Title: Understanding the Guam Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank Keywords: Guam Resolution, Meeting of LLC Members, Borrow Capital, Designated Bank, LLC Members, Capital Loan, Procedures, Purpose, Types Introduction: The Guam Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank is a formal document highlighting the agreement and authorization of limited liability company (LLC) members to borrow capital from a designated bank. This resolution ensures that proper procedures are followed while obtaining a capital loan for the LLC's operational or expansionary requirements. Types of Guam Resolution for Borrowing Capital: 1. Initial Capital Loan Resolution: The Initial Capital Loan Resolution is used when the LLC is borrowing capital for the first time from a designated bank. This resolution requires LLC members to gather and discuss the potential loan amount, interest rates, repayment terms, and any collateral needed. Once approved, this resolution serves as the foundation for future capital borrowings. 2. Additional Capital Loan Resolution: The Additional Capital Loan Resolution is used when the LLC has already obtained a capital loan but requires additional funds in the future. This type of resolution allows the LLC members to request another loan, specifying the increased capital needed, along with the updated terms and conditions. 3. Renewal or Refinancing Capital Loan Resolution: The Renewal or Refinancing Capital Loan Resolution is used when the LLC already has an existing capital loan but wishes to renew the loan or refinance it to obtain better terms, interest rates, or repayment schedules. LLC members can discuss and negotiate the revised loan terms with the designated bank through this resolution. Content: 1. Purpose and Background: The Guam Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank begins by stating the purpose of the resolution, which may include obtaining capital for business expansion, investment opportunities, operational needs, or financing new projects. It also provides a brief background on the LLC's financial position and the reasons behind the decision to borrow capital. 2. Meeting Details and Participants: The resolution includes the details of the meeting held by the LLC members, such as the date, time, and location of the meeting. It also lists the participants, including the LLC members, officers, and authorized representatives present during the meeting. 3. Capital Loan Proposal: This section outlines the proposed capital loan amount, terms, interest rates, and repayment conditions negotiated with the designated bank. It includes details about any collateral required for securing the loan, ensuring the financial stability and credibility of the LLC. The specific purposes for which the capital loan will be utilized can also be mentioned here. 4. Voting and Approval: The resolution includes the voting process conducted during the meeting, mentioning the number of votes in favor, against, or abstaining. It highlights the acceptance of the proposed capital loan by a majority or unanimous vote, depending on the LLC's operating agreement and state requirements. The resolution may also address any quorum requirements necessary for the vote to be valid. 5. Authorized Signers and Execution: This section identifies the authorized signers who will be responsible for executing the loan agreements, promissory notes, or any other documents required by the designated bank. It typically includes the names, titles, and signatures of the LLC members or officers entrusted with this responsibility. Conclusion: The Guam Resolution of Meeting of LLC Members to Borrow Capital from a Designated Bank empowers LLC members to take strategic financial decisions and borrow necessary capital for their business's growth and success. These resolutions exemplify the collaborative nature of LLC governance, facilitating responsible borrowing practices and ensuring compliance with legal obligations.

Guam Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank

Description

How to fill out Guam Resolution Of Meeting Of LLC Members To Borrow Capital From Designated Bank?

If you have to full, download, or printing legitimate document web templates, use US Legal Forms, the largest selection of legitimate forms, that can be found online. Use the site`s easy and handy search to find the documents you will need. A variety of web templates for enterprise and personal purposes are sorted by categories and says, or search phrases. Use US Legal Forms to find the Guam Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank in a couple of clicks.

If you are presently a US Legal Forms client, log in for your accounts and click on the Obtain option to get the Guam Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank. You can also entry forms you in the past acquired from the My Forms tab of the accounts.

