Guam Partnership Agreement for a Real Estate Development

Description

How to fill out Partnership Agreement For A Real Estate Development?

It is feasible to spend hours online trying to discover the legal document format that meets the federal and state requirements you have.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

It is straightforward to obtain or print the Guam Partnership Agreement for a Real Estate Development from our platform.

To find another variation of the form, leverage the Search section to locate the format that fulfills your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and click the Acquire button.

- Then, you can complete, modify, print, or sign the Guam Partnership Agreement for a Real Estate Development.

- Each legal document format you purchase is yours forever.

- To obtain an additional copy of any acquired form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the location/region you're choosing.

- Read the form summary to confirm you have selected the right form.

- If available, utilize the Preview button to review the document format as well.

Form popularity

FAQ

The business privilege tax in Guam is a tax imposed on businesses for the privilege of engaging in business activities. This tax is an important consideration for anyone involved in the real estate sector. Including guidelines about the business privilege tax in your Guam Partnership Agreement for a Real Estate Development can streamline compliance and clarify financial liabilities.

The North and Central Guam land use plan is a strategic framework that guides development and land use decisions in those areas. It aims to promote sustainable development while addressing community needs. Integrating the objectives of this plan into your Guam Partnership Agreement for a Real Estate Development can enhance project alignment with local regulations and community interests.

The business tax rate in Guam is currently set at 5% on gross income. This rate applies to various business activities, including real estate development. When drafting your Guam Partnership Agreement for a Real Estate Development, it's essential to factor in this tax rate as it affects overall profitability and financial planning.

The four types of partnerships include general partnerships, limited partnerships, limited liability partnerships (LLP), and joint ventures. Each type offers different levels of liability protection and management flexibility. Understanding these options helps you select the right structure for your Guam Partnership Agreement for a Real Estate Development, ensuring you meet your business objectives and legal requirements.

A partnership agreement is made by drafting a written document that specifies the terms and conditions governing the partnership. All partners should review the agreement to ensure clarity on responsibilities, profits, and conflict resolution. It's beneficial to utilize tools from US Legal Forms, which can assist you in creating an effective Guam Partnership Agreement for a Real Estate Development that aligns with legal standards.

Forming a partnership agreement involves several steps, starting with gathering each partner's contributions and visions. You must draft the document, detailing aspects like ownership shares, management duties, and exit strategies. Leveraging services from US Legal Forms can provide templates that help you create a solid Guam Partnership Agreement for a Real Estate Development.

Creating a simple partnership agreement begins with outlining the roles and responsibilities of each partner. You should include terms on profit sharing, decision-making processes, and dispute resolution methods. Using a comprehensive platform like US Legal Forms can streamline this process, ensuring your Guam Partnership Agreement for a Real Estate Development is clear and enforceable.

Yes, to operate a business in Guam, including a real estate development project, you need a valid business license. This license ensures compliance with local regulations and helps you establish your Guam Partnership Agreement for a Real Estate Development. It's crucial to check with the Guam Department of Revenue and Taxation for specific requirements tailored to your business.

You can certainly craft your own partnership agreement tailored to your needs. However, it is critical to include all necessary details relevant to your situation, particularly with a focus on real estate development in Guam. Utilizing resources like uslegalforms can streamline this process by providing templates designed specifically for a Guam Partnership Agreement for a Real Estate Development, equipping you with the necessary tools for a solid agreement.

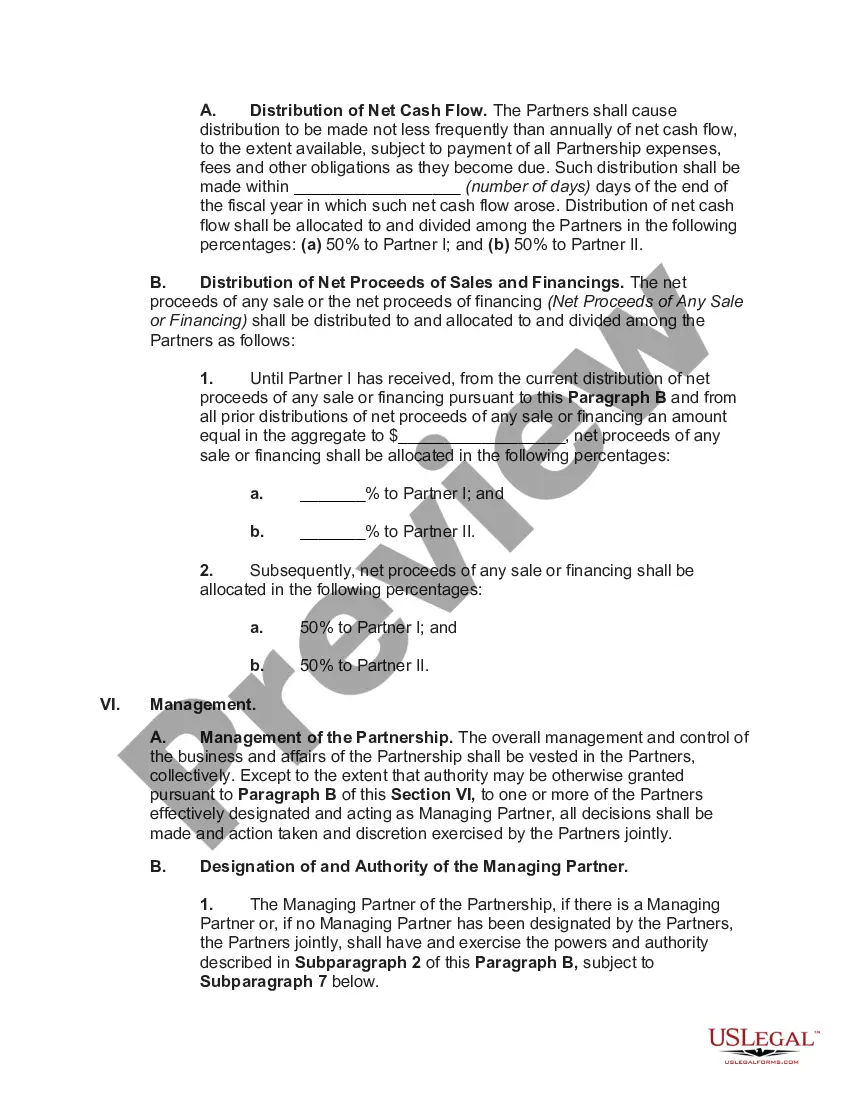

Key considerations in a partnership agreement include the purpose of the partnership, the capital contributions of each partner, the division of profits and losses, decision-making processes, and procedures for resolving disputes. Specifically for a Guam Partnership Agreement for a Real Estate Development, ensure all partners are clear on each aspect to avoid misunderstandings in the future. It may also be helpful to document exit strategies for partners wishing to leave the agreement.