Guam Notification of Review of Consumer Report is a legal document that provides individuals in Guam with the right to review their consumer report and assess the accuracy of the information held by consumer reporting agencies. This report contains essential keywords such as Guam, notification, review, consumer report, and relevant types associated with it. In Guam, consumers have the privilege to request a Notification of Review of their Consumer Report, which allows them to verify the accuracy of their personal information stored by consumer reporting agencies. This notification is crucial to ensure that the data collected is correct and up-to-date, as it may influence various aspects of an individual's life, including creditworthiness, employment opportunities, and insurance premiums. Although there are no distinct types of Guam Notification of Review of Consumer Report, it is essential to understand that the notification process can vary depending on the purpose. For instance, a consumer may request this notification to address errors or discrepancies found in their credit report, employment history, or even rental record. To initiate the Guam Notification of Review of Consumer Report, an individual must follow certain steps. Firstly, they need to contact the consumer reporting agency responsible for preparing their report. This agency may include credit bureaus, tenant screening services, or employment background check providers. It is crucial to identify the specific agency involved to direct the review request accurately. Once the agency is identified, the consumer needs to write a formal letter requesting the Notification of Review of Consumer Report. The letter should include important details such as full name, contact information, social security number, and any additional information that helps in locating the report. It is vital to clearly state the purpose of the review, whether it pertains to credit, employment, or rental records. After sending the letter, the consumer reporting agency is obliged to respond within a specific timeframe, typically within 30 days, as mandated by the Fair Credit Reporting Act (FCRA). The agency should provide the consumer with a copy of their consumer report along with any related documents or information utilized to generate the report. Upon receiving the consumer report, it is the responsibility of the consumer to thoroughly review the information provided. In case inaccuracies, incomplete data, or fraudulent activities are detected, the consumer should immediately report these issues to the agency, highlighting the specific inaccuracies and providing supporting evidence if available. If the consumer reporting agency fails to address the issues or correct the inaccuracies found during the review process, further action can be taken. This may include lodging a complaint with the Consumer Financial Protection Bureau (CFPB), contacting legal authorities, or seeking professional assistance to rectify the situation. In conclusion, the Guam Notification of Review of Consumer Report is a crucial mechanism that enables individuals in Guam to verify the accuracy of their consumer report. By diligently reviewing the report and taking appropriate action to correct any errors, consumers can protect their rights, ensure fair treatment, and maintain accurate records that may impact various aspects of their lives.

