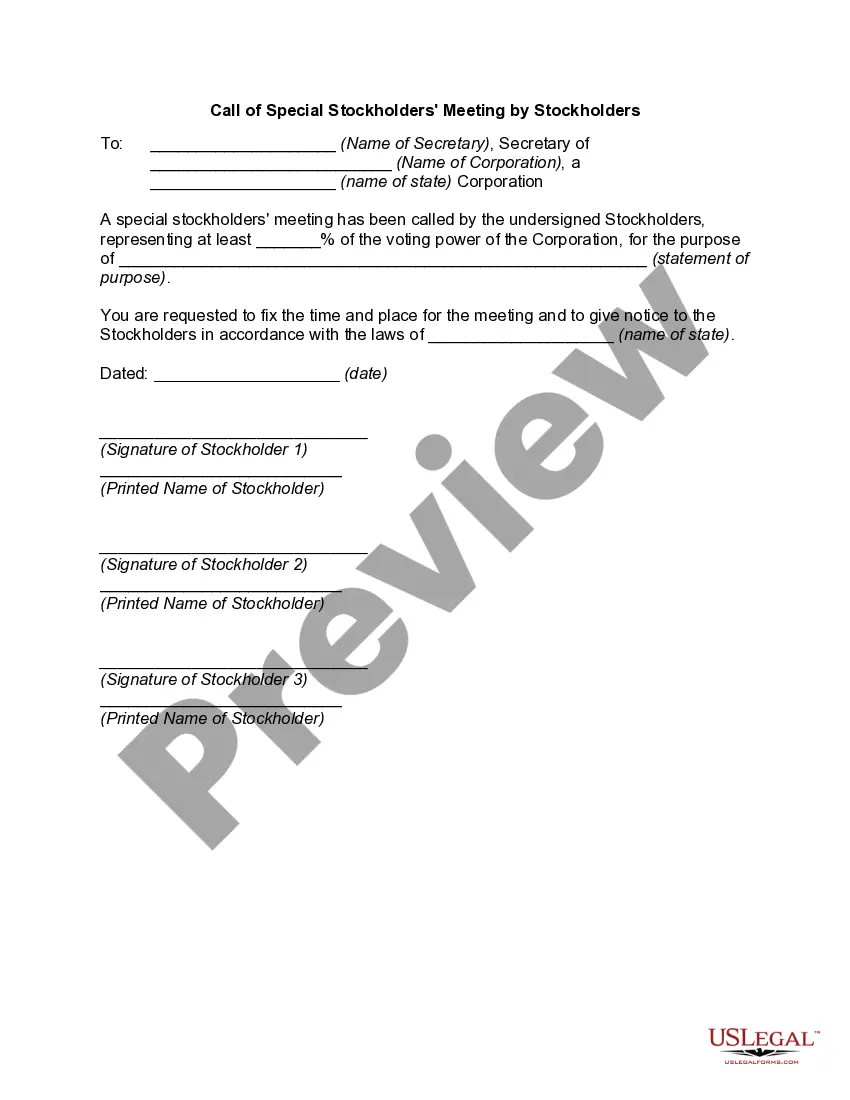

Guam Call of Special Stockholders' Meeting by Stockholders

Description

How to fill out Call Of Special Stockholders' Meeting By Stockholders?

Finding the right legal record web template might be a battle. Of course, there are a lot of templates available online, but how will you find the legal type you want? Take advantage of the US Legal Forms web site. The service offers a huge number of templates, like the Guam Call of Special Stockholders' Meeting by Stockholders, which can be used for organization and private needs. All of the types are checked out by pros and meet up with state and federal requirements.

Should you be already authorized, log in for your bank account and then click the Down load key to find the Guam Call of Special Stockholders' Meeting by Stockholders. Utilize your bank account to search through the legal types you might have ordered previously. Visit the My Forms tab of your bank account and acquire another duplicate from the record you want.

Should you be a new user of US Legal Forms, listed below are easy directions that you can adhere to:

- Initially, make sure you have chosen the correct type to your area/region. You may look through the form while using Review key and study the form explanation to make sure it is the best for you.

- In the event the type fails to meet up with your expectations, use the Seach field to get the appropriate type.

- When you are certain that the form is proper, click on the Get now key to find the type.

- Pick the prices program you would like and type in the necessary information and facts. Create your bank account and pay for an order with your PayPal bank account or Visa or Mastercard.

- Pick the file file format and obtain the legal record web template for your system.

- Complete, change and printing and indicator the acquired Guam Call of Special Stockholders' Meeting by Stockholders.

US Legal Forms will be the biggest local library of legal types in which you can find a variety of record templates. Take advantage of the service to obtain skillfully-created papers that adhere to state requirements.

Form popularity

FAQ

Typically either the president or a majority vote of the board (or both) can call a special meeting. You need to give proper notice to members and, of course, you need a quorum to do business. The procedure should be spelled out in your bylaws.

Special meetings of the Board for any purpose or purposes may be called at any time by the chairman of the Board, the chief executive officer, the secretary or any two directors. The person(s) authorized to call special meetings of the Board may fix the place and time of the meeting.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

A shareholder meeting will often be called when shareholder input is needed in a major decision, such as a change in directors. Investors are also able to call special shareholder meetings, subject to a specific set of rules.

Special meetings of the shareholders may be called for any purpose or purposes, at any time, by the Chief Executive Officer; by the Chief Financial Officer; by the Board or any two or more members thereof; or by one or more shareholders holding not less than 10% of the voting power of all shares of the corporation

The directors' must call the meeting within 21 days after the request is given to the Company and the meeting must be held no later than two months after the request (Section 249D(5)). The obligation to call the meeting is imposed on the directors, whereas the obligation to hold the meeting is imposed on the company.

Scheduled meetings Your business should hold at least one annual shareholders' meeting. You can have more than one per year, but one per year is often the required minimum. An annual board of directors meeting is often also held in conjunction with the shareholders' meeting as well.

The board of directors has the power to call general meetings and the majority of general meetings will be called by the directors (S302 of the Companies Act 2006). The members also have the ability to demand a general meeting.

Special meeting is a meeting called by shareholders to discuss specific matters stated in the notice of the meeting. It is a meeting of shareholders outside the usual annual general meeting.

Legal Definition of special meeting : a meeting held for a special and limited purpose specifically : a corporate meeting held occasionally in addition to the annual meeting to conduct only business described in a notice to the shareholders.