Guam Specific Guaranty

Description

How to fill out Specific Guaranty?

If you need to comprehensive, obtain, or print authorized papers layouts, use US Legal Forms, the biggest variety of authorized types, which can be found online. Take advantage of the site`s easy and practical search to obtain the paperwork you require. Different layouts for business and specific uses are sorted by types and suggests, or search phrases. Use US Legal Forms to obtain the Guam Specific Guaranty in a few clicks.

If you are presently a US Legal Forms consumer, log in to the profile and click the Obtain button to obtain the Guam Specific Guaranty. You can even access types you in the past acquired within the My Forms tab of your profile.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the shape for that right area/land.

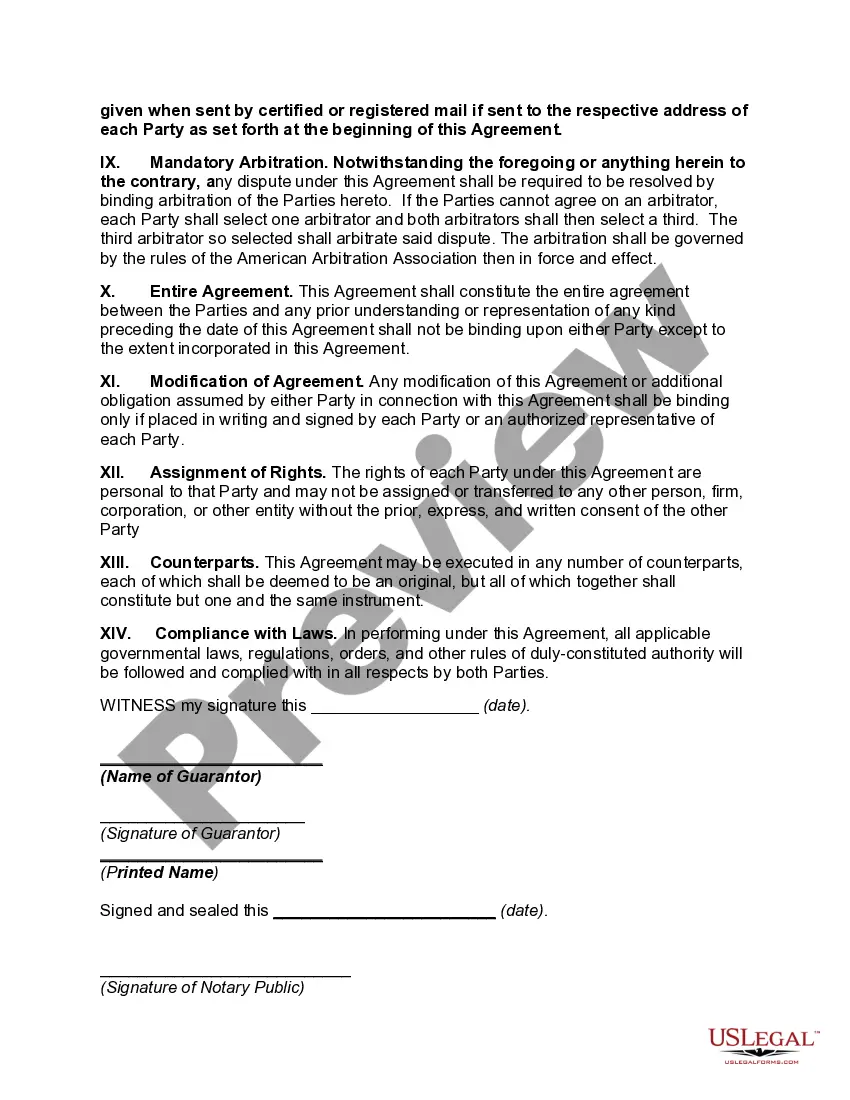

- Step 2. Use the Review option to look over the form`s content. Never overlook to see the outline.

- Step 3. If you are unsatisfied with the type, take advantage of the Research discipline near the top of the display screen to discover other versions in the authorized type design.

- Step 4. After you have located the shape you require, select the Buy now button. Choose the prices strategy you prefer and include your accreditations to register for an profile.

- Step 5. Process the purchase. You can use your charge card or PayPal profile to finish the purchase.

- Step 6. Pick the structure in the authorized type and obtain it on your system.

- Step 7. Full, change and print or indicator the Guam Specific Guaranty.

Every single authorized papers design you purchase is yours eternally. You might have acces to each type you acquired within your acccount. Go through the My Forms segment and select a type to print or obtain once more.

Be competitive and obtain, and print the Guam Specific Guaranty with US Legal Forms. There are millions of professional and condition-specific types you can utilize to your business or specific requirements.

Form popularity

FAQ

How much is the guaranty? VA will guarantee up to 50 percent of a home loan up to $45,000. For loans between $45,000 and $144,000, the minimum guaranty amount is $22,500, with a maximum guaranty, of up to 40 percent of the loan up to $36,000, subject to the amount of entitlement a veteran has available. VA-GUARANTEED HOME LOANS FOR VETERANS va.gov ? docs ? vap_26-4_online_version va.gov ? docs ? vap_26-4_online_version

PURPOSE OF VA GUARANTY. To encourage lenders to make VA loans by protecting loan holders and lenders against loss, up to the amount of the guaranty, in the event the loan is terminated by foreclosure. AMOUNT OF GUARANTY. The maximum guaranty on a VA loan is the lesser of the veteran's available.

A VA home loan guaranty means that a purchaser obtains a loan through a private lender, such as a bank, credit union or mortgage company. VA then works with the lender to guarantee the loan. If the home owner defaults on the loan, VA will pay the debt to the lender. What you need to know about VA's Home Loan Guaranty - VA.gov va.gov ? files ? What-you-need-to-know-ab... va.gov ? files ? What-you-need-to-know-ab...

To get a loan, you apply to the lender. If the loan is approved, VA guarantees the loan when it is closed. The guaranty means the lender is protected against loss if you or a later owner fail to repay the loan.

The first thing you need to do is request your VA home loan Certificate of Eligibility (COE). A COE does just what its name implies: It certifies to lenders that you are eligible to apply for a VA home loan.

The $36,000 isn't the total amount you can borrow. Instead, it means that if you default on a loan that's under $144,000, we guarantee to your lender that we'll pay them up to $36,000. For loans over $144,000, we guarantee to your lender that we'll pay up to 25% of the loan amount. VA Home Loan Limits | Veterans Affairs va.gov ? housing-assistance ? loan-limits va.gov ? housing-assistance ? loan-limits

Before you can apply for a VA loan, you'll need to receive your VA COE. Your COE shows that you meet the service requirements to qualify for a VA home loan.

1.5 percent For most loans, FSA charges the lender a guarantee fee of 1.5 percent of the guaranteed portion of the loan. This fee may be passed on to the borrower. Guaranteed Loan Program - USDA Farm Service Agency USDA Farm Service Agency (.gov) ? usdafiles ? FactSheets USDA Farm Service Agency (.gov) ? usdafiles ? FactSheets PDF