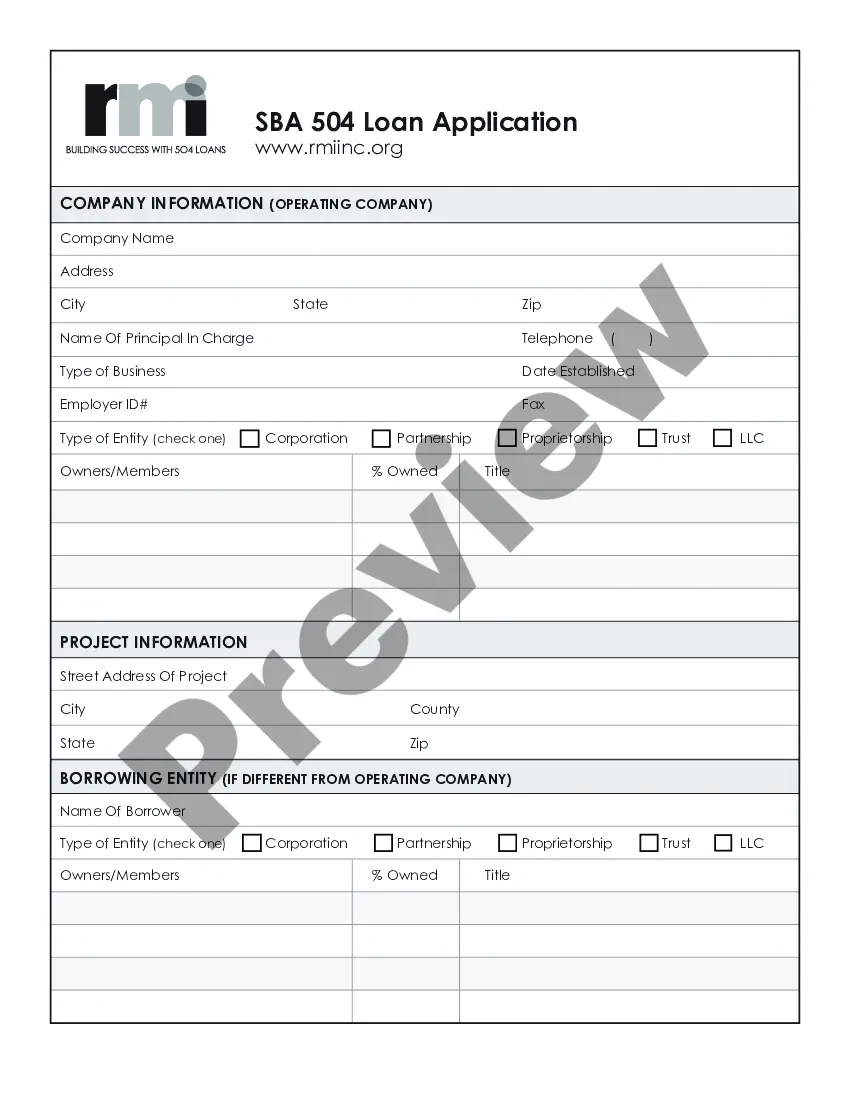

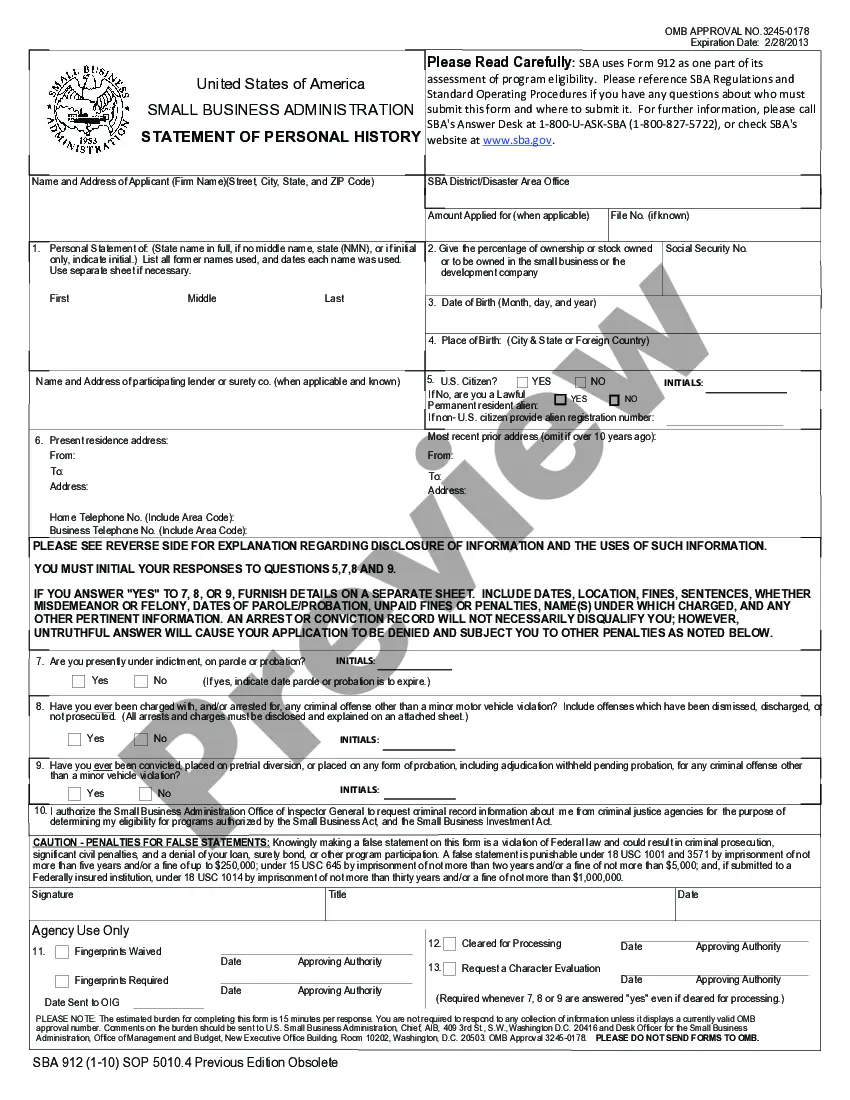

Guam Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

You can spend hours online looking for the legal document template that fits the state and federal demands you need. US Legal Forms provides a large number of legal forms which can be evaluated by professionals. You can actually obtain or print the Guam Small Business Administration Loan Application Form and Checklist from your support.

If you already possess a US Legal Forms account, it is possible to log in and click the Download option. Afterward, it is possible to total, edit, print, or sign the Guam Small Business Administration Loan Application Form and Checklist. Every legal document template you buy is your own property permanently. To obtain another copy of the bought type, proceed to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms website initially, stick to the easy recommendations below:

- Very first, ensure that you have selected the correct document template to the state/city of your choosing. See the type information to ensure you have chosen the right type. If offered, utilize the Preview option to search throughout the document template too.

- If you wish to discover another variation from the type, utilize the Look for area to find the template that meets your needs and demands.

- When you have found the template you want, simply click Get now to proceed.

- Select the prices prepare you want, enter your qualifications, and register for your account on US Legal Forms.

- Total the transaction. You may use your credit card or PayPal account to pay for the legal type.

- Select the formatting from the document and obtain it to the product.

- Make adjustments to the document if required. You can total, edit and sign and print Guam Small Business Administration Loan Application Form and Checklist.

Download and print a large number of document web templates while using US Legal Forms Internet site, which provides the greatest variety of legal forms. Use professional and express-specific web templates to handle your small business or person demands.

