The Guam Stock Option Agreement of Key Ironic Corporation refers to a legally binding document that outlines the terms and conditions for granting stock options to employees of Key Ironic Corporation who are located in Guam. This agreement serves as a means for employees to purchase a certain number of company stocks at a predetermined price, enabling them to benefit from potential future gains in the company's stock value. The Guam Stock Option Agreement reflects Key Ironic's commitment to providing incentives and rewards to its employees in Guam, allowing them to obtain a stake in the company's success. By issuing stock options, Key Ironic aims to align the interests of its employees with the shareholders, promoting employee loyalty, motivation, and long-term commitment to the company's overall goals and objectives. The agreement typically includes various key components such as the number of stock options granted, the exercise price (the price at which the options can be exercised), the vesting schedule (the timeline for employees to become eligible to exercise their options), and any applicable restrictions or conditions. This ensures that employees receive a fair and equitable opportunity to benefit from the potential growth of Key Ironic's stock price. Key Ironic Corporation may have different types of stock option agreements as part of its overall compensation and benefits strategy for employees in Guam. Some common variations may include: 1. Non-Qualified Stock Option Agreement: This type of agreement offers employees the ability to purchase stock options at a predetermined price but does not qualify for preferential tax treatment. Non-qualified stock options provide flexibility in terms of eligibility and timing for exercising the options. 2. Incentive Stock Option Agreement: In contrast to non-qualified stock options, incentive stock option agreements qualify for preferential tax treatment. They typically have more stringent eligibility criteria, such as specific employment tenure or other requirements. 3. Restricted Stock Option Agreement: This type of agreement imposes certain restrictions on the stock options granted to employees. These restrictions may include a vesting schedule, performance criteria, or other conditions that must be met before exercising the options. 4. Stock Appreciation Rights Agreement: Though not strictly a stock option agreement, stock appreciation rights (SARS) are commonly used alongside stock options. SARS provide employees with the opportunity to profit from the increase in Key Ironic's stock price without the obligation to purchase actual shares. The SARS value is tied to the appreciation in stock price and can be converted into cash or stock, depending on the terms outlined in the agreement. It is important to note that the specific details and provisions of the Guam Stock Option Agreement of Key Ironic Corporation may vary based on the company's policies, industry practices, and local regulations. Therefore, it is advisable to consult the actual agreement or seek professional advice for accurate and up-to-date information.

Guam Stock Option Agreement of Key Tronic Corporation

Description

How to fill out Guam Stock Option Agreement Of Key Tronic Corporation?

US Legal Forms - among the most significant libraries of legitimate varieties in the USA - delivers an array of legitimate record templates you are able to obtain or print. Making use of the internet site, you can find a large number of varieties for organization and specific reasons, categorized by groups, says, or keywords and phrases.You will find the most recent versions of varieties like the Guam Stock Option Agreement of Key Tronic Corporation in seconds.

If you already possess a subscription, log in and obtain Guam Stock Option Agreement of Key Tronic Corporation in the US Legal Forms catalogue. The Obtain key will show up on every form you view. You gain access to all earlier saved varieties in the My Forms tab of your accounts.

In order to use US Legal Forms for the first time, listed below are simple directions to obtain started off:

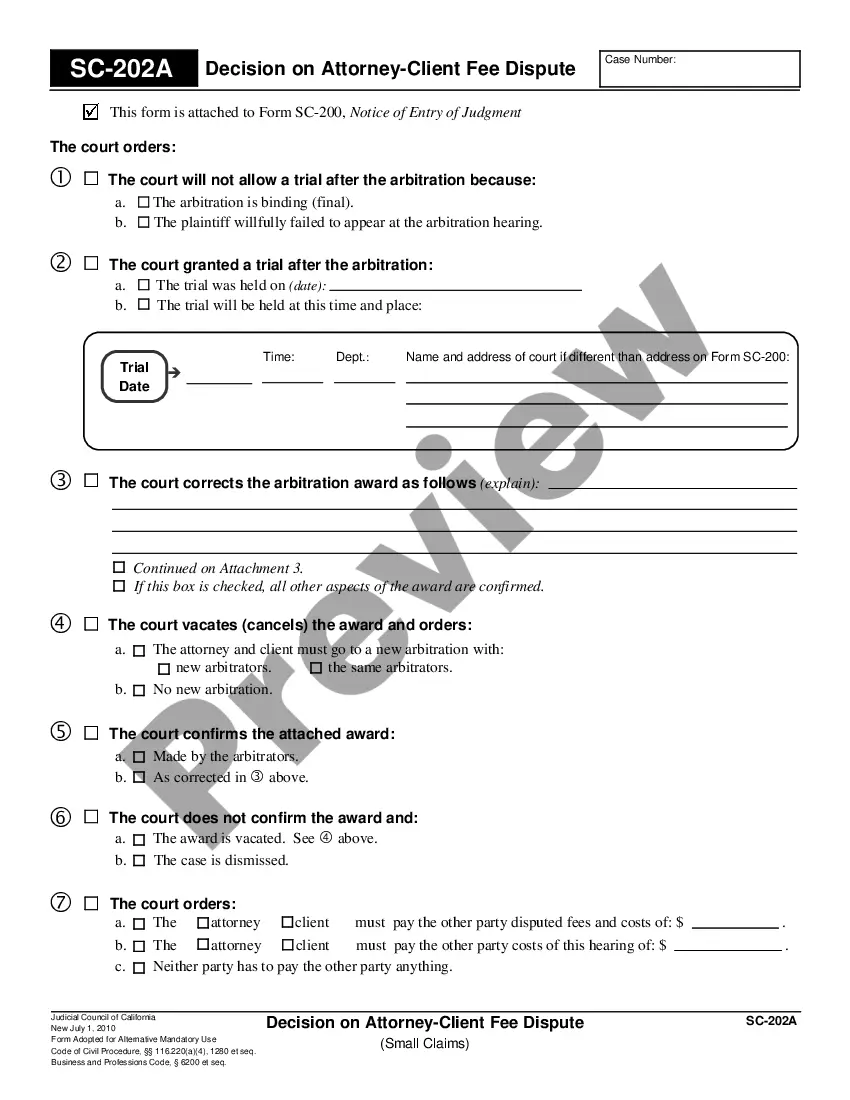

- Make sure you have picked out the proper form for your city/county. Select the Review key to analyze the form`s content. See the form description to ensure that you have chosen the correct form.

- In the event the form doesn`t match your demands, use the Search industry towards the top of the display screen to obtain the the one that does.

- If you are content with the shape, affirm your selection by simply clicking the Acquire now key. Then, choose the rates program you want and provide your credentials to sign up for an accounts.

- Procedure the deal. Utilize your Visa or Mastercard or PayPal accounts to perform the deal.

- Select the formatting and obtain the shape on your system.

- Make modifications. Load, revise and print and signal the saved Guam Stock Option Agreement of Key Tronic Corporation.

Every single format you added to your account lacks an expiry time and is your own permanently. So, if you would like obtain or print one more duplicate, just go to the My Forms portion and click on the form you require.

Gain access to the Guam Stock Option Agreement of Key Tronic Corporation with US Legal Forms, by far the most substantial catalogue of legitimate record templates. Use a large number of professional and state-particular templates that satisfy your small business or specific needs and demands.

Form popularity

FAQ

Today Keytronic is located all over the globe and trusted as a full service engineering design and manufacturing provider.

All major functions are centralized at our headquarters in Spokane, WA, providing consistency between factories and US based control of IP.

Keytronic offers precision metal stamping, fabrication and finishing capabilities from our in-house metals facility. Our full service metal shop can provide parts ranging from precision metal stampings to complex fabricated enclosures for telecommunications and gaming markets. What We Do ? Keytronic Contract Manufacturer keytronic.com ? what-we-do keytronic.com ? what-we-do

Excellent benefits. Keytronic provides competitive salaries and an excellent benefits package including medical, dental and vision coverage, life insurance options, short and long term disability, vacation and holidays, tuition reimbursement, and a 401(k) plan.