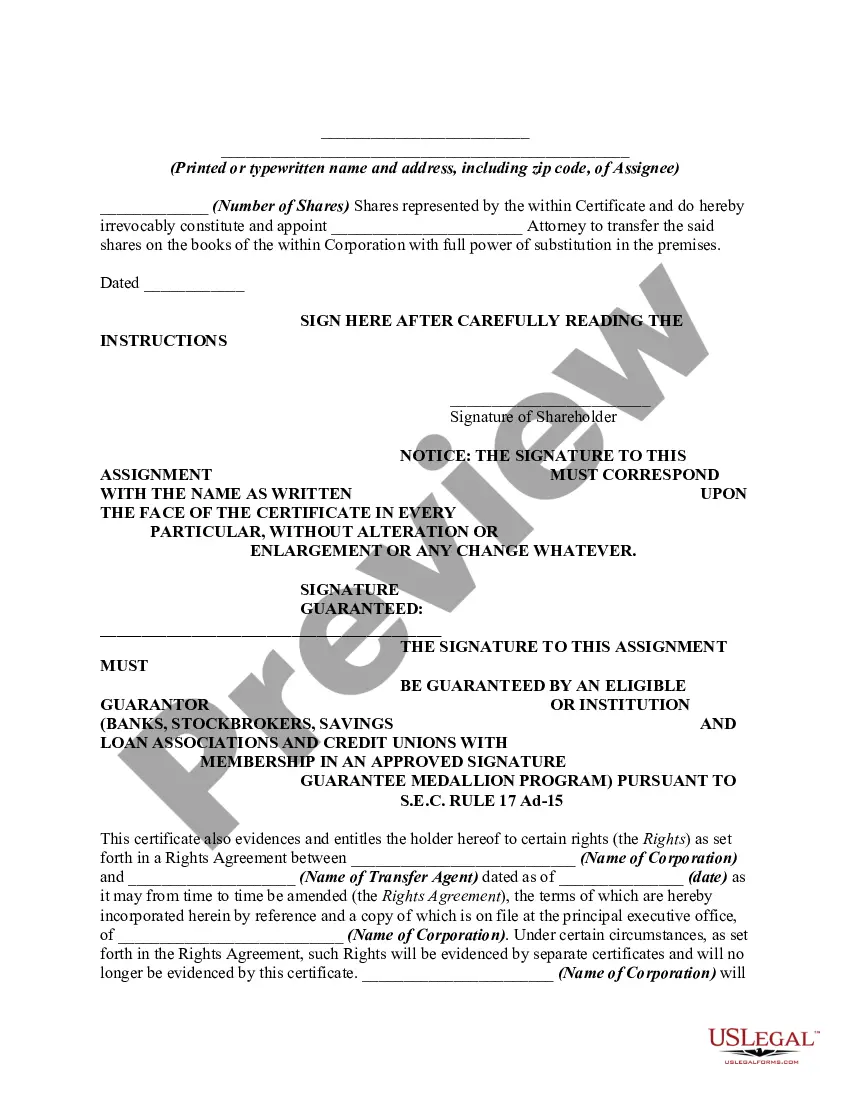

Are you within a placement where you need to have papers for either business or person uses just about every day? There are a variety of legal file templates available on the Internet, but locating ones you can trust isn`t straightforward. US Legal Forms gives a large number of type templates, much like the Guam Stock Certificate Legend - Common Stock, which can be composed in order to meet state and federal specifications.

When you are previously familiar with US Legal Forms web site and possess a free account, just log in. Following that, you can obtain the Guam Stock Certificate Legend - Common Stock web template.

If you do not offer an account and wish to begin using US Legal Forms, adopt these measures:

- Get the type you need and ensure it is for your correct area/region.

- Use the Preview button to examine the form.

- Read the description to actually have selected the proper type.

- In case the type isn`t what you`re trying to find, take advantage of the Lookup industry to get the type that fits your needs and specifications.

- Whenever you obtain the correct type, just click Acquire now.

- Opt for the costs program you desire, complete the desired information to generate your money, and buy your order using your PayPal or bank card.

- Choose a practical file format and obtain your backup.

Discover all the file templates you might have bought in the My Forms food selection. You can aquire a extra backup of Guam Stock Certificate Legend - Common Stock at any time, if possible. Just click the essential type to obtain or printing the file web template.

Use US Legal Forms, probably the most extensive selection of legal forms, to save lots of time as well as stay away from mistakes. The assistance gives appropriately produced legal file templates that can be used for a variety of uses. Create a free account on US Legal Forms and start producing your lifestyle easier.