Guam Anti-Dilution Adjustments are legal provisions that protect shareholders' ownership stakes in a company by adjusting the conversion or exercise price of securities when new shares are issued. These adjustments ensure that shareholders are not diluted or have their ownership stakes diminished when additional shares are issued at a lower price. There are different types of Guam Anti-Dilution Adjustments commonly used in corporate agreements and contracts. These include: 1. Full-Ratchet Anti-Dilution: This type of adjustment provides the most robust protection to existing shareholders. Under a full-ratchet anti-dilution clause, if new shares are issued at a price lower than the existing conversion or exercise price, the conversion or exercise price of the existing securities is adjusted downward to match the new issuance price. This adjustment is applied on a share-to-share basis. 2. Weighted-Average Anti-Dilution: Weighted-average anti-dilution is a more moderate form of adjustment that takes into account both the price and the number of new shares issued. It utilizes a formula to calculate the adjustment by factoring in the ratio of the new issuance price to the existing conversion or exercise price. 3. Broad-Based Weighted-Average Anti-Dilution: This type of anti-dilution adjustment is similar to the weighted-average method but includes additional factors such as outstanding securities and options not subject to adjustment. This adjustment provision aims to encompass a broader scope of securities and options in the calculation, leading to a more comprehensive adjustment value. 4. Narrow-Based Weighted-Average Anti-Dilution: Narrow-based weighted-average anti-dilution provisions only consider specific types of securities or options in the calculation. It excludes certain securities from the adjustment formula, such as those issued as part of employee stock option plans or certain convertible securities. Guam Anti-Dilution Adjustments are commonly included in shareholder agreements, convertible debt instruments, and stock option plans. These provisions protect the interests of existing shareholders, maintain their ownership percentages, and provide them with certain rights and remedies when facing dilution situations.

