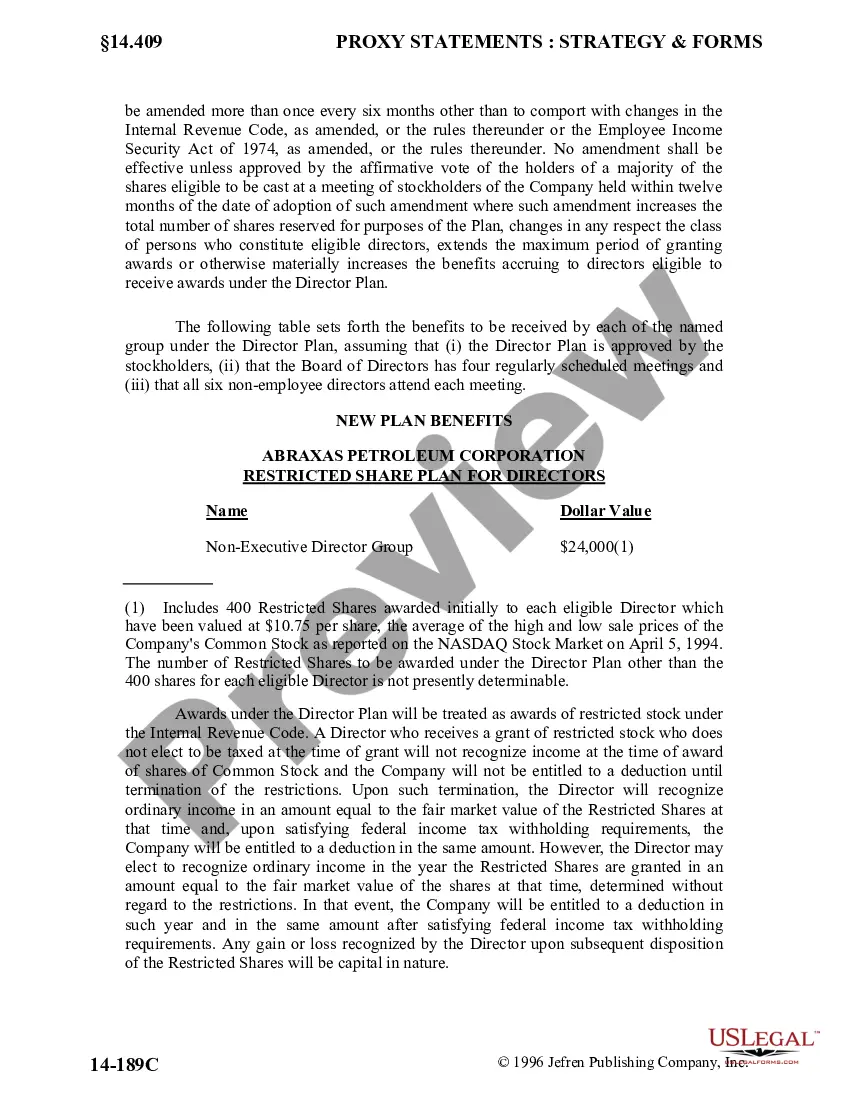

Title: Guam Approval of Restricted Share Plan for Directors: Decoding Its Significance with a Copy of the Plan Introduction: Understanding the Guam Approval of Restricted Share Plan for Directors is crucial in grasping its importance and implications for corporate governance. This article aims to provide a detailed description of this plan and shed light on its various types and applications. 1. What is the Guam Approval of Restricted Share Plan for Directors? The Guam Approval of Restricted Share Plan for Directors is a corporate initiative designed to incentivize and reward directors by granting them restricted shares in their respective companies. These plans align directors' interests with those of shareholders, enhance corporate governance practices, and foster long-term commitment to company success. 2. Importance of the Guam Approval of Restricted Share Plan for Directors: a. Alignment of Interests: By offering directors a stake in the company's performance, this plan promotes a shared vision focused on maximizing shareholder value. b. Retention and Attraction of Talent: Restricted share plans are valuable tools for attracting and retaining top-level talent, allowing companies to secure skilled directors in today's competitive market. c. Long-Term Perspective: The plan encourages directors to focus on the long-term success of the organization, as their shares typically vest over a defined period, ensuring continuity and stability. 3. Types of Guam Approval of Restricted Share Plans for Directors: a. Time-Based Restricted Share Plan: Under this type of plan, directors receive shares that vest gradually over a predetermined period, incentivizing their continued involvement and dedication. b. Performance-Based Restricted Share Plan: This plan aligns share vesting with specific performance goals or targets. Directors are rewarded with shares once the established criteria are met, encouraging active participation in driving the company's growth. c. Mixed/Combined Approach: Some companies employ a combination of time-based and performance-based elements to create a customized plan that suits their specific needs and objectives. 4. Procedure for Obtaining Guam Approval of Restricted Share Plan for Directors: a. Drafting the Plan: Companies need to formulate a comprehensive plan detailing the terms, conditions, and objectives of the restricted share scheme for directors. b. Approval Process: The plan must be presented to the Guam Regulatory Authority, which reviews the proposal to ensure compliance with applicable laws and regulations. c. Submission and Documentation: A copy of the approved plan, along with any supporting documents, must be formally submitted to the regulatory authority for final registration and authentication. Conclusion: The Guam Approval of Restricted Share Plan for Directors plays a pivotal role in shaping effective corporate governance practices and driving organizational success. By aligning directors' interests with the company's shareholders and fostering long-term commitment, these plans contribute to overall growth and sustainability. Understanding the types and approval process outlined in this article will assist companies in implementing these plans successfully.

