Guam Daily Accounts Receivable is a financial term that refers to the amount of money owed to an organization from its customers or clients in Guam on a daily basis. It represents the outstanding payments that a company expects to receive from its customers for goods or services provided. Accounts receivable is a crucial aspect of managing cash flow as it shows the value of sales that are yet to be collected. By monitoring Guam Daily Accounts Receivable, businesses can assess their financial health, evaluate credit policies, and identify potential cash flow issues. In Guam, there are different types of accounts receivable that companies may encounter: 1. Trade Receivables: These are the most common type of accounts receivable, representing payments due from regular customers for goods or services sold on credit terms. 2. Government Receivables: Guam Daily Accounts Receivable can also include outstanding payments from government agencies. This can apply to businesses that provide services or products to the government, such as contractors or vendors. 3. Delinquent Receivables: This category includes accounts receivable that are past due or have not been paid within the agreed-upon payment terms. Monitoring delinquent receivables is crucial for businesses as it helps them identify and manage potential collection issues. 4. Bad Debts: This refers to accounts receivable that are deemed uncollectible. Bad debts occur when a customer is unable or unwilling to pay their outstanding balance. Businesses need to account for bad debts and may have to write off these amounts as a loss. 5. Allowance for Doubtful Accounts: Companies often set aside a reserve known as an allowance for doubtful accounts. This reserve is an estimate of the potentially uncollectible receivables and is meant to account for potential losses that may arise in the future. Managing Guam Daily Accounts Receivable effectively involves establishing efficient credit and collection policies, monitoring payment trends, and pursuing timely collection activities. Companies may use various tools and software to track accounts receivable, generate invoices, and send reminders to customers regarding outstanding balances. By closely monitoring Guam Daily Accounts Receivable and implementing effective strategies for collection, businesses can ensure a healthy cash flow and maintain financial stability.