Guam Anti-Dilution Adjustments

Description

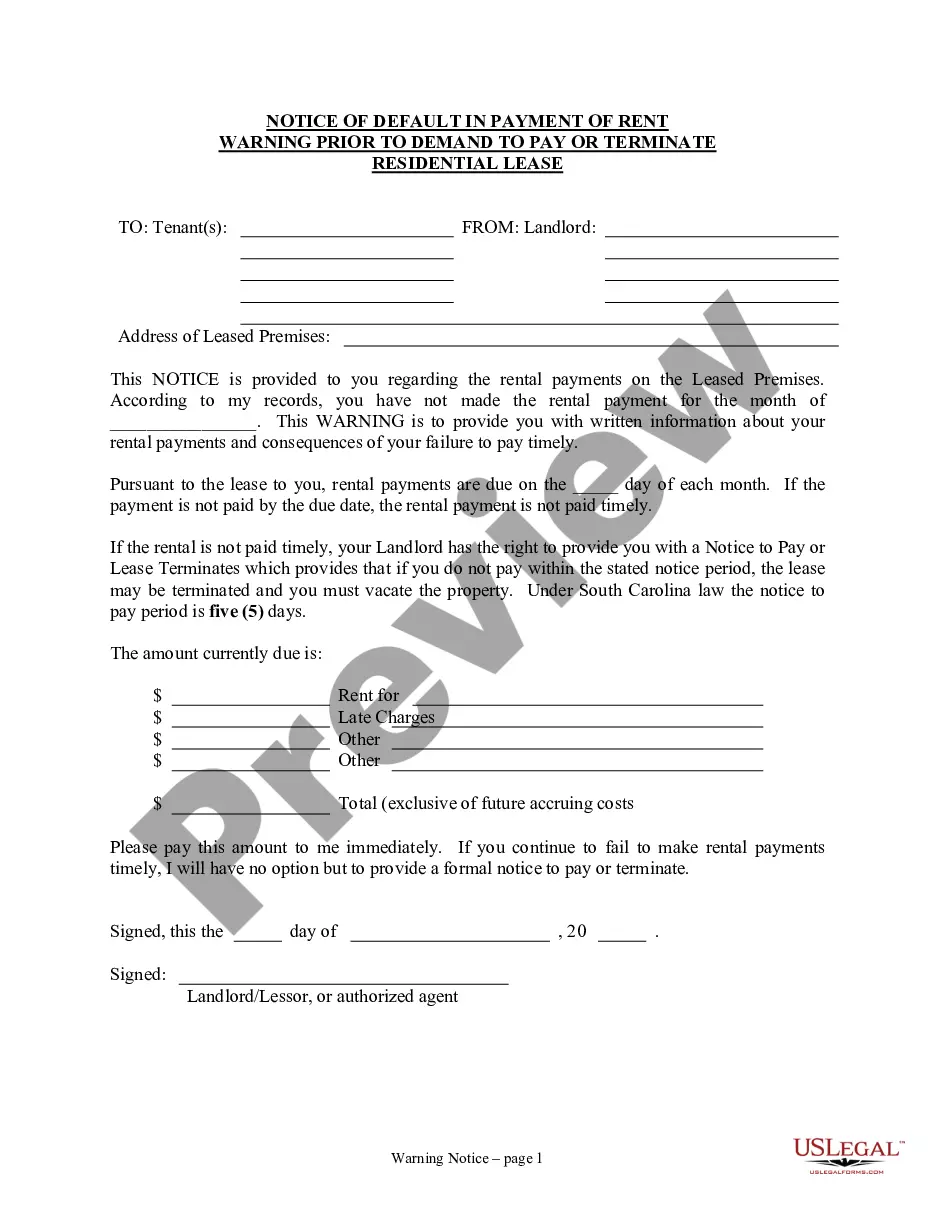

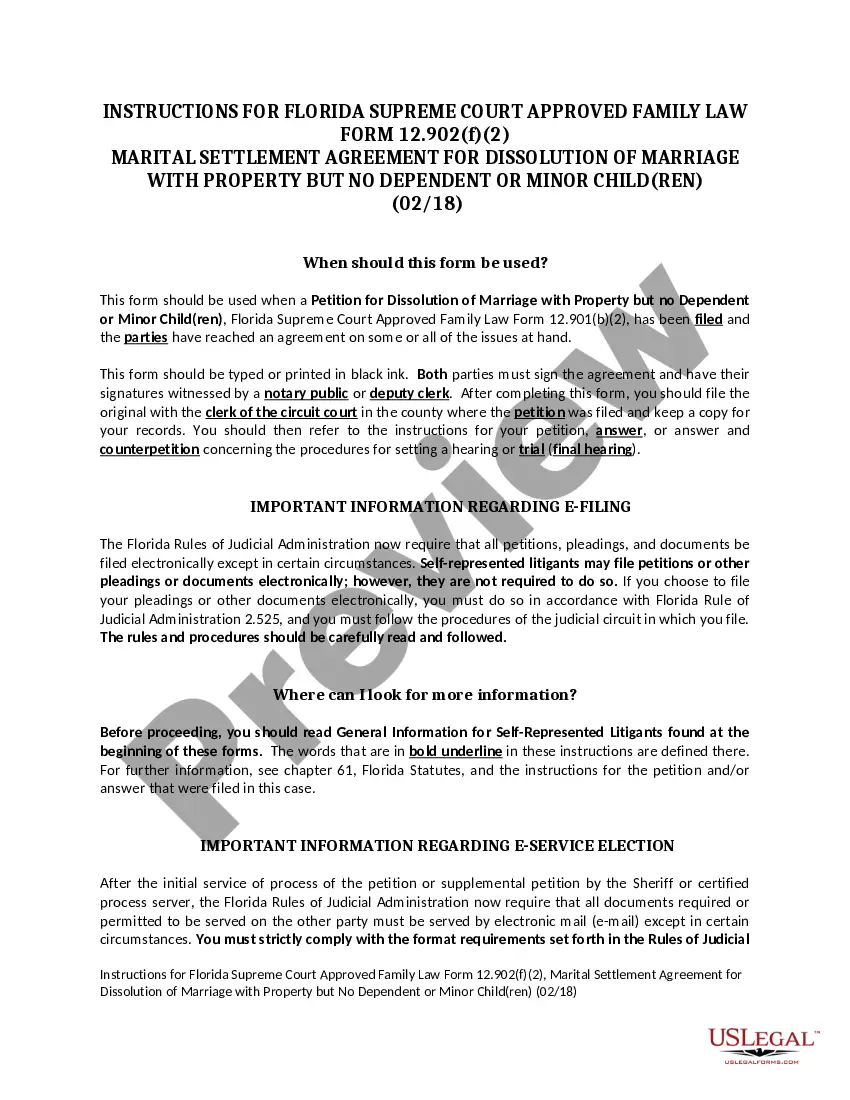

How to fill out Guam Anti-Dilution Adjustments?

Have you been inside a placement where you require paperwork for both enterprise or individual reasons just about every day? There are a variety of authorized file templates accessible on the Internet, but getting versions you can depend on isn`t effortless. US Legal Forms delivers thousands of kind templates, like the Guam Anti-Dilution Adjustments, which can be composed in order to meet federal and state requirements.

Should you be already knowledgeable about US Legal Forms site and get your account, basically log in. After that, you may acquire the Guam Anti-Dilution Adjustments template.

Should you not have an bank account and need to begin using US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for your appropriate metropolis/county.

- Take advantage of the Review switch to examine the form.

- Look at the information to ensure that you have chosen the correct kind.

- When the kind isn`t what you`re looking for, utilize the Research field to discover the kind that meets your needs and requirements.

- Whenever you find the appropriate kind, simply click Acquire now.

- Select the pricing prepare you would like, fill out the desired information to create your money, and pay for your order with your PayPal or Visa or Mastercard.

- Choose a handy file formatting and acquire your copy.

Discover all the file templates you possess purchased in the My Forms food selection. You can obtain a additional copy of Guam Anti-Dilution Adjustments whenever, if required. Just go through the required kind to acquire or produce the file template.

Use US Legal Forms, by far the most considerable variety of authorized kinds, to save lots of time and steer clear of errors. The assistance delivers expertly produced authorized file templates that you can use for an array of reasons. Generate your account on US Legal Forms and commence creating your way of life a little easier.

Form popularity

FAQ

