A Guam Mortgage Note refers to a legal document that outlines the terms and conditions of a mortgage loan agreement in Guam, a U.S. territory island located in the western Pacific Ocean. This note serves as evidence of the borrower's debt and specifies the repayment terms, including the principal amount borrowed, interest rate, payment schedule, and any other relevant information regarding the loan. The Guam Mortgage Note plays a crucial role in the real estate industry, as it creates a legally binding agreement between the lender (often a financial institution) and the borrower (an individual or entity). It serves as a proof of the borrower's obligation to repay the loan within the specified terms and helps protect the interests of both parties involved. Different types of Guam Mortgage Note can include: 1. Fixed-Rate Mortgage Note: This type of mortgage note establishes a fixed interest rate for the duration of the loan. Borrowers can expect consistent monthly payments throughout the repayment term, providing financial predictability. 2. Adjustable-Rate Mortgage Note (ARM): An ARM mortgage note offers an interest rate that can fluctuate based on market conditions. The note will specify the timing and frequency of interest rate adjustments, allowing payments to vary throughout the loan term. 3. Balloon Mortgage Note: A balloon mortgage note sets a fixed interest rate for an initial period, usually five to seven years, followed by a larger lump-sum payment (balloon payment) due at the end of the term. Borrowers who opt for this type of note typically plan to refinance or sell the property before the balloon payment becomes due. 4. Interest-Only Mortgage Note: In an interest-only mortgage note, borrowers are only required to make monthly payments toward the accrued interest for a specified period. Principal repayments may begin after this initial period, resulting in higher payments or a balloon payment later on. It is crucial for borrowers to carefully review and understand the terms and conditions stipulated in a Guam Mortgage Note. Consulting with legal and financial professionals is highly recommended ensuring compliance with Guam's mortgage regulations and to make informed decisions when entering into a mortgage loan agreement.

