Guam Yearly Expenses encompass various costs and expenditures that individuals or businesses residing or operating in Guam can expect to incur over a year. Whether you are planning to live, work, or invest in Guam, understanding its unique financial obligations is crucial for effective budgeting and financial management. Here is a detailed description of the different types of Guam Yearly Expenses to consider: 1. Housing Expenses: Guam offers a diverse range of housing options, including renting or purchasing apartments, houses, or condos. Monthly rent or mortgage payments, property insurance, property taxes, and utilities such as electricity, water, and internet are some recurring housing expenses in Guam. 2. Transportation Expenses: Commuting in Guam involves considerations like vehicle ownership, fuel costs, insurance premiums, and maintenance expenses. Additionally, vehicle registration fees, parking fees, and public transportation costs, if preferred, should be accounted for in your yearly budget. 3. Healthcare Expenses: Guam's healthcare system requires individuals to have appropriate medical coverage. Health insurance premiums, regular doctor visits, prescription medications, and potential emergency medical expenses should be included as part of your yearly expenditure. 4. Education Expenses: For families with children, understanding the educational expenses is essential. Guam offers a mix of public and private schools, each with its associated costs like tuition fees, textbooks, school supplies, uniforms, and extracurricular activities. Planning for these expenses is vital to ensure quality education for your children. 5. Food and Groceries: Including food and groceries in your yearly expenses is important. Given the island's distance from mainland suppliers, the cost of certain food items might be slightly higher. Planning a grocery budget considering the cost of fresh produce, meat, dairy products, and imported goods will help manage your overall expenses. 6. Entertainment and Recreation: Guam offers a vibrant entertainment scene, with various recreational activities and attractions. Allocating a portion of your yearly budget to enjoy dining out, visiting tourist spots, engaging in water sports, or exploring the island's natural beauty is advisable. 7. Taxes: Understanding the tax system in Guam is crucial. Income taxes, property taxes, business taxes, and any other applicable taxes should be considered in your yearly budget, as they can significantly impact your overall expenses. 8. Insurance Expenses: Guam, being prone to natural disasters like typhoons, earthquake, and flooding, calls for comprehensive insurance coverage, including homeowners' insurance, renters' insurance, business insurance, and possibly additional coverage for natural disasters. Annual insurance premiums should be factored in while calculating yearly expenses. 9. Miscellaneous Expenses: Despite diligent planning, unexpected or miscellaneous expenses are inevitable. This might include car repairs, home maintenance, personal care products, clothing, gifts, and other sporadic spending. Allocating a small portion of your budget to account for unpredictable expenses will ensure flexibility in your financial planning. Keywords: Guam, yearly expenses, housing expenses, transportation expenses, healthcare expenses, education expenses, food and groceries, entertainment and recreation, taxes, insurance expenses, miscellaneous expenses.

