The Guam Nonemployee Directors Stock Plan is a comprehensive program implemented by TJ International, Inc., to provide its nonemployee directors in Guam with an attractive stock option package. This plan aims to enhance the compensation and align the interests of the nonemployee directors with the long-term success of the company. By offering stock options, TJ International, Inc., seeks to motivate and retain talented individuals who contribute significantly to the organization's growth. Under this plan, Guam nonemployee directors are granted the opportunity to acquire company stocks at designated prices within specified timeframes. This program holds several types of stock options, each designed to offer unique benefits. 1. Stock Option Grants: The Guam Nonemployee Directors Stock Plan includes stock option grants, which enable nonemployee directors to purchase company shares at a predetermined exercise price during a specific duration. These grants have a vesting period, after which the directors gain the rights to exercise the options. 2. Performance-Based Stock Options: TJ International, Inc., also incorporates performance-based stock options within the Nonemployee Directors Stock Plan. These options are granted based on specific performance criteria established by the company. If the predetermined performance targets are met, the directors gain the ability to exercise these options at the designated exercise price. 3. Restricted Stock Units (RSS): Another aspect of the Guam Nonemployee Directors Stock Plan is the provision of restricted stock units. RSS represents a promise to deliver company shares to nonemployee directors upon satisfying predefined vesting requirements. These units offer an excellent opportunity for directors to receive company stocks as an incentive for their valuable contributions to TJ International, Inc. 4. Stock Appreciation Rights (SARS): The plan may also include stock appreciation rights, which grant the nonemployee directors the ability to receive the equivalent value of the appreciation in the company's stock price since the grant date. These rights are typically exercised by exchanging them for company shares or in cash. 5. Dividend Equivalents: Dividend equivalents are another component of the Guam Nonemployee Directors Stock Plan. This aspect entitles nonemployee directors to receive payments equal to the dividends declared on the company's common stock. These equivalents act as an additional benefit, reflecting the performance and success of TJ International, Inc. Overall, the Guam Nonemployee Directors Stock Plan of TJ International, Inc., provides attractive stock options and incentives for nonemployee directors in Guam. Through a variety of grants, options, and units, this plan effectively aligns the directors' interests with the long-term prosperity of the company.

Guam Nonemployee Directors Stock Plan of TJ International, Inc.

Description

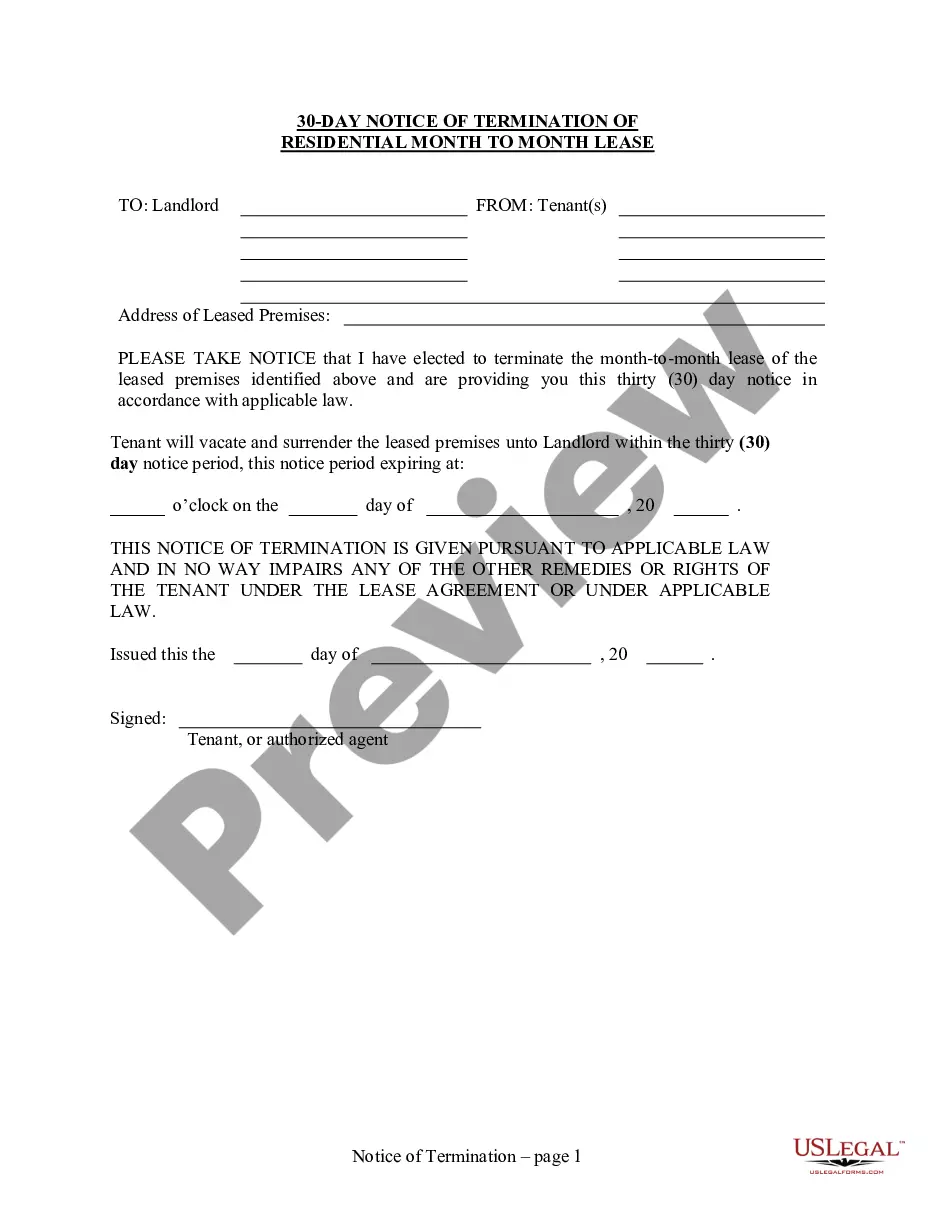

How to fill out Guam Nonemployee Directors Stock Plan Of TJ International, Inc.?

It is possible to spend several hours online trying to find the legal document template that fits the state and federal specifications you want. US Legal Forms gives a huge number of legal types that happen to be analyzed by professionals. You can actually download or print the Guam Nonemployee Directors Stock Plan of TJ International, Inc. from your service.

If you already possess a US Legal Forms account, you are able to log in and then click the Down load button. After that, you are able to full, change, print, or indicator the Guam Nonemployee Directors Stock Plan of TJ International, Inc.. Every legal document template you buy is yours for a long time. To obtain an additional backup of any purchased type, go to the My Forms tab and then click the related button.

If you work with the US Legal Forms site the first time, keep to the easy instructions under:

- Initial, make certain you have chosen the proper document template for your region/area of your liking. Read the type description to ensure you have chosen the correct type. If accessible, make use of the Preview button to appear throughout the document template at the same time.

- If you would like locate an additional edition from the type, make use of the Lookup field to obtain the template that fits your needs and specifications.

- After you have located the template you would like, simply click Get now to carry on.

- Find the pricing strategy you would like, enter your credentials, and register for a free account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal account to purchase the legal type.

- Find the format from the document and download it for your device.

- Make alterations for your document if needed. It is possible to full, change and indicator and print Guam Nonemployee Directors Stock Plan of TJ International, Inc..

Down load and print a huge number of document layouts using the US Legal Forms website, that provides the largest variety of legal types. Use skilled and status-particular layouts to tackle your business or individual requirements.