Guam Sample Letter for Written Acknowledgment of Bankruptcy Information

Description

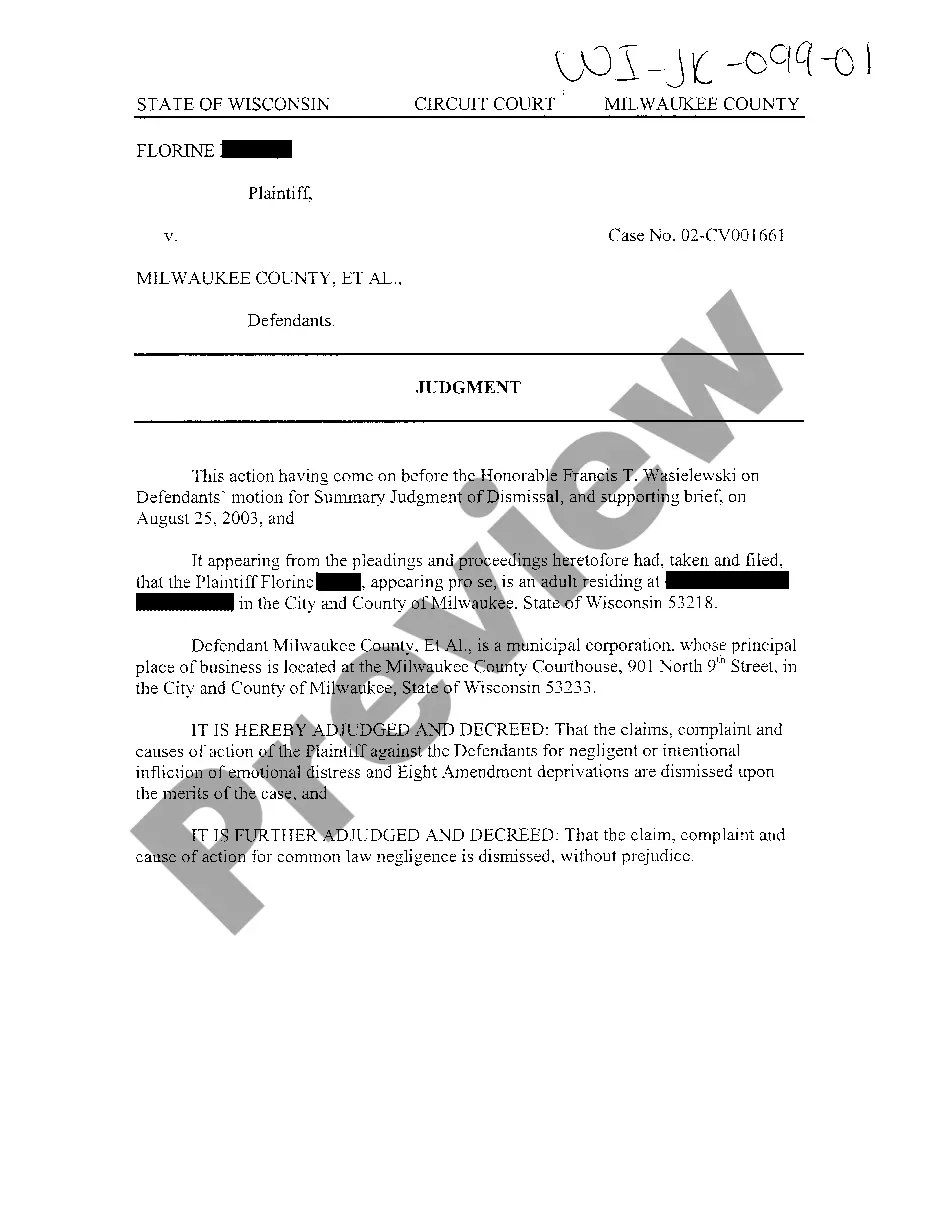

How to fill out Sample Letter For Written Acknowledgment Of Bankruptcy Information?

If you need to total, down load, or print out lawful papers templates, use US Legal Forms, the most important selection of lawful varieties, that can be found online. Use the site`s simple and easy practical search to discover the files you require. Various templates for organization and personal purposes are sorted by classes and claims, or key phrases. Use US Legal Forms to discover the Guam Sample Letter for Written Acknowledgment of Bankruptcy Information with a number of mouse clicks.

In case you are already a US Legal Forms customer, log in to your accounts and then click the Obtain button to have the Guam Sample Letter for Written Acknowledgment of Bankruptcy Information. You can even entry varieties you previously saved inside the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the shape for the correct area/region.

- Step 2. Utilize the Review method to look through the form`s content. Do not neglect to read the explanation.

- Step 3. In case you are unsatisfied using the form, use the Search discipline near the top of the screen to get other types from the lawful form template.

- Step 4. After you have identified the shape you require, click the Purchase now button. Pick the rates program you prefer and put your accreditations to register on an accounts.

- Step 5. Process the transaction. You should use your bank card or PayPal accounts to perform the transaction.

- Step 6. Select the file format from the lawful form and down load it on your own gadget.

- Step 7. Comprehensive, edit and print out or indicator the Guam Sample Letter for Written Acknowledgment of Bankruptcy Information.

Each and every lawful papers template you get is the one you have forever. You might have acces to each form you saved with your acccount. Go through the My Forms section and select a form to print out or down load once again.

Remain competitive and down load, and print out the Guam Sample Letter for Written Acknowledgment of Bankruptcy Information with US Legal Forms. There are thousands of skilled and express-specific varieties you can utilize for the organization or personal needs.

Form popularity

FAQ

Each of the 94 federal judicial districts handles bankruptcy matters, and in almost all districts, bankruptcy cases are filed in the bankruptcy court.

A bankruptcy case normally begins when the debtor files a petition with the bankruptcy court. A petition may be filed by an individual, by spouses together, or by a corporation or other entity.

Individual, corporate, and government bankruptcies are handled by U.S. Bankruptcy Courts ? a specialized system with many specialized rules. Federal courts have exclusive jurisdiction over bankruptcy cases.

Region 15 : District Of Guam (Bankruptcy Division)

All bankruptcy cases are handled in federal courts under rules outlined in the U.S. Bankruptcy Code. There are different types of bankruptcies, which are usually referred to by their chapter in the U.S. Bankruptcy Code.

Key Elements to Include in the Letter It should include the name and contact information of the debtor, the date of the filing, the court where the bankruptcy was filed, the case number, and the type of bankruptcy filed. It should also provide information about the bankruptcy trustee and the meeting of creditors.

The federal district courts are the trial courts in the federal court system. Guam has one federal district court, which is known as the U.S. District Court for the District of Guam.