Guam Mortgage Note

Description

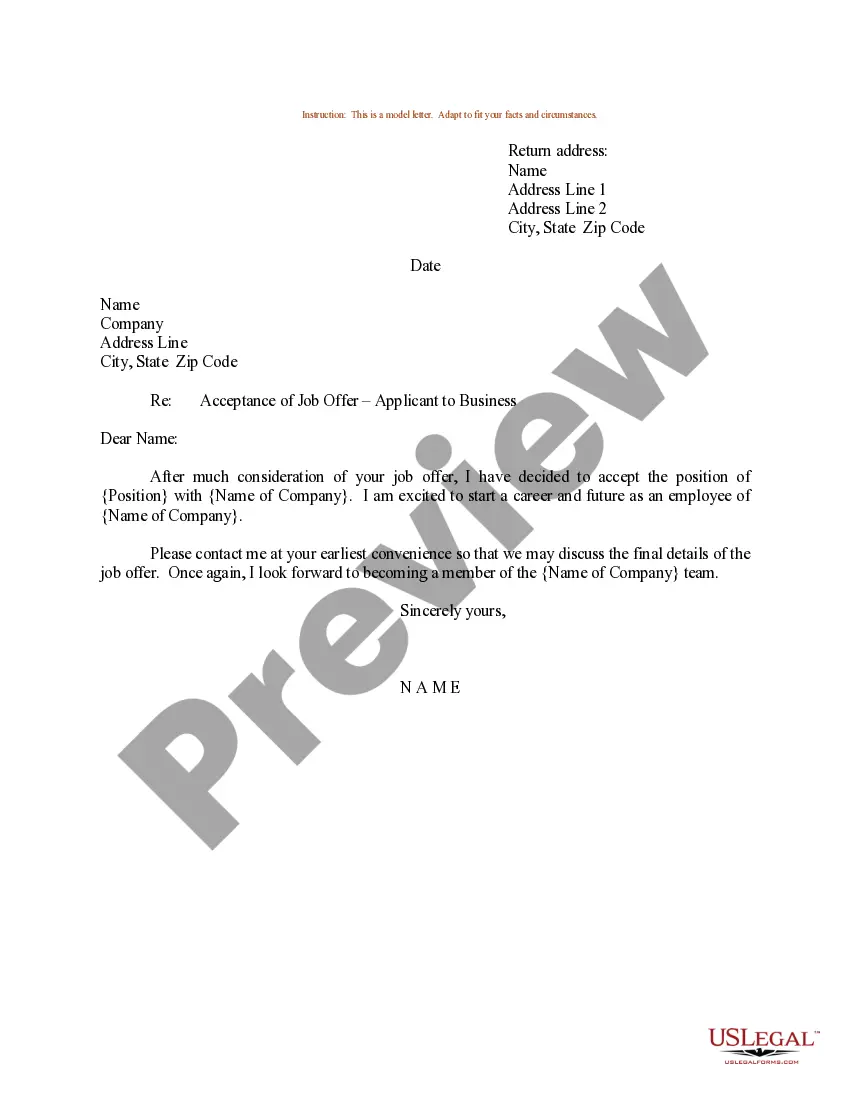

How to fill out Guam Mortgage Note?

If you need to complete, download, or printing authorized papers web templates, use US Legal Forms, the largest collection of authorized types, that can be found on-line. Use the site`s simple and hassle-free research to obtain the paperwork you need. A variety of web templates for business and individual uses are sorted by types and says, or key phrases. Use US Legal Forms to obtain the Guam Mortgage Note in a number of clicks.

In case you are currently a US Legal Forms client, log in to your bank account and then click the Down load key to have the Guam Mortgage Note. You may also access types you earlier downloaded inside the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape to the proper metropolis/land.

- Step 2. Take advantage of the Preview choice to look through the form`s content material. Don`t neglect to read through the description.

- Step 3. In case you are unsatisfied together with the form, utilize the Lookup field at the top of the display to locate other versions of the authorized form format.

- Step 4. Once you have found the shape you need, click the Acquire now key. Choose the costs plan you choose and add your credentials to register on an bank account.

- Step 5. Method the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to finish the financial transaction.

- Step 6. Choose the structure of the authorized form and download it on your system.

- Step 7. Complete, revise and printing or indication the Guam Mortgage Note.

Every authorized papers format you purchase is the one you have forever. You possess acces to each and every form you downloaded inside your acccount. Click on the My Forms area and decide on a form to printing or download once again.

Contend and download, and printing the Guam Mortgage Note with US Legal Forms. There are many skilled and express-specific types you can utilize for your personal business or individual requirements.

Form popularity

FAQ

As you may have guessed from what you've read so far, buying property on Guam is pretty similar to buying property on the U.S. mainland. You'll follow the same general process, including: Getting pre-qualified from a lender to eliminate any potential credit challenges and confirm your budget early in the process.

Your lender will typically provide you with a copy of the promissory note, along with several other documents, when you close on your home purchase. The lender will keep the original promissory note until the loan is paid off.

An overseas mortgage is any mortgage you take out on a property that's not in your country of residence. It can be from a local bank, or from an overseas lender in the country you want to buy in. Your approach will depend on your personal and financial situation, so it's important to do your research.

With the average mortgage rate doubling to about 7% in a year, inflation and limited houses for sale, home ownership continues to be out of reach for many Guam families based on a 29% drop in real property sales in the last quarter of 2022 compared to 2021.

The mortgage note is signed by borrowers at the end of the home buying process stating your promise to repay the money you're borrowing from your mortgage lender. This document will list how much you'll pay each month, when you'll make these payments and your mortgage's interest rate.

Can a U.S. Citizen Buy Property on Guam? Yes. Both U.S. citizens and permanent residents can buy property on Guam without restrictions, including houses and condos. By the way, the same isn't true of Guam's neighboring islands, the Commonwealth of the Northern Mariana Islands.

But median price has grown (by) double digits in the past five years. Single-family median price in Guam as of 2022 is $420,000, the condominium is about $315,000.