Guam Membership Certificate of Nonprofit or Non Stock Corporation

Description

How to fill out Membership Certificate Of Nonprofit Or Non Stock Corporation?

US Legal Forms - one of the most significant libraries of legal varieties in the USA - gives a wide array of legal file layouts you can down load or print. Using the internet site, you can find a large number of varieties for organization and specific uses, sorted by categories, states, or search phrases.You can get the most recent versions of varieties much like the Guam Membership Certificate of Nonprofit or Non Stock Corporation in seconds.

If you have a subscription, log in and down load Guam Membership Certificate of Nonprofit or Non Stock Corporation through the US Legal Forms local library. The Download button can look on each type you see. You have accessibility to all previously saved varieties within the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, here are simple recommendations to obtain began:

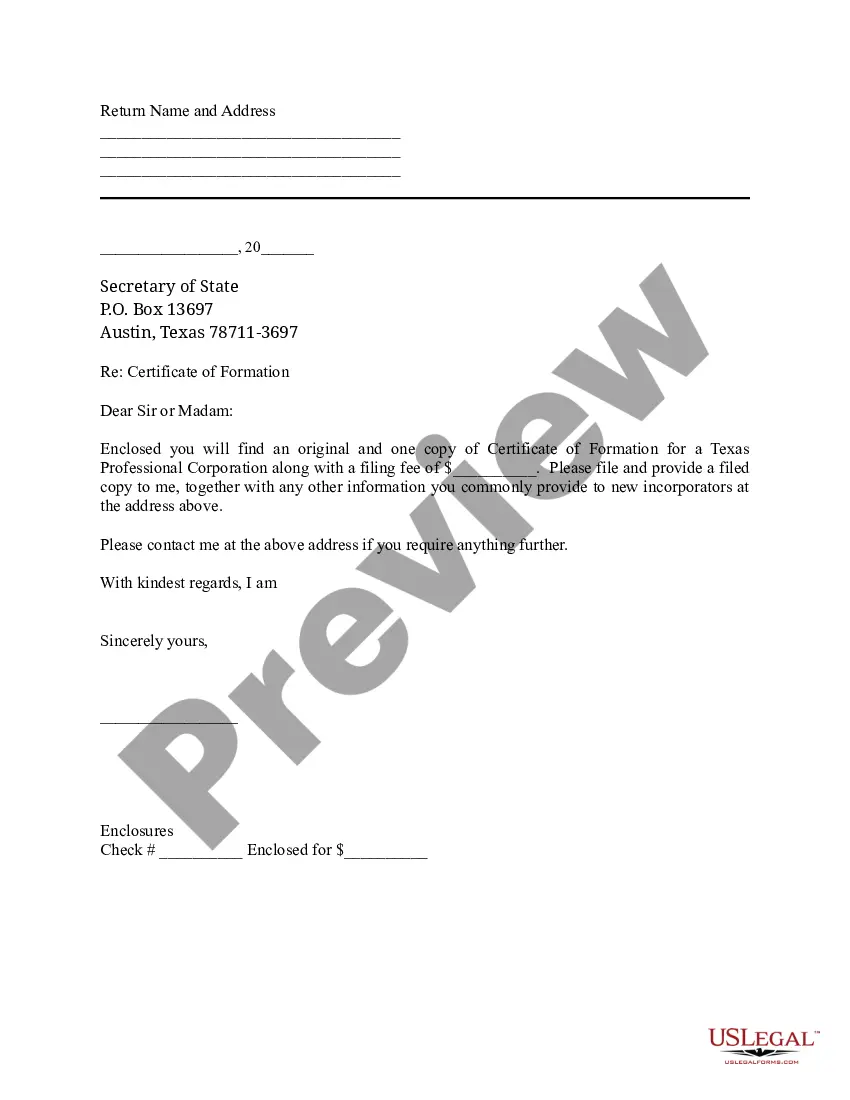

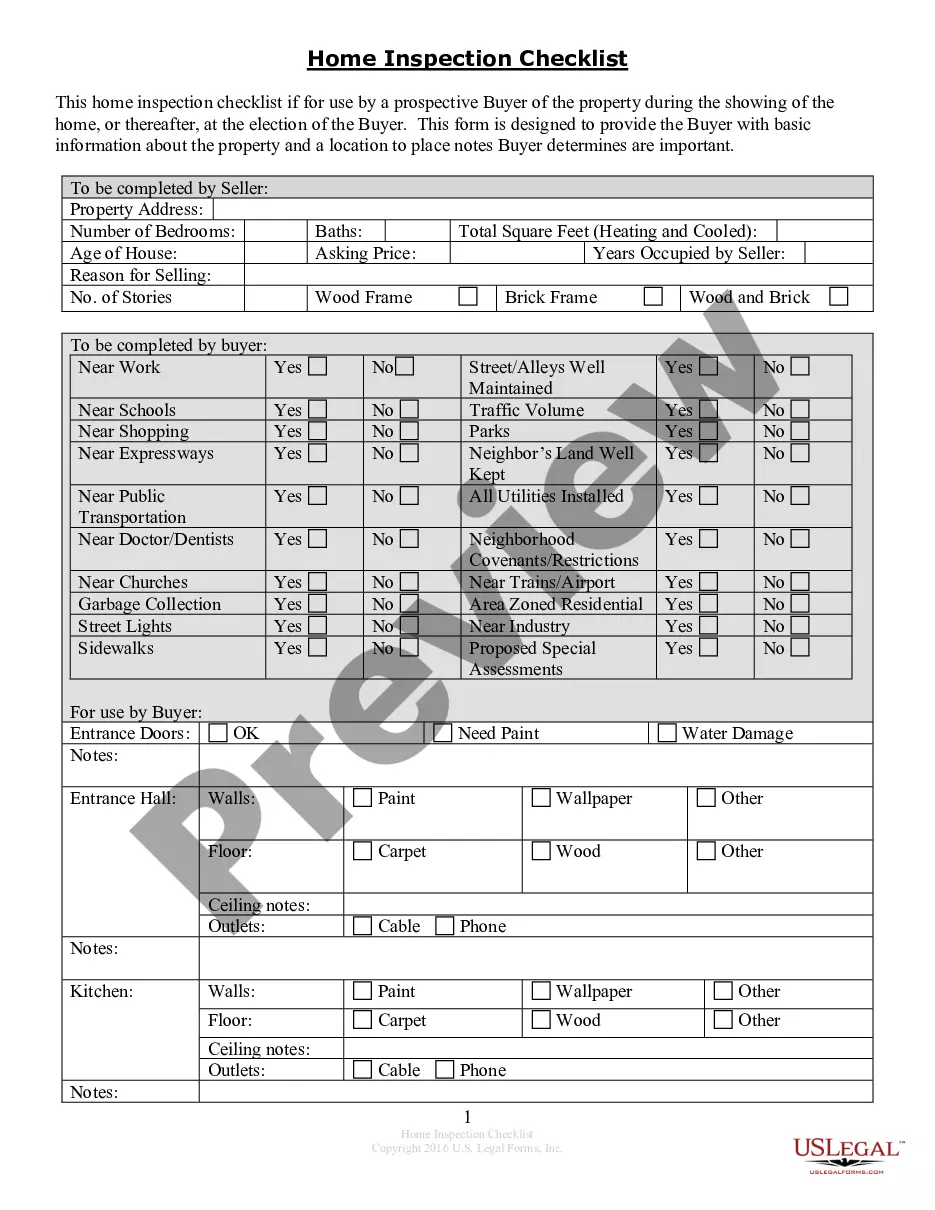

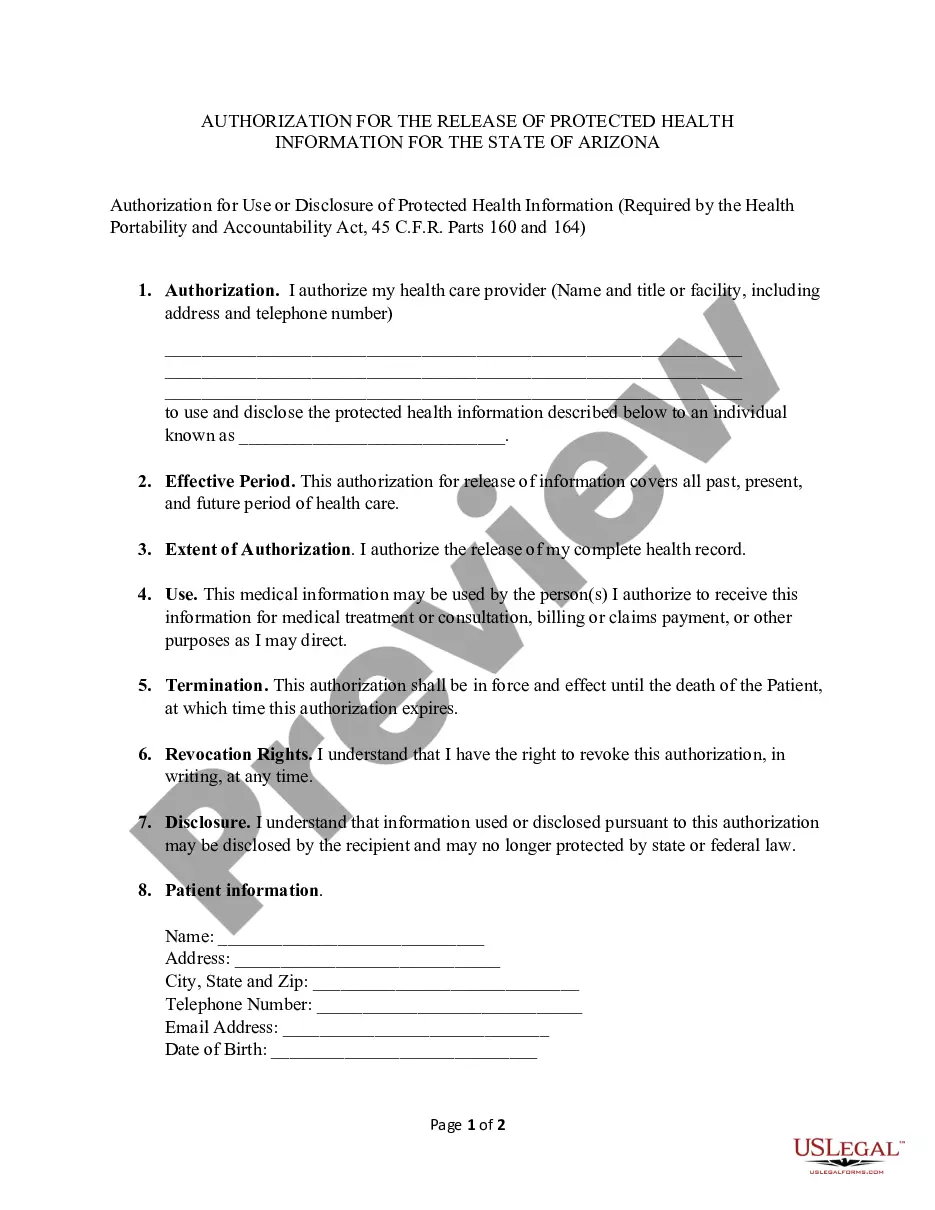

- Be sure you have selected the right type for the area/area. Go through the Preview button to check the form`s content material. Read the type information to ensure that you have selected the correct type.