Form popularity

FAQ

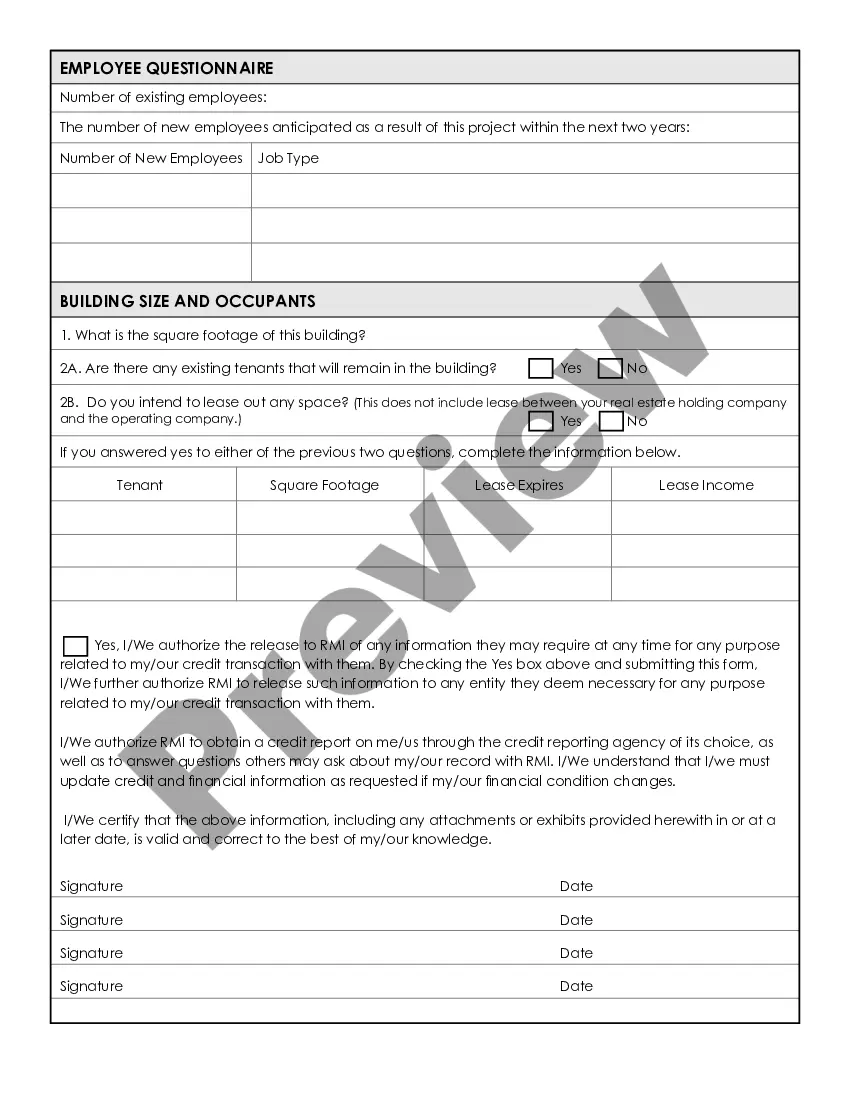

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

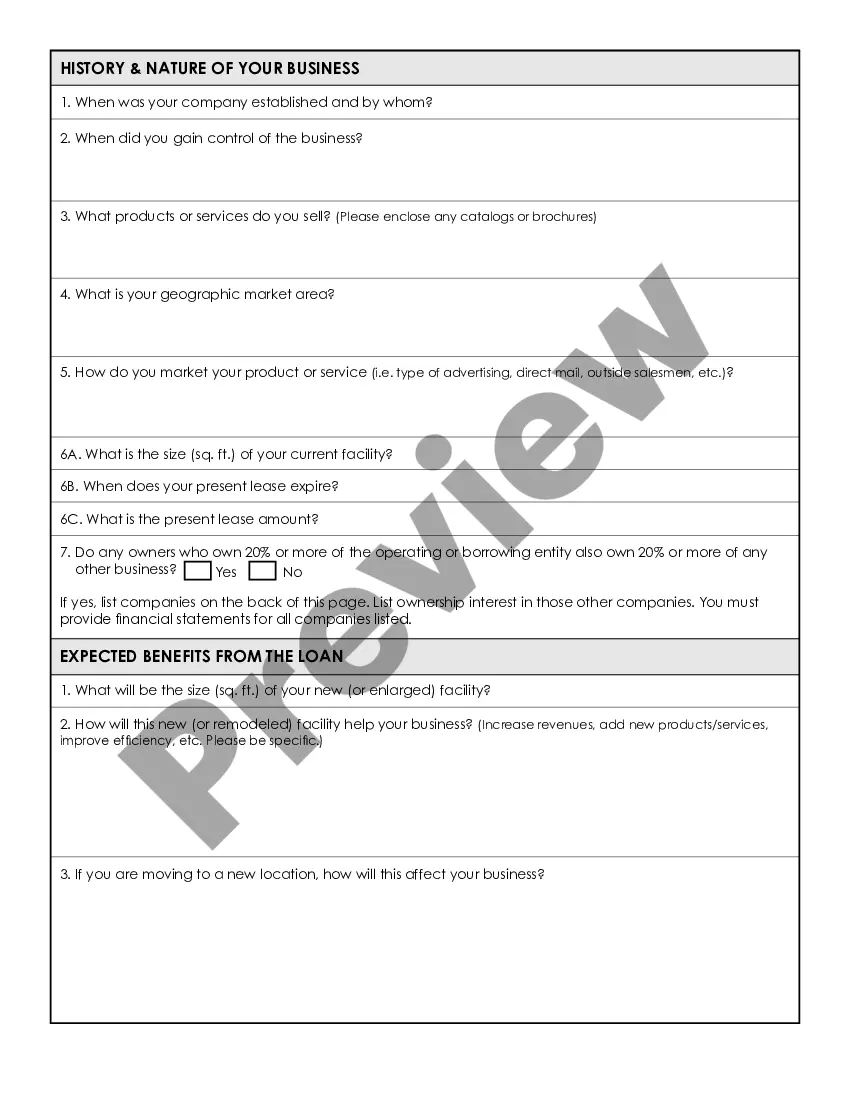

Lenders and loan programs have unique eligibility requirements. In general, eligibility is based on what a business does to receive its income, the character of its ownership, and where the business operates. Normally, businesses must meet SBA size standards, be able to repay, and have a sound business purpose.

