The Guam Agreement and Plan of Merger is a legal document that outlines the process for converting a corporation into a Maryland Real Estate Investment Trust (REIT). This highly specialized agreement is crucial for companies looking to restructure their operations and capital structures, particularly in the real estate sector. By utilizing this agreement, corporations can reap the numerous benefits associated with operating as a REIT, such as favorable tax treatment and increased flexibility in raising capital. The Guam Agreement and Plan of Merger typically includes the following key provisions: 1. Parties Involved: It highlights the parties to the agreement, identifying the corporation seeking conversion into a REIT, along with any subsidiaries or affiliated companies involved. 2. Conversion Terms: The agreement outlines the process and conditions for the conversion, including the steps to be undertaken, the required approvals, and the timeline for completion. 3. Merger Consideration: This section details how the corporation's shares will be exchanged or converted into REIT shares, including any cash payments or other benefits offered to shareholders. 4. Governance and Management: The agreement addresses the governance structure of the converted REIT, including the composition and authority of the board of trustees, shareholder voting rights, and any changes in management personnel. 5. Asset Transfers: If necessary, the agreement may provide for the transfer of certain assets or liabilities from the corporation to the REIT, ensuring a smooth transition of operations and maximizing the value of the company's real estate assets. 6. Tax and Regulatory Matters: Given the unique tax advantages associated with Rests, the agreement may cover specific provisions related to tax treatment, compliance with applicable laws and regulations, and any necessary filings with relevant regulatory authorities. Under the broad scope of the Guam Agreement and Plan of Merger, there can be various subtypes or specific variations of this document, tailored to meet different requirements or circumstances. Some potential types of Guam Agreements for conversion of corporations into Maryland Rests may include: 1. Cross-Border Conversion Agreement: This subtype caters to corporations that are not originally incorporated in Guam but intend to convert into a Maryland REIT. It includes additional provisions related to cross-border legalities, compliance, and coordination with respective jurisdictions. 2. Holding Company Conversion Agreement: This type of agreement is designed for a corporation that operates as a holding company and seeks to convert into a Maryland REIT. It encompasses provisions specific to the intricacies of managing multiple subsidiaries and aligning the overall holding company structure with REIT regulations. 3. Private REIT Conversion Agreement: Companies seeking to maintain privacy and restrict ownership of their REIT may require a private REIT conversion agreement. This subtype includes specific clauses related to shareholder qualifications, restrictions on transferability, and compliance with exemptions under applicable securities laws. Incorporating these relevant keywords into the content will enable search engine optimization and enhance the visibility of the discussion on the Guam Agreement and Plan of Merger and the various types of conversions into Maryland REIT.

Guam Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust

Description

How to fill out Guam Agreement And Plan Of Merger For Conversion Of Corporation Into Maryland Real Estate Investment Trust?

Are you in the position the place you will need files for sometimes business or individual reasons virtually every day? There are plenty of authorized file layouts available online, but finding versions you can trust is not easy. US Legal Forms gives a huge number of form layouts, much like the Guam Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust, which are composed to fulfill federal and state needs.

Should you be previously knowledgeable about US Legal Forms web site and also have your account, merely log in. Afterward, it is possible to download the Guam Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust format.

Unless you have an profile and would like to begin using US Legal Forms, abide by these steps:

- Discover the form you will need and make sure it is for the correct city/state.

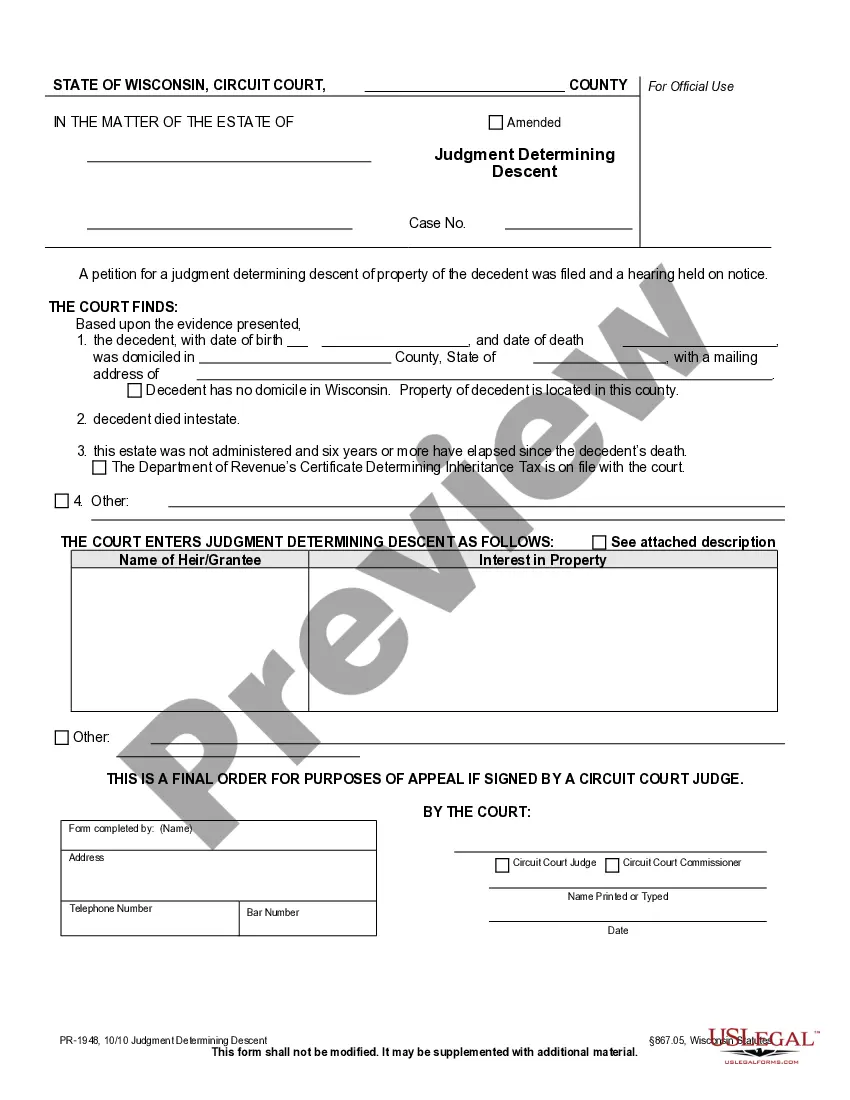

- Make use of the Review option to check the form.

- See the explanation to actually have selected the right form.

- When the form is not what you are looking for, make use of the Search discipline to find the form that meets your requirements and needs.

- Whenever you get the correct form, click Acquire now.

- Pick the costs plan you would like, complete the specified information and facts to generate your money, and pay money for the order utilizing your PayPal or Visa or Mastercard.

- Choose a handy file file format and download your copy.

Locate each of the file layouts you might have purchased in the My Forms menus. You can obtain a further copy of Guam Agreement and Plan of Merger for conversion of corporation into Maryland Real Estate Investment Trust at any time, if required. Just click on the required form to download or produce the file format.

Use US Legal Forms, by far the most substantial selection of authorized kinds, to save lots of time and avoid blunders. The service gives skillfully produced authorized file layouts that can be used for a selection of reasons. Create your account on US Legal Forms and begin making your way of life a little easier.