Guam Stock Option Agreement

Description

How to fill out Stock Option Agreement?

US Legal Forms - one of the greatest libraries of legal kinds in the States - provides a wide array of legal papers layouts it is possible to download or print out. Making use of the internet site, you may get thousands of kinds for enterprise and personal reasons, categorized by classes, claims, or search phrases.You will find the most up-to-date versions of kinds like the Guam Stock Option Agreement within minutes.

If you already possess a monthly subscription, log in and download Guam Stock Option Agreement through the US Legal Forms local library. The Acquire button can look on each and every develop you look at. You gain access to all in the past acquired kinds from the My Forms tab of your own bank account.

If you want to use US Legal Forms initially, here are straightforward guidelines to get you started off:

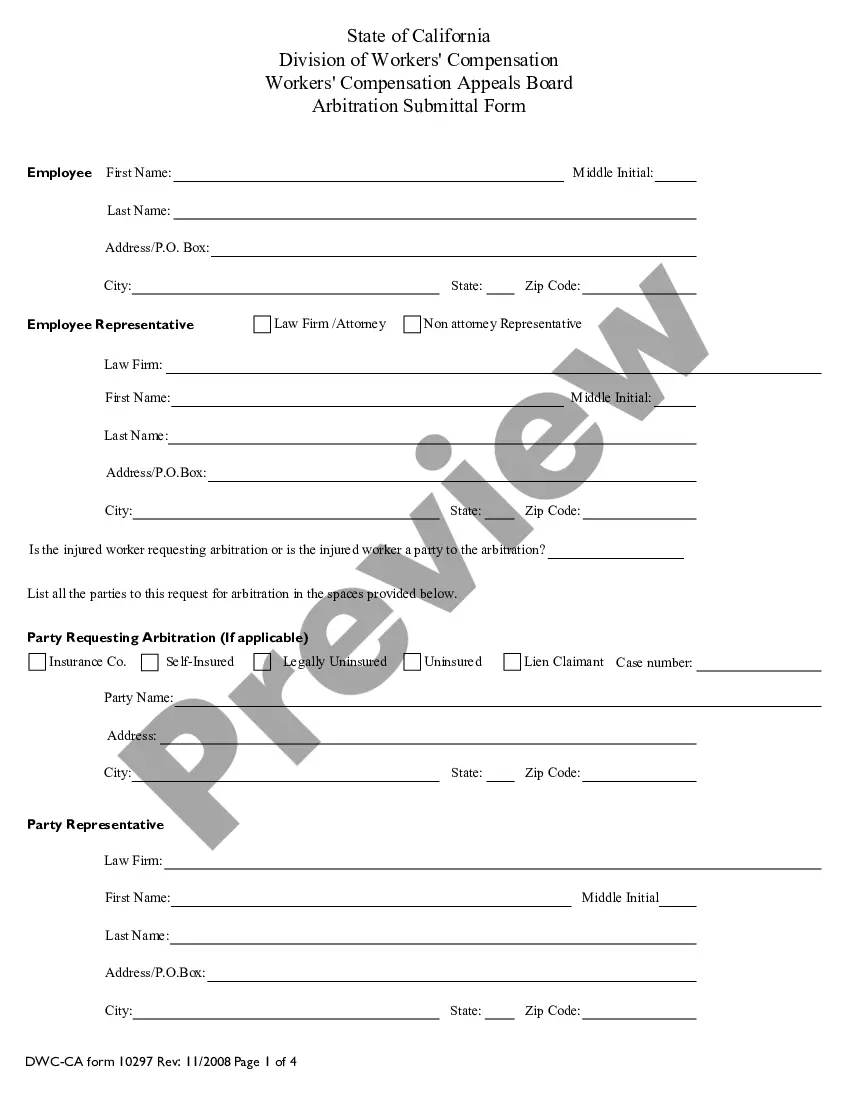

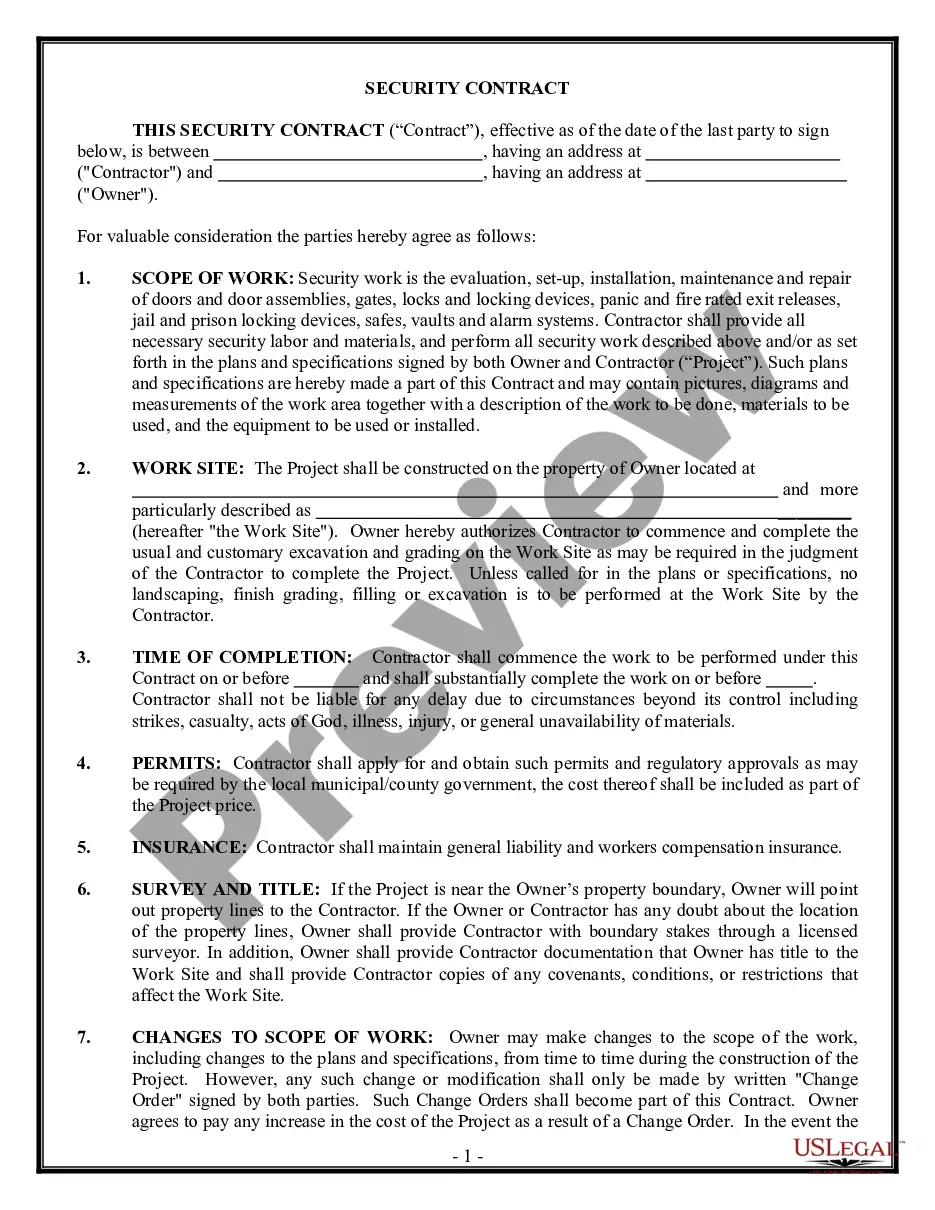

- Ensure you have picked out the proper develop to your town/region. Click on the Review button to check the form`s articles. See the develop outline to actually have chosen the appropriate develop.

- When the develop doesn`t fit your specifications, use the Look for industry at the top of the display screen to obtain the one which does.

- Should you be happy with the form, validate your choice by visiting the Get now button. Then, pick the pricing prepare you favor and offer your qualifications to register for an bank account.

- Procedure the deal. Make use of credit card or PayPal bank account to perform the deal.

- Pick the file format and download the form on the system.

- Make alterations. Complete, edit and print out and indication the acquired Guam Stock Option Agreement.

Every single web template you put into your account lacks an expiry date and is also the one you have eternally. So, if you want to download or print out yet another duplicate, just go to the My Forms segment and click in the develop you need.

