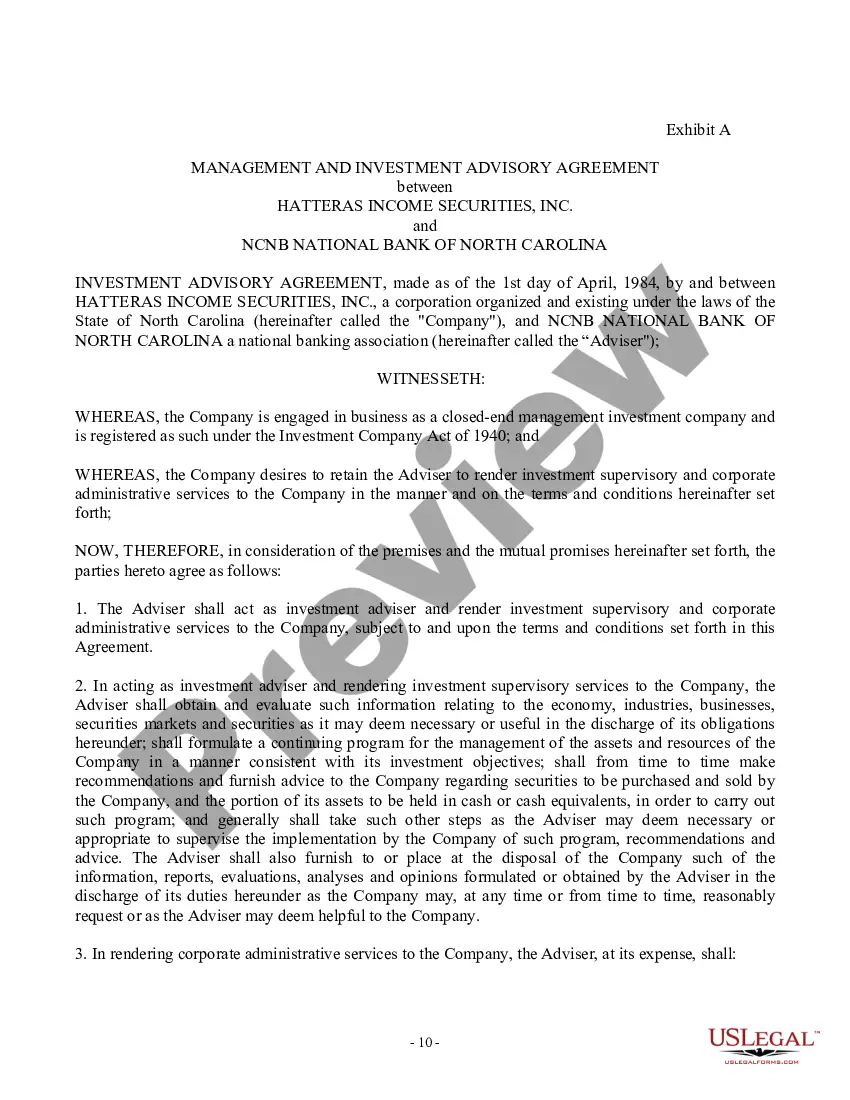

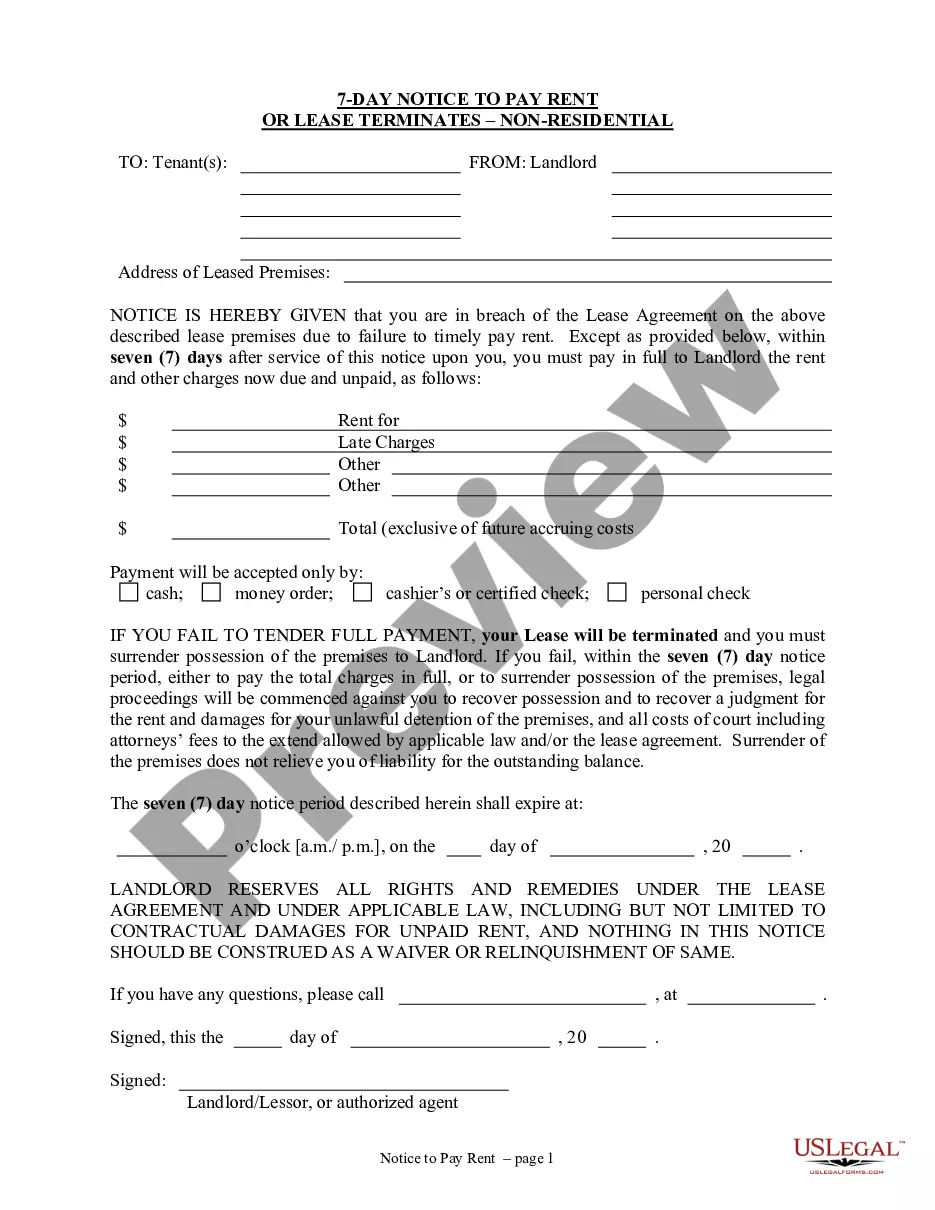

Guam Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement

Description

How to fill out Proxy Statement - Hatteras Income Securities, Inc. With Copy Of Advisory Agreement?

Finding the right legal papers web template could be a battle. Of course, there are plenty of templates available on the net, but how will you get the legal form you will need? Use the US Legal Forms website. The support delivers 1000s of templates, including the Guam Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement, which can be used for business and personal demands. All the forms are examined by specialists and satisfy federal and state requirements.

In case you are currently authorized, log in in your profile and click on the Obtain option to have the Guam Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement. Utilize your profile to check with the legal forms you possess bought formerly. Proceed to the My Forms tab of your profile and get yet another duplicate of the papers you will need.

In case you are a brand new user of US Legal Forms, listed below are straightforward instructions for you to adhere to:

- First, make certain you have chosen the proper form to your city/region. You are able to look through the shape while using Review option and read the shape outline to ensure it is the best for you.

- When the form fails to satisfy your requirements, utilize the Seach discipline to discover the correct form.

- Once you are sure that the shape is acceptable, go through the Purchase now option to have the form.

- Select the prices prepare you want and type in the required information. Design your profile and pay for your order utilizing your PayPal profile or Visa or Mastercard.

- Choose the data file structure and down load the legal papers web template in your product.

- Comprehensive, change and print out and indicator the obtained Guam Proxy Statement - Hatteras Income Securities, Inc. with copy of advisory agreement.

US Legal Forms may be the greatest catalogue of legal forms for which you can see a variety of papers templates. Use the company to down load professionally-produced files that adhere to state requirements.