Guam Worksheet - Escrow Fees

Description

How to fill out Worksheet - Escrow Fees?

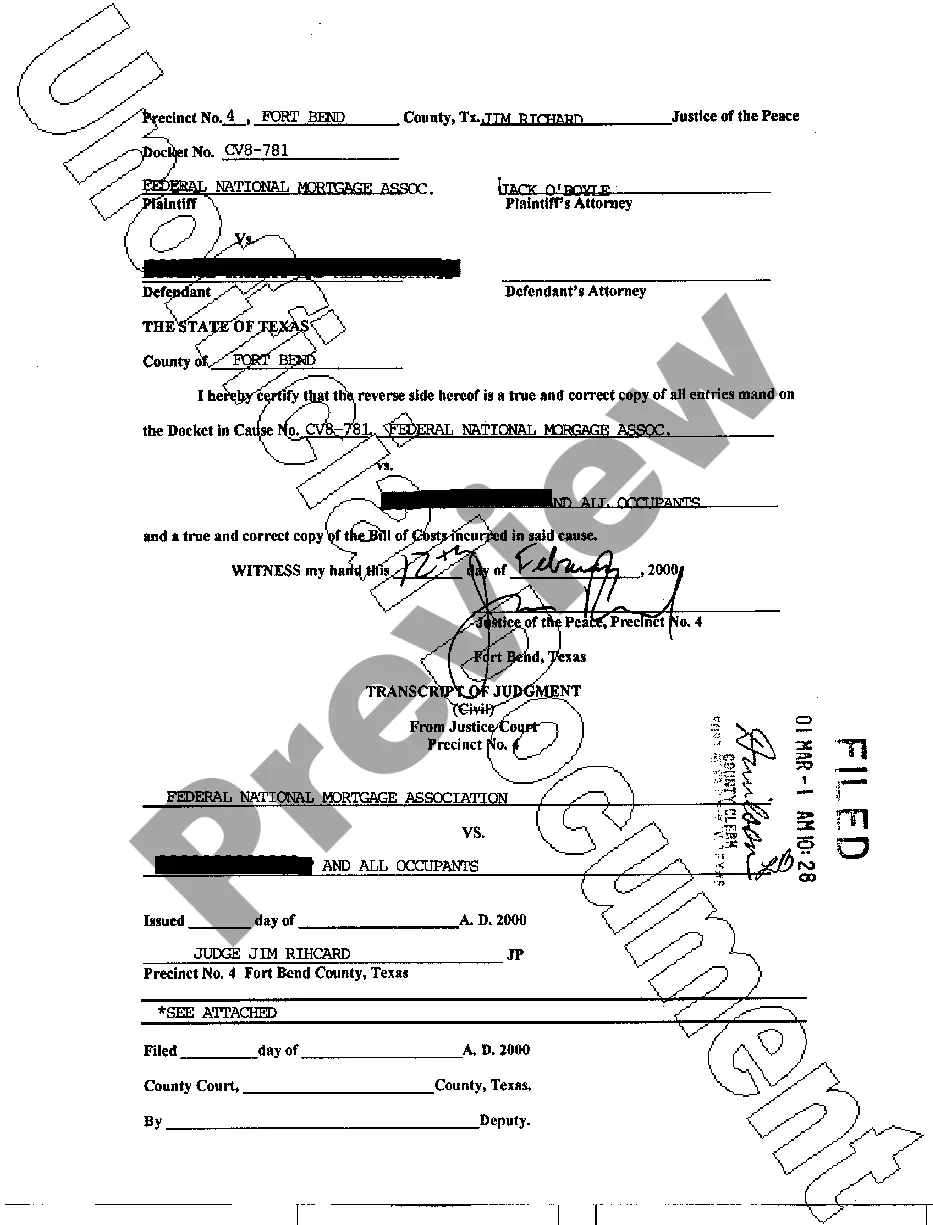

Discovering the right legal record template can be a battle. Obviously, there are plenty of web templates available on the Internet, but how can you discover the legal kind you require? Use the US Legal Forms site. The assistance gives a huge number of web templates, including the Guam Worksheet - Escrow Fees, that you can use for organization and personal needs. All of the varieties are checked out by pros and meet up with state and federal requirements.

Should you be presently listed, log in in your account and click on the Obtain button to get the Guam Worksheet - Escrow Fees. Make use of your account to look with the legal varieties you might have bought formerly. Go to the My Forms tab of your own account and acquire yet another duplicate from the record you require.

Should you be a fresh end user of US Legal Forms, allow me to share easy guidelines that you can comply with:

- First, ensure you have selected the correct kind for your personal area/state. You are able to look over the form utilizing the Preview button and look at the form information to ensure this is basically the best for you.

- If the kind is not going to meet up with your needs, make use of the Seach industry to get the right kind.

- When you are sure that the form is acceptable, select the Get now button to get the kind.

- Select the rates prepare you would like and enter in the needed info. Create your account and pay for your order making use of your PayPal account or Visa or Mastercard.

- Select the file structure and acquire the legal record template in your gadget.

- Full, change and print out and sign the attained Guam Worksheet - Escrow Fees.

US Legal Forms is definitely the greatest local library of legal varieties where you can find numerous record web templates. Use the service to acquire professionally-created paperwork that comply with status requirements.

Form popularity

FAQ

The average closing cost for a buyer in Hawaii is 0.9% of the total purchase price, as per ClosingCorp. It includes the cost of financing, property-related costs, and paperwork costs. Not all Hawaii home buyers pay the same costs at closing. It largely depends on the property's location.

Buyers and sellers split the escrow and title company fees in half. Escrow and title companies are the third parties that coordinate executing the Purchase Contract with the buyer and the seller. They also provide title reports, coordinate payments, and prepare documentation.

Complete the Closing Process In general, financing & closing costs can range from 2% to 5% of the purchase price of the property. Your lender or real estate agent in Guam can provide you with a detailed estimate of closing costs based on the specifics of your transaction.

Who Pays Escrow Fees ? Buyer or Seller? Typically, this cost is split between the buyer and seller, although it can be negotiated that one party will pay all or nothing. There is no specific rule for who pays the escrow fees, so speak to the seller of your future home or your real estate agent to work out who will pay.

Typically, this cost is split between the buyer and seller, although it can be negotiated that one party will pay all or nothing. There is no specific rule for who pays the escrow fees, so speak to the seller of your future home or your real estate agent to work out who will pay.

Escrow takes direction from the real estate contract to which all parties have agreed. This includes ensuring that no money changes hands until all contingencies have been met and title is clear. Typically, the cost of escrow is divided evenly between the buyer and the seller.

The Bottom Line: Escrow Is Mutually Beneficial, But Not Free These fees pay for third-party services that help you sell your home or complete the tasks required to successfully close your loan.