Guam Notification of Review of Consumer Report

Description

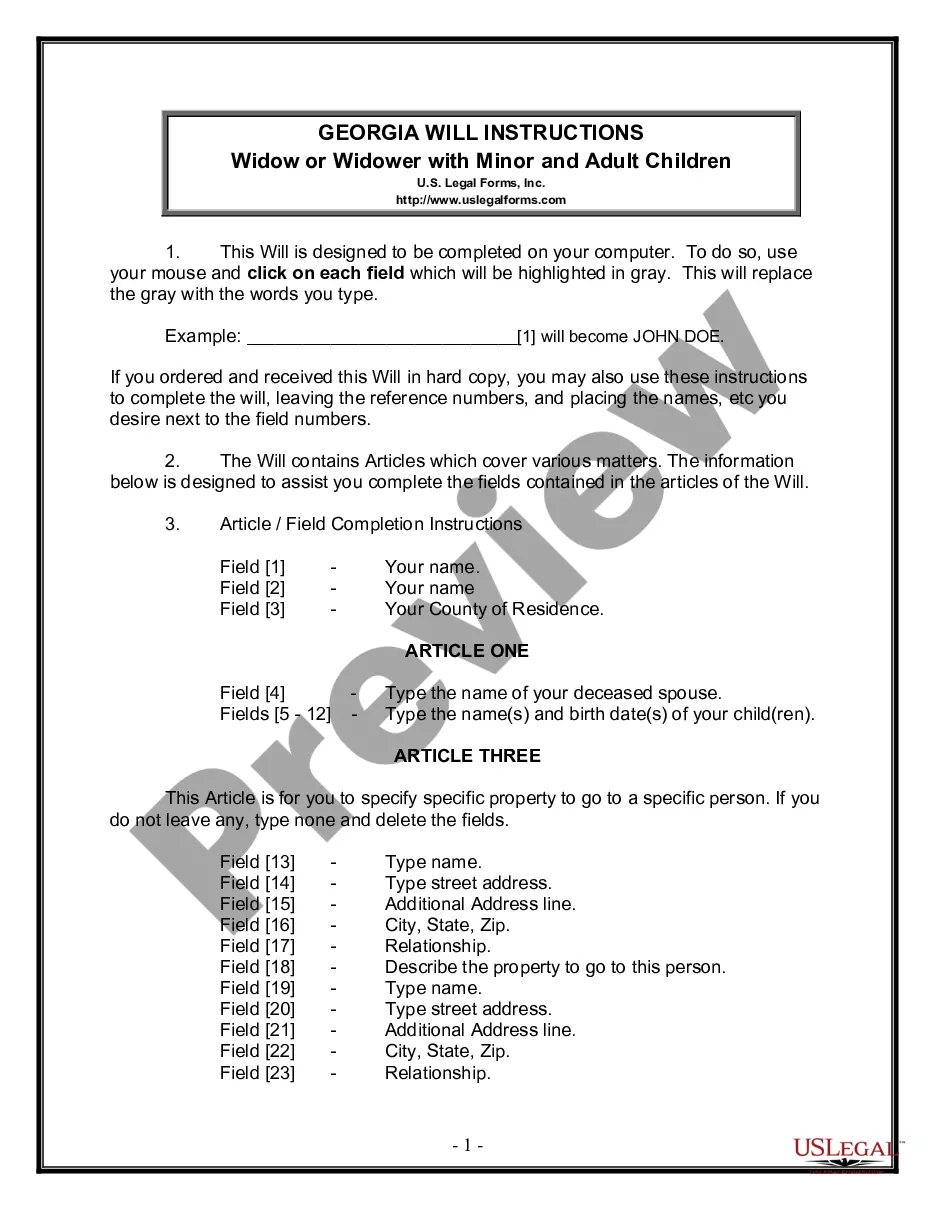

How to fill out Guam Notification Of Review Of Consumer Report?

