Guam Loan Agreement for Family Member

Description

How to fill out Loan Agreement For Family Member?

US Legal Forms - one of several greatest libraries of legal kinds in the States - provides a wide range of legal file templates you are able to download or print out. Utilizing the web site, you may get a large number of kinds for organization and individual functions, categorized by categories, says, or search phrases.You can find the most up-to-date variations of kinds like the Guam Loan Agreement for Family Member in seconds.

If you currently have a membership, log in and download Guam Loan Agreement for Family Member from the US Legal Forms catalogue. The Obtain button will show up on each type you see. You get access to all earlier acquired kinds within the My Forms tab of your respective accounts.

If you want to use US Legal Forms the very first time, listed below are easy instructions to help you get started out:

- Make sure you have chosen the proper type to your city/region. Click on the Preview button to review the form`s content material. Browse the type information to ensure that you have selected the correct type.

- If the type does not suit your requirements, make use of the Lookup area on top of the display screen to obtain the one that does.

- In case you are happy with the form, validate your choice by clicking on the Get now button. Then, pick the rates strategy you like and supply your references to sign up for the accounts.

- Process the transaction. Utilize your charge card or PayPal accounts to finish the transaction.

- Choose the format and download the form on your device.

- Make alterations. Fill out, edit and print out and indication the acquired Guam Loan Agreement for Family Member.

Each and every template you put into your account does not have an expiry day and is also your own property forever. So, if you wish to download or print out an additional backup, just check out the My Forms portion and then click in the type you need.

Obtain access to the Guam Loan Agreement for Family Member with US Legal Forms, probably the most extensive catalogue of legal file templates. Use a large number of professional and condition-specific templates that meet up with your organization or individual requires and requirements.

Form popularity

FAQ

A family loan is a loan between family members ? but it's up to you and the lender to decide how it's structured. A family loan can have interest or not, be repaid in installments or a lump sum and you could even provide collateral. This type of loan can be informal or formalized with a loan agreement.

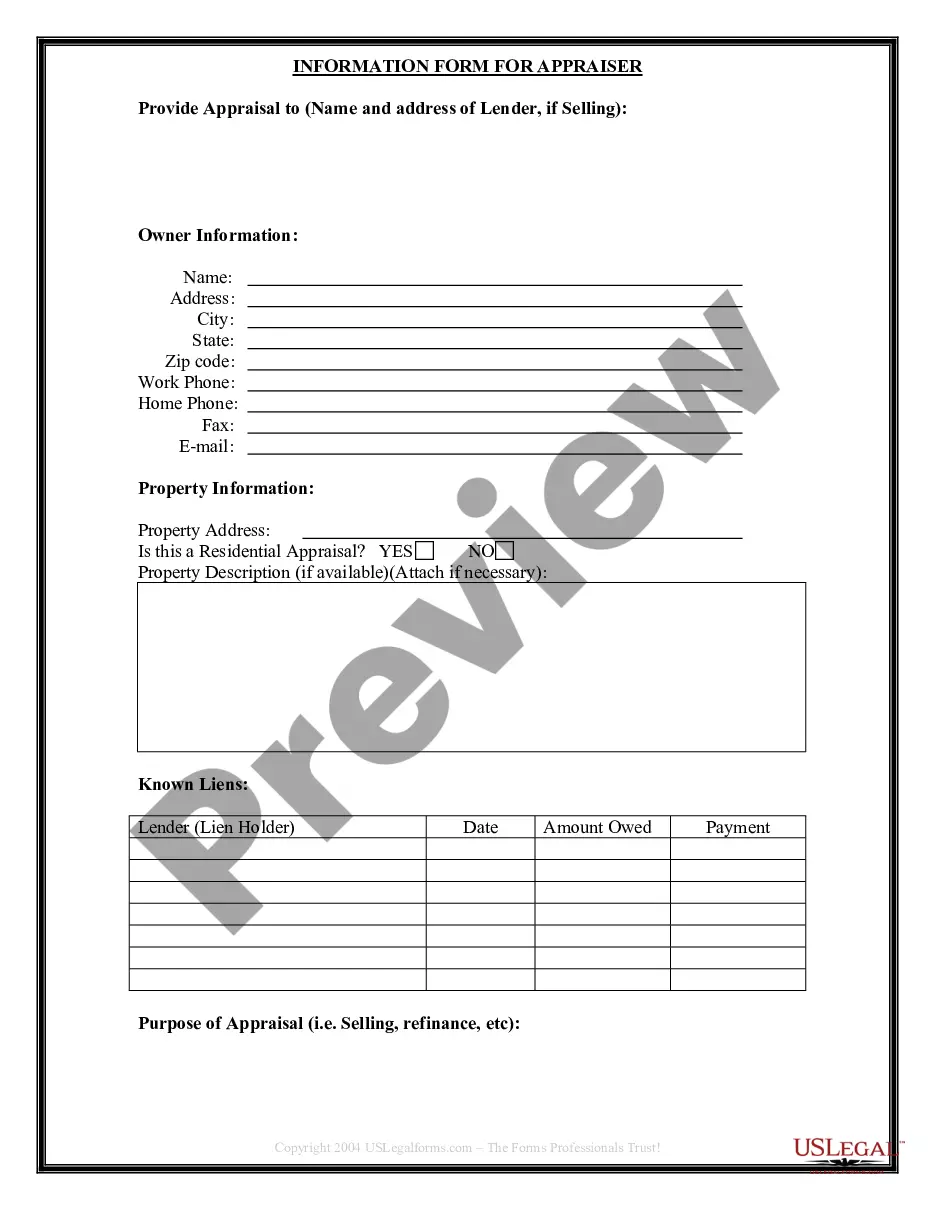

Draw Up a Loan Agreement Basic terms for a loan agreement with family or friends should include the following: The amount borrowed (principal) Interest rate (if applicable) Repayment terms (monthly installments over a set period or a lump sum on a specific date)

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).

A comprehensive contract should include the following details: The amount to be borrowed (loan principal) The interest rate on the loan, if applicable (you must charge interest if your loan amount is over $10,000) The method by which the money will be transferred and repaid.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

Once executed a loan agreement will be legally binding and in effect.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.