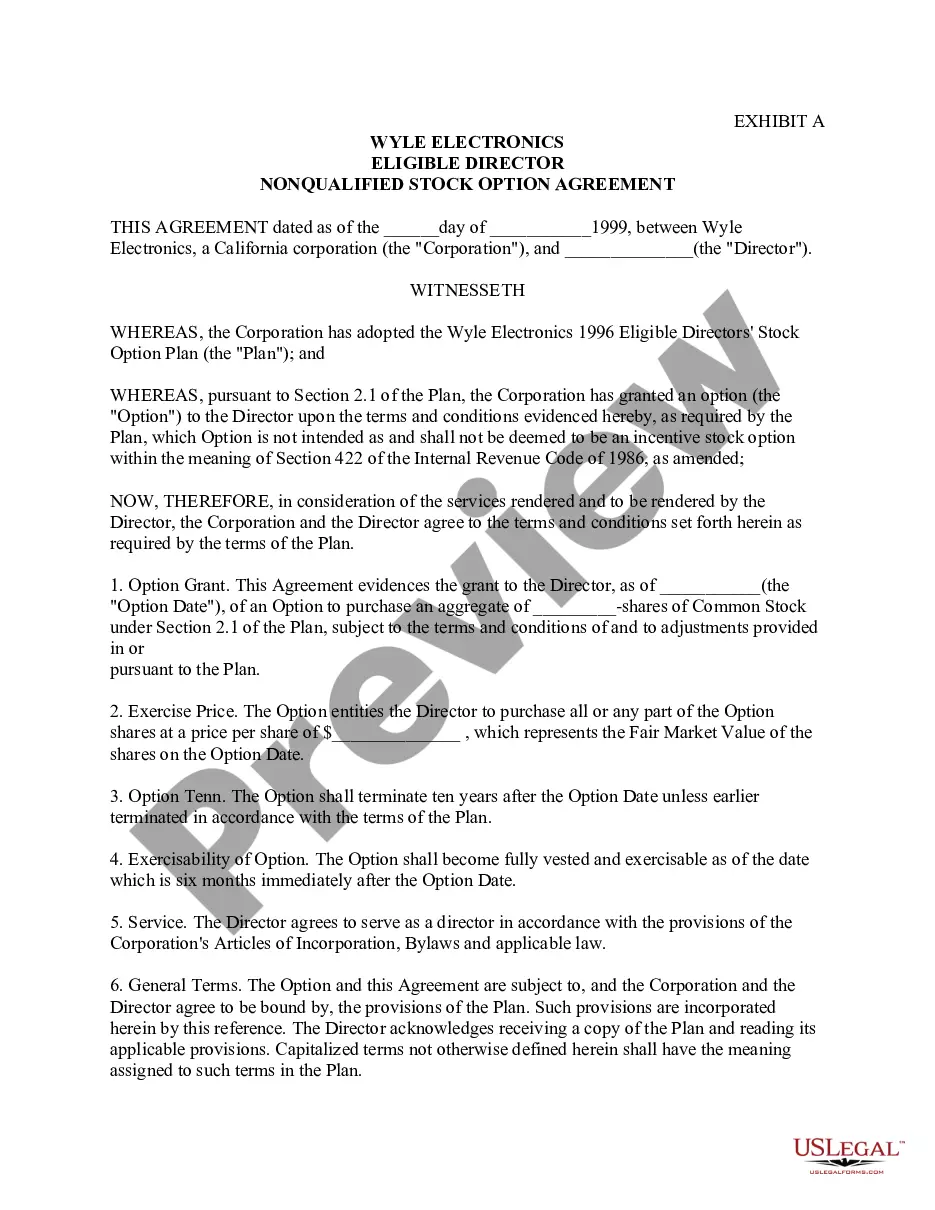

Guam Eligible Directors' Stock Option Plan of Wyle Electronics

Description

How to fill out Eligible Directors' Stock Option Plan Of Wyle Electronics?

Are you presently inside a placement where you need to have documents for either business or specific purposes just about every day time? There are tons of legal record themes available on the Internet, but finding types you can trust isn`t easy. US Legal Forms gives a huge number of kind themes, like the Guam Eligible Directors' Stock Option Plan of Wyle Electronics, which can be written to meet federal and state demands.

When you are presently acquainted with US Legal Forms web site and have a free account, basically log in. After that, you can obtain the Guam Eligible Directors' Stock Option Plan of Wyle Electronics template.

If you do not offer an bank account and need to start using US Legal Forms, follow these steps:

- Get the kind you will need and make sure it is for your proper city/county.

- Utilize the Preview button to analyze the shape.

- Browse the information to actually have selected the right kind.

- In case the kind isn`t what you`re searching for, take advantage of the Look for discipline to find the kind that fits your needs and demands.

- If you find the proper kind, simply click Acquire now.

- Opt for the costs program you need, fill in the necessary details to generate your bank account, and purchase your order utilizing your PayPal or credit card.

- Decide on a hassle-free data file file format and obtain your copy.

Find each of the record themes you may have bought in the My Forms food selection. You may get a more copy of Guam Eligible Directors' Stock Option Plan of Wyle Electronics any time, if required. Just go through the required kind to obtain or produce the record template.

Use US Legal Forms, by far the most extensive selection of legal varieties, in order to save time as well as avoid blunders. The assistance gives appropriately produced legal record themes that you can use for a variety of purposes. Create a free account on US Legal Forms and commence creating your lifestyle easier.