Guam Liquidation of Partnership with Authority, Rights and Obligations during Liquidation refers to the process of winding up a partnership in Guam, a U.S. territory located in the Western Pacific Ocean. This process involves the dissolution and distribution of partnership assets, settling of debts, and terminating the partnership's legal existence. The liquidation stage is a crucial part of the process and involves various aspects and responsibilities. During the Guam Liquidation of Partnership, certain keywords come into play that help define the overall process. These keywords include partnership dissolution, liquidator, assets, liabilities, debts, termination, distribution, rights, and obligations. Let's explore the specific components and types of liquidation that exist in Guam: 1. Voluntary Liquidation: This type of liquidation occurs when the partners themselves mutually decide to dissolve the partnership voluntarily. It can happen for various reasons such as retirement, insolvency, or simply the desire to end the partnership. 2. Involuntary Liquidation: In contrast to voluntary liquidation, involuntary liquidation happens when external factors or court orders force the partnership to dissolve. This can occur due to bankruptcy, breach of partnership agreement, or certain legal violations. Authority, Rights, and Obligations during Liquidation: a) Liquidator's Authority: The liquidator, typically appointed by the partners or the court, assumes the authority to oversee the entire liquidation process. They have the power to sell partnership assets, settle debts and claims, and distribute remaining assets to partners. b) Dissolution of Authority: As the liquidation process commences, the partnership's authority to conduct regular business operations ceases to exist. The focus shifts towards winding up affairs, settling obligations, and distributing assets. c) Rights of Partners: During liquidation, partners hold the right to receive their respective share of the assets after debts and liabilities have been settled. This distribution is based on the partnership agreement or, in the absence of such, on their proportionate ownership interest. d) Obligations of Partners: Partners have several obligations during the liquidation process. These include providing accurate and complete financial records, cooperating with the liquidator, notifying creditors and stakeholders, and fulfilling any remaining partnership liabilities. e) Debt Settlement: One of the primary obligations during liquidation is settling the partnership's debts. The liquidator must assess all outstanding debts and liabilities, communicate with creditors, negotiate payment terms, and ensure the fair distribution of available assets to all eligible parties. f) Asset Distribution: Once all debts and liabilities are satisfied, the remaining partnership assets are distributed among the partners. This distribution can be in the form of cash, properties, or any other assets as agreed upon. It is important to note that Guam's liquidation of partnership with authority, rights, and obligations during liquidation follows applicable laws and regulations governing partnerships in the territory. It is advisable for partners to consult legal professionals familiar with Guam's partnership laws to ensure compliance and a smooth liquidation process.