Guam Daily Accounts Receivable

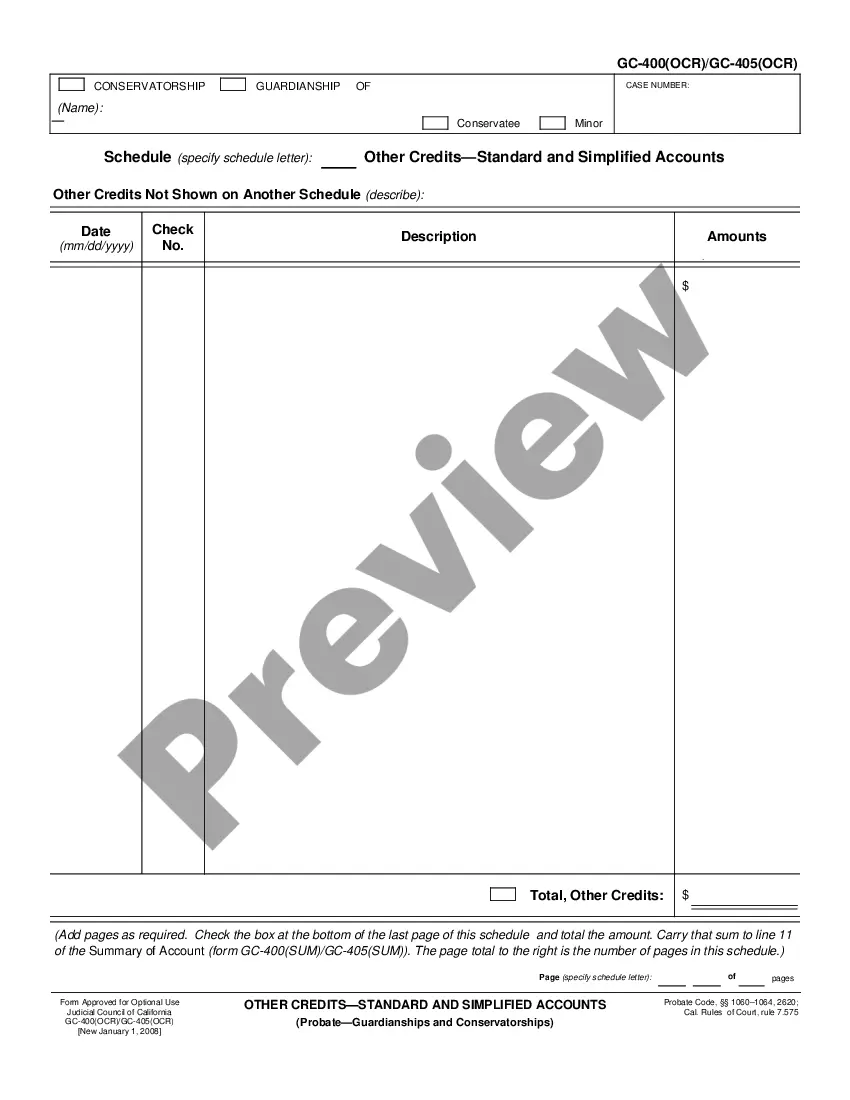

Description

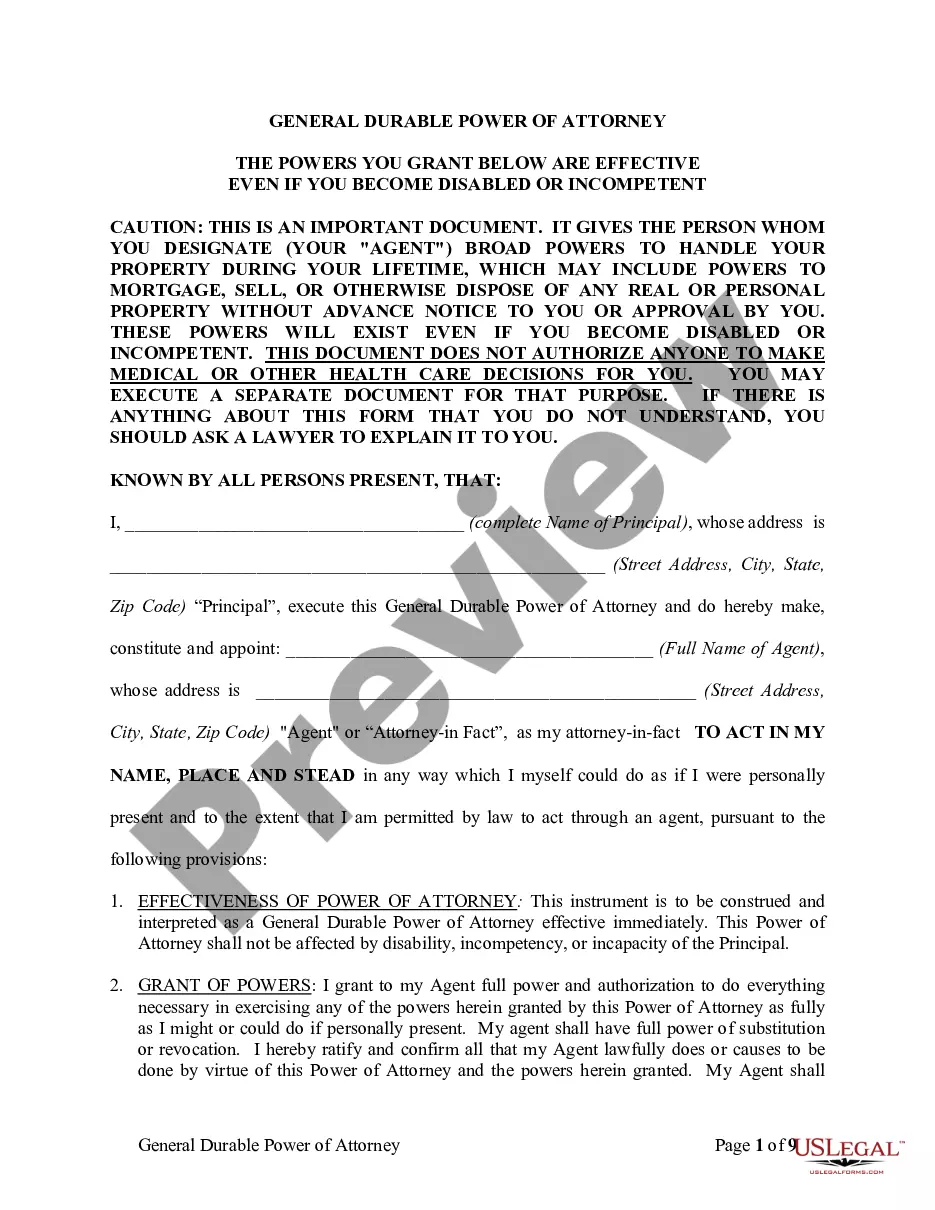

How to fill out Guam Daily Accounts Receivable?

US Legal Forms - one of several most significant libraries of lawful types in the USA - gives a wide range of lawful papers templates it is possible to down load or print. Using the internet site, you can find 1000s of types for business and personal uses, sorted by categories, states, or search phrases.You can get the most up-to-date variations of types like the Guam Daily Accounts Receivable in seconds.

If you already possess a subscription, log in and down load Guam Daily Accounts Receivable from the US Legal Forms collection. The Down load option can look on every develop you perspective. You gain access to all formerly saved types from the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, listed here are easy recommendations to help you get started:

- Make sure you have selected the right develop for your city/area. Select the Review option to examine the form`s content material. Look at the develop outline to actually have chosen the appropriate develop.

- In the event the develop doesn`t satisfy your specifications, make use of the Look for discipline towards the top of the screen to get the the one that does.

- When you are pleased with the form, confirm your choice by simply clicking the Acquire now option. Then, select the rates program you like and give your credentials to register for the bank account.

- Approach the deal. Make use of your charge card or PayPal bank account to complete the deal.

- Find the format and down load the form on the system.

- Make modifications. Load, revise and print and signal the saved Guam Daily Accounts Receivable.

Each format you put into your bank account lacks an expiration date and is also your own property forever. So, if you want to down load or print another backup, just check out the My Forms section and click on the develop you want.

Gain access to the Guam Daily Accounts Receivable with US Legal Forms, one of the most comprehensive collection of lawful papers templates. Use 1000s of expert and status-particular templates that fulfill your small business or personal demands and specifications.

Form popularity

FAQ

It is calculated by dividing receivables by total sales and multiplying the product by 365 (days in the period). To determine whether or not your average collection period results are good, simply compare your average against the credit terms you offer your clients.

