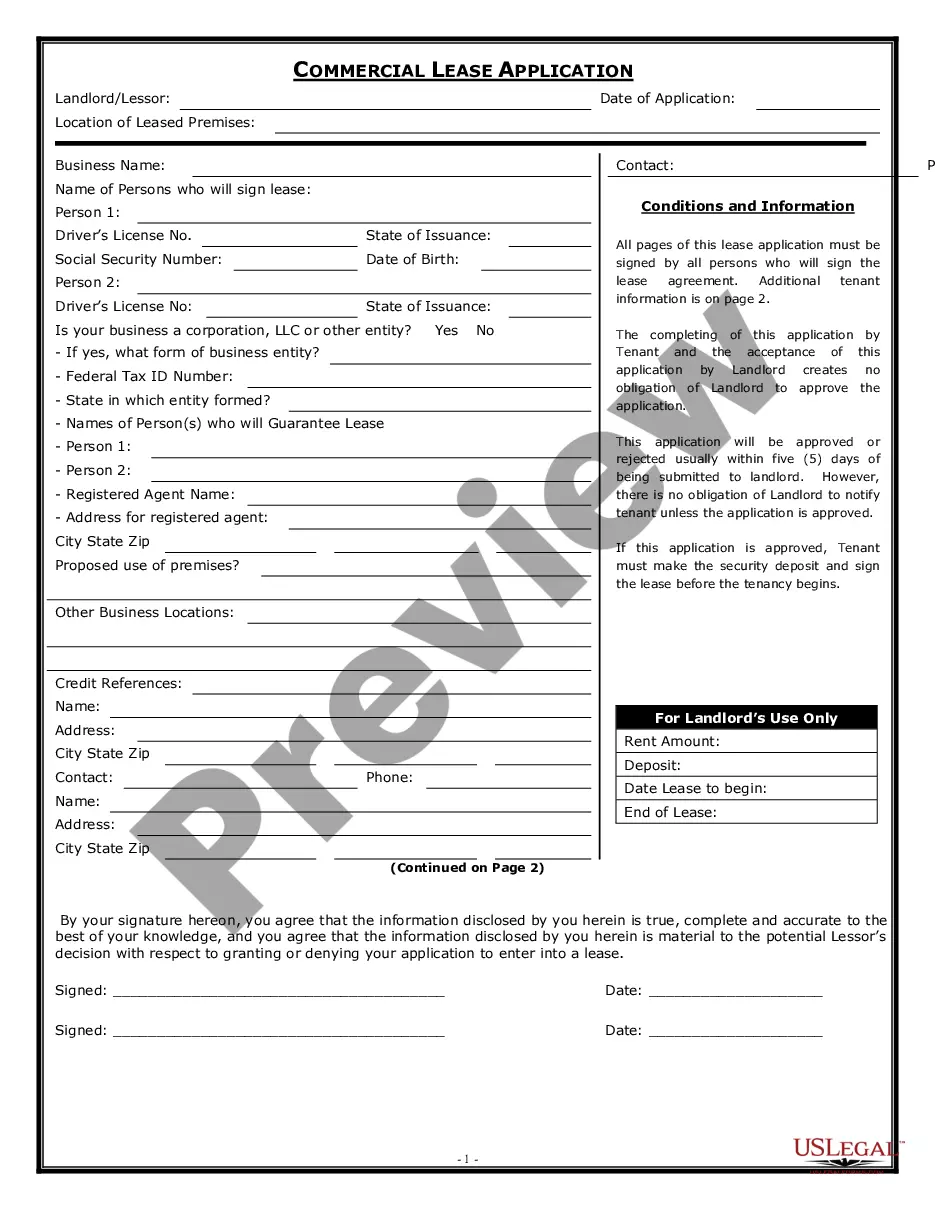

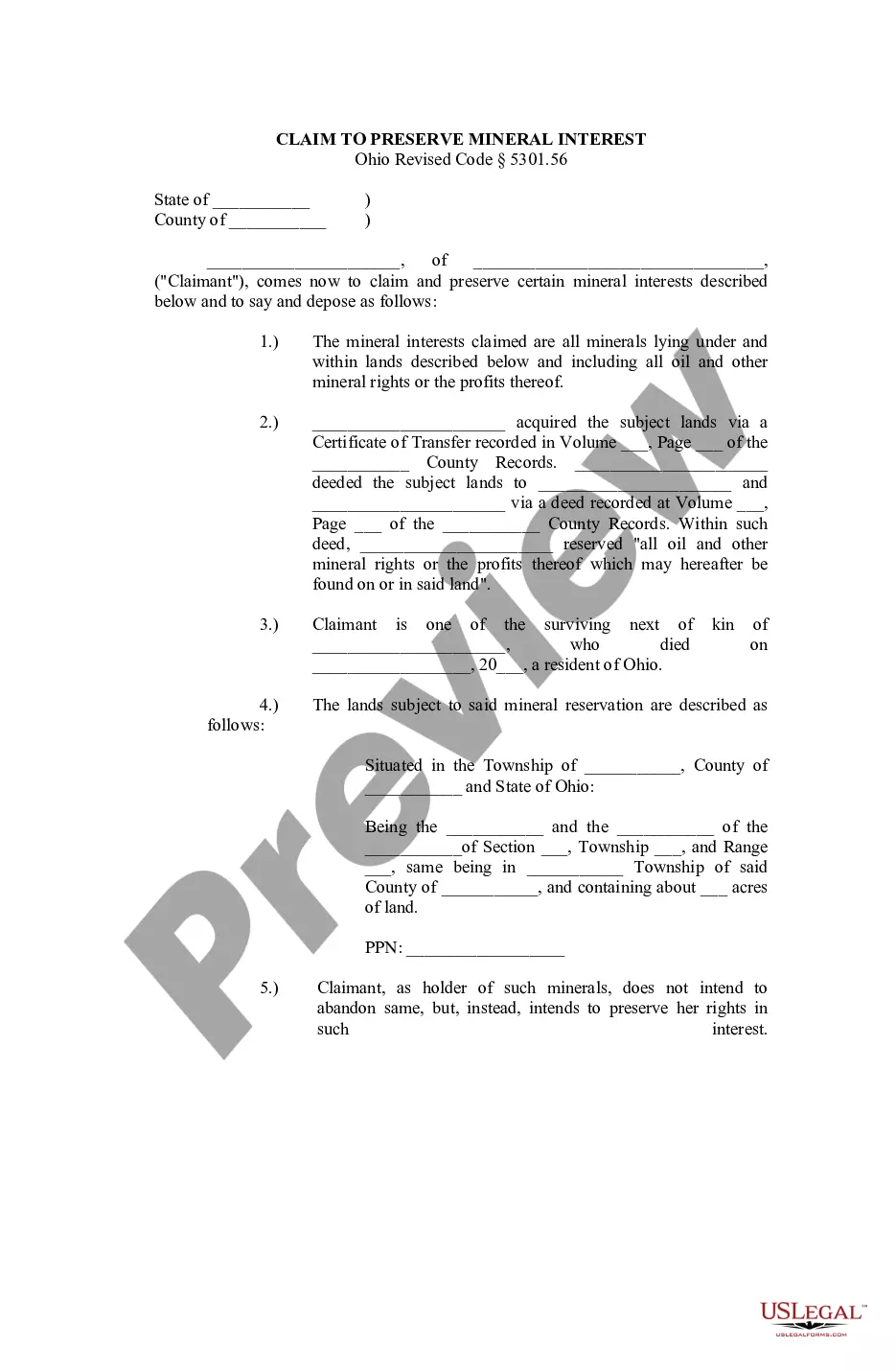

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

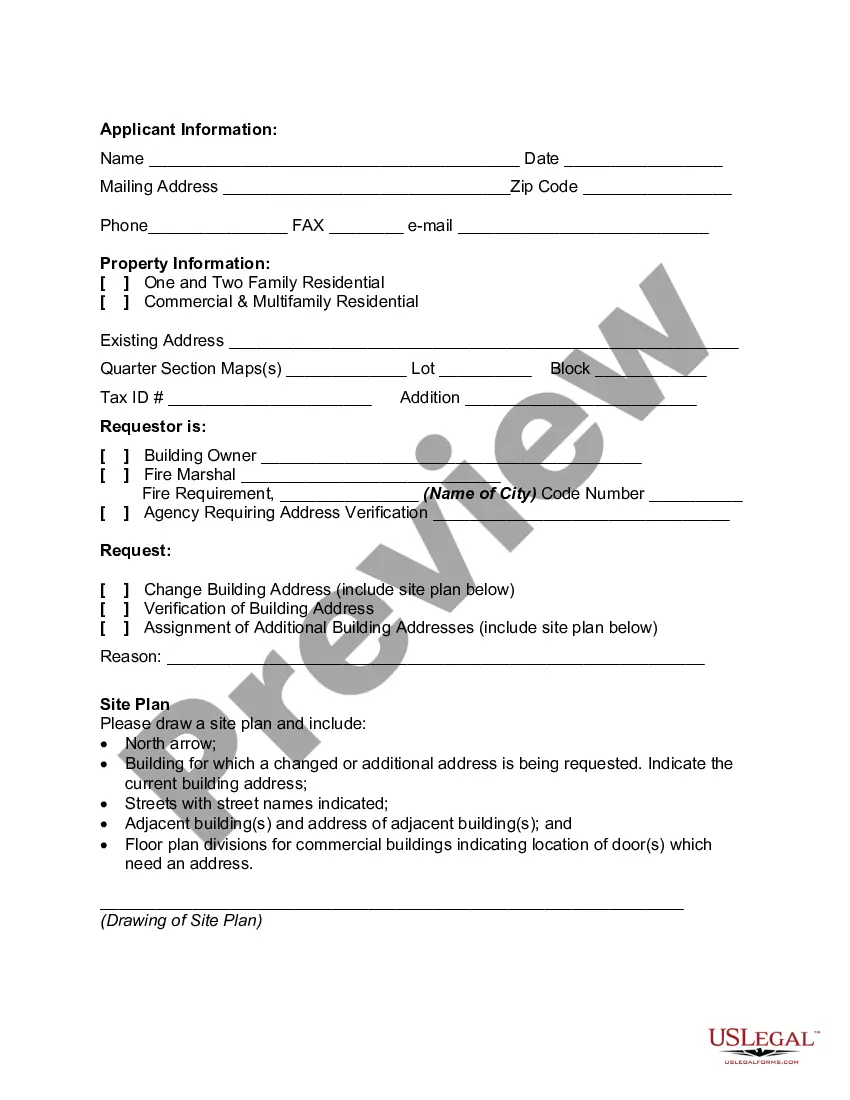

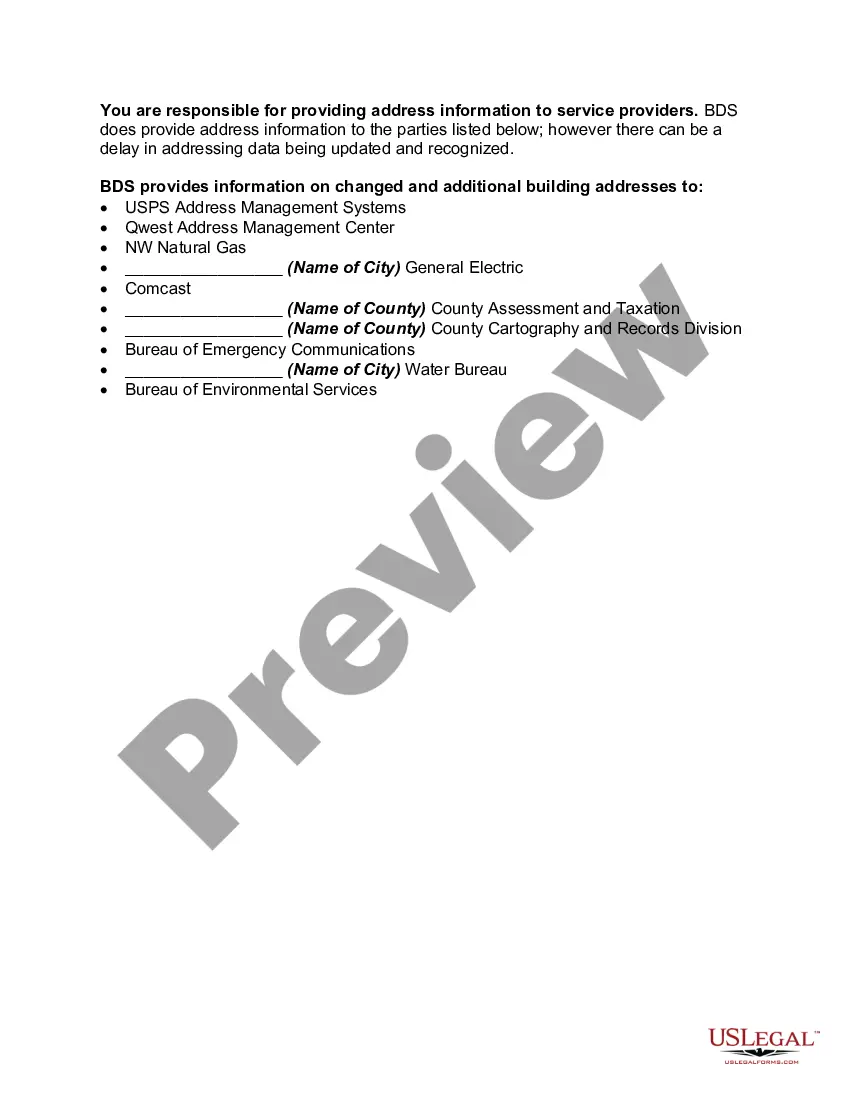

Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification

Description

How to fill out Building Address Application - Change Of Address, Additional Address Assignment, Or Address Verification?

Selecting the finest approved document template can be challenging. Of course, there exist numerous themes accessible online, but how can you obtain the official form you need.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification, that can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification. Use your account to browse the legal forms you may have purchased in the past. Navigate to the My documents tab of your account and download another copy of the document you need.

Finally, complete, modify, print, and sign the obtained Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification. US Legal Forms is the largest collection of legal forms where you can discover various document templates. Use the service to download properly crafted paperwork that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, confirm you have selected the correct form for the area/state. You can view the form using the Review button and read the form description to ensure it is the right one for you.

