An accountant is one who is skilled in keeping accounts and books of accounts correctly and properly. An accountant plays a variety of roles including the review, audit, organization and certification of financial information. The various types of accountants include; auditors, forensic accountants, public accountants, tax professionals, financial advisers and consultants. Accountants have a minimum of a bachelor’s degree, but often have other advanced degrees, and all accountants must be certified through the appropriate state board.

Most states have statutes that provide for a state board of accountancy or a board of certified public accountants. Statutes may require the registration of accountants and accounting firms with the state board of accountancy. A state has the power to revoke the license which grants the right to practice public accountancy. Regulations relating to accountants in various states are discussed in the links below.

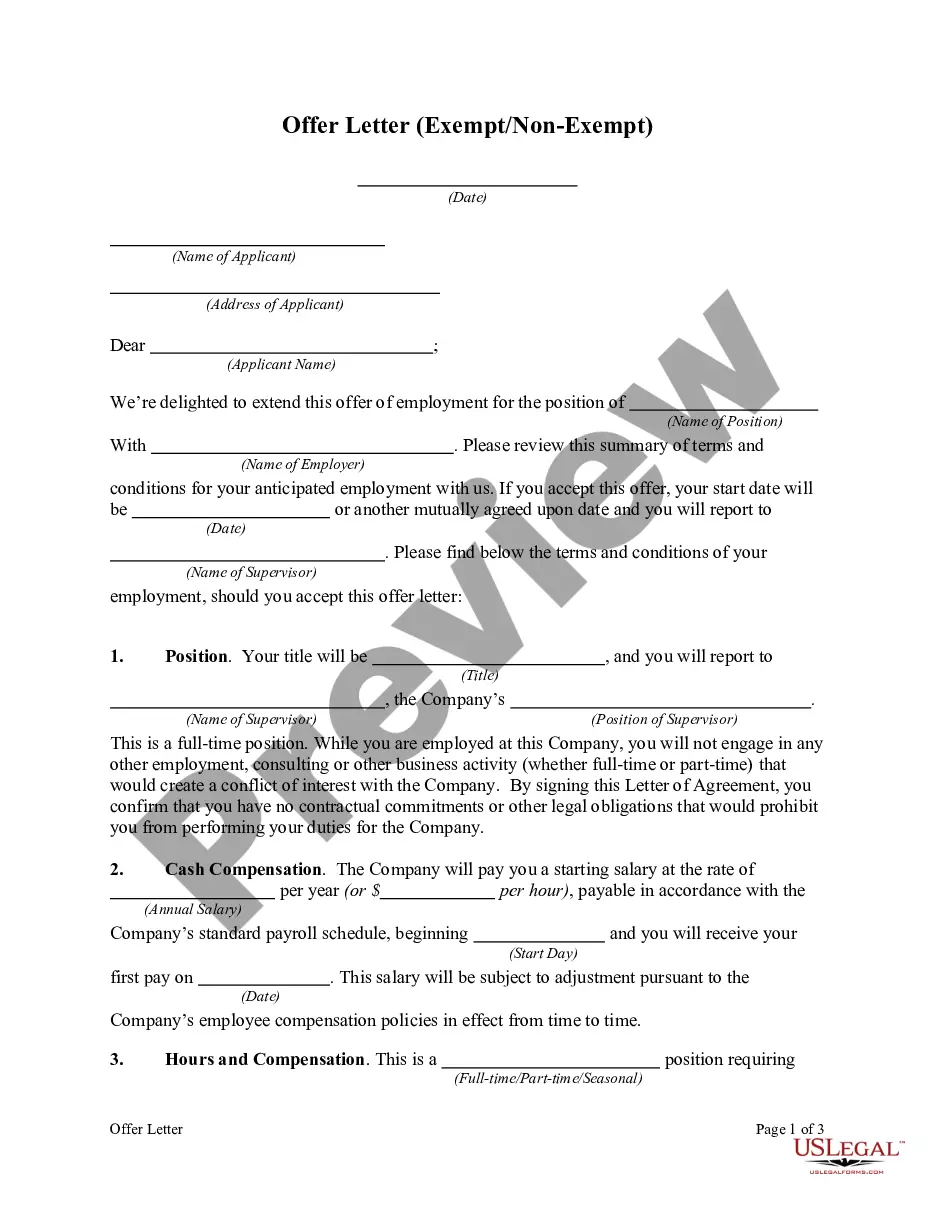

Guam Employment Agreement with Staff Accountant — Detailed Description In Guam, an employment agreement with a staff accountant is a legally binding document that outlines the terms and conditions of employment specific to staff accountants working on the island. This agreement serves as a crucial framework that governs the employer-employee relationship and ensures clarity and understanding between both parties involved. The Guam Employment Agreement with Staff Accountant covers various aspects, including job responsibilities, compensation, benefits, working hours, leave policies, termination procedures, and other key provisions. It is essential for both the employer and the staff accountant to thoroughly understand and agree upon the contents of the agreement before commencing work. 1. Job Responsibilities: This section defines the specific duties and responsibilities expected of a staff accountant in the respective organization. It may include tasks related to financial record keeping, financial analysis, preparing reports, tax compliance, and other accounting activities. 2. Compensation: This section outlines the details of the staff accountant's remuneration package. It typically includes information about salary, frequency of pay, potential bonus structures, and provisions for salary reviews or increments. 3. Benefits: Guam Employment Agreements may also incorporate details regarding employee benefits such as healthcare coverage, retirement plans, paid time off, sick leave, and any other perks or allowances provided by the employer. 4. Working Hours: This section specifies the standard work hours for staff accountants, including any provisions for flexible working hours or overtime compensation. It may also address remote work arrangements and the expectation of availability during certain periods. 5. Leave Policies: This segment covers policies for vacation leave, personal leave, parental leave, and any other types of leave that may be applicable to staff accountants. It outlines the process for requesting and approving leave and any limitations or requirements associated with each type of leave. 6. Termination Procedures: This section outlines the procedures and conditions for terminating the employment agreement, both for the employer and the staff accountant. It may cover notice periods, severance pay, and exit formalities. Different types of Guam Employment Agreements with Staff Accountant may exist, tailored to specific employment arrangements: 1. Full-Time Employment Agreement: This type of agreement is for staff accountants who work on a full-time basis, typically 40 hours per week, and enjoy the benefits and entitlements associated with full-time employment. 2. Part-Time Employment Agreement: Part-time staff accountants have a reduced workload and may work fewer hours compared to full-time employees. The agreement specifics, such as compensation and benefits, would generally be adjusted accordingly. 3. Fixed-term Employment Agreement: Staff accountants hired for a specific project or a predetermined period would enter into a fixed-term agreement. This specifies the duration of employment and may include provisions for contract renewal or termination at the project's conclusion. 4. Probationary Employment Agreement: This type of agreement is often used when hiring new staff accountants or employees with relatively limited experience. It establishes a probationary period during which the employer assesses their suitability for a permanent position. Probation terms, including duration and termination conditions, are included in this agreement. Guam Employment Agreements with Staff Accountant are customizable and can be modified to reflect the specific needs and requirements of the employer and the staff accountant. It is crucial to consult legal professionals knowledgeable in Guam labor laws to ensure compliance and accuracy in drafting these agreements.