Guam Yearly Expenses

Description

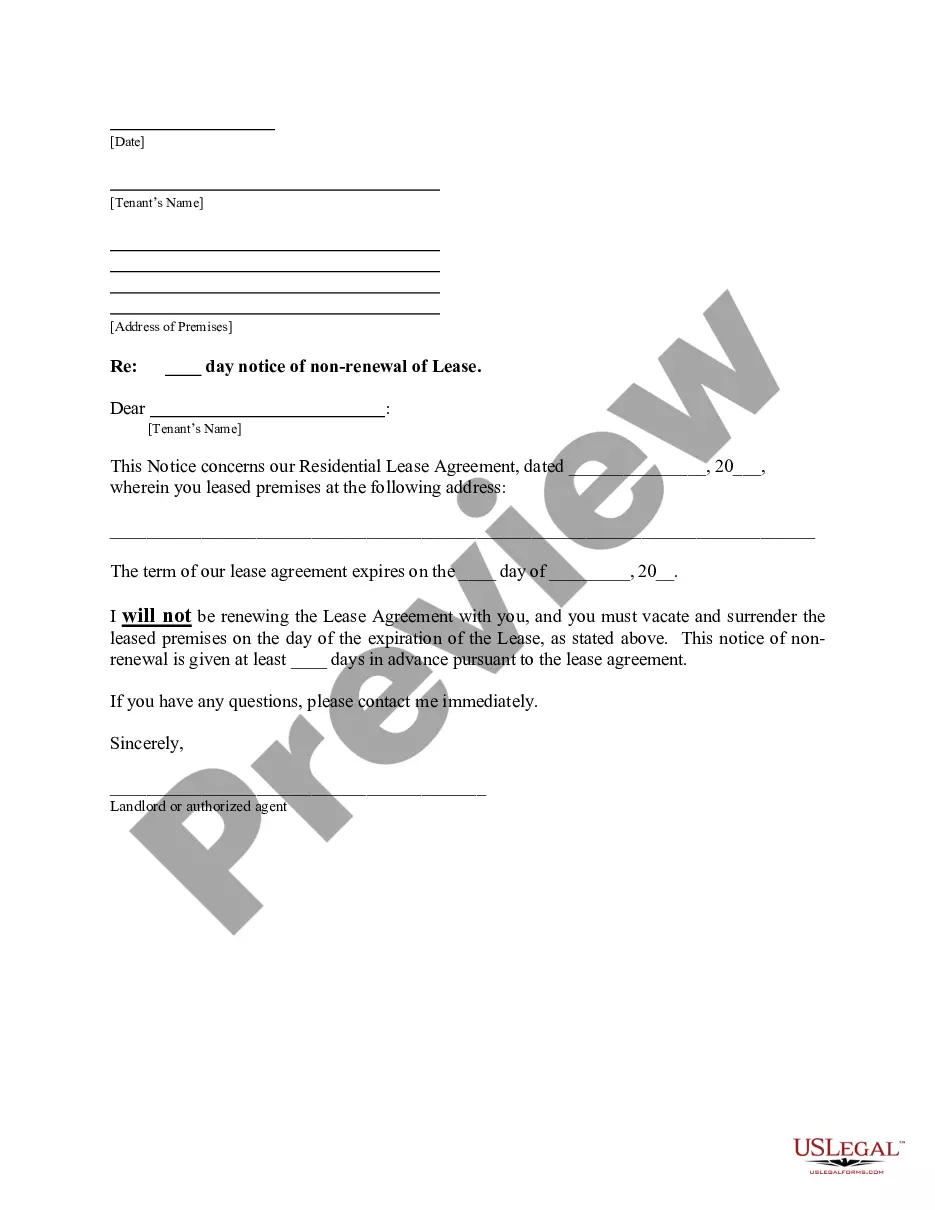

How to fill out Guam Yearly Expenses?

US Legal Forms - one of several most significant libraries of legal kinds in the United States - offers an array of legal document templates you may down load or printing. Utilizing the site, you can get a large number of kinds for organization and personal functions, categorized by groups, suggests, or key phrases.You can find the most up-to-date versions of kinds much like the Guam Yearly Expenses in seconds.

If you already possess a registration, log in and down load Guam Yearly Expenses in the US Legal Forms library. The Acquire option can look on each and every type you view. You get access to all in the past downloaded kinds inside the My Forms tab of your bank account.

If you wish to use US Legal Forms the very first time, listed here are simple guidelines to help you get began:

- Ensure you have chosen the correct type for your personal area/region. Click the Preview option to review the form`s content material. Browse the type explanation to ensure that you have selected the correct type.

- If the type doesn`t fit your specifications, take advantage of the Search industry on top of the screen to obtain the one that does.

- When you are happy with the shape, verify your decision by clicking on the Buy now option. Then, choose the rates prepare you like and give your accreditations to register for an bank account.

- Process the deal. Use your Visa or Mastercard or PayPal bank account to perform the deal.

- Pick the formatting and down load the shape on your product.

- Make changes. Load, modify and printing and indication the downloaded Guam Yearly Expenses.

Each template you added to your money lacks an expiry time and is your own property eternally. So, if you want to down load or printing another copy, just check out the My Forms section and click on on the type you will need.

Gain access to the Guam Yearly Expenses with US Legal Forms, probably the most comprehensive library of legal document templates. Use a large number of skilled and state-particular templates that meet your business or personal requires and specifications.

Form popularity

FAQ

Average living expenses for a single person The average monthly living expenses for a single person in the USA are $3,189, which is $38,266 per year. The average cost for a family of four is $7,095 per month, which is $85,139 per year.

Guam holds a special attraction for U.S. citizens, who can easily live and work in the territory. Neither citizens nor permanent residents require work visas for employment on Guam, and everything runs on the U.S. dollar, just like on the Mainland.

The main idea is to limit your living expenses to roughly 50% of your income. That way, you'll have enough leftover for your savings and fun expenditures.

It's expensive Nearly everything on Guam is imported and that means costs are higher than in the States. It's not like South America or the Caribbean where the cost of living can be relatively low for a Statesider. The costliest items are gas, food, and utilities.

$155 USD is the average daily price for traveling as a couple in Guam. This daily budget would be based off living in a hotel for the month. The average price of food for one day is $67 USD. The average price of a hotel for a couple is $50 USD.

As with most islands, the cost of living in Guam is about 50% higher than on the mainland. Due to extra costs to get supplies and goods to the island, prices are much higher in return. Renting a home in Guam would cost you between $1,400 and $2,000 per month, and utilities will likely run you up to $500 per month.

Cost of living in Guam is 6% more expensive than in Honolulu, Hawaii (United States)

According to the latest statistics, the average yearly expenses of a US consumer in 2020 are $61,334. This averages to $5,111 per month. This represents a 2.7 percent fall from 2019, during which average consumer spending in the US was $63,036 the first decrease in years.

Average monthly expenses per household: $5,111. The average expenses per month for one consumer unit in 2020 was $5,111. That means the average spending per year is $61,334.

It's expensive Nearly everything on Guam is imported and that means costs are higher than in the States. It's not like South America or the Caribbean where the cost of living can be relatively low for a Statesider. The costliest items are gas, food, and utilities.