Title: Understanding Guam Sample FCRA Letter to Applicant: A Comprehensive Guide Introduction: This article aims to provide a detailed description and explanation of Guam Sample FCRA (Fair Credit Reporting Act) Letters to Applicants, offering insights into their purpose, format, and different types. The FCRA serves as a legal framework governing how consumer credit information is collected, used, and disclosed. Understanding these letters is vital for employers and applicants to ensure compliance with the FCRA and maintain transparency in the hiring process. 1. What is the FCRA? — Definition and purpose of the Fair Credit Reporting Act. — Overview of FCRA provisions relevant to employment screening. — Importance of FCRA compliance in maintaining fairness, accuracy, and confidentiality in the background check process. 2. What is a Guam Sample FCRA Letter to Applicant? — Explanation of the FCRA letters specifically designed for Guam. — Purpose of providing applicants with notice and obtaining their consent for background checks. — Requirements for employers to use and customize these letters. 3. Key Components and Format of a Guam Sample FCRA Letter to Applicant: — Clear language emphasizing the background check process and potential impact on employment. — Disclosure requirements of background checks. — Instructions for applicants to provide their consent. — Explanation of the applicant's rights under the FCRA, including the ability to dispute inaccuracies. 4. Types of Guam Sample FCRA Letters to Applicant: — Pre-Adverse Action Letter— - Description of this letter sent when an employer is considering taking adverse actions based on the applicant's background check. — Explanation of applicant's rights to review the report and dispute any inaccuracies. — Instructions for requesting a copy of the background check report. — Adverse Action Letter— - Overview of the letter sent when an employer intends to take adverse actions based on the background check results. — Description of applicant's rights to receive a copy of the report and dispute inaccuracies. — Explanation of how to contact the employer and any relevant third-party agencies involved. 5. The Importance of Compliance: — Emphasize employer obligations under the FCRA to avoid legal repercussions. — Discuss potential penalties for non-compliance. — Advise employers to seek legal counsel or use reputable FCRA compliance services. Conclusion: Understanding Guam Sample FCRA Letters to Applicants is crucial for employers and applicants alike. By adhering to FCRA guidelines, employers can conduct fair and transparent background checks while ensuring applicants are aware of their rights and have the opportunity to address any inaccuracies in their reports. Compliance with these letters is essential to foster trust, maintain legal compliance, and protect the reputation of both employers and applicants.

