Title: A Comprehensive Guide to Guam Assignment of Interest in Joint Venture Introduction: In the world of business, joint ventures have become a popular strategy to leverage resources and expand markets. Guam, a U.S. territory located in the Western Pacific, also offers enticing opportunities for joint ventures. This article aims to provide a detailed insight into Guam Assignment of Interest in Joint Venture, exploring its various forms and implications. 1. Understanding Guam Assignment of Interest in Joint Venture: The Guam Assignment of Interest in Joint Venture refers to the legal mechanism through which one party transfers their ownership rights, claims, and responsibilities to another entity within a joint venture arrangement. This allows the transferee to assume a specific position or participate in the joint venture project on behalf of the assignor. 2. Common Types of Guam Assignment of Interest in Joint Venture: a. Voluntary Assignment: In this type, the assignor willingly transfers their interest in the joint venture to the transferee. This can happen when a party wishes to exit the joint venture due to various reasons such as financial constraints, strategic repositioning, or other business-related motives. b. Involuntary Assignment: When an assignor is forced to relinquish their interest in a joint venture against their will, it is known as an involuntary assignment. This could occur due to breach of contract, non-performance, bankruptcy, or other legal obligations. c. Partial Assignment: This form of assignment involves the transfer of only a portion of the assignor's interest in the joint venture to the transferee. It often occurs when an assignor wishes to diversify their business portfolio or reduce risk exposure. d. Complete Assignment: In contrast to partial assignment, a complete assignment involves the transfer of the assignor's entire interest in the joint venture to the transferee. This could result from a complete exit strategy or a strategic decision to focus on other business pursuits. 3. Implications of Guam Assignment of Interest in Joint Venture: a. Legal Considerations: Executing a valid and enforceable Guam Assignment of Interest requires compliance with relevant laws, regulations, and joint venture agreements. Proper documentation, including written consent from all involved parties, is crucial to safeguard the interests of all stakeholders. b. Financial Matters: The assignment of interest may entail the transfer of financial commitments, profits, losses, and liabilities associated with the joint venture. A thorough assessment of financial obligations and potential risks must be performed before executing the assignment. c. Continuity of Operations: Successful transfer of interest ensures the smooth continuation of joint venture operations. The transferee must be capable of assuming the assigned responsibilities, fulfilling contractual obligations, and contributing to the collaborative effort effectively. Conclusion: Guam Assignment of Interest in Joint Venture is a vital mechanism that allows businesses to transfer ownership rights, claims, and responsibilities within a joint venture. From voluntary and involuntary assignments to partial and complete assignments, various types exist. Understanding the legal and financial implications of such assignments is crucial before entering into this business endeavor. By following proper procedures and ensuring compliance, businesses can leverage the opportunities Guam offers for joint ventures.

Guam Assignment of Interest in Joint Venture

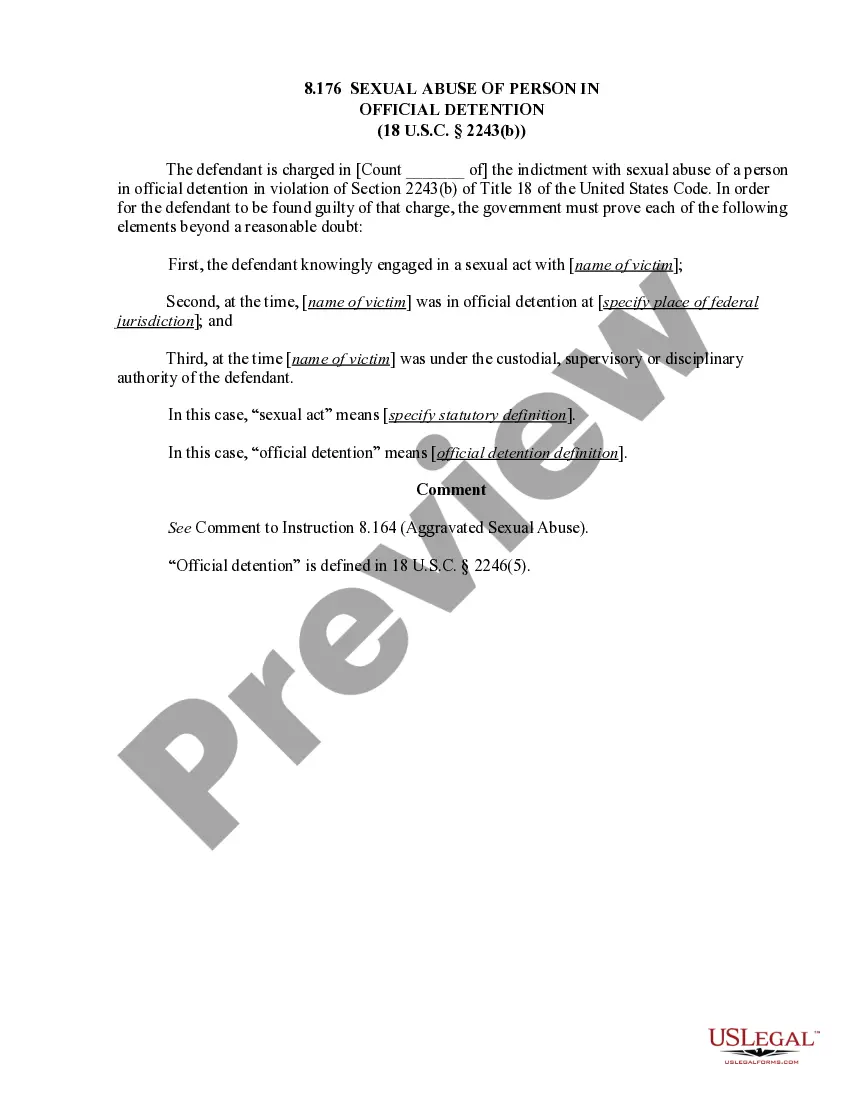

Description

How to fill out Guam Assignment Of Interest In Joint Venture?

Choosing the right authorized papers format can be quite a have a problem. Of course, there are plenty of web templates available on the net, but how do you discover the authorized kind you require? Take advantage of the US Legal Forms internet site. The services provides thousands of web templates, like the Guam Assignment of Interest in Joint Venture, that can be used for organization and private demands. Every one of the varieties are checked by experts and meet federal and state needs.

When you are presently registered, log in to your profile and click the Down load key to find the Guam Assignment of Interest in Joint Venture. Make use of your profile to check from the authorized varieties you might have purchased previously. Check out the My Forms tab of your profile and obtain another version in the papers you require.

When you are a brand new customer of US Legal Forms, here are basic directions so that you can adhere to:

- Initial, make sure you have chosen the appropriate kind for the town/area. You may check out the shape making use of the Preview key and read the shape explanation to make certain it will be the right one for you.

- In case the kind is not going to meet your requirements, use the Seach industry to find the correct kind.

- When you are sure that the shape is proper, click the Acquire now key to find the kind.

- Opt for the prices strategy you want and enter in the needed info. Make your profile and pay for your order making use of your PayPal profile or bank card.

- Select the data file formatting and down load the authorized papers format to your system.

- Complete, edit and produce and indicator the attained Guam Assignment of Interest in Joint Venture.

US Legal Forms is the greatest catalogue of authorized varieties for which you will find various papers web templates. Take advantage of the service to down load appropriately-created papers that adhere to status needs.