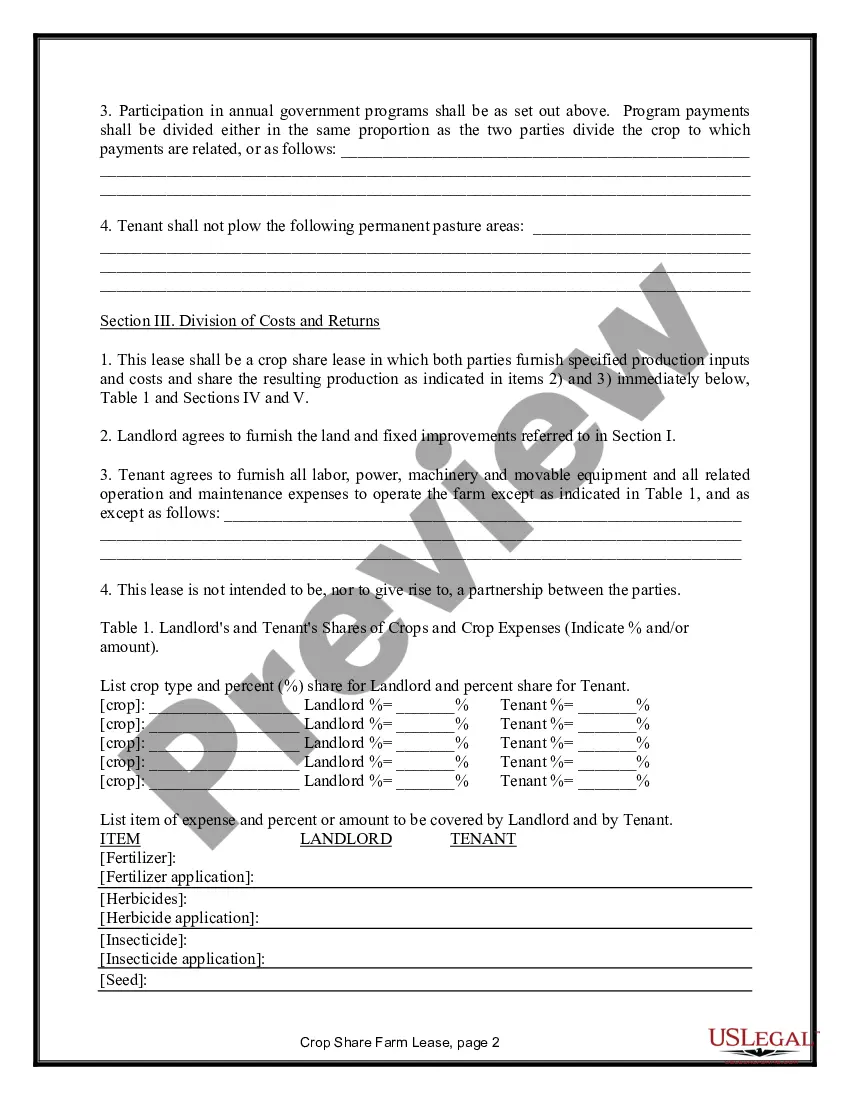

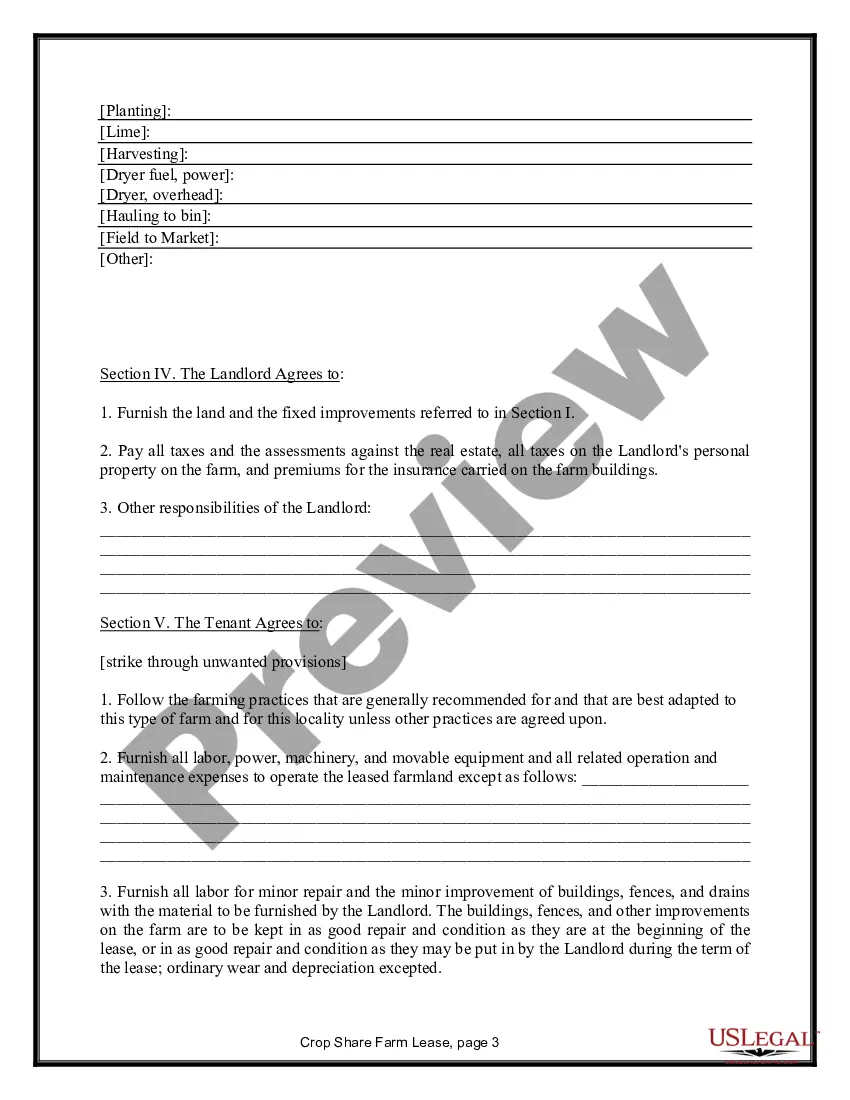

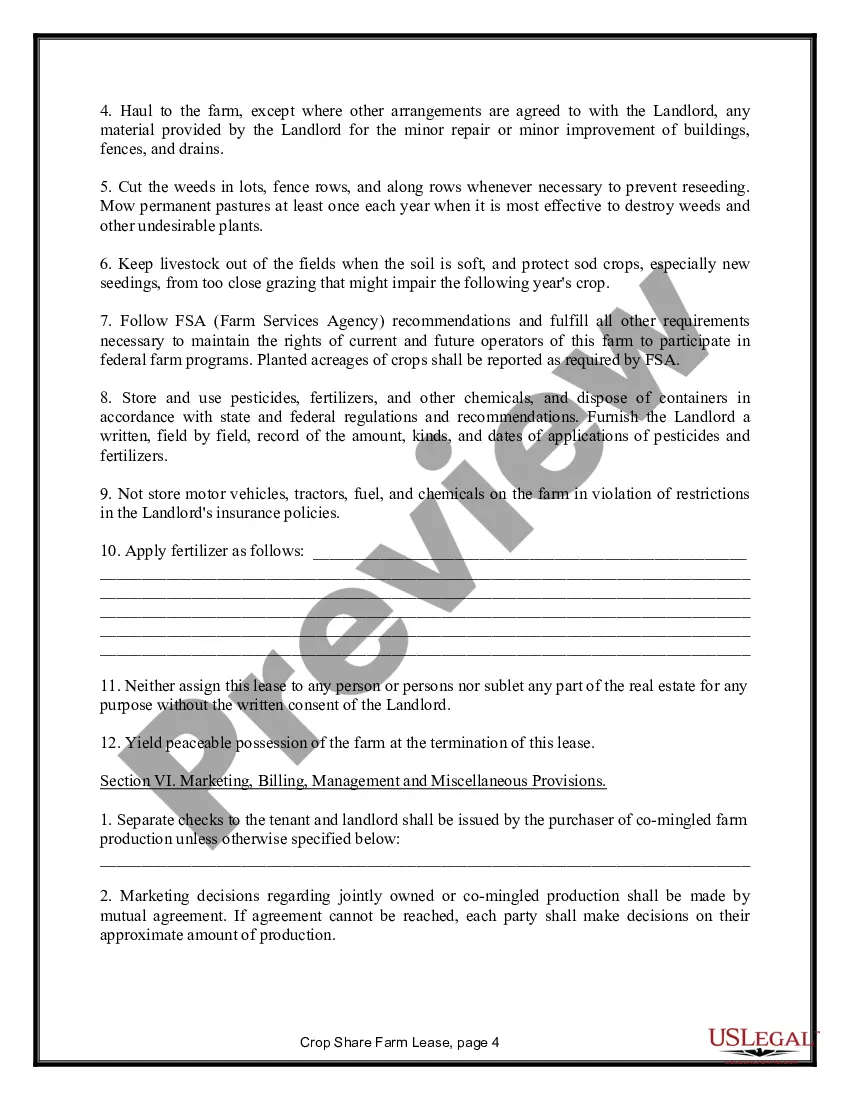

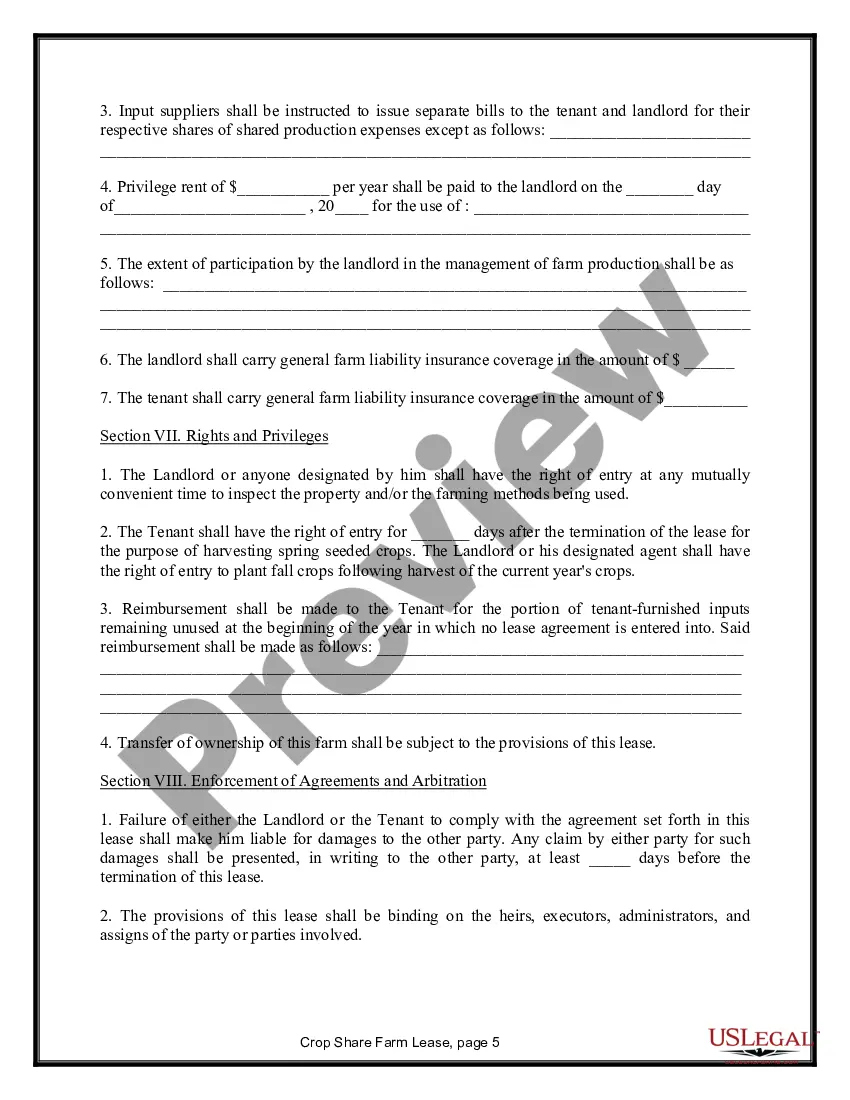

Guam Farm Lease or Rental — Crop Share is a form of agricultural agreement in which a landowner grants the use of their land to a tenant for the purpose of farming in exchange for a share of the crops grown. This arrangement allows both parties to benefit from agricultural production and can vary in terms and conditions depending on the specific type of lease or rental agreement. One type of Guam Farm Lease or Rental — Crop Share is a fixed-cash rental agreement. In this scenario, the landowner receives a predetermined amount of cash from the tenant as rent, regardless of the crop yield or market fluctuation. This type of agreement provides stability for both parties, as