Guam Sample FCRA Letter to Applicant

Description

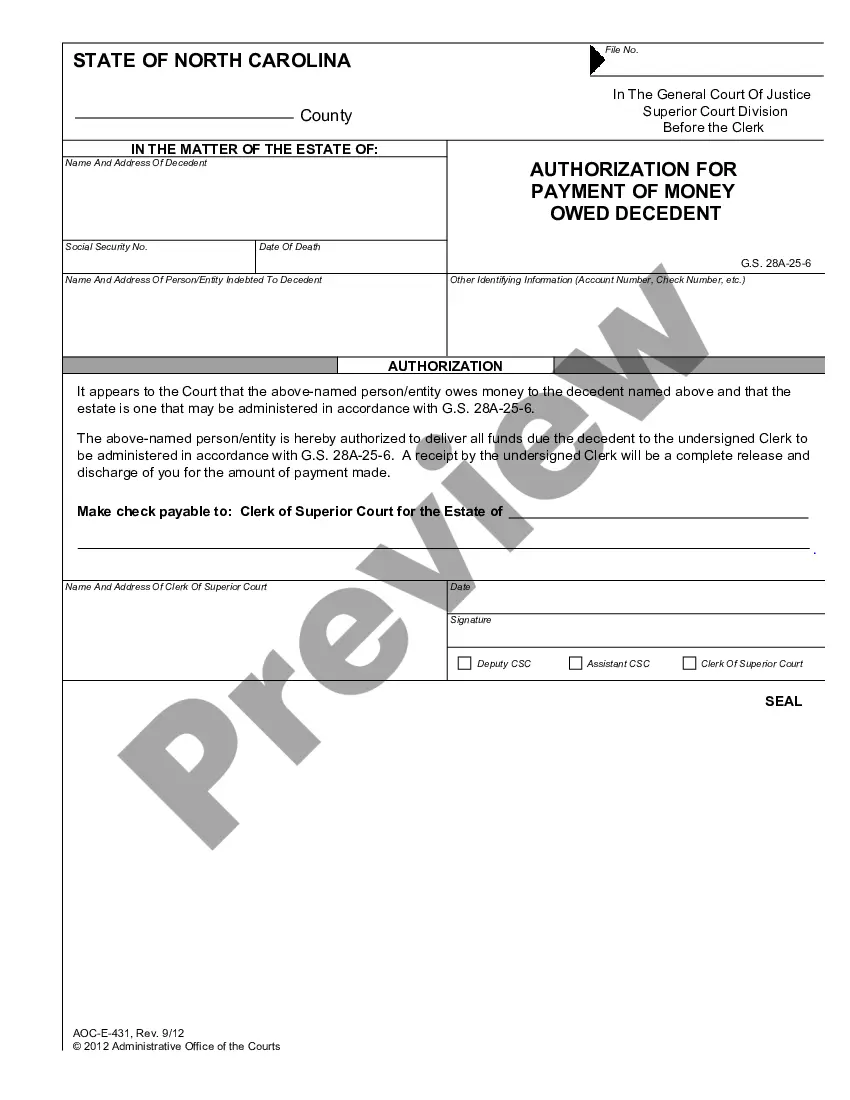

How to fill out Guam Sample FCRA Letter To Applicant?

US Legal Forms - one of several most significant libraries of legitimate kinds in the States - provides an array of legitimate papers templates you are able to download or produce. Making use of the site, you may get a large number of kinds for business and individual purposes, categorized by categories, suggests, or search phrases.You will discover the most up-to-date variations of kinds like the Guam Sample FCRA Letter to Applicant in seconds.

If you already have a subscription, log in and download Guam Sample FCRA Letter to Applicant in the US Legal Forms local library. The Download switch will appear on every type you perspective. You have accessibility to all formerly delivered electronically kinds from the My Forms tab of your respective bank account.

If you would like use US Legal Forms initially, here are simple instructions to help you started out:

- Make sure you have chosen the right type to your area/area. Select the Preview switch to check the form`s content. Read the type description to ensure that you have chosen the right type.

- In the event the type doesn`t match your specifications, take advantage of the Search field on top of the display screen to obtain the one who does.

- If you are pleased with the form, verify your selection by clicking on the Buy now switch. Then, select the costs program you want and provide your accreditations to register for an bank account.

- Method the transaction. Make use of your bank card or PayPal bank account to finish the transaction.

- Pick the format and download the form on the system.

- Make adjustments. Load, edit and produce and indicator the delivered electronically Guam Sample FCRA Letter to Applicant.

Every format you added to your money lacks an expiry particular date and it is your own for a long time. So, if you would like download or produce one more duplicate, just proceed to the My Forms portion and then click about the type you want.

Get access to the Guam Sample FCRA Letter to Applicant with US Legal Forms, one of the most substantial local library of legitimate papers templates. Use a large number of professional and express-specific templates that fulfill your organization or individual requires and specifications.

Form popularity

FAQ

Before you take adverse action, you will provide the applicant or employee a notice that includes a copy of the background check/consumer report you used to make your decision and provide them with a summary of their rights under the FCRA. This is commonly referred to as a Pre-Adverse Action Notice.

How to write an adverse action letter sample step by step.Step 1: Create the header.Step 3: Include the credit score.Step 4: Include the credit reporting agency.Step 5: Include the reasons for the denial.Step 6: Include notices of rights.Step 8: Add a personal message.Step 9: Sign the letter.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.

Adverse action notices can be provided electronically via email as long as the consumer provides consents to receiving electronic notices that complies with the ESIGN Act. The ESIGN Act disclosure has a number of requirements and must be signed by the consumer before the consumer receives the electronic notices.

Pre-Adverse Action The pre-adverse action letter can be delivered via electronic or hard copy form. Its purpose is to inform the applicant that you will not hire them for the position based on information uncovered in the background check.

Waiting period. While not explicitly prescribed by the FCRA, courts and Federal Trade Commission guidance suggest five days is a reasonable period to wait after the pre-adverse action notice and before taking adverse action.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

Adverse Action Notice notifies the candidate that information contained on their background report may negatively affect a decision about their employment. It is intended to give the candidate an opportunity to respond to the information contained in the report, so by law it must contain a copy of the report.

The employer must then certify compliance to the company from which they are getting the information. This includes verification that you have notified the individual and received permission, complied with all FCRA requirements and will not discriminate against the individual.

Continue with the hire or take adverse action Taking adverse action is regrettable for both the organization and the candidate, but eventually you'll need to decide to rescind your job offer or proceed with hiring.