Account receivables are classified as current assets assuming that they are due within one year. To record a journal entry for a sale on account, one must debit a receivable and credit a revenue account. When the customer pays off their accounts, one debits cash and credits the receivable in the journal entry.

You can find your accounts receivable balance under the 'current assets' section on your balance sheet or general ledger. Accounts receivable are classified as an asset because they provide value to your company. (In this case, in the form of a future cash payment.)

Typically, the average accounts receivable collection period is calculated in days to collect. This figure is best calculated by dividing a yearly A/R balance by the net profits for the same period of time.

Average accounts receivable is calculated as the sum of starting and ending receivables over a set period of time (generally monthly, quarterly or annually), divided by two.

Most schedules of accounts receivable are designed as aging schedules. An aging schedule lists each customer's name, balance and a breakdown showing if the amounts are current or past due. Open a spreadsheet program. The easiest way to create a schedule of accounts receivable is by using a spreadsheet document.

Account Receivable is an account created by a company to record the journal entry of credit sales of goods and services, for which the amount has not yet been received by the company. The journal entry is passed by making a debit entry in Account Receivable and corresponding credit entry in Sales Account.

Businesses must be able to manage their average collection period to operate smoothly. The average balance of AR is calculated by adding the opening balance in AR and ending balance in AR, then dividing that total by two.

The schedule of accounts receivable is a report that lists all amounts owed by customers. The report lists each outstanding invoice as of the report date, aggregated by customer.

On a trial balance, accounts receivable is a debit until the customer pays. Once the customer has paid, you'll credit accounts receivable and debit your cash account, since the money is now in your bank and no longer owed to you. The ending balance of accounts receivable on your trial balance is usually a debit.