Guam Approval of Restricted Share Plan for Directors with Copy of Plan

Description

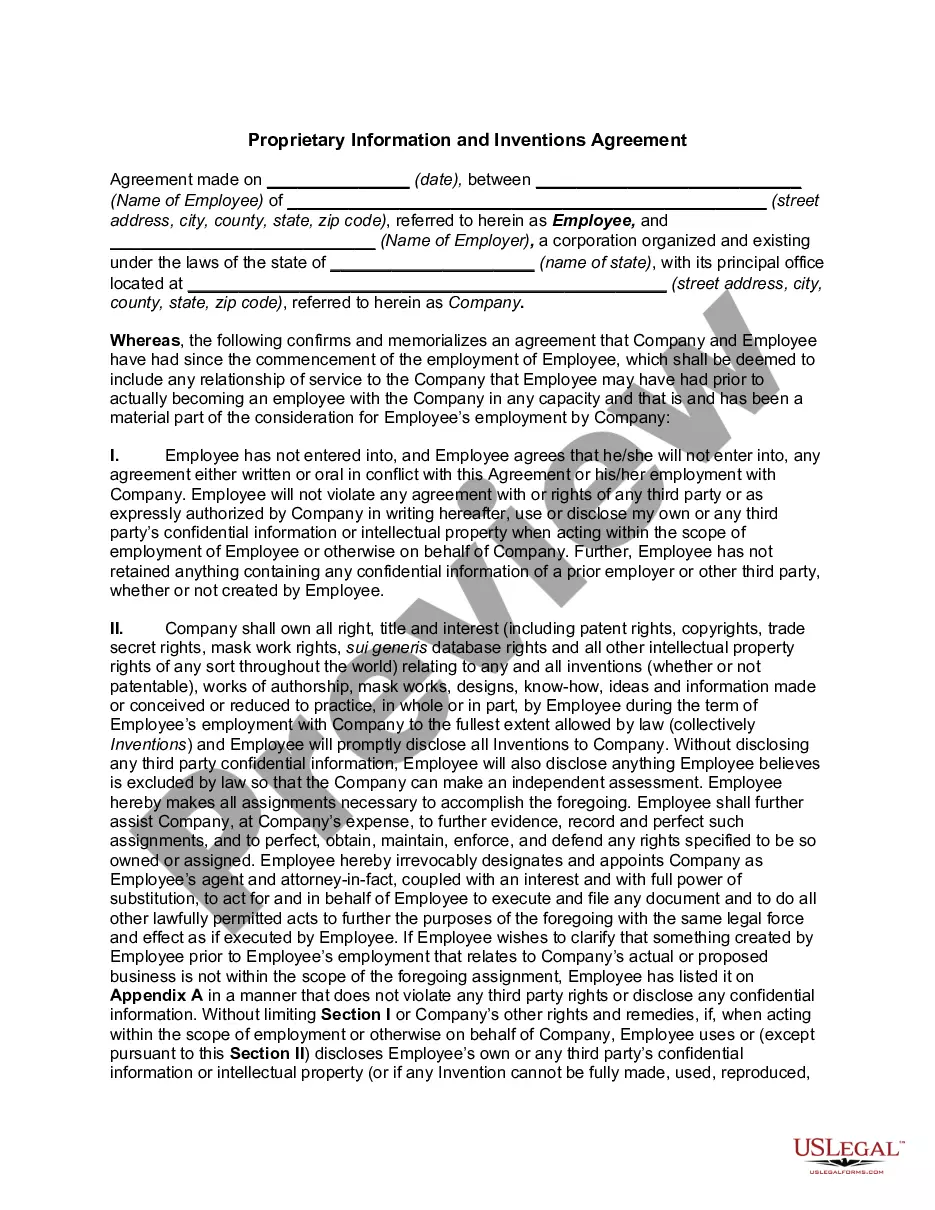

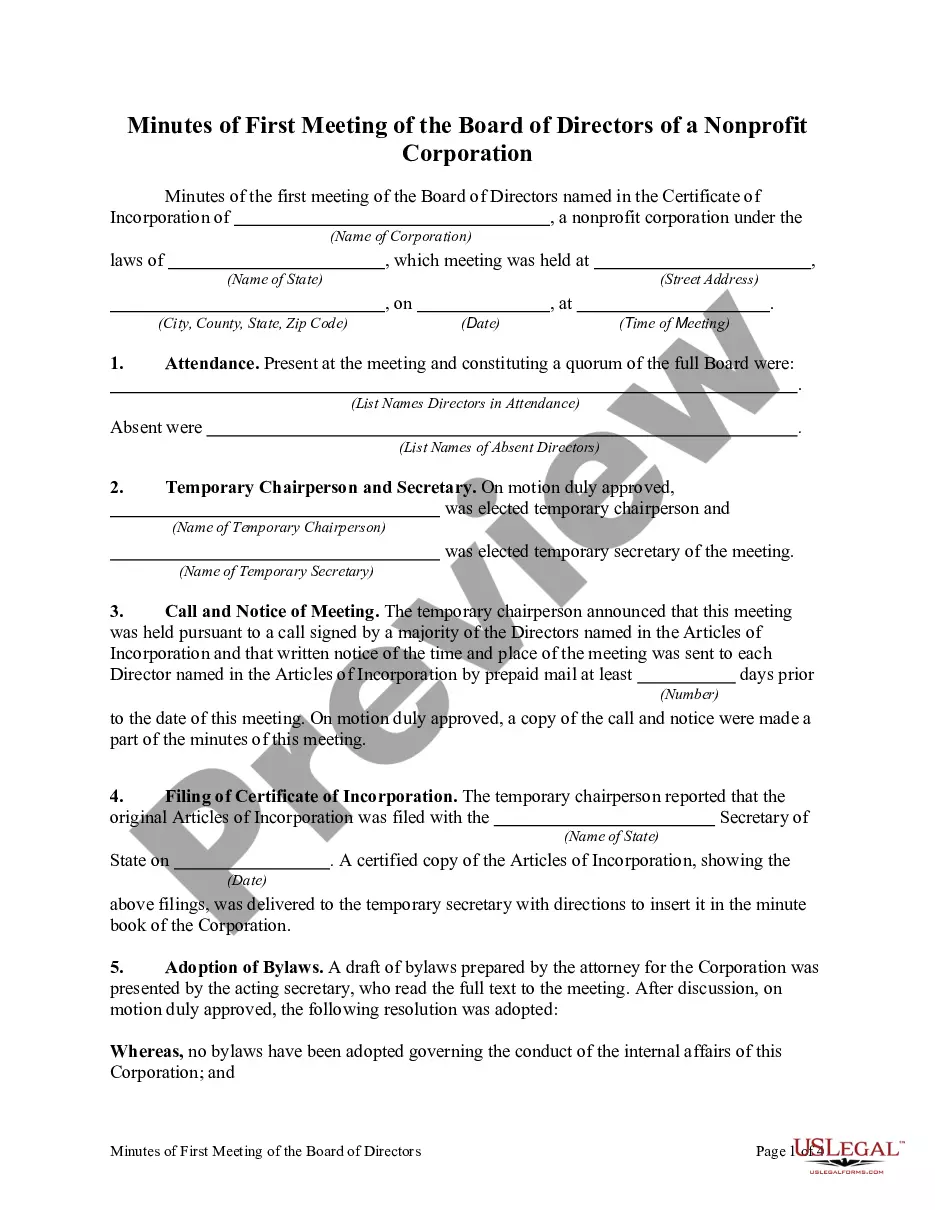

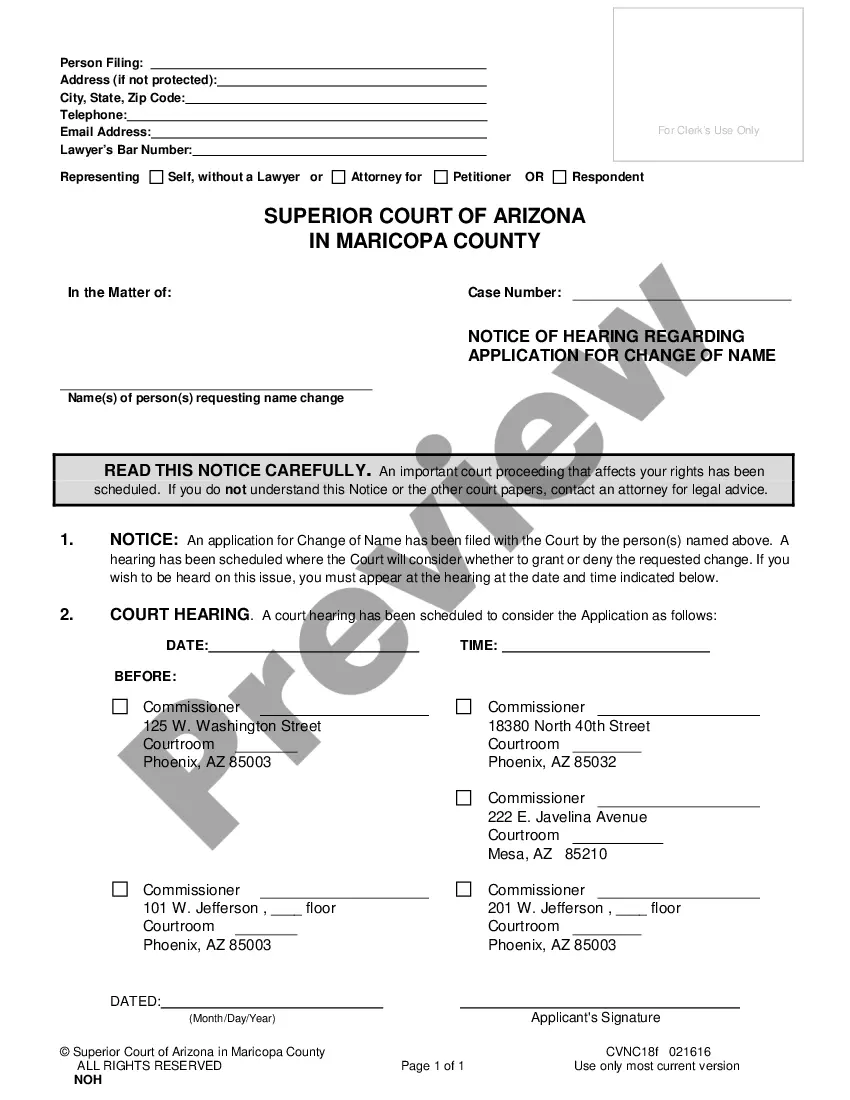

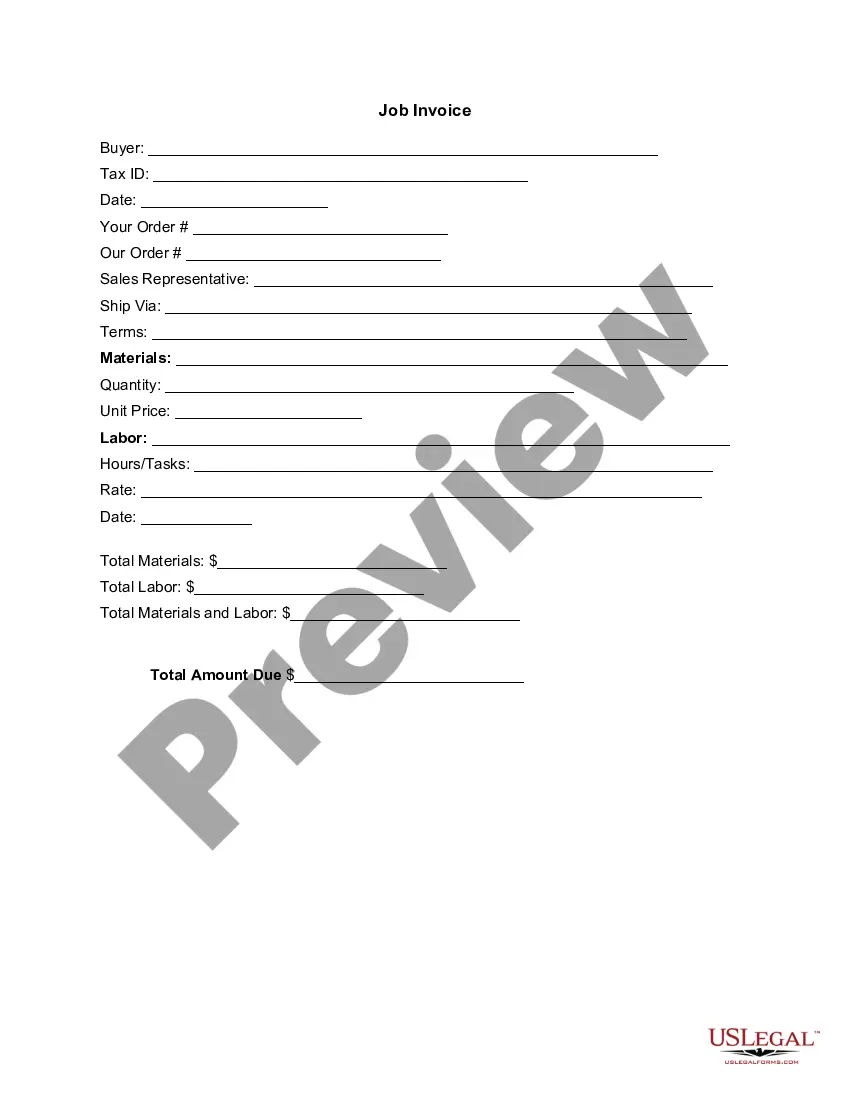

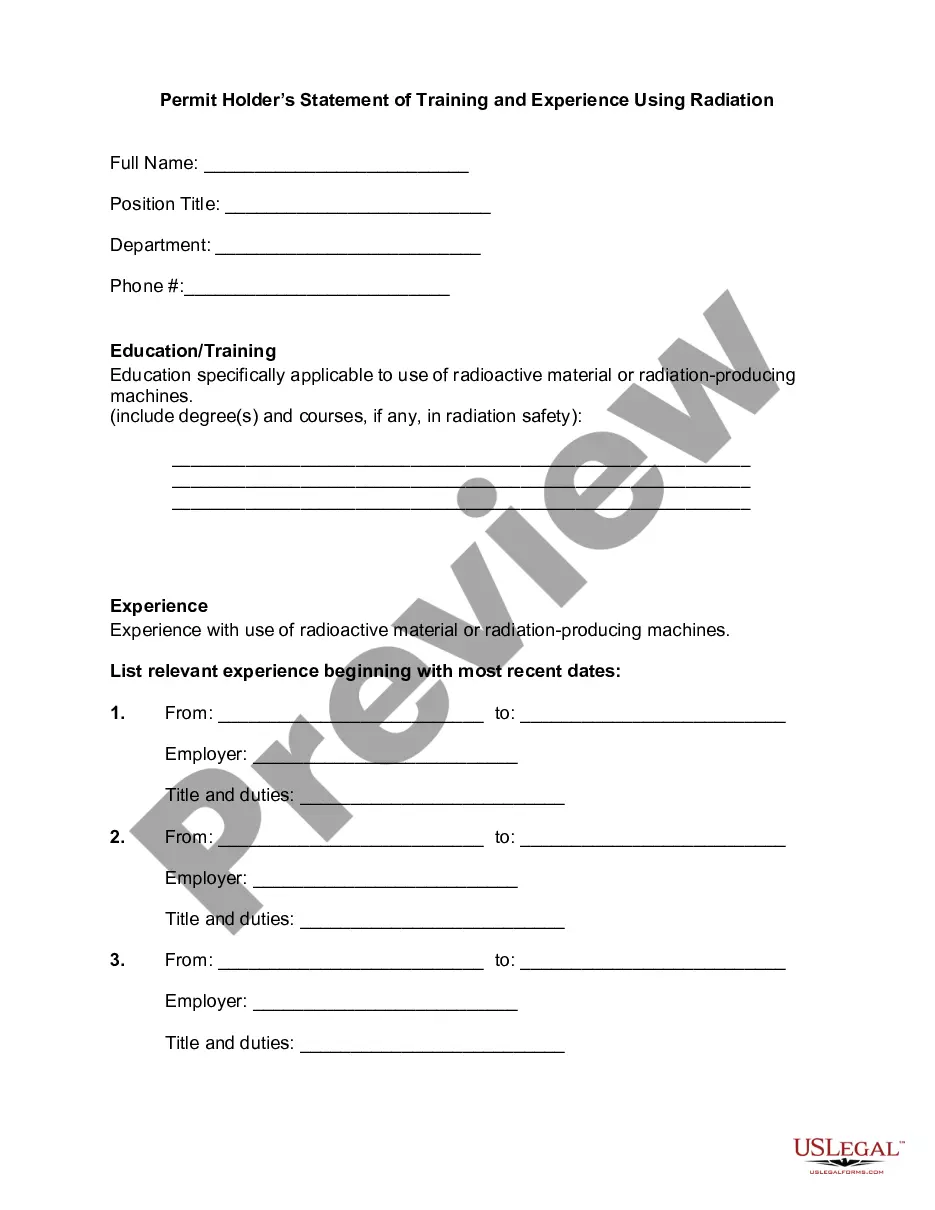

How to fill out Guam Approval Of Restricted Share Plan For Directors With Copy Of Plan?

Are you in the place that you need to have papers for sometimes business or person functions almost every time? There are a variety of legitimate record themes accessible on the Internet, but locating versions you can rely is not effortless. US Legal Forms provides thousands of form themes, such as the Guam Approval of Restricted Share Plan for Directors with Copy of Plan, that are created to fulfill state and federal needs.

