Guam Stock Option Plan for Federal Savings Association is a financial mechanism offered by Federal Savings Associations (FSA's) in Guam that allows their employees to purchase company stock at a predetermined price within a specific timeframe. This employee benefit program provides an opportunity for FSA's to incentivize and retain their workforce while aligning their interests with the overall success of the institution. The Guam Stock Option Plan is designed to attract and reward talented individuals, encourage loyalty, and promote long-term commitment among employees. The Guam Stock Option Plan for Federal Savings Association is typically structured to have different types of stock option plans: 1. Non-Qualified Stock Option (NO): This is the most common type of stock option plan which grants employees the right to purchase shares at a predetermined price, usually lower than the current market price, within a specific timeframe. Nests offer flexibility in terms of eligibility requirements and may be granted to employees at any level of the organization. 2. Incentive Stock Option (ISO): SOS grant employees the right to purchase shares at a predetermined price, usually at the fair market value, within a specific timeframe. These plans offer tax advantages to employees upon exercise, as they may qualify for capital gains tax treatment instead of ordinary income tax rates. SOS typically have specific eligibility criteria and are subject to various regulations set forth by the Internal Revenue Service (IRS). 3. Restricted Stock Unit (RSU) Plan: RSU plans are an alternative to traditional stock option plans, where the employee is granted units of company stock instead of options. These units convert to actual shares after a predefined vesting period, during which the employee must meet certain employment conditions. RSS provide employees with a direct ownership stake in the company and often align their interests with long-term growth objectives. 4. Employee Stock Purchase Plan (ESPN): While not strictly a stock option plan, ESPN is another type of equity-based compensation offered by FSA's. ESPN allow employees to purchase company stock at a discounted price, usually through payroll deductions. ESPN promote broad-based employee participation and are governed by specific rules and guidelines set by the employer. In conclusion, the Guam Stock Option Plan for Federal Savings Association is a comprehensive employee benefit program that provides various types of stock option plans to incentivize, retain, and reward employees. Whether through Non-Qualified Stock Options, Incentive Stock Options, Restricted Stock Units, or Employee Stock Purchase Plans, FSA's aim to create a culture of ownership, align employee interests with the institution's success, and foster a motivated and dedicated workforce.

Guam Stock Option Plan For Federal Savings Association

Description

How to fill out Guam Stock Option Plan For Federal Savings Association?

If you wish to full, down load, or produce lawful papers templates, use US Legal Forms, the largest selection of lawful varieties, that can be found on the Internet. Use the site`s basic and hassle-free research to get the files you want. Various templates for business and personal purposes are categorized by categories and states, or keywords and phrases. Use US Legal Forms to get the Guam Stock Option Plan For Federal Savings Association in just a handful of mouse clicks.

In case you are currently a US Legal Forms client, log in to your profile and then click the Download button to get the Guam Stock Option Plan For Federal Savings Association. Also you can accessibility varieties you in the past saved from the My Forms tab of the profile.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the shape for your appropriate metropolis/nation.