the tenant carries all the production and market risks, while the landowner can rely on a consistent income. Another type is a flexible-cash rental agreement. This arrangement involves the landowner receiving a base rental payment, as well as an additional percentage of the crops grown and sold. The tenant and landowner agree on a predetermined rental rate and share of crop revenue, allowing the landowner to participate in the potential profits of the farming operation. A variation of the Guam Farm Lease or Rental — Crop Share is known as sharecropping. Sharecropping involves a closer partnership between the landowner and tenant. The landowner typically provides the land, equipment, seeds, and fertilizers, while the tenant provides the labor. The crop yield is then divided between the landowner and tenant, usually in a predetermined proportion. This type of arrangement incentivizes both parties to work collaboratively to maximize the productivity and profitability of the farm. Benefits of the Guam Farm Lease or Rental — Crop Share include risk sharing, as both parties assume a portion of the farming-related risks, such as market price volatility, natural disasters, or pests. It also allows aspiring farmers with limited capital or land access to pursue their agricultural dreams by leasing or renting land. Overall, the Guam Farm Lease or Rental — Crop Share provides a mutually beneficial arrangement for landowners and tenants looking to engage in agricultural activities. Whether it's a fixed-cash rental, flexible-cash rental, or sharecropping, these agreements foster collaboration, risk management, and the potential for successful farming operations on the island of Guam.

