A Guam LLC Operating Agreement for Two Partners is a legal document that outlines the responsibilities, rights, and obligations of each partner in a Limited Liability Company (LLC) based in Guam. This agreement is a crucial component in setting up an LLC and serves as a blueprint for how the business will be run. The Guam LLC Operating Agreement for Two Partners establishes the roles and contributions of each partner, how profits and losses will be allocated between the partners, as well as how decision-making processes and voting rights will be handled. It also helps protect the partners' personal assets from any liabilities that the business may incur. There are several types of Guam LLC Operating Agreements for Two Partners, each with its own specifications and considerations. Some of these agreements may include: 1. Simple Partnership Agreement: This type of operating agreement establishes a basic structure for the LLC. It outlines the capital contributions, profit and loss distribution, management responsibilities, and decision-making processes. 2. Silent Partner Agreement: In this arrangement, one partner acts as a silent or passive investor, providing capital but not actively participating in the day-to-day management of the business. The agreement specifies the silent partner's limited role and the extent of their liability. 3. Managing Partner Agreement: This type of agreement designates one partner as the primary manager responsible for making operational decisions and overseeing the LLC's daily activities. The agreement outlines the managing partner's authorities and limits, while also defining the non-managing partner's role. 4. Equal Partner Agreement: This agreement treats both partners as equals in terms of capital contributions, decision-making authority, and profit/loss distribution. It ensures that both partners have equal rights and responsibilities in running the LLC. 5. Different Capital Contribution Agreement: In situations where partners contribute funds or assets to the LLC unequally, this agreement outlines the specific details of each partner's capital contribution, along with the resulting profit/loss distribution. Regardless of the type chosen, a Guam LLC Operating Agreement for Two Partners is essential for establishing clear guidelines for the LLC's management, operations, and financial matters. It is highly recommended consulting with legal professionals familiar with Guam's laws and regulations to ensure compliance and protection for both partners involved.