In case you are presently knowledgeable about US Legal Forms website and possess a free account, simply log in. Afterward, it is possible to obtain the Guam Approval of Restricted Share Plan for Directors with Copy of Plan format.

If you do not come with an account and need to begin using US Legal Forms, abide by these steps:

- Discover the form you want and make sure it is for that right area/county.

- Make use of the Preview button to analyze the form.

- Look at the outline to actually have selected the right form.

- In the event the form is not what you are looking for, take advantage of the Research industry to find the form that meets your requirements and needs.

- If you obtain the right form, click on Get now.

- Choose the costs program you want, fill in the specified info to generate your account, and buy the transaction using your PayPal or charge card.

- Pick a convenient file format and obtain your version.

Find all the record themes you have bought in the My Forms food list. You can get a additional version of Guam Approval of Restricted Share Plan for Directors with Copy of Plan anytime, if needed. Just go through the essential form to obtain or print the record format.

Use US Legal Forms, one of the most extensive variety of legitimate types, to save lots of time as well as prevent mistakes. The assistance provides expertly produced legitimate record themes that you can use for an array of functions. Generate a free account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

Restricted shares are often granted in stages, each having its own vesting date or milestone attached. This gives employees rights to company assets over time. Once vested, restricted shares are assigned a fair market value. Restricted shares may also be restricted by a double-trigger provision.