Should you use US Legal Forms the first time, follow the instructions under:

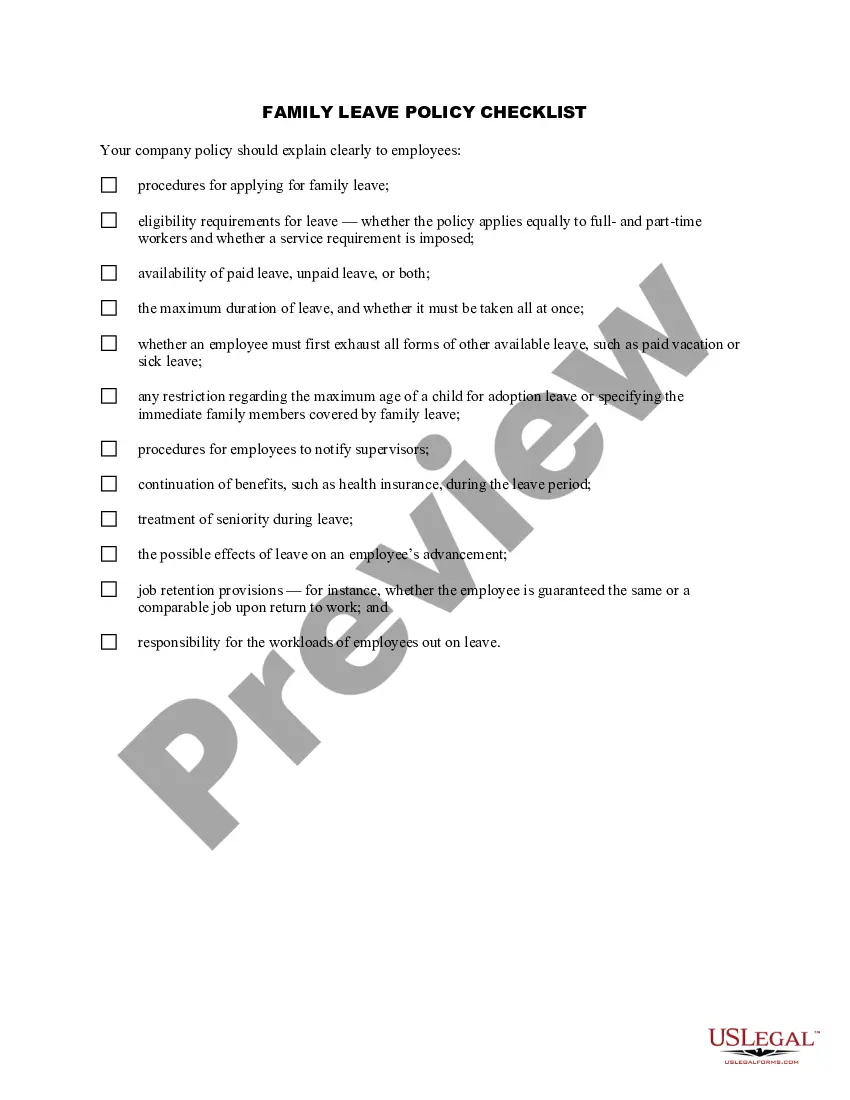

- Step 1. Make sure you have chosen the shape for your appropriate city/region.

- Step 2. Make use of the Preview option to examine the form`s articles. Do not neglect to see the information.

- Step 3. If you are not satisfied using the form, take advantage of the Research area near the top of the display screen to discover other models from the legitimate form format.

- Step 4. Upon having discovered the shape you will need, click on the Get now option. Select the prices strategy you like and add your qualifications to sign up on an accounts.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal accounts to accomplish the purchase.

- Step 6. Choose the file format from the legitimate form and download it on your own device.

- Step 7. Total, edit and printing or sign the Guam Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank.

Every single legitimate document format you buy is the one you have for a long time. You have acces to every form you acquired inside your acccount. Select the My Forms segment and choose a form to printing or download once again.

Contend and download, and printing the Guam Resolution of Meeting of LLC Members to Borrow Capital from Designated Bank with US Legal Forms. There are many expert and state-certain forms you can utilize for your enterprise or personal requires.