Guam Farm Lease or Rental - Crop Share

Description

How to fill out Farm Lease Or Rental - Crop Share?

If you want to full, obtain, or print authorized file web templates, use US Legal Forms, the biggest selection of authorized types, which can be found on-line. Use the site`s simple and easy handy lookup to get the papers you want. A variety of web templates for company and personal uses are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to get the Guam Farm Lease or Rental - Crop Share in a couple of clicks.

When you are previously a US Legal Forms customer, log in to the bank account and then click the Obtain option to find the Guam Farm Lease or Rental - Crop Share. Also you can access types you previously acquired within the My Forms tab of your own bank account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Make sure you have chosen the form for that correct metropolis/region.

- Step 2. Make use of the Review choice to look over the form`s content. Do not forget to learn the outline.

- Step 3. When you are unhappy with all the form, use the Look for field near the top of the screen to locate other models in the authorized form template.

- Step 4. When you have discovered the form you want, click the Acquire now option. Select the pricing strategy you choose and put your qualifications to sign up for an bank account.

- Step 5. Process the financial transaction. You may use your charge card or PayPal bank account to finish the financial transaction.

- Step 6. Choose the structure in the authorized form and obtain it on the device.

- Step 7. Comprehensive, edit and print or sign the Guam Farm Lease or Rental - Crop Share.

Each authorized file template you purchase is your own permanently. You possess acces to each form you acquired in your acccount. Click the My Forms section and pick a form to print or obtain yet again.

Remain competitive and obtain, and print the Guam Farm Lease or Rental - Crop Share with US Legal Forms. There are thousands of skilled and status-specific types you can utilize for your personal company or personal requires.

Form popularity

FAQ

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

The traditional share arrangement for a grain crop like corn or wheat is one-third to the landowner and two-thirds to the tenant. Usually, the expenses paid, and crop received, are equal to the share i.e. the landowner would pay one-third of the expenses and receive one-third of the crop.

States such as Haryana, Punjab, Gujarat, Maharashtra and Assam do not ban leasing, but the leaseholder has the right to purchase the cultivated land after a certain point. Only West Bengal, Rajasthan, Andhra Pradesh and Tamilnadu have liberal land leasing laws.

A farm lease is a written agreement between a landowner and a tenant farmer. Through a farm lease, the landowner grants the tenant farmer the right to use the farm property. Key terms of basic leases include the length of the lease, rent amounts and frequency of payment, how to renew or end the lease, and more.

Most farmers find that a combination of both ownership and leasing is desirable, especially when capital is limited. For many new farmers, especially in areas where land is quite expensive, leasing land is often the best option.

Sharecropping, form of tenant farming in which the landowner furnished all the capital and most other inputs and the tenants contributed their labour. Depending on the arrangement, the landowner may have provided the food, clothing, and medical expenses of the tenants and may have also supervised the work.

Tenant farming, agricultural system in which landowners contribute their land and a measure of operating capital and management while tenants contribute their labour with various amounts of capital and management, the returns being shared in a variety of ways.

Farmland has historically been a good investment. Unfortunately, not many investors have been able to benefit from this asset class, given the high upfront costs of buying farmland.

In tenant farming, tenants live in the same land and engage in agricultural practices for a given period, and finally get their payments as money, fixed amount of crop, or in combination. In the case of sharecropping, tenant receives his portion as a share. He has to give a share to the landowner, which is pre decided.

The advantages of the first are that the tenant in many cases is free to manage the farm as he pleases, and as a long-time proposition he may pay less rent than under crop-sharing arrangements. The chief disadvantage is that the tenant agrees to pay a definite sum before he knows what his income will be.