Guam Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

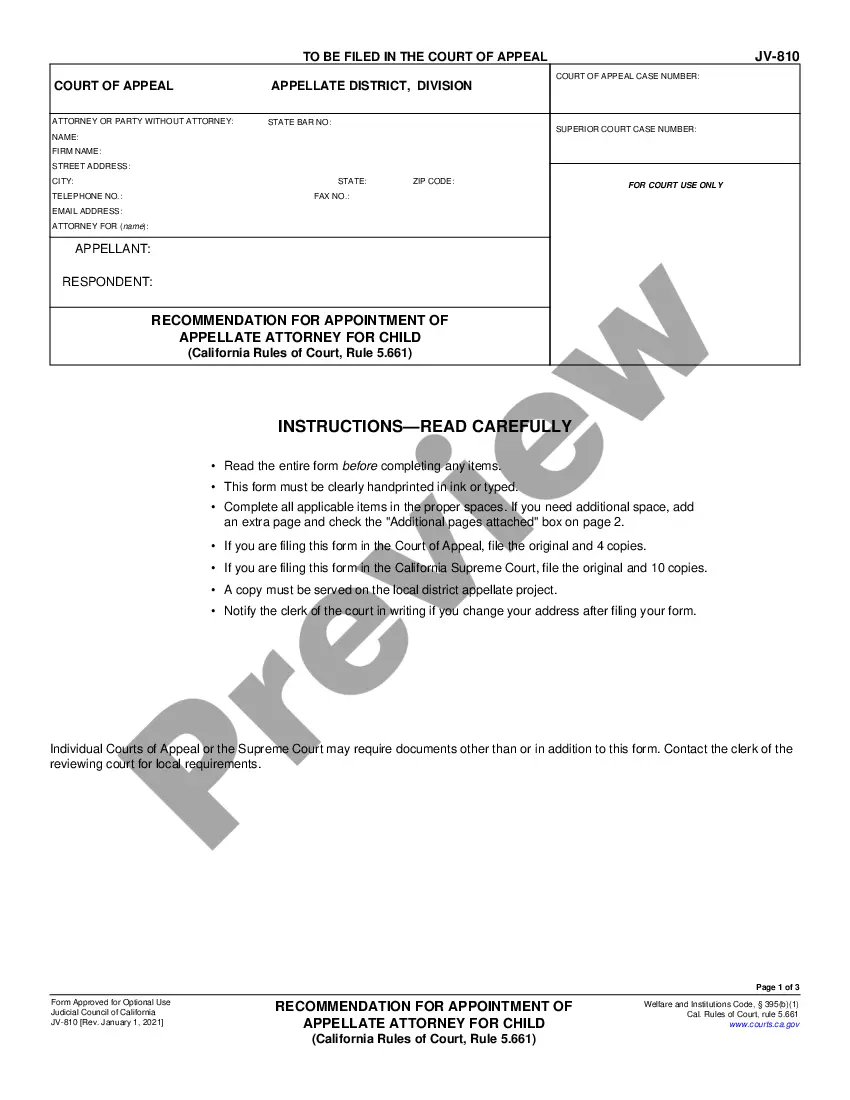

How to fill out Guam Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

US Legal Forms - one of several biggest libraries of lawful varieties in the United States - offers an array of lawful document web templates it is possible to download or produce. Making use of the website, you will get a large number of varieties for organization and personal purposes, sorted by categories, says, or keywords and phrases.You will discover the most up-to-date versions of varieties just like the Guam Liquidation of Partnership with Authority, Rights and Obligations during Liquidation within minutes.

If you already possess a monthly subscription, log in and download Guam Liquidation of Partnership with Authority, Rights and Obligations during Liquidation in the US Legal Forms catalogue. The Acquire button will appear on every kind you perspective. You get access to all formerly downloaded varieties in the My Forms tab of your own bank account.

In order to use US Legal Forms initially, allow me to share basic directions to help you began:

- Make sure you have picked the proper kind for the town/region. Select the Review button to check the form`s articles. See the kind description to actually have selected the appropriate kind.

- If the kind does not fit your specifications, take advantage of the Lookup area towards the top of the display screen to get the one that does.

- In case you are content with the form, affirm your decision by clicking the Get now button. Then, select the pricing strategy you like and give your accreditations to sign up for the bank account.

- Procedure the purchase. Make use of your charge card or PayPal bank account to accomplish the purchase.

- Select the format and download the form on your own device.

- Make alterations. Load, revise and produce and sign the downloaded Guam Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Every single template you included with your bank account lacks an expiry date and is your own property for a long time. So, if you would like download or produce yet another copy, just proceed to the My Forms area and click on the kind you need.

Obtain access to the Guam Liquidation of Partnership with Authority, Rights and Obligations during Liquidation with US Legal Forms, probably the most comprehensive catalogue of lawful document web templates. Use a large number of specialist and state-certain web templates that fulfill your business or personal demands and specifications.

Form popularity

FAQ

When a company goes into liquidation its assets are sold to repay creditors and the business closes down. The company name remains live on Companies House but its status switches to 'Liquidation'.

The first preference is given to the company's secured creditors. The remaining money is then used to discharge preferential creditors, i.e., taxes due to the government, salaries of employees, etc.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

In any case, the first step in the liquidation process is for the company directors to seek impartial advice from an insolvency expert, before convening a meeting with shareholders to announce the intended liquidation.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

3 Types of Liquidation There are different types of liquidation used for a variety of purposes. The most common types of liquidation are compulsory liquidation, members' voluntary liquidation, and creditors' voluntary liquidation.

1. Initiation of Liquidation1.1 When liquidation to be ordered by Adjudicating Authority.1.2 Contents of liquidation order.1.3 Effect of liquidation order.1.4 Model time frame for completion of liquidation process.2.1 Public announcement of appointment of liquidator.2.2 Reporting by Liquidator.More items...?03-Jul-2021

Once the liquidator is appointed, one of the first duties of his is collecting, consolidating and verifying the claims of stakeholders of the CD. Within a period of 30 days from the liquidation commencement date, the liquidator must collect or receive the claims27 of creditors.

Types of Asset LiquidationComplete liquidation. Complete liquidation is the process by which a business sells off all its net assets and ceases operation.Partial liquidation.Voluntary liquidation.Creditor induced liquidation.Government induced liquidation.