Guam Agreement for Withdrawal of Partner from Active Management

Description

How to fill out Agreement For Withdrawal Of Partner From Active Management?

If you wish to compile, acquire, or produce genuine document templates, utilize US Legal Forms, the largest repository of authentic forms, accessible online.

Employ the website's straightforward and efficient search function to locate the documents you need.

Various templates for business and personal uses are categorized by groups and locations, or search terms. Utilize US Legal Forms to quickly find the Guam Agreement for Withdrawal of Partner from Active Management with just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to all forms you've downloaded in your account. Click on the My documents section and select a form to print or download again.

Complete and obtain, and print the Guam Agreement for Withdrawal of Partner from Active Management using US Legal Forms. Thousands of professional and state-specific forms are available for your personal business or individual requirements.

- If you are an existing US Legal Forms user, Log In to your account and click the Acquire button to access the Guam Agreement for Withdrawal of Partner from Active Management.

- You can also retrieve forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the document for the correct region/country.

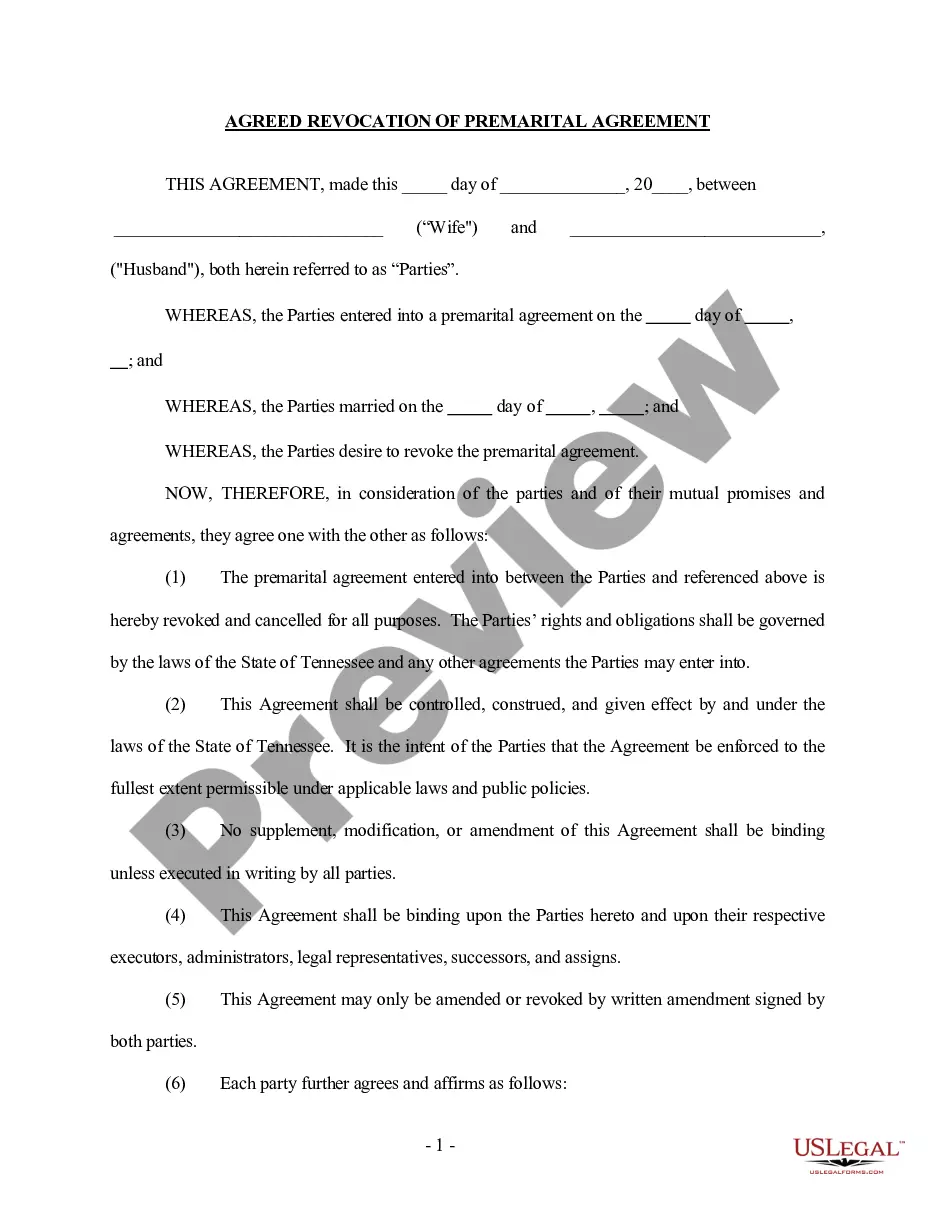

- Step 2. Use the Preview option to review the document's content. Be sure to read the summary.

- Step 3. If you are unsatisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have located the required document, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Guam Agreement for Withdrawal of Partner from Active Management.

Form popularity

FAQ

The substantial presence test determines if an individual is considered a resident of the United States for tax purposes. While Puerto Rico has its own tax rules, it does not count toward the substantial presence test in the same way as the 50 states. If you are dealing with partnerships in Puerto Rico or Guam, understanding the implications of this test is crucial, especially when it comes to withdrawing a partner from management. Using a Guam Agreement for Withdrawal of Partner from Active Management can help you navigate these complexities.

A partner can withdraw from a partnership by following the terms outlined in the partnership agreement, often requiring a notice period and potential buyout provisions. It's essential to ensure that all legal aspects are covered to avoid complications. Using a Guam Agreement for Withdrawal of Partner from Active Management will support this process by providing a clear framework for the withdrawal, ensuring that the remaining partners and the business remain compliant and operational.