After you vest your RSUs, you own the stock and can keep it or sell it. Even if you leave your company, you still own the stock. For example, let's say you are granted 10,000 RSUs when you start working at your company, with the vesting schedule just described.

The underlying company stock is not issued until the RSUs vest. When an employee receives Restricted Stock Units, they have an interest in the company's equity, but the units have no tangible value until they vest. Once the RSUs vest, the employee can keep, sell, or transfer the shares, just like any other stock.

Vesting Schedule The restricted stock units are assigned a fair market value when they vest. Upon vesting, they are considered income, and often a portion of the shares is withheld to pay income taxes. The employees receive the remaining shares and can sell them at their discretion.

The main difference between restricted stock and performance shares is that restricted stock is typically awarded to employees with the condition that they remain with the company for a certain period of time, while performance shares are awarded to employees based on the company's performance.

After you exercise your options, you can usually either keep the shares or sell them.

Here's an example. Say you've been granted 1,500 RSUs and the vesting schedule is 20% after one year of service, and then equal quarterly installments thereafter for the next three years. This would mean that after staying with your company for a year, 300 shares would vest and become yours.

Restricted shares are unregistered, non-transferable shares issued to a company's employees. They give employees incentives to help companies attain success. They are most common in established companies that want to motivate people with an equity stake. Their sale is usually restricted by a vesting schedule.