This response letter indicates acknowledgement and acceptance of the resignation.

Guam Acceptance of Resignation of Officer by Nonprofit Corporation

Description

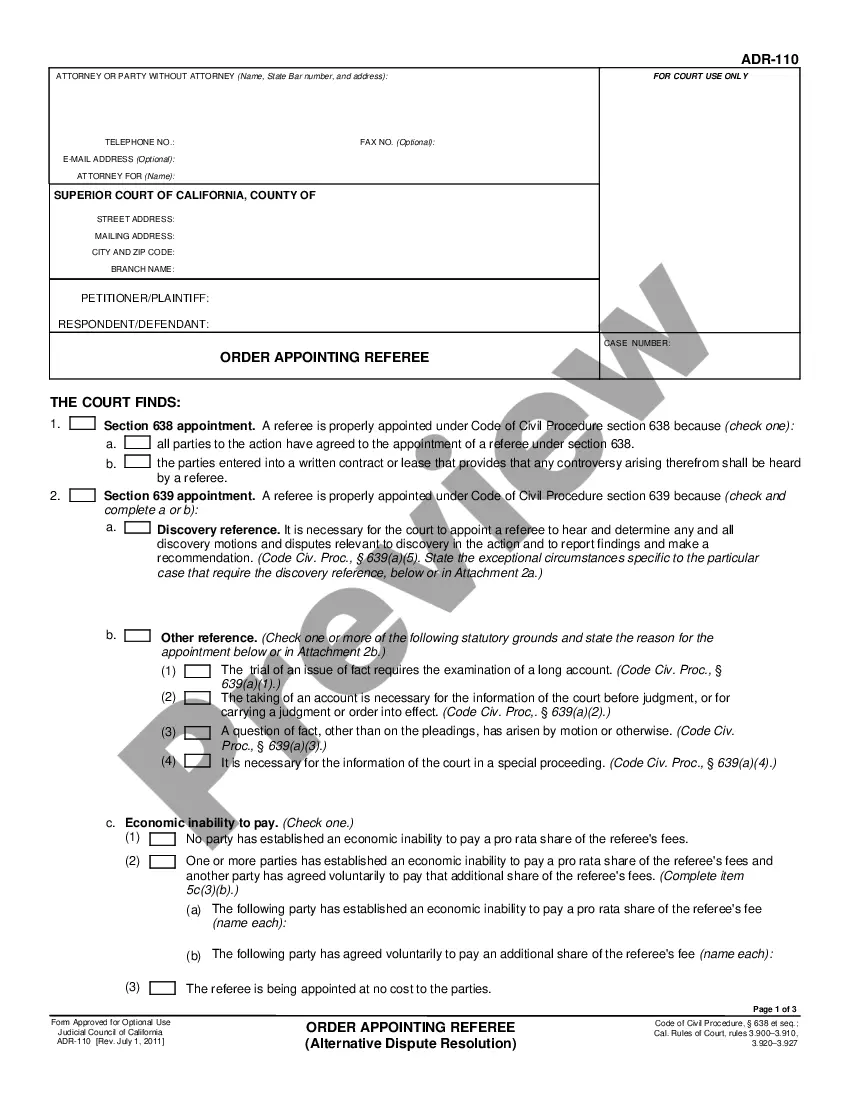

How to fill out Acceptance Of Resignation Of Officer By Nonprofit Corporation?

If you need to finish, obtain, or print out valid document templates, utilize US Legal Forms, the largest repository of legal forms, accessible on the web.

Employ the site's straightforward and user-friendly search to find the documents you require. Various templates for commercial and personal use are categorized by categories and claims, or keywords.

Utilize US Legal Forms to find the Guam Acceptance of Resignation of Officer by Nonprofit Corporation with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Compete and obtain, and print the Guam Acceptance of Resignation of Officer by Nonprofit Corporation with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to receive the Guam Acceptance of Resignation of Officer by Nonprofit Corporation.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Utilize the Review option to verify the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you desire, click on the Purchase now button. Select your preferred pricing plan and provide your credentials to register for the account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Guam Acceptance of Resignation of Officer by Nonprofit Corporation.

Form popularity

FAQ

The country code for Guam is +1, with the area code being 671. This code is significant when considering communication and operations for nonprofits operating in or connected to Guam. If your organization needs to address legal matters like the Guam Acceptance of Resignation of Officer by Nonprofit Corporation, knowing this information can facilitate easier interactions with local authorities and partners.

The Guam code annotated provides a version of the Guam laws that includes references and additional explanations for better understanding. This resource can be especially valuable when dealing with complex legal matters, like the Guam Acceptance of Resignation of Officer by Nonprofit Corporation process. By using an annotated version, nonprofits can gain insight into interpretations and precedents related to their specific legal obligations.

Guam operates under a unique legal system that incorporates federal U.S. laws along with its local laws. While Guam adheres to many laws enacted by Congress, it also has the authority to establish its regulations, such as those pertaining to nonprofits. Therefore, understanding the implications of U.S. laws on the Guam Acceptance of Resignation of Officer by Nonprofit Corporation will help you navigate any legal nuances.

The Guam code is a compilation of laws and regulations specific to Guam, encompassing various areas of law such as civil, criminal, and administrative regulations. It serves as a legal framework that governs the behavior of individuals and organizations, including nonprofit corporations. For those involved with the Guam Acceptance of Resignation of Officer by Nonprofit Corporation, familiarity with the Guam code is essential to ensure compliance during the resignation process.

An annotated code includes additional information such as case law, legal opinions, and commentary to provide context and interpretation, while an unannotated code presents the statutes and regulations without such insights. In understanding the Guam Acceptance of Resignation of Officer by Nonprofit Corporation, an annotated code can offer crucial explanations relevant to nonprofit governance. This can help organizations ensure they are following the correct procedures as outlined in Guam law.

When a nonprofit executive director resigns, it’s important to promptly accept the resignation formally. You should document the resignation using the Guam Acceptance of Resignation of Officer by Nonprofit Corporation process. This ensures legal compliance and clarity in leadership transitions. Additionally, you may want to communicate the change to stakeholders and begin the search for a new executive director.

If all board members of a nonprofit resign, the organization may face significant operational challenges. Typically, state laws will dictate the next steps, which may include appointing new directors or seeking legal intervention to stabilize the organization. This situation emphasizes the importance of a solid governance structure to prevent such occurrences. Understanding the implications of resignations aligns with the Guam Acceptance of Resignation of Officer by Nonprofit Corporation, ensuring your nonprofit is prepared for any changes.

The format for resignation acceptance should include a clear acknowledgment of the resignation, the member’s name, the position, and the effective date. Additionally, it’s essential to include a statement of gratitude for their service. Acknowledging their contributions not only maintains goodwill but also strengthens the organization’s image. This formal acceptance aligns with the Guam Acceptance of Resignation of Officer by Nonprofit Corporation principles.

When a nonprofit board member resigns, begin by notifying the remaining board members promptly. Next, review your bylaws for any specific actions or votes needed regarding the vacancy. It may also be beneficial to start the search for a new candidate to fill the role to ensure continuity. Establishing a proper process related to the Guam Acceptance of Resignation of Officer by Nonprofit Corporation can streamline this transition.

To confirm acceptance of a resignation, send a formal letter or email to the resigning board member. This document should acknowledge the receipt of their resignation and outline the effective resignation date. Keeping a copy for your records is also essential, as it supports the Guam Acceptance of Resignation of Officer by Nonprofit Corporation process. This confirmation ensures clarity and transparency in your governance.