- In the event the type doesn`t satisfy your specifications, make use of the Search field towards the top of the display to get the the one that does.

- In case you are happy with the form, verify your decision by clicking the Get now button. Then, pick the pricing plan you prefer and offer your qualifications to sign up on an profile.

- Process the deal. Use your Visa or Mastercard or PayPal profile to finish the deal.

- Choose the formatting and down load the form in your system.

- Make changes. Complete, modify and print and sign the saved Guam Membership Certificate of Nonprofit or Non Stock Corporation.

Each design you included with your bank account lacks an expiration time and is your own property forever. So, if you wish to down load or print an additional duplicate, just go to the My Forms section and click about the type you want.

Obtain access to the Guam Membership Certificate of Nonprofit or Non Stock Corporation with US Legal Forms, one of the most extensive local library of legal file layouts. Use a large number of professional and state-particular layouts that fulfill your organization or specific requirements and specifications.

Form popularity

FAQ

Nonprofits do not have owners. As a result, nonprofits do not nave owner equity. In both cases, net assets equal the difference between the total assets and total liabilities. However, nonprofits generate the Statement of Financial Position which only presents revenue, assets and liabilities.

Nonprofit stakeholders include individuals, groups, communities, governments, and others, that affect, or are affected by, one or more nonprofit organizations or the sector as a whole. Thus, stakeholder perspectives reflect a myriad of interests.

A nonprofit corporation has no owners (shareholders) whatsoever. Nonprofit corporations do not declare shares of stock when established. In fact, some states refer to nonprofit corporations as non-stock corporations.

Do nonprofit organizations have shareholders? The answer to that is simple and clear: no. In fact, no one can claim possession of a nonprofit. They must pass organizational and operational tests in order for the IRS to recognize their tax-exempt status.

Shareholders receive a return on their investments when dividends are paid or when assets are distributed after dissolution. Non-profit corporations neither issue shares nor pay dividends, no part of the income may be distributed to its members, directors, or officers.