The anti-dilution adjustment clause is a provision contained in a security or merger agreement. The anti-dilution clause provides current investors with the right to maintain their ownership percentage in the company by purchasing a proportionate number of new shares at a future date when securities are issued.

Anti-dilution provisions act as a buffer to protect investors against their equity ownership positions becoming diluted or less valuable. This can happen when the percentage of an owner's stake in a company decreases because of an increase in the total number of shares outstanding.

An anti-dilution provision grants an investor the right to convert their preferred shares at the new price. Imagine you own preferred stock that you purchased for $20 per share. If the company that issued the shares goes public and issues shares at $15, the value of your investment would've gone down.

Full ratchet anti-dilution lowers the conversion price of the protected stock to the price paid in the down round. The new conversion price is then divided into the original issue price to arrive at the new conversion ratio.

Price-based anti-dilution: When a company raises money in a down round, that issuance is viewed as diluting the value of the stock held by the earlier investors. For that reason, investors often negotiate anti-dilution protection as part of their investment in order to offset the dilutive effects of future down rounds.

Anti-dilution clauses That is, in case shares are issued at a lower price than the price per share that was paid by the existing shareholder. This is achieved by granting such existing investors the right to receive additional shares (referred to here as ?anti-dilution shares'') for free in the course of a down round.

ASC 260 requires entities to present basic and diluted EPS with equal prominence on the face of the income statement for each period presented. Under ASC 270-10, the same requirement applies to interim periods.

Anti-dilution provisions act as a buffer to protect investors against their equity ownership positions becoming diluted or less valuable. This can happen when the percentage of an owner's stake in a company decreases because of an increase in the total number of shares outstanding.