SBA Express It features the easiest SBA application process and accelerated approval times, plus it offers longer terms and lower down payment requirements than conventional loans.

Generally, you should have a minimum credit score of 650, strong cash flow and at least two years in business to qualify for an SBA Express loan. You'll also have to meet the SBA's standard eligibility criteria and demonstrate your need for financing.

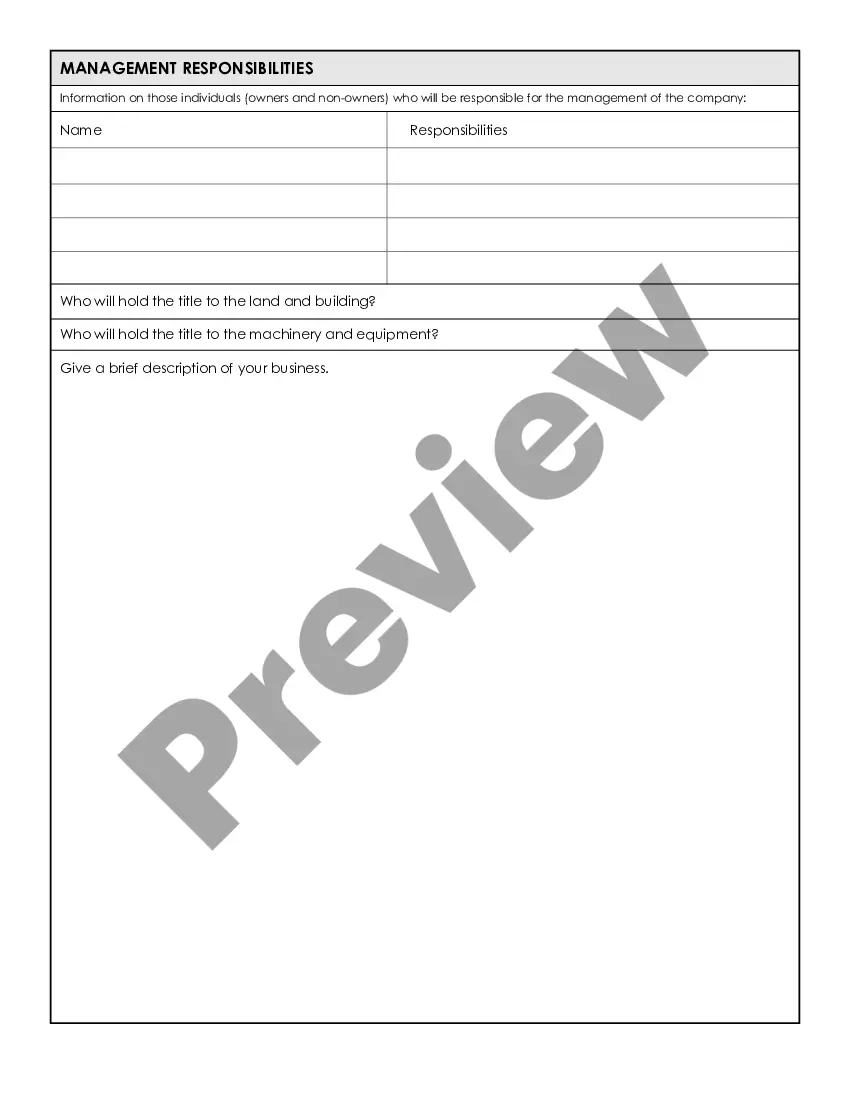

Both your personal and business credit reports, income tax returns and bank statements will be reviewed. You'll also need to provide business financial statements, including a profit and loss statement, cash flow and balance sheet and a complete accounting of all business debt and creditors.

In most cases, SBA loans require at least one owner or stakeholder to sign an unlimited personal guarantee on their loan. However, lenders may ask that other individuals involved in the company's ownership or who have an important say in the business's operations sign a personal guarantee as well.