Get access to the Guam Stock Option Agreement with US Legal Forms, one of the most comprehensive local library of legal papers layouts. Use thousands of expert and express-specific layouts that meet your business or personal requirements and specifications.

Form popularity

FAQ

An option grant is a right to acquire a set number of shares of stock of a company at a set price.

Companies can grant them to employees, contractors, consultants and investors. These options, which are contracts, give an employee the right to buy, or exercise, a set number of shares of the company stock at a preset price, also known as the grant price. This offer doesn't last forever, though.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

A typical size for the option pool is 20% of the stock of the company, but, especially for earlier stage companies, the option pool can be 10%, 15%, or other sizes. Once the pool is established, the company's board of directors grants stock from the pool to employees as they join the company.

There are two main ways to allocate options to your team: As a percentage of the salary - companies offer options to their team based on their salary, seniority, and type of role. As a percentage of the company - in this case, key people might get allocated a fixed % of the company's total equity.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

Remember: If you hope to purchase and sell your stock someday, accepting your stock option grant is the first step you have to take.It doesn't cost anything to accept the grant, and you're not obligated to actually exercise your options.

Log in to your account or register as a new user. On the NetBenefits home page, select your stock plan to get started. On the Stock Plan Summary page, choose the award you want to accept. Go to the Accepting Your Grants page to see your award.