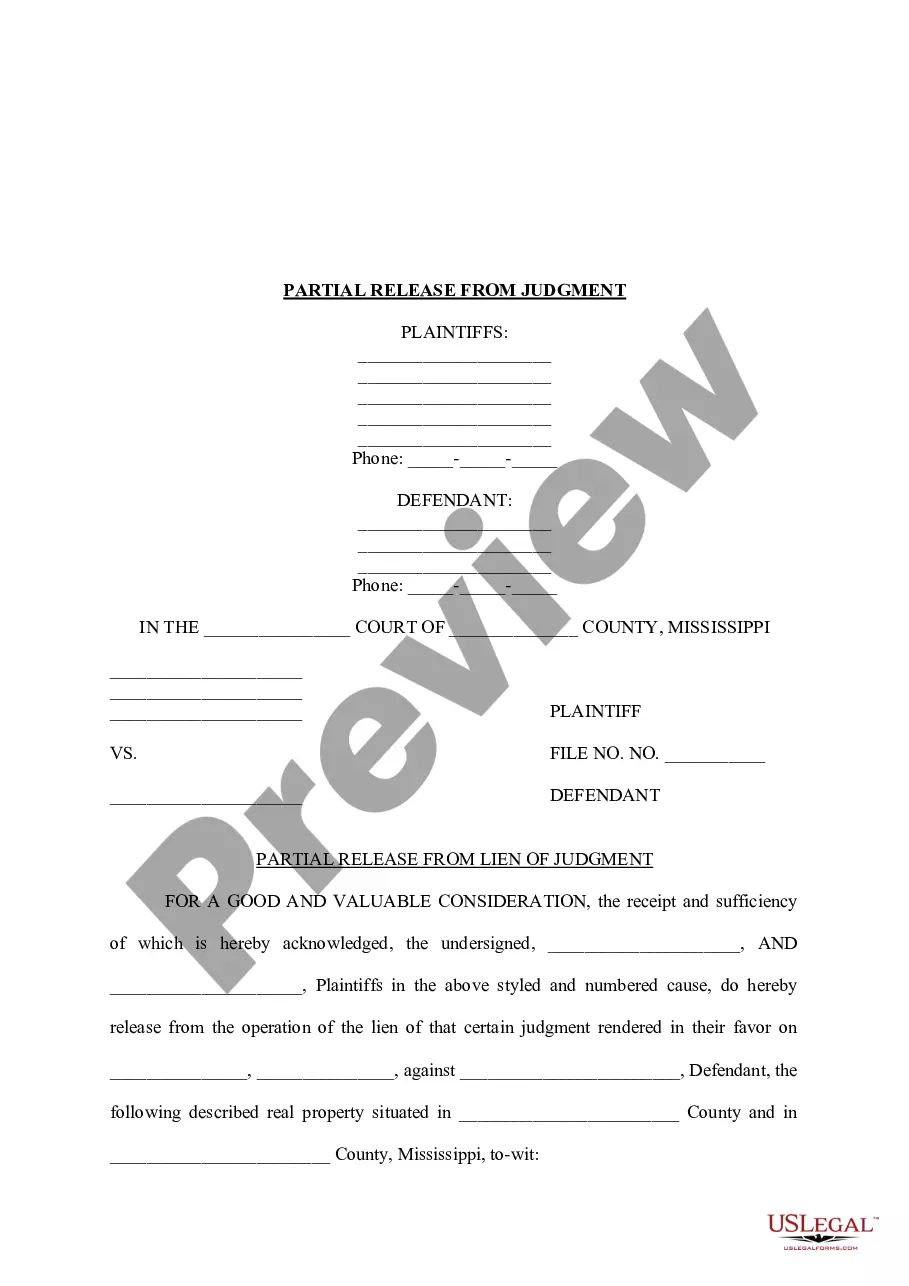

US Legal Forms - one of several largest libraries of legal kinds in the United States - provides a wide range of legal papers templates you can download or print. While using website, you can get thousands of kinds for organization and specific purposes, sorted by categories, states, or keywords.You will discover the most up-to-date models of kinds just like the Guam Notification of Review of Consumer Report within minutes.

If you already have a registration, log in and download Guam Notification of Review of Consumer Report through the US Legal Forms local library. The Obtain option will show up on each type you look at. You have accessibility to all previously delivered electronically kinds from the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, listed here are basic recommendations to help you started off:

- Ensure you have picked the correct type for your personal city/area. Click the Review option to check the form`s content. Read the type outline to ensure that you have chosen the proper type.

- In the event the type does not suit your needs, take advantage of the Research field near the top of the monitor to discover the one that does.

- When you are happy with the form, confirm your selection by simply clicking the Get now option. Then, opt for the costs strategy you prefer and offer your references to sign up on an accounts.

- Method the financial transaction. Make use of credit card or PayPal accounts to finish the financial transaction.

- Select the file format and download the form on your own product.

- Make alterations. Complete, revise and print and indicator the delivered electronically Guam Notification of Review of Consumer Report.

Each and every design you added to your account does not have an expiry date which is the one you have for a long time. So, if you wish to download or print an additional copy, just check out the My Forms area and click about the type you want.

Obtain access to the Guam Notification of Review of Consumer Report with US Legal Forms, one of the most comprehensive local library of legal papers templates. Use thousands of specialist and condition-specific templates that fulfill your organization or specific requires and needs.

Form popularity

More info

Notification paragraph Customer Notification question Customer Notification sentence summary Customer Notification paragraph summary.