- If the form does not fulfill your requirements, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Get now button to acquire the form.

- Select the pricing plan you prefer and enter the required information. Create your account and pay for your order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

To email the Guam Department of Revenue and Taxation, first visit their official website to find the correct email address for your inquiries. When drafting your email, provide clear details about your issue, especially if it involves your Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification. This clarity will help expedite your request and ensure you receive a timely response.

While you cannot email the Internal Revenue Service directly with personal tax information, you can contact them through their official website or telephone lines for support. They provide various resources to help you with your tax-related queries, including matters related to your Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification. Always be cautious about sharing sensitive information online.

The Director of the Guam Department of Revenue and Taxation oversees all operations related to tax collection and regulation in Guam. For the most accurate and up-to-date information on the current director, you can check the official Guam Department of Revenue and Taxation website. Understanding the leadership can offer insights into how tax policies, including the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification, are administered.

You must mail your Guam tax return to the Guam Department of Revenue and Taxation. The mailing address can typically be found on the department's official website or your tax return form. Including your Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification documents ensures that your address details are current and up to date.

To send your tax documents via email, you should first ensure that they are in an acceptable format, such as PDF. Then, locate the designated email address provided by the Guam Department of Revenue and Taxation for submission. It is essential to include your identification information and any relevant references regarding your Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification, to facilitate processing.

Form change of address refers to a document used to officially notify authorities of an address update. The key is to use the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification to ensure proper and timely communication. This process is crucial for maintaining accurate records and ensuring that you receive important correspondence at your new address.

The form for individual change of address is typically the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification. This form allows individuals to update their addresses seamlessly, ensuring that both governmental and essential services have the latest information. Platforms like uslegalforms provide a convenient way to access and complete this form.

Yes, if you earn income in Guam, filing a Guam tax return is likely mandatory. This requirement ensures that you remain compliant with local tax laws. Make sure to utilize tools like the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification to keep your address current, helping to avoid any miscommunication regarding your tax obligations.

Yes, you can electronically file form 8822 online if you have the necessary software or access to an e-filing platform. This form is aimed at changing your address with the Internal Revenue Service (IRS) and is crucial for ensuring your tax documents are sent to the correct address. Consider using the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification as part of your overall address management strategy.

To file the Gross Receipts Tax (GRT) in Guam, you need to complete the appropriate forms and submit them to the Department of Revenue and Taxation. This process often involves detailing your business income, applicable deductions, and credits. Utilizing resources such as the Guam Building Address Application - Change of Address, Additional Address Assignment, or Address Verification can assist in maintaining accurate records while filing your taxes.