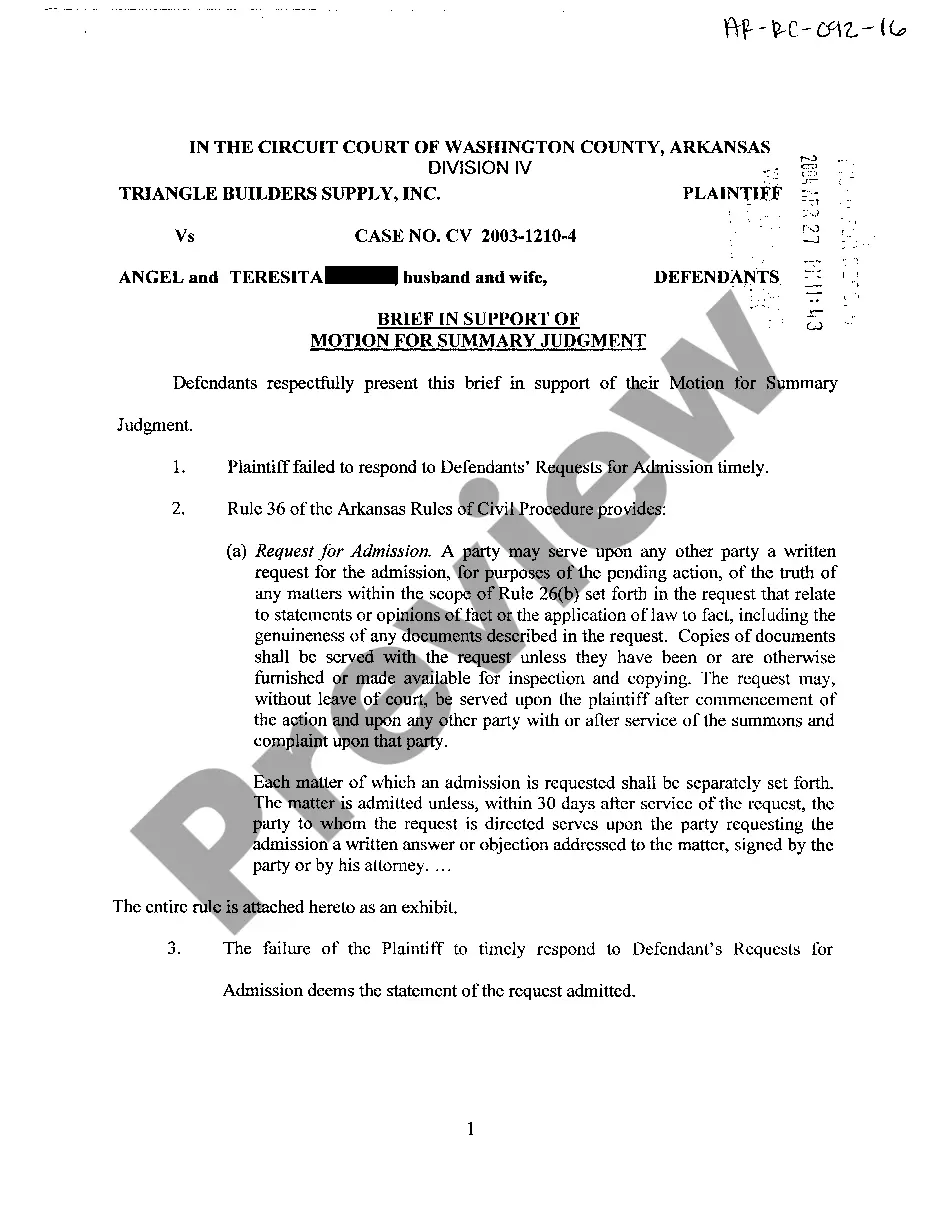

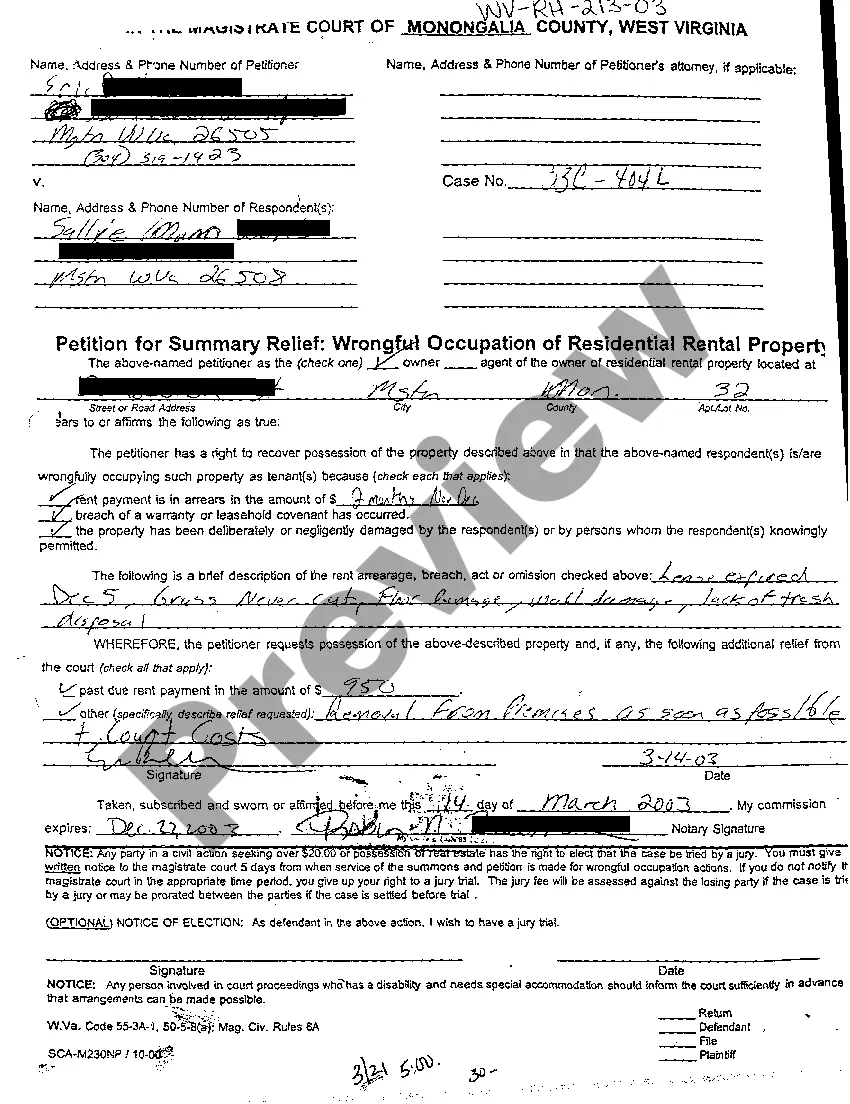

- Step 2. Make use of the Preview choice to examine the form`s articles. Don`t neglect to see the explanation.

- Step 3. In case you are not satisfied with all the type, make use of the Look for discipline on top of the screen to discover other models from the lawful type format.

- Step 4. After you have found the shape you want, select the Purchase now button. Pick the prices strategy you prefer and add your accreditations to sign up for an profile.

- Step 5. Method the deal. You can utilize your credit card or PayPal profile to perform the deal.

- Step 6. Choose the structure from the lawful type and down load it in your system.

- Step 7. Complete, edit and produce or signal the Guam Stock Option Plan For Federal Savings Association.

Every single lawful papers format you acquire is your own forever. You possess acces to every single type you saved within your acccount. Select the My Forms portion and pick a type to produce or down load once again.

Contend and down load, and produce the Guam Stock Option Plan For Federal Savings Association with US Legal Forms. There are millions of professional and express-specific varieties you may use to your business or personal demands.