Guam Collections Coordinator Checklist is a comprehensive and professional tool used by collections coordinators in Guam to monitor and manage collection activities effectively. This checklist ensures that all necessary steps and procedures are followed meticulously to maintain efficiency and maximize the chances of successful debt recovery. The Guam Collections Coordinator Checklist provides a structured framework to handle various types of debts, ranging from personal loans, credit card debts, medical bills, utilities bills, to commercial debts. Key components of the Guam Collections Coordinator Checklist include: 1. Documentation Review: This involves verifying the accuracy and completeness of all relevant documents associated with the debt, such as loan agreements, invoices, payment history records, and any supporting documentation. 2. Contact Information Consolidation: The checklist emphasizes the need to gather and centralize accurate contact information of debtors, including their full name, addresses, phone numbers, and email addresses. This enables effective communication for payment reminders and negotiation purposes. 3. Communication Strategy: A well-defined communication strategy is essential for successful debt recovery. The checklist guides coordinators in deciding the appropriate channels of communication, such as phone calls, emails, or written correspondence, and establishes a timeline for follow-ups. 4. Payment Plan Evaluation: Coordinators use this checklist to review and assess debtors' financial conditions to create suitable payment plans. They consider factors like income, expenses, and assets to determine the most realistic and feasible repayment options. 5. Negotiation Techniques: Effective negotiation skills play a crucial role in debt recovery. This checklist covers various negotiation strategies and provides guidelines for coordinators to follow, ensuring they maintain professionalism while also highlighting the importance of prompt payment. 6. Legal Considerations: Some debts may require legal actions for recovery. The checklist outlines the necessary steps for coordinators to take when escalating the debt recovery process legally, including engaging with legal counsel, preparing legal notices, and understanding relevant local laws and regulations. Different types of Guam Collections Coordinator Checklists include: 1. Personal Debts Collections Coordinator Checklist: This checklist focuses on managing and recovering personal debts, such as personal loans or credit card debts. 2. Commercial Debts Collections Coordinator Checklist: Created specifically for coordinating the recovery of debts owed by businesses. It includes additional considerations related to commercial contracts, accounts receivables, and potential legal ramifications. 3. Healthcare Debts Collections Coordinator Checklist: Tailored for coordinators handling medical or healthcare-related debts, as it involves specific regulations and guidelines unique to the healthcare industry. By following the Guam Collections Coordinator Checklist, collections coordinators can streamline their processes, improve the chances of recovering debts, and maintain a professional and organized approach throughout the debt recovery journey.

Guam Collections Coordinator Checklist

Description

How to fill out Guam Collections Coordinator Checklist?

If you have to full, download, or print out lawful document templates, use US Legal Forms, the biggest variety of lawful types, which can be found online. Use the site`s basic and handy look for to find the documents you require. Various templates for company and individual uses are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to find the Guam Collections Coordinator Checklist within a handful of clicks.

When you are presently a US Legal Forms customer, log in in your account and click on the Acquire key to have the Guam Collections Coordinator Checklist. Also you can accessibility types you earlier downloaded in the My Forms tab of your own account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for your correct metropolis/nation.

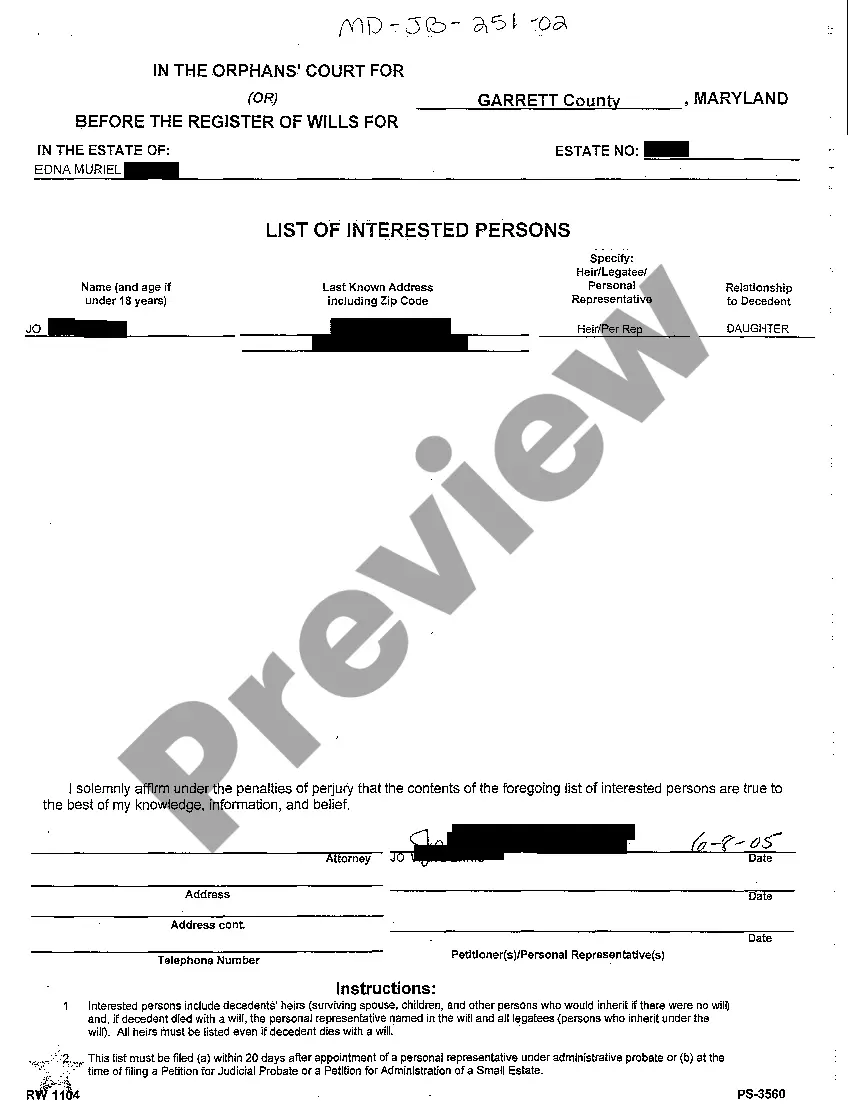

- Step 2. Utilize the Preview option to check out the form`s articles. Never neglect to see the outline.

- Step 3. When you are not happy with all the develop, make use of the Search area towards the top of the display screen to discover other types from the lawful develop format.

- Step 4. Once you have discovered the shape you require, click the Get now key. Choose the prices strategy you choose and add your credentials to sign up for the account.

- Step 5. Method the deal. You can use your credit card or PayPal account to perform the deal.

- Step 6. Pick the structure from the lawful develop and download it on the product.

- Step 7. Full, edit and print out or signal the Guam Collections Coordinator Checklist.

Every lawful document format you purchase is your own property eternally. You possess acces to every single develop you downloaded in your acccount. Click the My Forms segment and pick a develop to print out or download yet again.

Compete and download, and print out the Guam Collections Coordinator Checklist with US Legal Forms. There are many professional and status-particular types you may use to your company or individual needs.