To obtain a Guam GRT account number, you need to register your business with the Guam Department of Revenue and Taxation. Provide the required documentation, such as your business license and identification. Additionally, if you're involved in a partnership and a partner is withdrawing, you might find the Guam Agreement for Withdrawal of Partner from Active Management beneficial in clarifying responsibilities. This can simplify your account management after the changes.

Filing GRT tax in Guam involves gathering your sales-related information, completing the necessary forms, and submitting them to the Guam Department of Revenue and Taxation. It's crucial to calculate your gross receipts accurately, as it directly impacts your tax liability. You may also want to consider using the Guam Agreement for Withdrawal of Partner from Active Management if your business structure changes. This agreement helps outline the terms if a partner exits, ensuring compliance and smooth transition.

Yes, Guam is considered a U.S. territory for tax purposes, which means specific federal tax laws apply. However, Guam also has its own tax regulations that can differ from the mainland. When dealing with matters such as the Guam Agreement for Withdrawal of Partner from Active Management, recognizing this distinction is crucial for accurate tax compliance.

The Gross Receipts Tax (GRT) rate in Guam applies to the total revenue of businesses operating within the territory. It is important to stay informed about these rates to ensure proper financial planning, especially when executing agreements like the Guam Agreement for Withdrawal of Partner from Active Management. Compliance with tax rules promotes business sustainability.

1 and 2 taxes differ primarily in the type of income they report. hile 2 is for employee wages and taxes withheld, 1 relates to income for independent contractors. Understanding these differences helps clarify tax responsibilities, especially when navigating agreements like the Guam Agreement for ithdrawal of Partner from Active Management.

Customs tax in Guam can apply to goods imported into the territory, which affects both businesses and consumers. Various rates may apply depending on the type of goods. If you're involved in partnership agreements, like the Guam Agreement for Withdrawal of Partner from Active Management, understanding customs taxes is essential for informed decision-making.

1 form is utilized in Guam for reporting income received by an independent contractor or selfemployed individual. This form ensures accurate reporting for tax purposes. When discussing partnerships and agreements, such as the Guam Agreement for Withdrawal of Partner from Active Management, knowing how to handle W1 forms is essential for compliance.

Form 5074 is used for tax exemption elections and is specific to certain tax situations in Guam. Individuals and businesses may utilize this form to assert their eligibility for specific tax benefits. Understanding its implications is crucial, especially when making arrangements like the Guam Agreement for Withdrawal of Partner from Active Management.