Guam Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions

Description

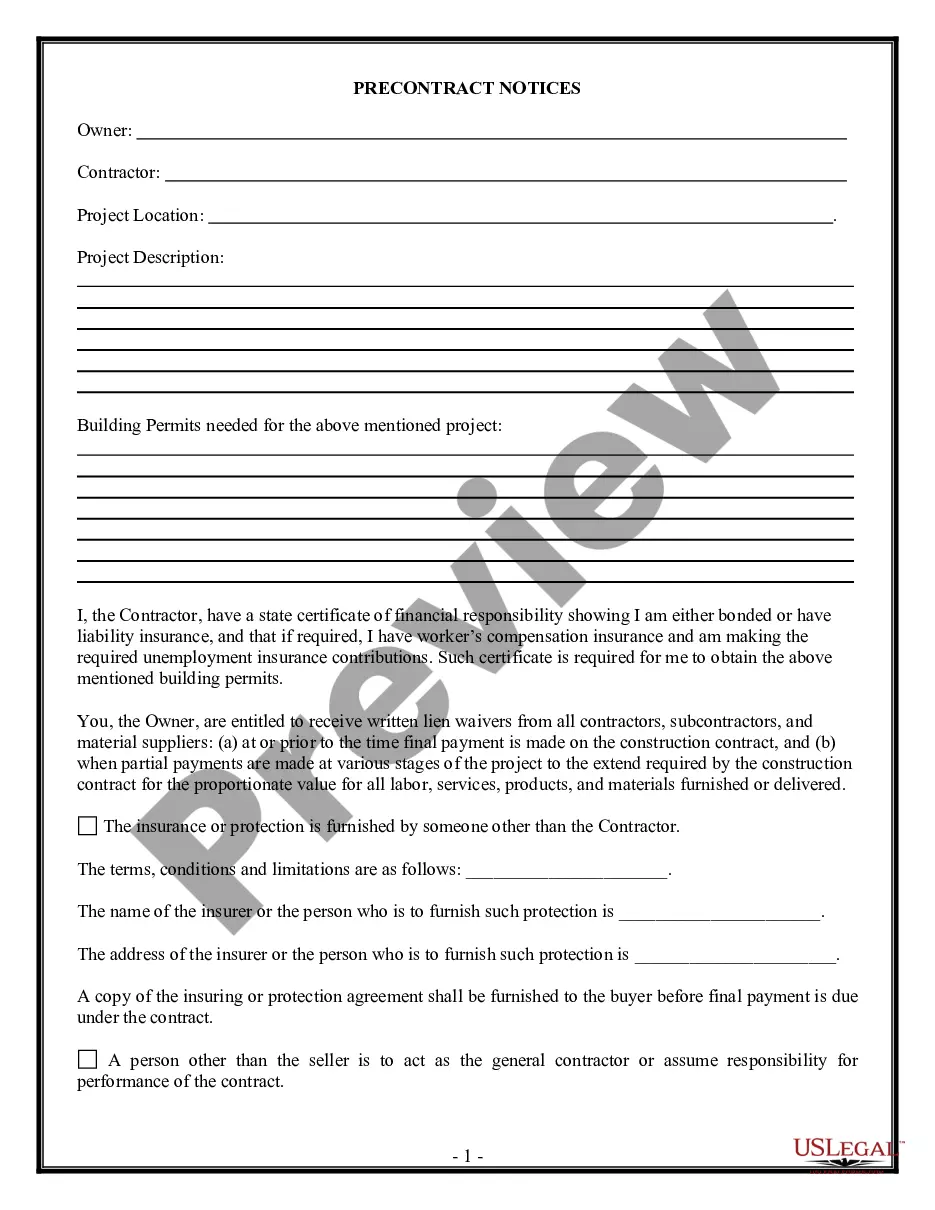

How to fill out Shareholders Buy Sell Agreement Of Stock In A Close Corporation With Noncompetition Provisions?

Locating the appropriate sanctioned document format can be problematic.

Clearly, numerous templates exist online, but how do you identify the sanctioned type you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct document for your specific city/county. You can review the document using the Preview button and analyze the document summary to confirm it is the correct one for you.

- The service offers a vast selection of templates, including the Guam Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions, which you can apply for business and personal purposes.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Guam Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions.

- Use your account to browse through the legal documents you have previously acquired.

- Visit the My documents section of your account to download another version of the document you require.

Form popularity

FAQ

While buy-sell agreements offer clear advantages, they also have disadvantages. Some parties may feel constrained by the terms, particularly if they wish to sell their shares to someone not specified in the agreement. Furthermore, the Guam Shareholders Buy Sell Agreement of Stock in a Close Corporation with Noncompetition Provisions can limit flexibility and may not adequately reflect changes in market value over time.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

A Share Sale and Purchase Agreement is an agreement for the sale and purchase of a stated number of shares at an agreed price. The shareholder selling their shares is the seller and the party buying the shares is the buyer. This agreement details the terms and conditions of the sale and purchase of the shares.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

A share purchase agreement is a legal contract between two parties: a seller and a buyer. They may be referred to as the vendor and purchaser in the contract. The contract is proof that the sale and the terms of it were mutually agreed upon.

Closing. Closing or Completion under a share purchase agreement may occur concurrently with its signing, or may be postponed to account for the fulfilment of certain conditions, known as Conditions Precedent or CPs. CPs typically include regulatory clearances, board/shareholder approval, third-party consents, and so on

An agreement to sell is a crucial precursor to the sale deed. This document, which has legal sanctity, states the seller's intention to sell the property and the buyer's intention to purchase the same in the future.

Shareholder's agreement is primarily entered to rectify the disputes that occurred between the company and the Shareholder. Meanwhile, the Share Purchase agreement is a document that legalizes the process of transaction of share held between the buyer and the seller.

An equity purchase agreement, also known as a share purchase agreement or stock purchase agreement, is a contract that transfers shares of a company from a seller to a buyer. Equity purchases can be used to acquire a business in whole or in part.

A 'share sale' typically involves the sale of the shares of a company. The legal contracting parties to the share sale agreement will be the actual shareholder of the company (ie, as the seller) who is disposing of his shares in the company, and the buyer who will become the new shareholder of the target company.