Guam Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status

Description

How to fill out Independent Sales Representative Agreement With Developer Of Computer Software With Provisions Intended To Satisfy The Internal Revenue Service's 20 Part Test For Determining Independent Contractor Status?

US Legal Forms - one of several largest libraries of legal kinds in the States - delivers a wide array of legal document themes you are able to down load or print. Using the site, you may get a large number of kinds for enterprise and person uses, sorted by groups, suggests, or search phrases.You can get the most up-to-date variations of kinds just like the Guam Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status in seconds.

If you currently have a membership, log in and down load Guam Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status through the US Legal Forms catalogue. The Obtain key will appear on every single form you look at. You get access to all formerly acquired kinds in the My Forms tab of the bank account.

If you would like use US Legal Forms the first time, listed below are easy recommendations to obtain started out:

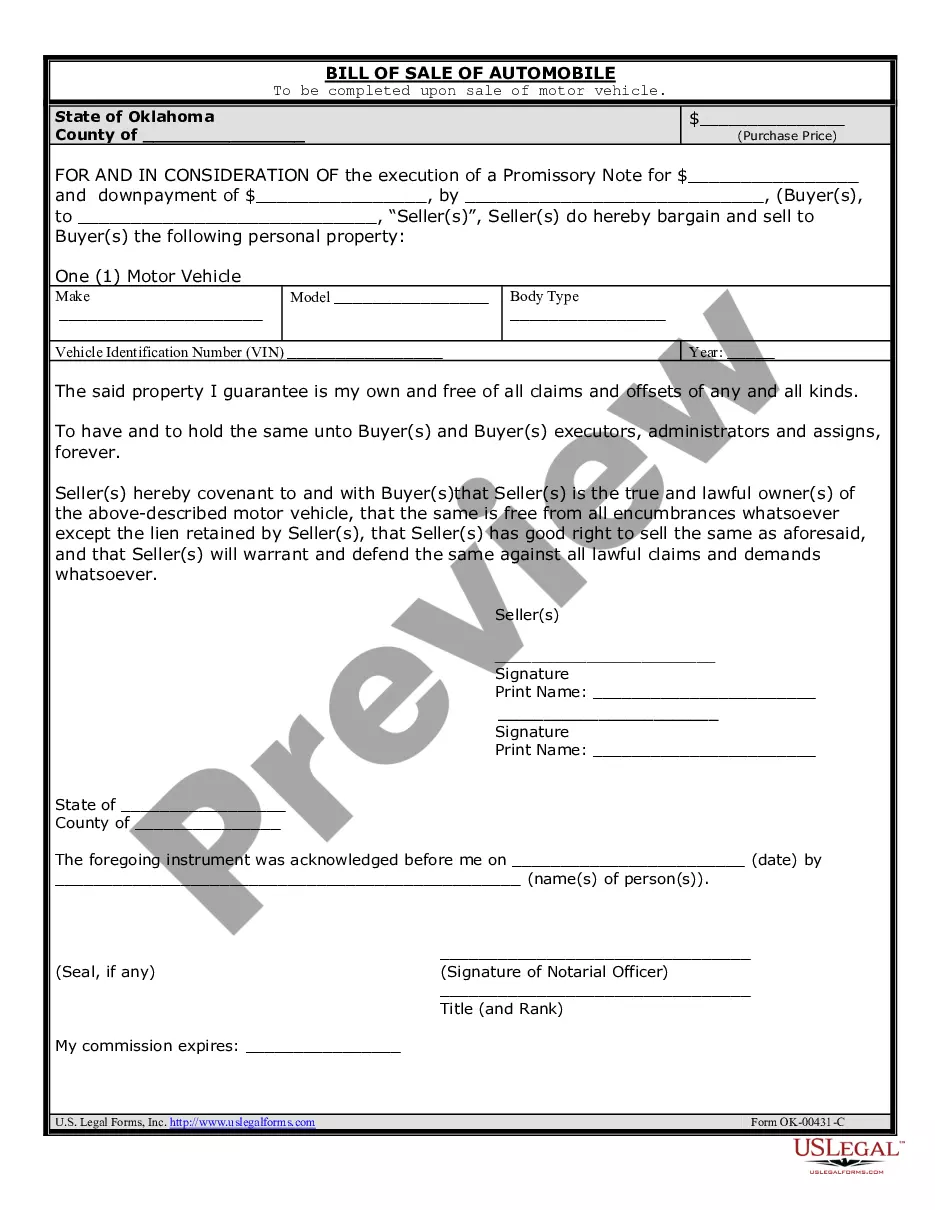

- Be sure to have chosen the proper form to your town/state. Click on the Review key to review the form`s articles. See the form information to ensure that you have selected the proper form.

- In case the form does not suit your demands, take advantage of the Lookup area at the top of the screen to find the one that does.

- When you are content with the form, validate your choice by simply clicking the Buy now key. Then, choose the pricing plan you like and give your qualifications to register on an bank account.

- Procedure the purchase. Make use of your bank card or PayPal bank account to complete the purchase.

- Pick the structure and down load the form on the gadget.

- Make alterations. Fill out, edit and print and signal the acquired Guam Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status.

Each template you included in your money does not have an expiry date and it is your own forever. So, in order to down load or print an additional backup, just proceed to the My Forms segment and click around the form you require.

Obtain access to the Guam Independent Sales Representative Agreement with Developer of Computer Software with Provisions Intended to Satisfy the Internal Revenue Service's 20 Part Test for Determining Independent Contractor Status with US Legal Forms, one of the most extensive catalogue of legal document themes. Use a large number of professional and status-specific themes that meet your company or person demands and demands.