Guam LLC Operating Agreement for Two Partners

Description

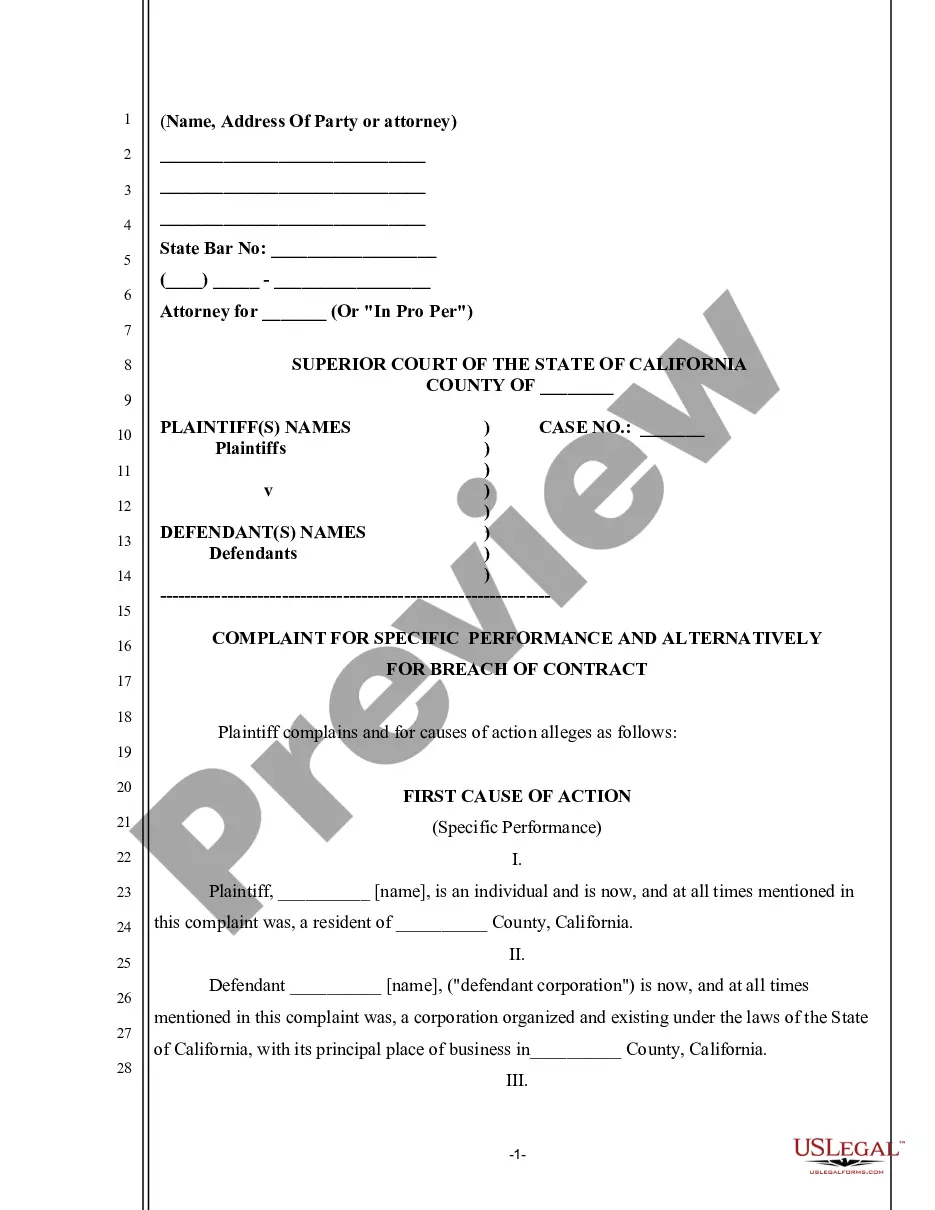

How to fill out Guam LLC Operating Agreement For Two Partners?

US Legal Forms - among the largest libraries of lawful kinds in the States - delivers a wide range of lawful papers web templates you can download or produce. Making use of the web site, you can find a huge number of kinds for enterprise and individual reasons, sorted by groups, suggests, or keywords.You will discover the newest models of kinds like the Guam LLC Operating Agreement for Two Partners within minutes.

If you already possess a membership, log in and download Guam LLC Operating Agreement for Two Partners from your US Legal Forms catalogue. The Obtain button will appear on each and every develop you see. You get access to all previously acquired kinds inside the My Forms tab of your own accounts.

If you would like use US Legal Forms initially, allow me to share simple directions to obtain started out:

- Ensure you have chosen the proper develop for the city/state. Click the Review button to analyze the form`s articles. Look at the develop information to ensure that you have selected the proper develop.

- If the develop does not satisfy your specifications, take advantage of the Look for field on top of the monitor to get the the one that does.

- In case you are happy with the form, affirm your option by visiting the Get now button. Then, choose the prices strategy you like and offer your accreditations to sign up for the accounts.

- Approach the purchase. Make use of credit card or PayPal accounts to complete the purchase.

- Pick the format and download the form in your system.

- Make modifications. Complete, modify and produce and indication the acquired Guam LLC Operating Agreement for Two Partners.

Every single web template you included in your bank account lacks an expiration day and is the one you have forever. So, if you wish to download or produce another backup, just visit the My Forms section and click around the develop you will need.

Get access to the Guam LLC Operating Agreement for Two Partners with US Legal Forms, by far the most extensive catalogue of lawful papers web templates. Use a huge number of specialist and express-specific web templates that fulfill your business or individual requires and specifications.

Form popularity

FAQ

Member LLC Operating Agreement is a document that establishes how an entity with two (2) or more members will be run. Without putting the contract into place, the entity is governed in accordance with the rules and standards established by the state, which may or may not align with the company's goals.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

Single-member LLC Ownership A Single-member LLC has one owner (member) who has full control over the company. The LLC is its own legal entity, independent of its owner. Multi-member LLC Ownership A Multi-member LLC has two or more owners (members) that share control of the company.

When you are drafting a partnership operating agreement, you need to include the following information:Name of your partnership.Principal place of business.Certificate of formation proving that you and your partners have indeed formed a partnership.Name and address of the registered agent of your partnership.More items...

DOMESTIC CORPORATIONS are formed in Guam by three (3) or more persons where either the secretary or treasurer of the corporation must be a resident of Guam.

Member LLC Operating Agreement is a document that establishes how an entity with two (2) or more members will be run. Without putting the contract into place, the entity is governed in accordance with the rules and standards established by the state, which may or may not align with the company's goals.

Banker suggests that answering "yes" to one or more question; it may be time to dissolve your partnership.Review your partnership agreement.Consult your state's statutes.Schedule a meeting with your business partner.File Articles of Dissolution.Divide the partnership assets equitably.

An operating agreement is ONLY required in the five (5) States of California, Delaware, Maine, Missouri, and New York. In all other States, an operating agreement is not required but is recommended to be written and signed by all members of the LLC.

member LLC is easier for tax purposes because no federal tax return is required, unless the business decides to be treated as a corporation for tax purposes. The income is reported on the member's tax return. A multiple member LLC must file tax return, and give the members K1 forms to file with their returns.

member LLC operating agreement is a legal contract that outlines the agreedupon ownership structure and sets forth the governing terms for a multimember LLC. In addition, it sets clear expectations about each member's powers, roles, and responsibilities.